Day-Traders Send US Producer Prices Soaring In July

Tyler Durden

Tue, 08/11/2020 – 08:40

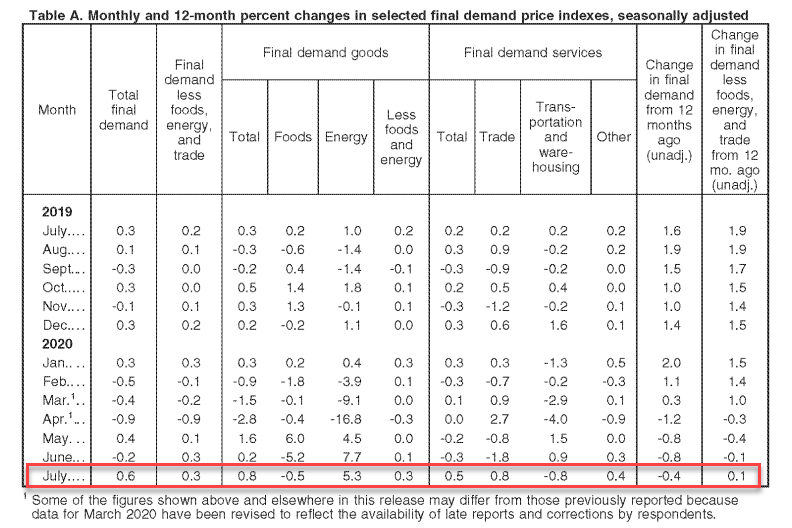

US Producer prices were expected to rise MoM following four declines in the last five months and they did, rising 0.6% MoM (double the expected 0.3% MoM rise). However, this was not enough to unwind the annual deflationary print (PPI -0.4% YoY)

Source: Bloomberg

This is the biggest MoM jump in headline PPI since Oct 2018.

Ex-food-and-energy, the beat was even more impressive with a 0.5% MoM spike vs 0.1% expected which lifted YoY Core PPI off its multi-year lows…

Source: Bloomberg

The biggest driver of this rebound was energy goods as food prices continue to slide.

However, even more stunning was a 7.8% surge in the index for portfolio management was a major factor in the

advance in prices for final demand services.

The indexes for machinery and vehicle wholesaling, automobiles and automobile parts retailing, long-distance motor carrying, legal services, and machinery and equipment parts and supplies wholesaling also moved higher. Conversely, prices for airline passenger

services decreased 7.0 percent. The indexes for automotive fuels and lubricants retailing and for guestroom rental also declined.

Over one-third of the July advance in the index for final demand goods is attributable to gasoline prices, which rose 10.1 percent. The indexes for diesel fuel, home heating oil, electric power, fluid milk products, and industrial chemicals also increased. Conversely, meat prices fell 8.0 percent. The indexes for residential natural gas and carbon steel scrap also decreased.

via ZeroHedge News https://ift.tt/2Ch2Cqq Tyler Durden