SPAC Stocks Slammed After SEC Chair Clayton Vows To “Look Closer” At Transactions

Tyler Durden

Thu, 09/24/2020 – 10:15

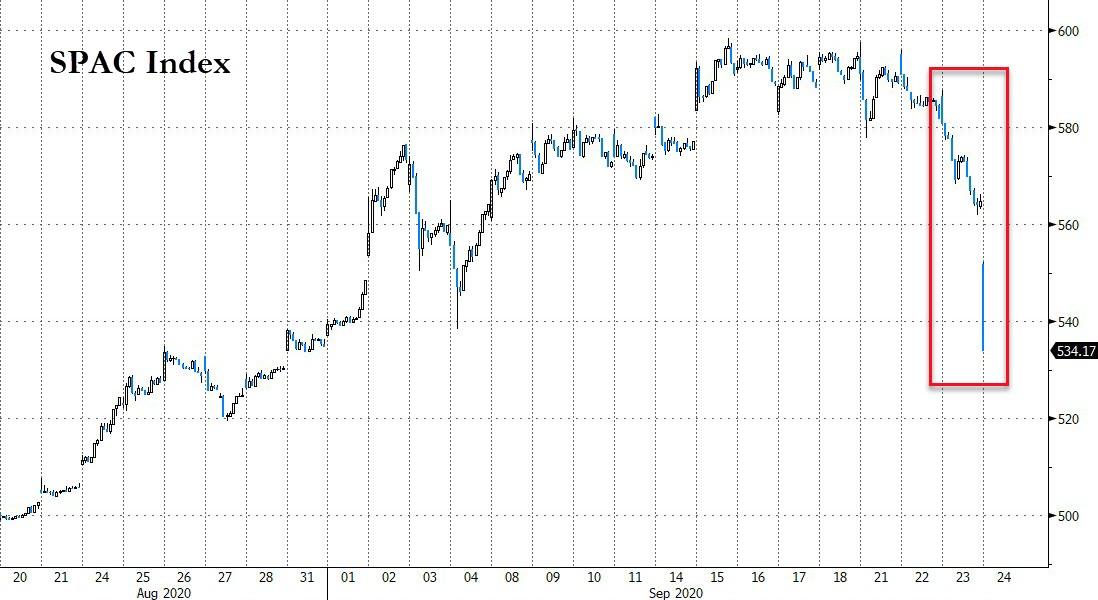

SPAC stocks like Forum Merger II, Tortoise Acquisition, and DiamondPeak Holdings all tumbled after SEC Chair Jay Clayton said the agency would be looking closer at the transactions going forward, in an interview on CNBC.

Given the ongoing implosion of one of the market’s most well known recent SPAC transactions in Nikola (which is down about 15% again this morning and has traded with a 16 handle literally days after touching $50), Clayton likely thought it wise to make a round of PR stops on Thursday morning to assure investors that, even though fraud could be widespread in SPACs, the SEC is on the case.

The SEC Chair assured investors that the SEC was focusing on certain parts of the SPAC process while Andrew Ross Sorkin noted that over 100 companies have used the IPO-end-around go to public this year so far.

“To the extent that the SPAC structure is an alternative to an IPO, it’s actually really healthy,” Clayton said, defending the process at first.

“Competition to the IPO process is probably a good thing, but for good competition and good decision making you need good information and one of areas in SPAC space I’m particularly focused on is incentives and compensation to the SPAC sponsors,” Clayton said.

“Competition to the IPO process is probably a good thing, but for good competition and good decision making you need good information and one of areas in SPAC space I’m particularly focused on is incentives and compensation to the SPAC sponsors,” says SEC Chairman Jay Clayton. pic.twitter.com/JNnhX0vCbl

— Squawk Box (@SquawkCNBC) September 24, 2020

Clayton continued, telling Andrew Ross Sorkin: “For good competition and good decision making you need good information. One of the areas I’m particularly focused on is the incentives and compensation to the SPAC sponsors. How much of the equity do they have now, how much of the equity did they have at the time of transaction?”

“What are their incentives? We want to make sure investors understand those things. And then at the time of the transaction, when they vote, that they’re getting the same rigorous disclosure that you get in connection with bringing an IPO to market,” he said.

Then, comically, he thanks CNBC: “I appreciate you guys bringing to light that SPACs are different than IPOs.”

With Clayton offering no specifics about concrete steps the agency is ready to make right now to reel in the SPAC frenzy, it is likely that the feeding frenzy of questionable transactions will continue throughout the rest of 2020 – or at least until another SPAC publicly implodes, leaving the SEC not so much worried about the individual investor – but rather how the embarrassment affects their image as an agency.

Then, maybe they’ll do something about it.

via ZeroHedge News https://ift.tt/3i16Uks Tyler Durden