ECB Preview: Watch For A Dovish Tilt And Euro Jawboning

Tyler Durden

Thu, 09/10/2020 – 07:15

The European Central Bank is expected to keep policy unchanged when its latest decision is announced at 7:45 a.m, however analysts will be on the lookout for for any hints about more asset purchases before the end of the year. Focus for the release and on Lagarde’s press conference 45 minutes later will be on the Bank’s assessment of the region’s economic outlook and recent appreciation of the EUR. While official forecasts will confirm that the region’s economy avoided the worst downside risks from the pandemic, the ECB faces the twin challenges of inflation which has turned negative for the first time in two years and a rapidly appreciating currency. Investors will also be on the watch for any hints about more asset purchases before the end of the year.

According to sellside consensus, the overarching intention of the ECB on Thursday will be to not appear hawkish by default vs the Fed. As a result, expectations are for the ECB to

- indicate the need for persistent monetary accommodation,

- to highlight its ability to add accommodation if needed,

- to stress the relevance of the euro for monetary policy and

- a broad-based review.

Mentions of EUR will be closely watched. Lagarde is expected to mirror Lane’s comments last week about the exchange rate, and there is an outside chance that the ECB may in fact include an objective statement about EUR appreciation in its introductory statement as the ECB is much more concerned about the potential for further euro appreciation rather than about the present level. Somewhat paradoxically, an upgrade of GDP forecasts are expected, as Bloomberg sources suggested on Wednesday which sparked a EUR rally.

Looking at asset purchases, ING analysts say that given objections to using the total PEPP envelope by some in the July account, there will be little appetite to provide much guidance on a further expansion this week; They also believe that Lagarde unlikely to be too heavy-handed on EUR.

According to a Citi FX trader, “The main focus is on growth forecasts and expected jawboning of the currency. Positioning remains long especially in the RM and CTA space and while we expect the ECB to stress the downside risks associated with an increase in Covid cases we don’t expect large movements in spot today. Note we have seen RM start to buy once again (first significant buying since the start of the month), pushing us away from support at 1.1750 and 1.1680. A break of 1.1680 is where the pain starts for RM and the picture will start to look very ugly very quickly is we get through and hold below this area.”

Below is a recap of the key analyst view courtesy of NewsSquawk:

- OVERVIEW: Policymakers are once again expected to stand pat on rates with the balance sheet remaining the tool of choice for the Governing Council. Expectations are for an eventual expansion of the current Pandemic Emergency Purchase Programme (PEPP) remit of EUR 1.35trl and extension of its duration, however, consensus suggests that December is viewed as a more opportune time for this action. As such, focus for the announcement will likely centre on the Bank’s assessment of the region’s economic outlook and recent appreciation of the EUR.

- PRIOR MEETING: At the July meeting, policymakers opted to stand pat on rates, whilst leaving bond buying operations unchanged, as was expected. Furthermore, the central bank maintained forward guidance and reiterated its willingness to adjust policy as needed to ensure that its objectives are met. President Lagarde’s introductory statement noted that incoming data signalled a resumption of activity (but still way below pre-COVID levels) with indicators suggesting a bottoming in April, and an improvement in May/June. Lagarde was quick to note that unless there are any upside surprises in the economy, the ECB will use the full envelope of its PEPP, in a flexible and targeted manner. Lagarde also pushed back on questions surrounding a potential adjustment to the bank’s tiering multiplier, noting that the matter was not discussed by the Governing Council, nor were any other adjustments to current policy settings.

- RECENT DATA: The upcoming meeting takes place against the backdrop of headline CPI running at -0.2% on a Y/Y basis (negative for the first time since 2016) with the core (ex-food and energy) metric falling to 0.6% from 1.3% as one-off factors from Italy and France in July were unwound. On the growth front, Q2 GDP revealed a 12.1% contraction in the Eurozone economy; the largest on record. The declines in growth were relatively similar across Germany, France and Italy with a deeper contraction of 18.5% seen in Spain. PMI readings in the region showed some signs of pulling back, albeit remaining in expansionary territory with the Eurozone Composite print falling to 51.9 from the 54.9 seen in July. Unemployment continues to see mild upticks with the rate in July rising to 7.9% from 7.7%, albeit the headline remains supressed by job retention schemes.

- RECENT COMMUNICATIONS: Arguably the most important commentary as of late has come from Chief Economist Lane, who, on the day that EUR/USD breached 1.20 to the upside for the first time since 2016, remarked “that there has been a repricing of the EUR in recent weeks, adding that the ECB does not target the FX rate but the EUR/USD rate does matter”. On the economy itself, Lane recently noted that the Q3 rebound is expected to be strong, albeit the ECB stands ready to provide more stimulus if required. Other policymakers including Germany’s Schnabel and Slovakia’s Kazimir have noted that the Eurozone economy is performing in-line with the Bank’s base case scenario, with the former concluding that the current PEPP size is appropriate and now is not the time to adjust the tiering multiplier. Her German colleague Weidmann has continued to bang the drum for the hawks on the Governing Council by stating that “EU extraordinary fiscal and monetary support must be temporary and it needs to be scaled back after COVID”.

