“It’s Time To Lighten Exposure”: Here Are The Next Four Risks For Markets

Tyler Durden

Sat, 09/19/2020 – 13:15

September’s big event for markets – the FOMC meeting – has come and gone and clearly there was some disappointment in markets from a statement that many viewed as not dovish enough.

In fact, as Morgan Stanley’s Andrew Sheets writes, “conventional wisdom is that the meeting was ‘hawkish’, but we feel that this interpretation is just a little slanted by the immediate market reaction” which of course is true, and shows the degree to which the market is now reliant on the Fed’s monetary generosity. After all, this was a meeting where the world’s most important central bank suggested that it would keep rates at ~0% even if unemployment moved back down to 3.5-4.5% and where, in the Q&A, the Fed Chair downplayed the impact of central bank policy on asset prices. As Sheets concludes “if that’s ‘hawkish’, we’re grading the Fed on one heck of a curve.” That, or maybe it just shows that there is no longer a market which discounts any future outside of traders hoping to frontrun the Fed at every step (something which even Blackrock admitted it is doing).

Indeed, as Morgan Stanley’s chief global strategist writes “maybe that’s the challenge; expectations for the Fed had grown to an extent that was hard to meet.” In any case, with the Fed now in the rearview mirror, and as markets adjust through the immediate reaction (lower), we need to turn our attention to what’s next.

Here four key risks converge all near the end of this month, which is why Sheets thinks “that they support the idea of a more challenging September and holding lighter exposure”, something the market’s recent downbeat tone has duly noted. The “next four things” to focus on, according to Morgan Stanley, are:

-

The fate of additional US stimulus (CARES 2.0), which weighs heavily on our USeconomic numbers;

-

The first US presidential debate (September 29), whichcould impact market views on how close (or not) the contest is;

-

COVID-19cases, which by month-end should better reflect the impact of school reopeningsin the US and Europe;

-

Brexit, where economists have recently raised their probability of no deal (with SocGen going as high as 80%)

Some more details on each of these:

-

CARES 2.0 (month-end): A second round of fiscal stimulus (CARES 2.0) represents a potential ~US$1+ trillion swing in US economic data (and potentially as much as $2.2 trillion based on Pelosi’s latest “ask”). This matters, especially as much of this spending is in areas with high fiscal multipliers. Morgan Stanley’s US public policy team thinks that the effective deadline for a deal is near month-end, given the need to also pass government funding, and for members of Congress to close to business and get on the campaign trail

-

First US presidential debate (September 29): This is arguably the most important ‘moment’ in the US campaign between now and the election (there are two other debates, but the first should be the most watched). As such, it could both focus investor attention on the race and shape opinions on how close (or not) the contest is. History suggests some evidence that markets trade softer leading up to a US presidential election.

-

COVID-19 cases (month-end): Summer, when schools are out and it’s easy to be outdoors, was always going to be the ‘easy part’ for social distancing. With schools and universities back, COVID-19 cases at month-end should give a better picture of the implications of this ‘reopening’, for better or worse.

-

Brexit (September-October): The probability of a ‘no deal’ Brexit is rising, per Wall Street economists. While it is possible that this is simply part of the negotiation strategy, the risk of a more market-negative outcome has risen. Timing here is uncertain, but the next month is critical.

Looking at the above four risks – to which we can now add the dramatic political implications for both the Supreme Court and the election unleashed by the passing of Ruth Bader Ginsburg – Morgan Stanley concludes that “holding lighter exposure is prudent, and that investors will get a better opportunity in the near future to be more aggressive.”

Yet despite some near-term turbulence as a result of the events above which add near-term uncertainty, Morgan Stanley does not see them as significant longer-term challenges. Specifically, the bank thinks that:

-

The market could ultimately become comfortable with a variety of US election outcomes, and similar to 2016 benefit from the election moving behind us.

-

The fate of CARES 2.0 will be reflexive, i.e., if its failure produces a material market reaction, this reaction could make new support more likely.

-

While a near-term rise in COVID-19 cases is a worry, we are also moving closer to a vaccine, where progress remains encouraging With each passing day, we move a little closer to that outcome.

