World Bank Warns Recovery Could Take “Five Years”

Tyler Durden

Thu, 09/17/2020 – 21:00

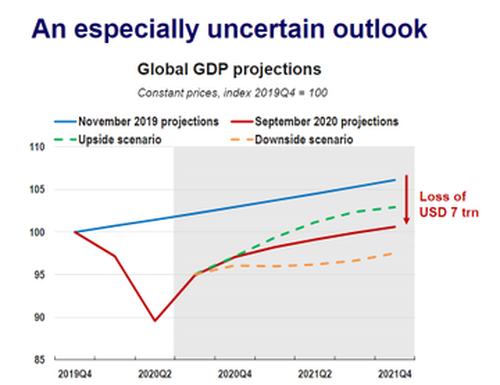

Global economic activity around the world has stabilized in mid-September, though far below pre-COVID-19 levels as recoveries risk reversing if monetary and fiscal stimulus is not continued at rates seen in the first half of 2020. We noted Wednesday, a new OECD report offered some hope the global downturn is not as severe as previously thought but is still viewed as an “unprecedented” decline.

We also noted the OECD report is problematic for policy-makers who have unleashed easy-money policies during the pandemic to artificially inflate economies and boost risk assets, as policy support in the second half of the year might not be as great as what was seen earlier in the year (as is currently playing out in Washington with the prospect of a slimmed-down stimulus bill getting slimmer).

So with waning support from central banks and fiscal stimulus from governments, the quick rebound seen in the global economy has likely stalled, and the shape of the recovery will no longer resemble a “V” but more of a “W” or “U” or “L.”

For more color on the shape of the global recovery, or rather perhaps how long the recovery will last, chief economist of the World Bank, Carmen Reinhart, warned Thursday, a full recovery could take upwards of five years, reported El País.

“There will probably be a quick rebound as all the restriction measures linked to lockdowns are lifted, but a full recovery will take as much as five years,” Reinhart said, while speaking at a conference in Madrid, Spain.

Reinhart said (as quoted by Reuters), “the pandemic-caused recession will last longer in some countries than in others and will increase inequalities as the poorest will be harder hit by the crisis in rich countries and the poorest countries will be harder hit than richer countries.”

“Central banks have tried to provide liquidity to avoid affecting more households. But as much as central banks give support, there are businesses that will not return, there are closed restaurants or stores that will not reopen, there are homes that will take a long time to find employment, there are airlines or hotels that will not survive a long period without normal mobility. There are going to be a lot of bankruptcies: if you look at the credit rating agencies, S&P, Moody’s, Fitch, the amount of reduction in credit quality that has been seen since the beginning of the year, both at the corporate and sovereign levels, has been a record. And central banks are not all-powerful either: no matter how much credit support is given, at some point you have to face the deterioration in the financial system, and that is not a criticism: it is inevitable because of the deep drop in the economy. Under these conditions, we have to think about cuts that allow new credits for recovery,” she said.

She added, “this crisis did not start as a financial crisis. But given the depth of this decline we are experiencing, it is turning into a financial crisis. For very obvious reasons: many households have lost a job that they will not get back, they have difficulties in paying their debts, many businesses have closed their doors and will not reopen them, the shopping centers are paralyzed and half empty.”

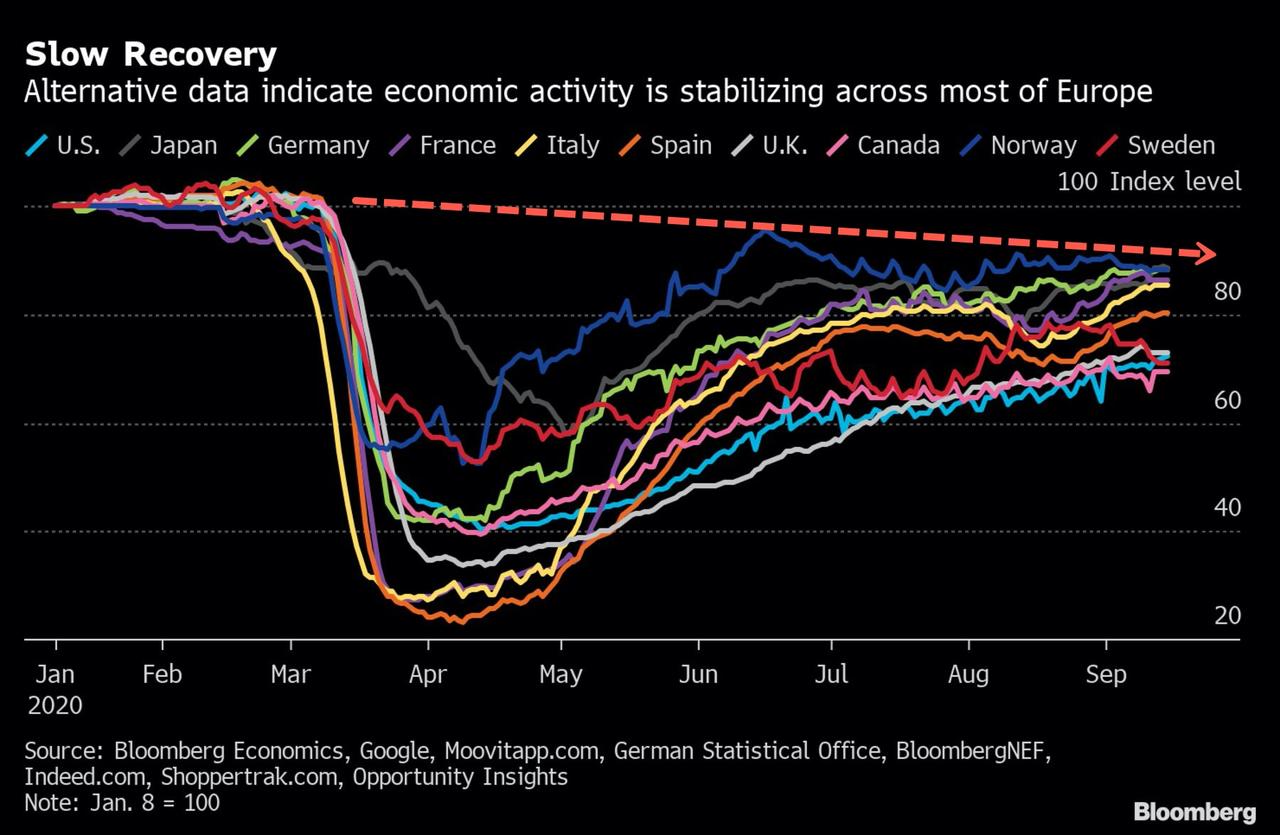

This comes as 29.7 million people around the world have been infected with COVID-19 and 938,820 have died, according to the latest Johns Hopkins University figures. High frequency data (via Bloomberg) is showing the recovery around the world has stabilized but risks a reversal if more policy support, if that is from central banks or governments is not seen.

Readers should be asking: What happens when Wall Street misreads the shape of the recovery?

To answer that, Gary Shilling, the president of A. Gary Shilling & Co., told CNBC’s Elizabeth Schulze in a July interview that once investors realize the shape of the recovery is an “L” rather than the overhyped “V,” it would trigger a 1930s stock market decline.

via ZeroHedge News https://ift.tt/3hEzOXG Tyler Durden