- RATES: From a rates perspective, consensus looks for the Bank to stand pat on the deposit, main refi and marginal lending rates of -0.5%, 0.0% and 0.25% respectively. At the March meeting, officials resisted market expectations that had priced in a 100% chance of a 10bps reduction to the deposit rate and since that meeting, rhetoric from the Bank has done nothing to indicate that a further adjustment lower could be on the cards. As a guide, markets currently have around 3bps of further loosening priced in by year-end and around 9bps by the end of 2021.

- BALANCE SHEET: With the balance sheet seen as a preferred easing tool for the Governing Council, focus remains on any adjustments to its PEPP which currently has an envelope of EUR 1.35trl and is set to run at least until the end of June 2021. Despite some mild objections as revealed by the account of the July meeting, the ECB’s current assumption remains that the PEPP envelope will be used in full. Given the precarious nature of the Eurozone’s economic outlook, economist broadly anticipate a further expansion of the envelope at some stage, however, views are mixed on when this will take place and how large any increase will be. Consensus, according to a Bloomberg News poll, is for a EUR 350bln expansion by December with an extension of the programme until the end of 2021. In terms of house views, UBS are one of those who are looking at a potential expansion and extension of PEPP in December, whilst also raising the possibility of an eventual inclusion of other asset classes (e.g. junk bonds) if needed to calm market tensions. SocGen look for a EUR 500bln PEPP expansion at some stage and extension until the end of 2021, whilst touting the possibility of a phasing out of PEPP as of mid-2021. Nordea suggest “If the ECB wants to send a dovish signal, it could commit to buying bonds at a pace similar to that seen during the early stages of the PEPP or it could even set a floor under the pace of purchases”. Perhaps the most dovish call comes from Pantheon Macro who forecast an increase in the PEPP envelope this week, citing the likely dip in the accompanying inflation projections.

- EUR: One of the key talking points heading into the meeting has been the recent appreciation of the EUR after EUR/USD briefly breached 1.20 to the upside on September 1st; as a reference point, EUR/USD traded on a 1.14 handle heading into the previous meeting on July 16th. The appreciation in EUR prompted speculation over the possibility of verbal intervention from the Governing Council with a research piece by Goldman Sachs noting that “an exogenous 10% tradeweighted EUR appreciation typically educes real GDP and CPI each by around 1% after two years”, adding that “this rule of thumb implies that the appreciation so far might lower growth and inflation by about 1⁄4 pp in each of the next two years”. Following the breach of 1.20 to the upside in EUR/USD, Chief Economist Lane remarked that “there has been a repricing of the EUR in recent weeks, adding that the ECB does not target the FX rate but the EUR/USD rate does matter”; a comment which prompted downside in EUR with EUR/USD having not risen above 1.20 since. In terms of what’s expected for the press conference this week, President Lagarde is likely to tow a similar line with UBS expecting her to “to respond as she has done previously, saying the ECB does not target the exchange rate, but that the Euro nevertheless has an important impact on inflation and growth, and hence does play a role in the ECB’s policy considerations”. At current levels, the Swiss bank does not expect aggressive verbal intervention against the EUR.

- ECONOMIC PROJECTIONS: Also, of interest for market participants will be the accompanying staff economic projections, which could offer an insight into the Bank’s assessment of the economic recovery and whether further stimulus will be required to offset the hit from COVID-19. UBS suggests that 2020 growth is likely to see a modest upgrade to -8% (prev. -8.7%) with 2021 and 2022 to be held at 5.2% and 5.3% respectively. On the inflation front, forecasters will need to balance higher oil price assumptions and German VAT reduction against the firmer EUR, which UBS believes will overall leave the headline 2020 HICP forecast at 0.3%, 2021 raised to 0.8% (prev. 0.7%) and 2022 upgraded to 1.0% (prev. 0.9%).

- TIERING: An adjustment to the current multiplier of six for its two-tiered deposit system remains a potential option for the ECB. However, given the recent pushback from Schnabel and lack of discussion in the July account, a change on this front is seen as unlikely this week.