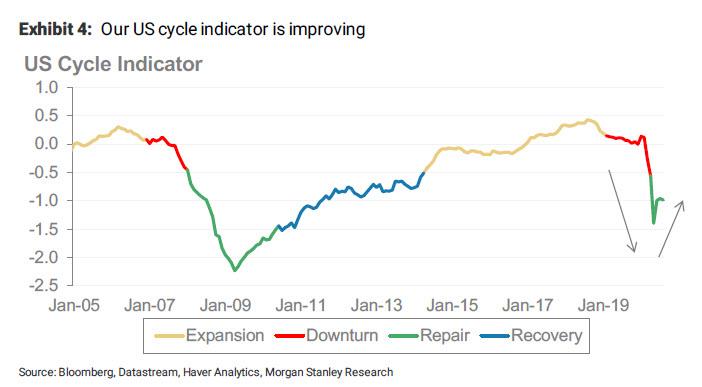

Meanwhile, according to Sheets the broad backdrop remains more similar than different to a ‘normal’ early-cycle, post-recession backdrop (which is of course entirely artificial, and purely on the back of a massive market eruption even as much of the economy remains in a dismal state as the latest update from the commercial real estate sector indicated). Which brings us back to Morgan Stanley’s “above-consensus” optimism on the 12-month global outlook, which it believes market prices do not reflect due to skepticism that ‘normality’ could be achieved (we would side with the market on this).

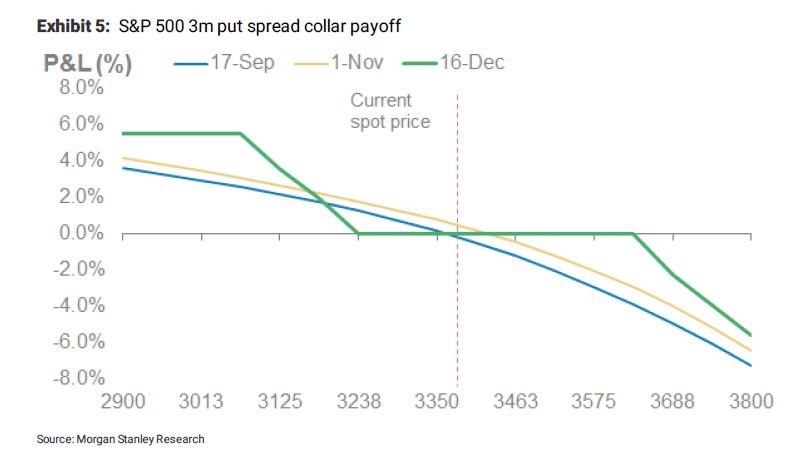

So how to trade all of this? Morgan Stanley has proposed several trades that reflect its current framework of thinking. The bank believes that risk/reward remains best in credit, especially European credit, which is most removed from some of these near-term risks. The bank is also selling equity volatility, which has the highest cross-asset risk premium. For hedges: i) Put spread collars; ii) EM FX; and iii) Commodities with more challenging supply/demand dynamics (oil, aluminium and iron ore).

-

Defensive equities (staples/utilities) versus the market: Defensives have lagged despite yields remaining near cycle lows. Carry is positive. Utilities is the more interesting sector here, given the sector’s ESG angle.

-

EM FX: Many EM economies are facing real fundamental pressure, while the carry in many parts of EM FX is historically low. MS sees little local incentive to strengthen FX, given the current challenges. The bank are long USD/COP and USD/CLP.

-

Commodities with weaker supply/demand support (oil, aluminium, iron ore): If your broader view is more ‘reflationary’, these commodities are interesting hedges. The cost of carry is low, and further price appreciation is potentially limited by the supply backdrop. That said, MS is selling 3m $50 calls on Brent oil to reflect the bank’s commodity team fundamental view that near-term dynamics look challenging.

-

Equity put spread collars: Selling a call to fund a put spread benefits from current levels of both volatility and skew. A put spread hedges against the type of equity downside Sheet is worried about (<10%).

via ZeroHedge News https://ift.tt/2FUWqFT Tyler Durden