Goldman Gives Up On New Stimulus In 2020, Cuts Q4 GDP Growth Forecast From 6% to 3%

Tyler Durden

Thu, 09/24/2020 – 09:15

“A U.S. fiscal deal was baked into markets and now what you are seeing is that the probability of a deal going through has simply reversed,” said Legal and General Investment Management PM Justin Onuekwusi, and he couldn’t be more correct when it comes to big bank analysts who during the August meltup were rushing to upgrade their GDP forecasts (if only to validate the market meltup which we now know was not due to fundamentals but a gamma squeeze orchestrated by SoftBank and facilitated by Robinhood traders).

Even as we were warning all the way back in late July that the fiscal cliff – and the lack of new stimulus clarity – threatens to derail the tepid economic rebound, sellside analysts were tripping over each other to upgrade their Q3 and Q4 GDP forecasts. Well, now that Congressional attention is more focused on the Supreme Court, it seems that a new fiscal deal is 2021 business which now seems unlikely to take place before the election, and really before a new president is appointed – a process which according to president Trump will involve the Supreme Court and may drag well into next year.

Indeed, as Justin adds, “we have heard this week how important a fiscal deal is to the Federal Reserve but from a political standpoint, focus has moved more towards the election and Supreme Court deliberations rather than the economy,” and sure enough, overnight the first GDP downgrade came from Goldman Sachs, which aggressively reversed on its previous “base case” of a $1.5 – $2 trillion stimulus being passed “shortly”, and as a result the bank just slashed its Q4 GDP growth forecast in half from 6% to 3%. Here’s why:

We think it is now clear that Congress will not attach additional fiscal stimulus to the continuing resolution. This implies that after a final round of extra unemployment benefits that is currently being disbursed, any further fiscal support will likely have to wait until 2021.

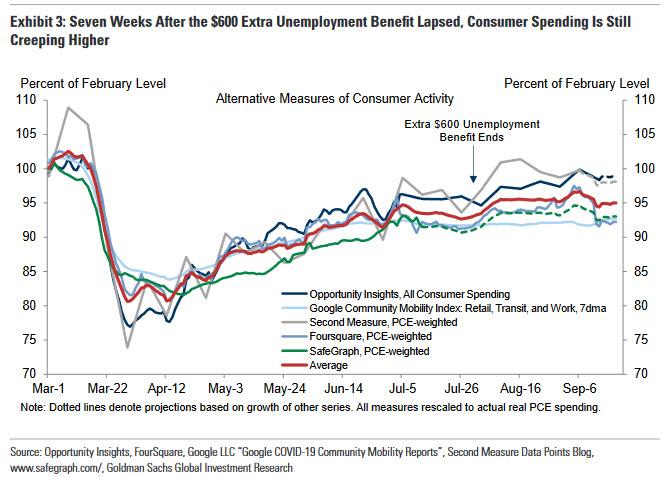

We estimate that the withdrawal of fiscal support will reduce disposable incomen in Q4 to roughly the pre-pandemic level. This will weigh on consumer spending, but probably by less than initially feared. Seven weeks after unemployment benefits lapsed, timely spending measures have trended higher, reflecting an offset from ongoing adaptation and reopening in the service sector. This process can likely continue to at least some extent in coming months, and we therefore expect softer but still modestly positive consumption growth in Q4.

Some more details on the expected hit from this lack of stimulus:

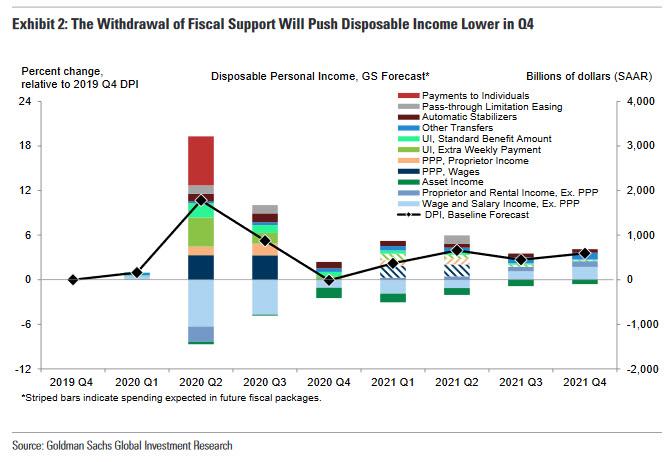

The withdrawal of fiscal support will reduce disposable income in Q4. We estimate that after peaking in Q2, disposable income fell in Q3 and will fall further in Q4 to roughly the pre-pandemic level, as shown in Exhibit 2. While rapid job growth has partially restored private income in Q3 and should provide a further boost in Q4, the sharp decline in fiscal support is likely to outweigh the gain in private income.

And as noted above, and as we said almost two months ago, Goldman now expects that the hit to disposable income “will weigh on consumer spending in Q4, though probably somewhat less than we initially feared” as shown in the next chart.

As a result, Goldman’s chief economist Jan Hatzius is lowering his consumer spending expectations for the remaining months of this year, “but not dramatically” penciling in a deceleration in consumption growth to 0-½% in September and October and -½% in November and December, “by which point the boost from the last round of extra unemployment benefits is likely to have faded.”

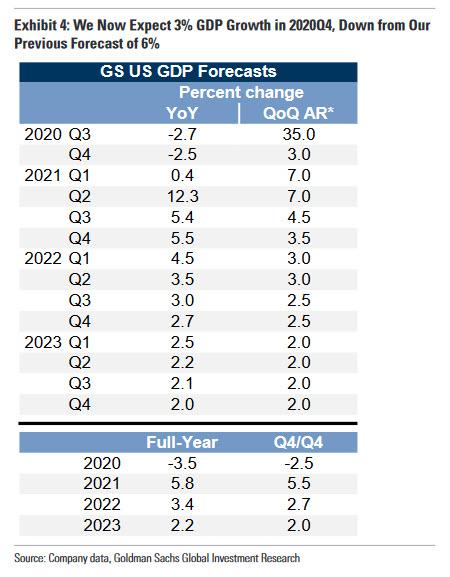

This downgrade to Goldman’s consumption forecast results in a downgrade to the bank’s GDP growth forecast to 3% on a quarterly annualized basis, from 6%previously:

“We are lowering our Q4 GDP growth forecast from 6% to 3% on a quarterly annualized basis. This leaves more room for catch-up later, and we have therefore raised our 2021Q2-Q4 growth forecasts as a partial offset. Our new forecasts imply full-year growth of -3.5% in 2020 and +5.8% in 2021 (or -2.5% in2020 and +5.5% in 2021 on a Q4/Q4 basis).”

While Hatzius concedes that this will delay the recovery somewhat he notes that this “leaves more room for catch-up next year, especially once a vaccine becomes available”

We have therefore bumped our 2021 Q2 forecast by 1pp to 7% and our 2021Q3 and Q4 forecasts by ½pp each to 4.5% and 3.5%. We are offsetting the hit to Q4 with higher growth in Q2-Q4 because we are more confident that widespread distribution of a vaccine to the full population will be achieved by Q2 than by Q1 of next year in light of the recent press reports that the FDA is likely to announce tougher standards for vaccine authorization

Incidentally, Goldman’s core assumption that a vaccine is widely available in early 2021 and was the reason why the bank hiked its GDP forecast a few weeks ago, is where it will also be proven wrong, as a credible vaccine – one which sees a take up by a majority of the population – is unlikely to happen in 2021.

via ZeroHedge News https://ift.tt/3050ECq Tyler Durden