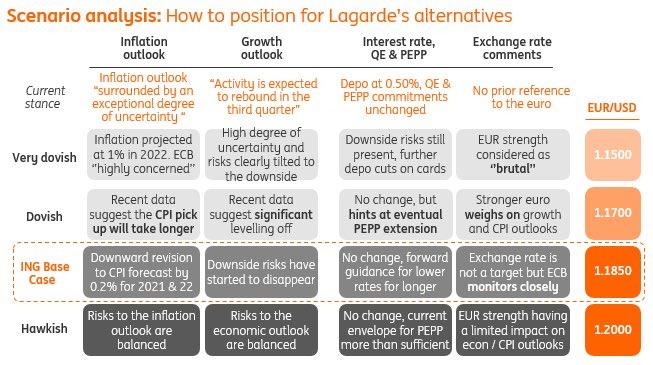

For those who like prefer sheets, here is all you need courtesy of Arkera’s Viraj Patel:

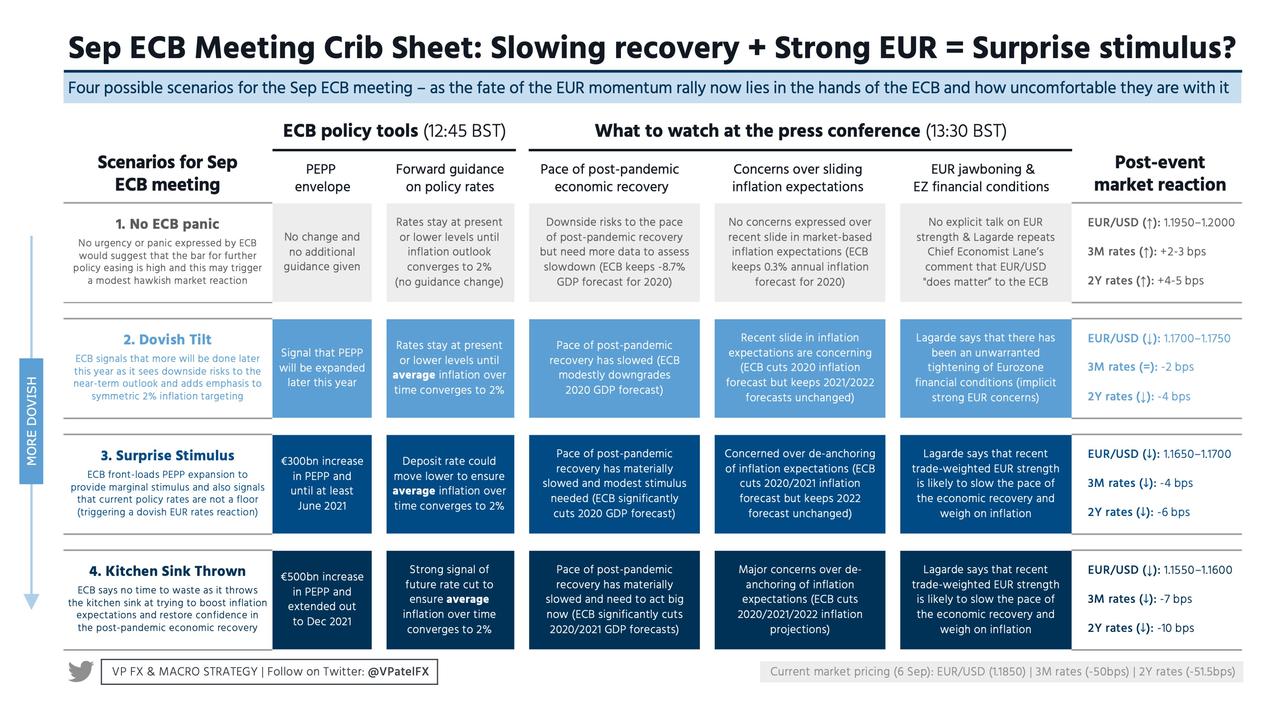

Finally, courtesy of Bloomberg’s Vassilis Karamanis, here is a complete walkthrough on how to trade the Euro:

- Euro price action since late July highlights market focus on support around $1.1750, and the currency’s moves Thursday could show that the level is now a definite line in the sand.

- Downside risks for the euro stem from the possibility that European Central Bank President Christine Lagarde could attempt to talk it down, building on recent comments by Chief Economist Philip Lane that essentially marked a cycle high just above $1.20.

- The currency may also be weighed down by potential signs of increased monetary stimulus, either through an interest-rate cut or an acceleration of the institution’s emergency bond purchases. Should these risks materialize and the currency manage to stay close to $1.1750, then the market has a clear level to focus onward.

- Investors won’t be caught totally off guard by any of these risks, if options are any guide. After the market was caught short-gamma on strikes below $1.1850, and with demand for euro puts picking up lately and implied volatility rallying, front-end risk reversals mirrored the most euro-bearish sentiment in nearly two months earlier Thursday.

- As the shared currency trades around 1.5% below its Sept. 1 peak of $1.2011, short-term positioning suggests upside risks may be actually prevailing currently in the euro-dollar pair

via ZeroHedge News https://ift.tt/3ih0Oh5 Tyler Durden