Wells CEO Is “Extremely Disappointed” With First Quarterly Loss Since 2008; Massive Dividend Cut

Tyler Durden

Tue, 07/14/2020 – 08:18

While JPMorgan at least had a stellar trading quarter to offset another surge in loan loss reserves (i.e. balance sheet deterioration vs income statement improvement), Wells Fargo just had the ugly balance sheet to flaunt and boy was it ugly.

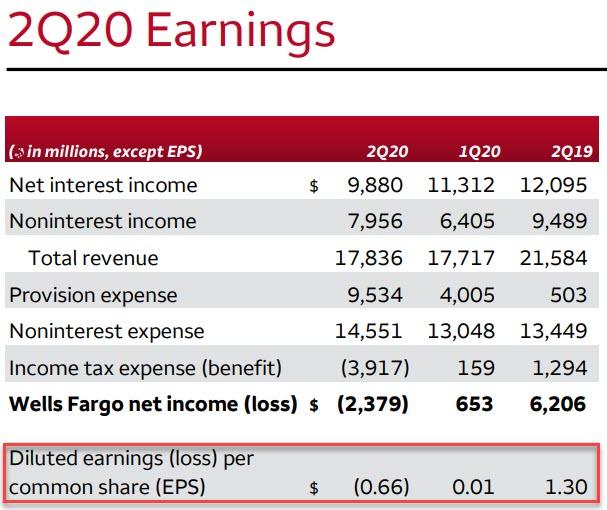

For the second quarter, Warren Buffett’s favorite bank reported a Q2 loss per share of 66 cents, down sharply from the $1.30 profit a year ago, and far worse than the 13 cent loss consensus estimate. More importantly, this was the first time Wells posted a quarterly loss since 2008, confirming that this is indeed the biggest crisis since Lehman.

And while it was widely expected that the bank would cut its dividend of 55 cents, with the bank saying last month that it would cut the dividend to comply with the new restrictions the Federal Reserve brought on payouts, consensus expected the cut to be to 20 cents per share. Which is why when Wells unveiled that its new dividend would be just 10 cents (from 55 cents previously), it led to even more disgust with – and selling of – one of the worst performing stocks of 2020.

A few other Bloomberg headlines from what was a catastrophic quarter for Wells:

