Tech Stock Buybacks Are Surging

Tyler Durden

Sun, 08/02/2020 – 20:46

Two months ago, we showed that contrary to conventional wisdom and corporate reps and warrants that buybacks had effectively been put on hold for the duration of the covid pandemic, not only were companies still repurchasing their shares but it was the tech names – those who have stormed higher since the March lows – that were the biggest culprits.

Now, two months after we first revealed Wall Street’s worst kept secret, the Financial Times has also noticed that Corporate America is finding it hard to kick the share buyback habit, even after the US slipped into its worst recession in decades.

While total buybacks are indeed expected to drop this year as the downturn caused by coronavirus saps corporate profits, companies in the S&P 500 that have reported second-quarter earnings so far have reduced the number of their outstanding shares by an average of 0.3 per cent from the previous quarter, according to calculations from Credit Suisse.

Furthermore, updates showed that some of the largest US multinationals continued to buy back their own stock or even accelerated stock repurchases and nowhere more so than the tech names we first highlighted at the end of May.

Take Google’s parent company Alphabet, which spent $6.9bn on buybacks for the quarter, up 92% from a year prior, the company revealed in its earnings results last Thursday.

Microsoft, the second-largest listed US company, purchased $5.8bn of its own stock in the period, up 25% from a year earlier, and likely among the chief reasons for the stock’s amazing surge.

Elsewhere, Biogen spent $2.8bn on buybacks for the period, up 17% from last year, WR Berkley, an insurer, did not buy any of its shares in the second quarter last year, but spent $97m on its stock in the period this year, and Celanese increased its planned buybacks for the year by $500m to $1.5bn in July, after selling its stake in a Japanese joint venture.

Of course, the biggest source of buybacks was once again Apple, which repurchased $16BN in the second quarter, down 6% on the period last year, though by far the biggest stock repurchaser among S&P 500 companies in recent years.

As we first noted in May, and as JPM strategist David Lebovitz echoed last week, the buybacks were “not happening everywhere”, but were “driven by specific sectors and stocks”. He added that financial and materials companies were potentially more willing to engage in buybacks through the downturn, because their stocks have not advanced as much as companies in other sectors since the lows in March.

More marquee names joined the party with Edward Jones estimating that Berkshire Hathaway plowed about $5.3bn into stock repurchases during the quarter. Berkshire reports its earnings next month and if the sum is confirmed it would mark the largest quarterly share repurchase since the company began buying back its stock in 2011.

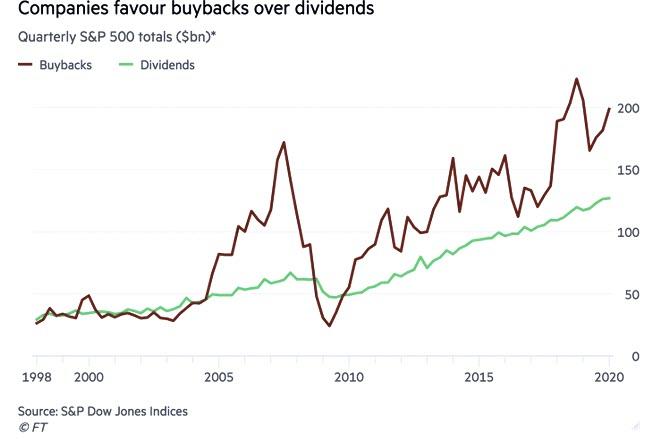

In summary after a brief dip in Q1, the buybacks have staged an impressive rebound as shown in the chart below:

As the FT notes, companies expanding repurchase programs – which is most tech names – “run against the grain of the broader market, where many businesses reduced or suspended buybacks as the downturn took hold. Second-quarter EPS for companies in the S&P 500 will probably drop about 39%”, a number that would be even bigger had it not been for buybacks according to Refinitiv.

And while in April Goldman projected that the amount spent by S&P 500 companies could halve this year, to $371bn from a record $806bn spent on share buybacks in 2018, Goldman’s forecast may prove to be far too low, even though nearly a fifth of companies in the S&P 500 have put buyback programs on ice since March, including the big banks such as Bank of America, Wells Fargo and JPMorgan Chase, who are typically among the biggest buyers of their own stock.

In any case, the buyback spree doesn’t seem like it will end any time soon: “As long as you’re a company that is earning money greater than your borrowing rate, you can just keep borrowing and buying back shares,” said Stephen Dover, head of equity for Franklin Templeton, the San Mateo-based fund manager.

That said, sentiment may change now that buybacks have become a hot political topic, especially as Congress debated stimulus programs this spring. Joe Biden and Donald Trump have both spoken out against the practice, noting that big programs have often sucked free cash flow away from businesses, while Democratic senators Bernie Sanders and Chuck Schumer have also called for curbs.

“Scrutiny around buybacks is already happening and will continue to happen,” said Mr Dover. “It was there before the current crisis and now it’s amplified.”

via ZeroHedge News https://ift.tt/2D63S0a Tyler Durden