HEROES vs HEALS: Will Congress Blink?

Tyler Durden

Fri, 07/31/2020 – 14:04

One month ago we warned that, absent a deal to extend the record US fiscal stimulus underwritten during the covid shutdowns, the US economy was “about to fly off a fiscal cliff“, resulting an even bigger hit to US consumption than that seen in Q2, and since it makes up 70% of US GDP, leading to another devastating hit to the economy.

With the official deadline now past and the $600 in weekly expanded unemployment benefits ending today, have we flown off the cliff, or will – as Bank of America writes this morning – Congress blink after all?

HEROES vs. HEALS

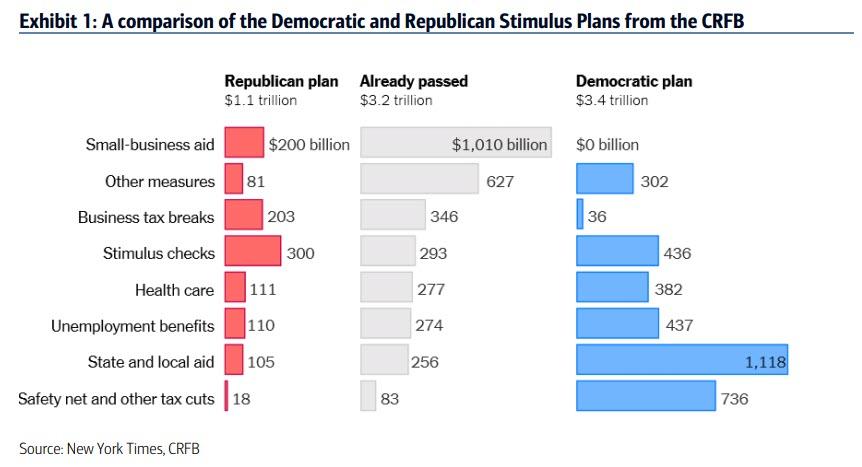

As BOfA’s chief economist Michelle Meyer recaps today, the next round of stimulus – considered to be Phase IV – is proving to be harder to get through than the first three. The Democrats have put forward the HEROES bill of $3.4tr while the Republicans have their HEALS bill of $1.1tr. The two bills are summarized in the exhibit below based on work from the Center for Responsible Federal Budget (CRFB). Not only is there a significant difference in the dollar amount but also the intent of the policy.

For what it’s worth, BofA continues to expect that a bill is passed in early August likely coming in above the HEALS act but still significantly short of the HEREOS. The bank’s economists review the various pressure points and assess the impact on the economy.

Can’t we all get along

As BofA summarizes, the main area of agreement is over stimulus checks as both the Reps and Dems are calling for a second round of checks along the same lines of the CARES act – up to $1,200 for individuals and $2,400 for joint filers – though the HEROES act includes $1,200/dependent for up to three, while the HEALS act includes $500 for all dependents. According to CRFB, this provision would amount to $300bn under the Republican proposal and $413bn under the Democratic proposal. The stimulus checks should be able to be rolled out fairly quickly. The CARES Act was signed on March 27 and money started to hit bank accounts on April 15th with about three-quarters of funds being distributed by the end of the month. If the legislation is signed into law in the first half of August, we should start to see the money flow in before the end of the month with the biggest support in early September.

What does this do for the economy? A working paper by the Chicago Fed (Karger E. and Rajan A.) found that 48% of the checks were spent over a 2-week period. The rest was saved or used to pay down debt (frankly, we think this is dead wrong as billions of stimulus funds clearly funneled into brokerage accounts as the Robinhood euphoria has made all too clear). Plugging in this marginal propensity to consumer (MPC) to the $300-413bn range of stimulus funds and assume that about three-quarters will be distributed efficiently, it could boost the level of consumer spending by about 10%, likely showing up most significantly for the September retail sales report.