- 2Q Rev. $17.84B, -17% Y/Y

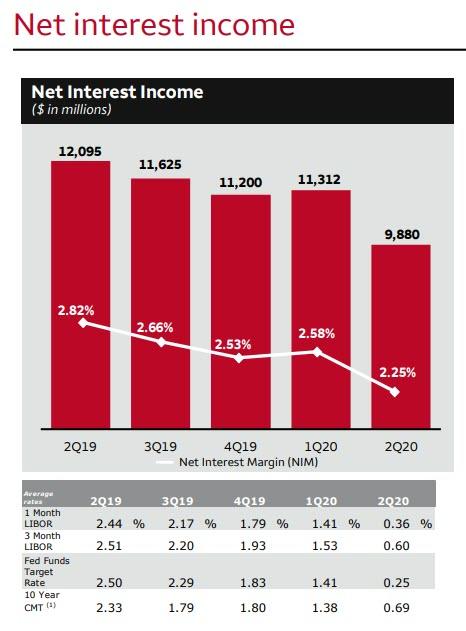

- 2Q Net Interest Margin 2.25%, Est. 2.33%

- 2Q Loans $935.2B, Est. $1T

- 2Q Net Interest Income $9.9B, Est. $10.32B

- 2Q Total Average Loans $971.3B, +0.7% Q/Q

- 2Q Incl $8.4B Boost in Credit Loss Reserve

- 2Q Efficiency Ratio 81.6%, Est. 70.4%

- View of Length, Severity of Downturn Deteriorated

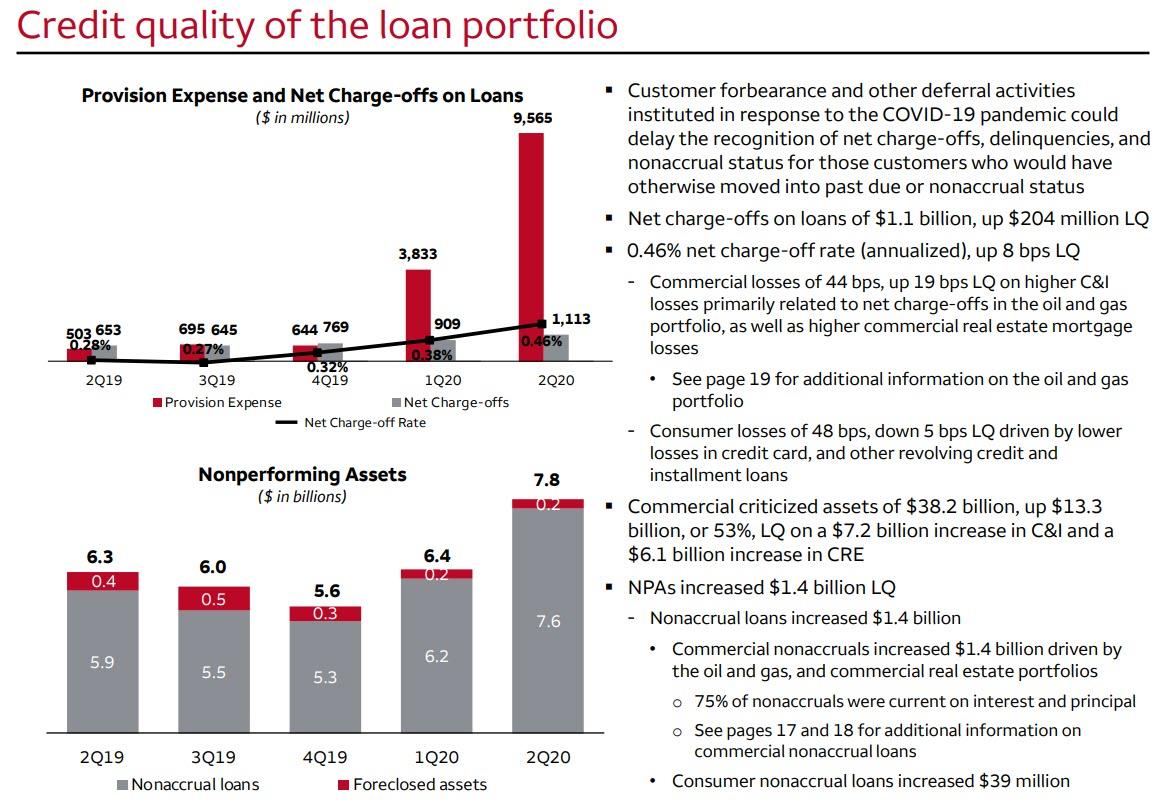

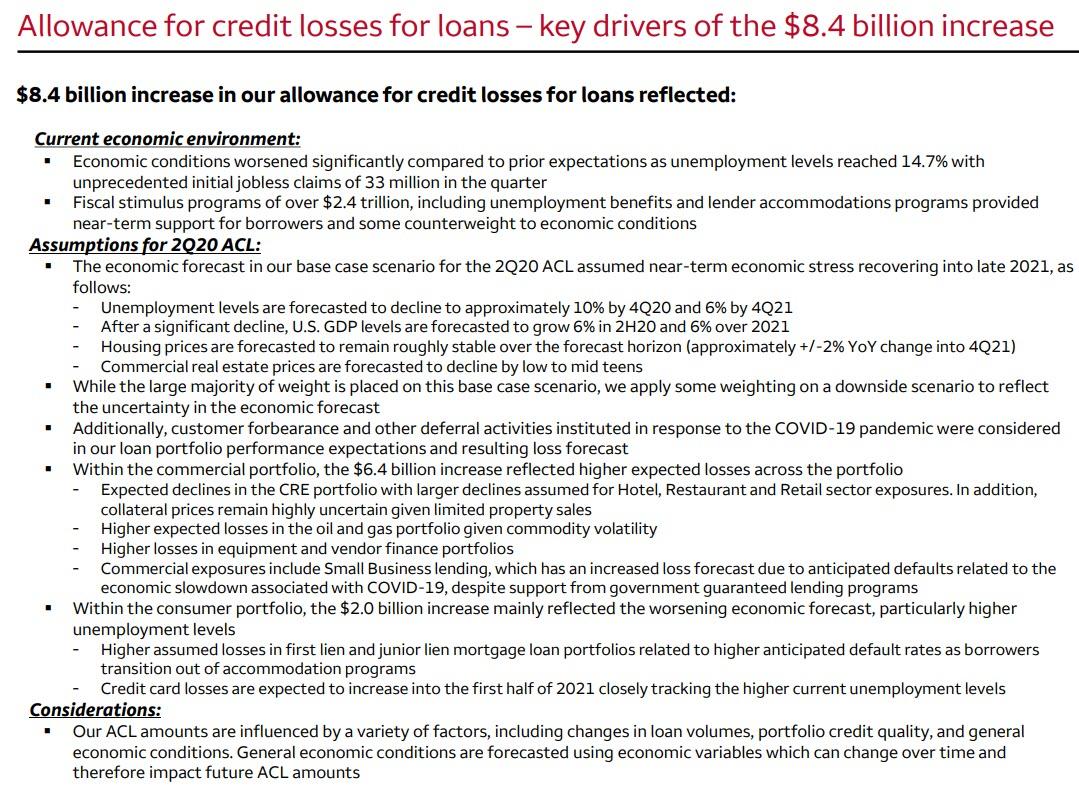

There was more. Consensus also got a kick in the groin after Wells reported that its Q2 provision for credit losses would be a whopping $9.5BN, double the $4.86BN expected, and consisting of $8.4 billion increase in the allowance for credit losses as well as $1.1 billion of net charge-offs for loans. The provisions were 17 times the amount taken a year ago and double last quarter’s, when we warned the number was not nearly enough.

