Stocks Pump’n’Dump On Fed Financial Stability Fears

Tyler Durden

Wed, 09/16/2020 – 16:00

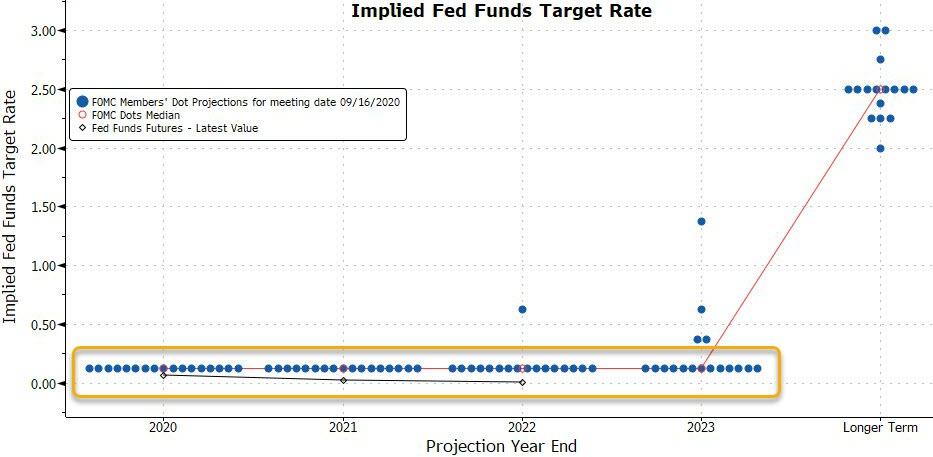

Lower (rates) for longer (at least 2024) but inflation, growth, and rate projections are all inconsistent. As Peter Boockvar at Bleakley Advisory Group points out the committee cut its 2021 GDP forecast to 4% from 5%, while at the same time lowering forecasts for the unemployment rate to 5.5% from 6.5% and raising core PCE estimates to 1.7% from 1.5%.

“No color on the inconsistency,” says Boockvar.

“They somehow think that the longer-run fed funds rate should be 2.5% but they have no intentions on trying to get there for the next 3 years, even if we get a vaccine, which we know is the main reason why we’re in the circumstances we are in.”

Stocks didn’t care – they just rallied (while everything else largely shrugged) and everything was looking good… until Powell was asked about financial stability (in other words – bubbles):

“Monetary policy should not be the first line of defense,” Powell says, noting regulatory tools should be the first line.

“We always leave open the idea that we will not ignore those kinds of risks.”

Powell was pressed further as to whether such bubble concerns could prompt a rate hike. Powell said that the majority of the FOMC would need to have concluded that the monetary stance was fostering financial instability.. but the market did not like that and stocks were slammed lower…

Did the market just warn Powell not to “meddle with the primary forces of nature…money!”…

Overall, from the FOMC statement drop, the dollar is modestly higher and big tech stocks worst…

Nasdaq has tumbled to its lowest relative to Small Caps in almost a month…

Source: Bloomberg

Of course, we couldn’t continue without mentioning SNOW – which exploded out of its IPO, before sliding back from exuberant opening levels…