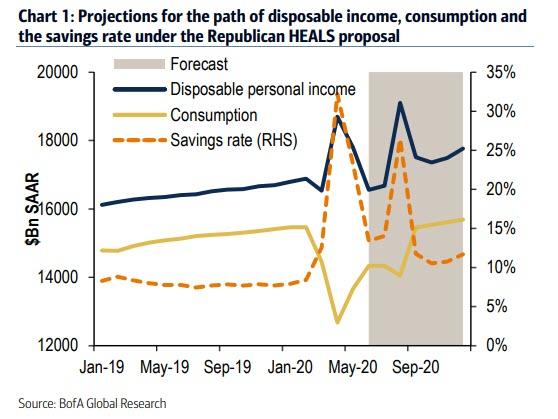

The stimulus checks create a “hump-like” trajectory for income and savings. We simulate the path for income and spending going forward to capture the impact of the stimulus checks (assuming the Republican proposal for unemployment benefits). You can clearly see:

- hump in income;

- temporary bounce in savings;

- lagged response in consumer spending

No way, no how

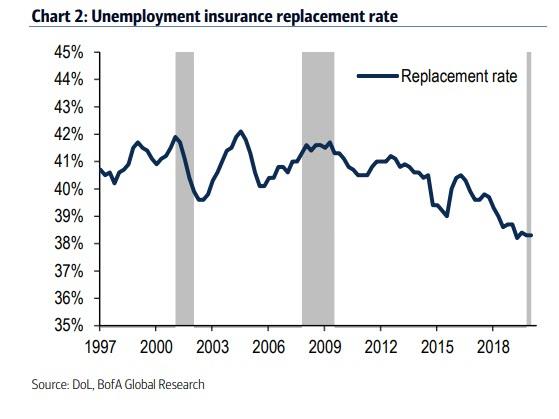

There are two main areas of disagreement over the stimulus: unemployment benefits and state & local aid. The CARES Act added an additional $600/week to unemployment insurance (UI) and expanded eligibility to self-employed and gig workers. To put this into perspective, prior to CARES, the average weekly UI was $373/week in 2020 1Q. As such, the “replacement” income from UI spiked higher from an average of 38%.

If the average weekly wage of UI recipients was unchanged, the replacement rate will be just under 100%. More likely, however, is that the average weekly wage of UI recipients has declined given that the recession had a disproportionate effect on hourly and low income workers. Indeed Ganong et al. estimate the current median replacement rate to be 134%.

The Democrats are calling for this program to be extended through January, while the Republicans are calling for two stages:

1) additional UI declines to $200/week through September;

2) formula imposed where UI goes to 70% of income.

However, state unemployment offices have argued that it will be very challenging to put in place a formula even with the additional money allocated by the Republican bill to update systems.

We can estimate the impact to income and spending from these proposals. If the current policy continues, spending should remain at current levels. Job creation—and therefore labor income— will slowly reduce the unemployment benefits but it will simply be a substitution of income and therefore spending should continue to be supported. Assuming the current 30 million people on UI (standard program and Pandemic Unemployment Assistance, although the true number is likely somewhat smaller given PUA counts retroactive weeks as a separate claim), the reduction to $200/week would slice about $12bn of personal income/week. BofA estimates the transition to a replacement rate of 70% would then boost the benefit to a little more than $300/week, on average. Therefore, personal income relative to the $600/week benefit would be reduced by about $9bn/week beginning in October. Assuming a MPC of about 70%, this proposal would reduce purchasing power by around $7.5bn/week in August and September, and by $5bn/week beginning in October.

When will we see the impact? It will be a bit confusing because the stimulus check will provide an offset so the hit to consumer spending might not be clear until mid-to-late September. The other consideration is that we should see the number of people on UI decline as jobs return, reducing the shock to the consumer. More immediately BofA is quite concerned about the possibility of a temporary lapse of UI given that the CARES UI program expires on July 31st. There has been some discussion of a stopgap bill to prevent the decline in stimulus, but it doesn’t look like the central case. As such, for the next two weeks, we could see a decline in income of $18bn/week. This could weaken near-term spending — we will carefully monitor the aggregated BAC credit and debit card data to determine the impact. Of course, Congress could theoretically backdate the UI payments to make up for these lost weeks.