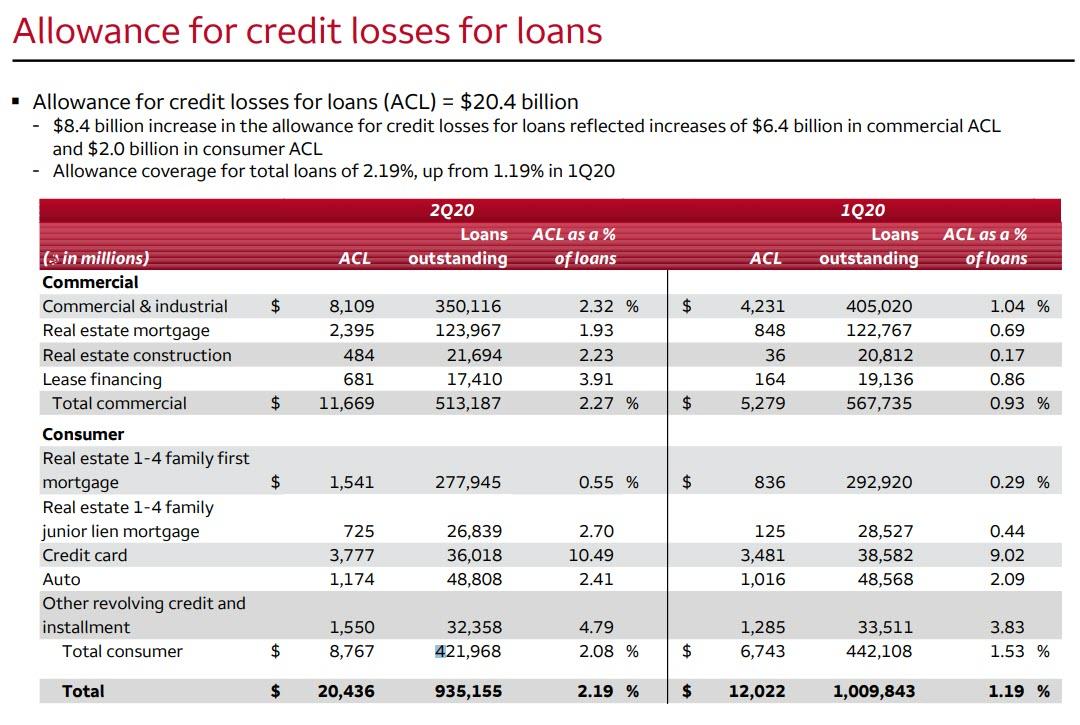

How did Wells get to this $8.4BN number? Well, the bank first laid out its total allowance for credit losses, which was a paltry 2.19% of the $935BN in loans outstanding, of just $20.4BN, meaning that the full losses will be orders of magnitude higher…

… which then prompted the following frentic discussion, attempting to justify the surge in reserves… which unfortunately will not be nearly enough.