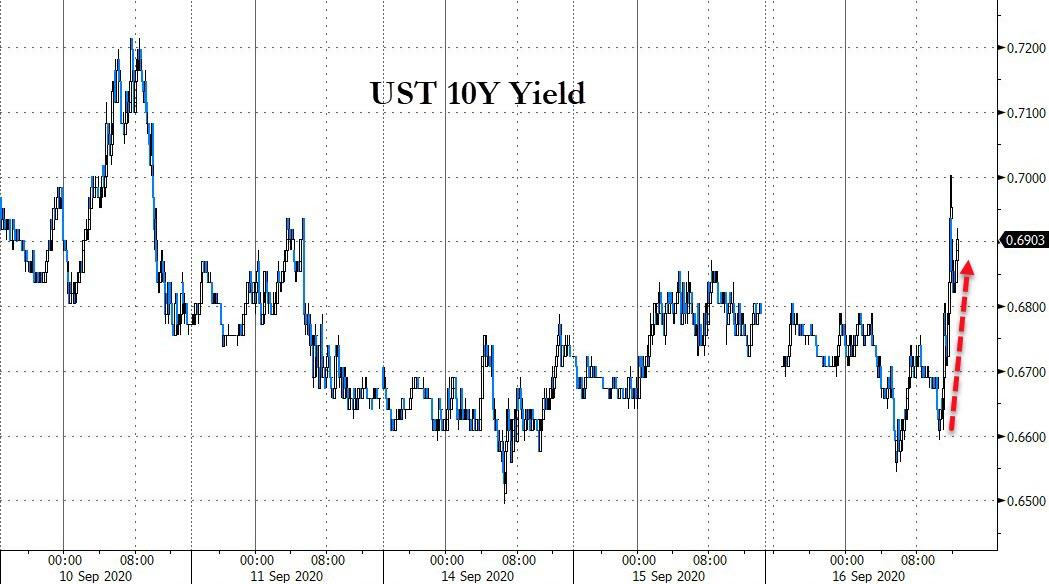

Treasury yields moved marginally higher (10Y +1bps)…

Source: Bloomberg

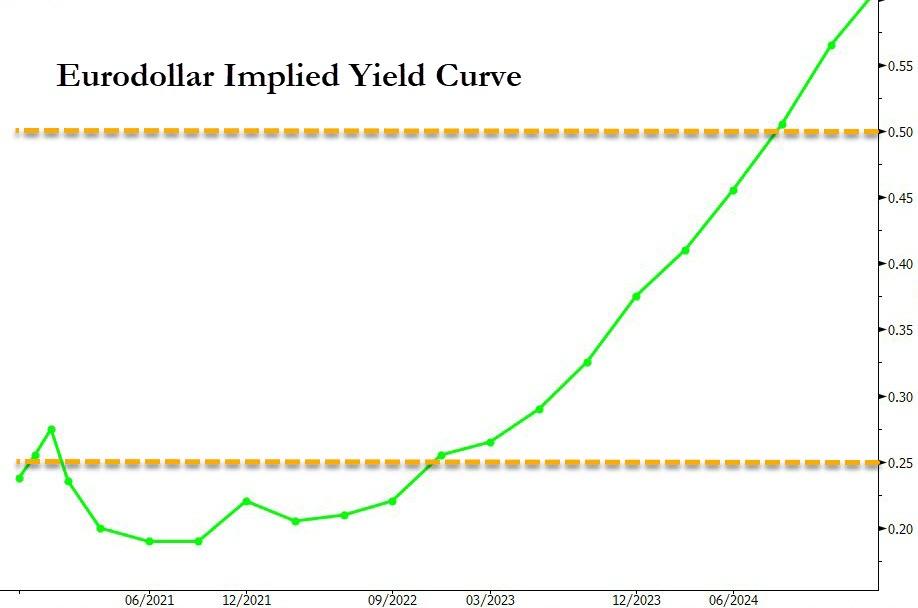

But short-term markets remain convinced there will be no rate hike until mid-2024…

Source: Bloomberg

FX markets were largely clueless with the dollar whipping around all over the place…

Source: Bloomberg

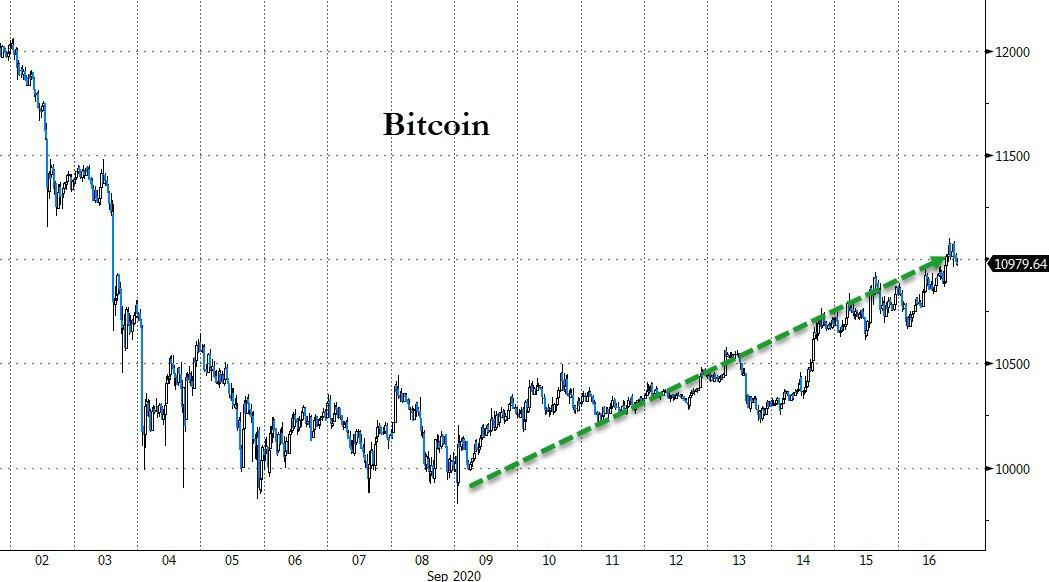

Bitcoin surged back above $11,000…

Source: Bloomberg

WTI topped $40 after a surprise crude draw…

Gold was unchanged on the day…

Finally, this won’t end well…

Source: Bloomberg

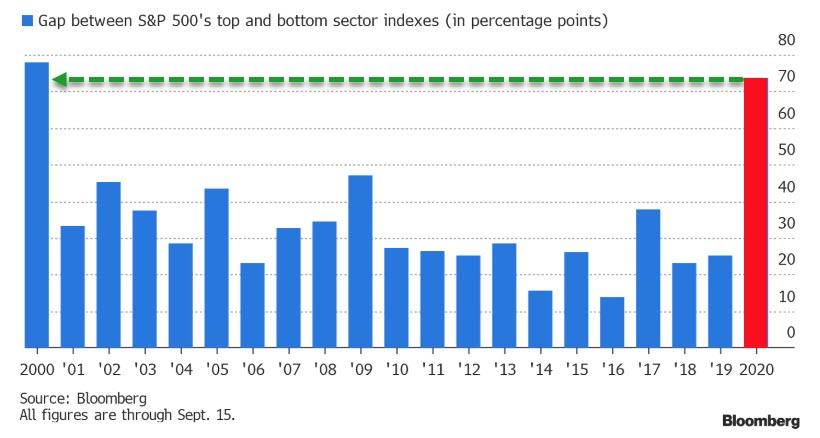

And as Bloomberg notes, this year’s gap between the S&P 500 Index’s best- and worst-performing industry groups is unusually wide. Technology stocks climbed 27% to rank first among the S&P 500’s 11 sectors as of Tuesday, according to data compiled by Bloomberg. Energy was last with a 47% loss.

The differential of 74 percentage points between them was the widest through Sept. 15 for any two sectors since 2000. Back then, utility stocks led the way and raw-material producers trailed as a bear market got underway.

Source: Bloomberg

via ZeroHedge News https://ift.tt/2FK8TMy Tyler Durden