State and local stress

The Dems propose nearly $1tr for S&L aid while the Reps allow for greater flexibility to use the $150bn that has been allocated through the CARES Act. These funds could now be used to cover shortfalls in the FY2019 year. There is also a difference in education funding where the Reps allocate $105bn for education with 2/3rd reserved to help schools reopen for in-person education. To receive funding, the schools would need to meet “minimum opening requirements”.

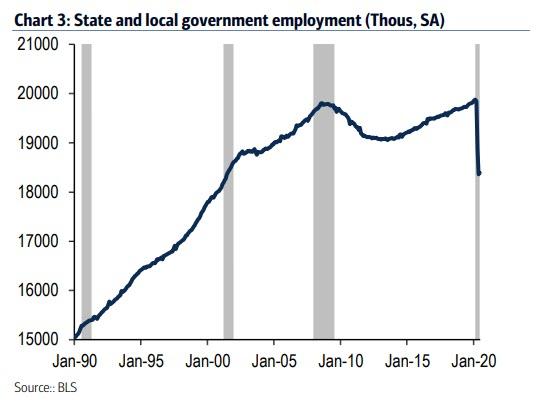

According to data compiled by NCSL (National Conference of State Legislatures) 32 states and DC have all revised down their revenue projections for FY2021from their preCOVID levels, illustrating the breadth of need for some type of state and local aid. Without additional funds, the risk is that S&L governments will continue to cut back on expenditures and employment. We have already seen 1.5mn jobs lost in S&L gov’ts since February

You down with PPP 2.0?

The Reps are calling for a new round of funding for the Paycheck Protection Program (PPP) as well as more money for emergency business loans. The Reps PPP 2.0 would leave about $190bn of support for second loans for PPP recipients (which uses about $100bn from PPP 1.0) and change the eligibility to businesses with fewer than 300 employees (vs. the current 500) while requiring that firms demonstrate that their revenue fell by at least 50%. The change in business size would likely be marginal in terms of outreach as 86% of small business jobs are in companies with fewer than 250 employees. They also call for a liability shield to protect businesses from COVID-related lawsuits. The latter is a “red-line” for the Reps but Dems have argued that the liability shield would give large employers the ability to escape damages to their workers. It is difficult to precisely quantify the impact to the economy from this program but presumably it will help to keep small businesses afloat, supporting the labor market and likely resulting in a faster recovery of jobs.

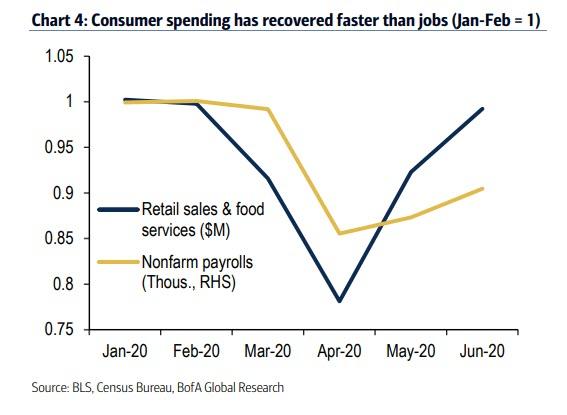

Bottom line: fiscal stimulus has been critical to restoring the health of the economy. As Chart 4 shows, the labor marker only recovered a third of the way back but yet retail spending has made a full recovery.

How can the US solve for this differential? Only stimulus (and lot more of it). What comes next will determine the path forward for the economy.

via ZeroHedge News https://ift.tt/2XcV6Es Tyler Durden