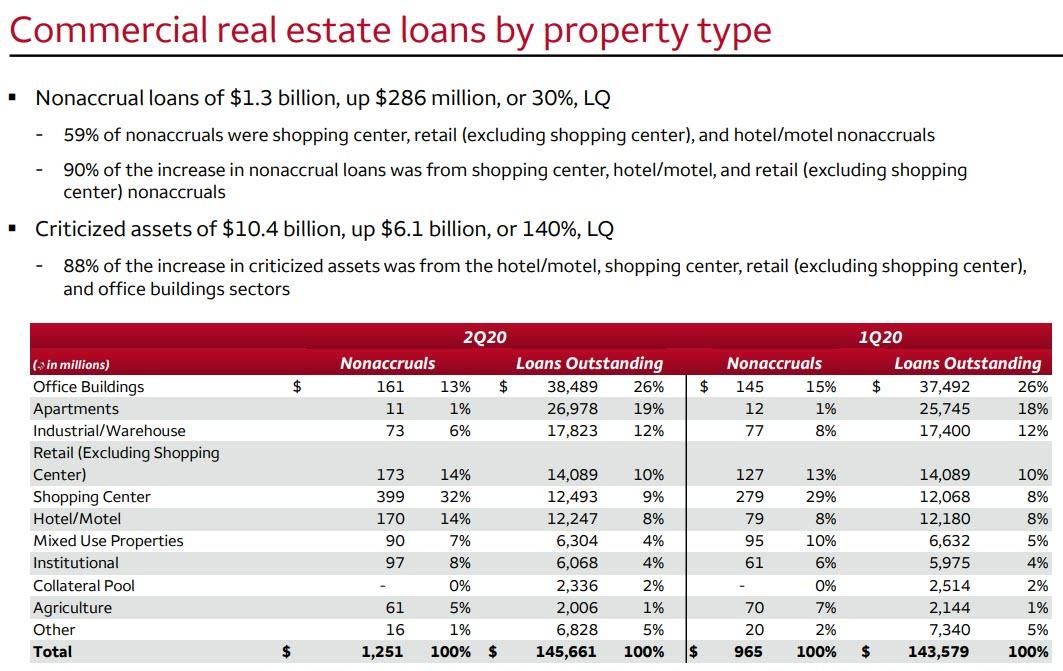

It’s about to get much worse, though, because as Wells conveniently highlighted it has some $146BN in commercial real estate loans, most of which will be impaired in the coming months amid a record delinquency and default wave.

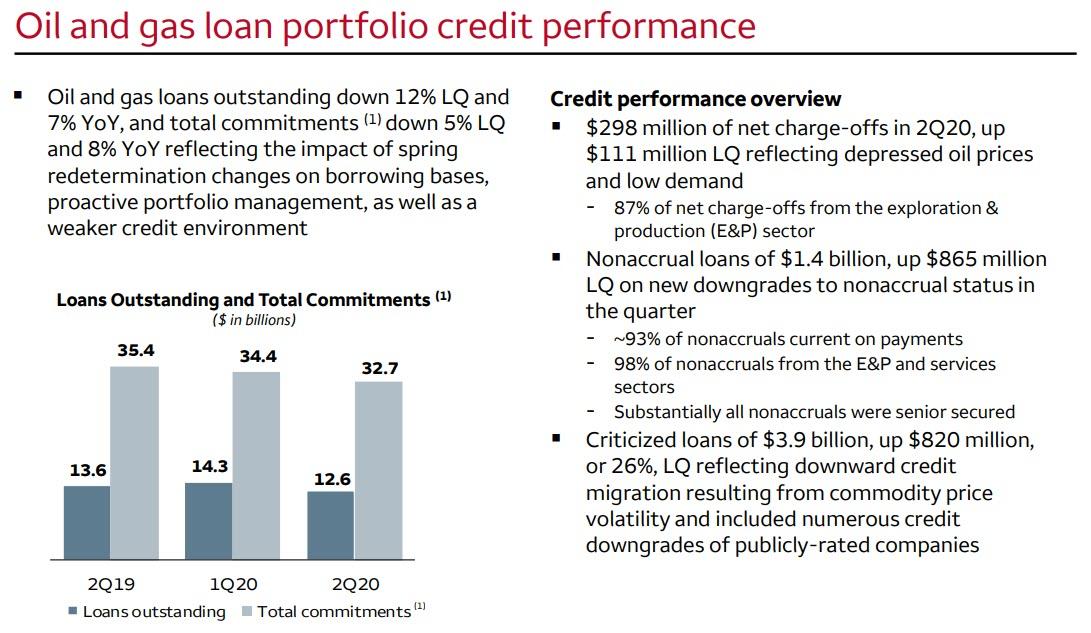

But wait, there’s even more, because as of Q2, JPM also has $32.7BN in total oil and gas loan commitments, of which $12.6BN are currently outstanding.

Finally, the cherry on top is that all this is happening as Wells Net Interest Margin just plunged to the lowest ever as rates are preparing to go negative.

With all that in mind, perhaps nobody summarized Wells’ dismal quarter better than CEO Charlie Scharf:

“We are extremely disappointed in both our second quarter results and our intent to reduce our dividend. Our view of the length and severity of the economic downturn has deteriorated considerably from the assumptions used last quarter.”

Scharf also said the dividend cut to 10 cents, half the consensus estimate, reflected “current earnings capacity assuming a continued difficult operating environment, evolving regulatory guidance, and protects our capital position if economic conditions were to further deteriorate.” Plus, “regulatory commitments” remain the bank’s top priority, Scharf said.

To be sure, the stock was just as disappointed:

What can help the stock here? Probably nothing… except perhaps for Buffett to fully liquidate his entire holdings.

* * *

Here is the full Q2 earnings slideshow (pdf link)

via ZeroHedge News https://ift.tt/2Zqk707 Tyler Durden