American Airlines Gets Upsized $5.5 Billion Loan From US Treasury, Averting 19,000 Furloughs

Tyler Durden

Fri, 09/25/2020 – 17:41

American Airlines has avoided pulling a 737 MAX into the liquidity abyss.

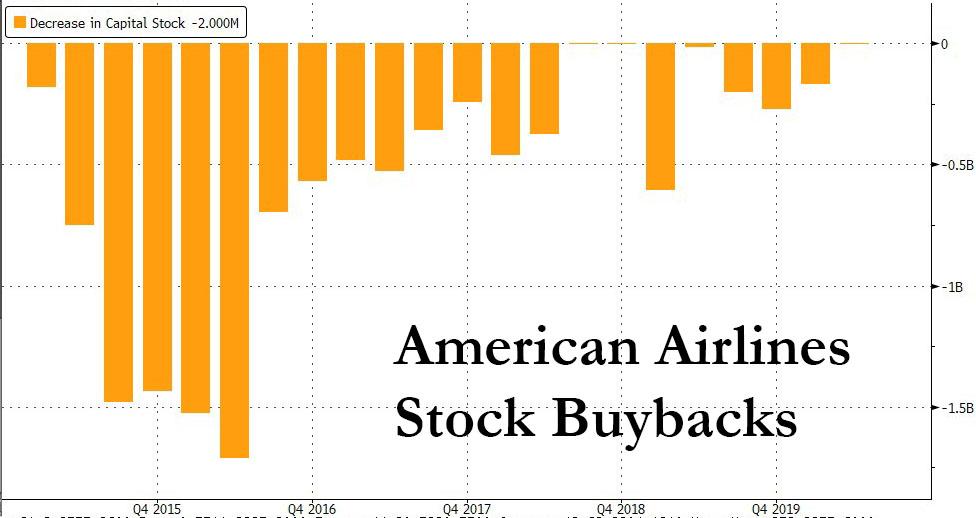

Late on Friday, the largest US carrier – which in good times spent billions of cash on stock buybacks only to now find itself on the verge of collapse due to the collapse in air travel as a result of covid…

… filed an 8K announcing it had entered a loan agreement with the US Treasury for a secured term loan facility backed by the company’s loyalty program, which permits American to borrow up to $5.48 billion, upsized from an original $4.75 billion target, after companies such as Delta Air Lines Inc. and Southwest Airlines Co. opted out of the funds and the remaining money was reallocated.

American also said that it has been advised by the Treasury that it intends to allocate additional loans under the “CARES Act”” in October 2020, and the airline could receive as much as $2 billion more when the funds are adjusted a second time.

American immediately borrowed $550 million under the facility “and may, at its option, borrow additional amounts in up to two subsequent borrowings until March 26, 2021.”

So what is the cost of this taxpayer-funded bailout loan to American? Why a “whopping” L+3.5%:

Borrowings under the Facility will bear interest at a variable rate per annum equal to (a)(i) the London interbank offer rate divided by (ii) one (1) minus the Eurodollar Reserve Percentage (as defined in the Loan Agreement) plus (b) 3.50%.

The applicable interest rate for the $550 million loan drawn on the Closing Date under the Facility will be 3.87% per annum for the period from the Closing Date through September 15, 2021 at which time the interest rate will reset in accordance with the foregoing formula.

Curiously, not even Uncle Sam is willing to a accept a covenant lite deal: according to the 8K, the Loan Agreement requires American “to appraise the value of the Collateral and recalculate the collateral coverage ratio. If the calculated collateral coverage ratio is less than 1.6 to 1.0, American will be required either to provide additional Collateral (which may include cash collateral) to secure its obligations under the Loan Agreement or repay the term loans under the Facility, in such amounts that the recalculated collateral coverage ratio, after giving effect to any such additional Collateral or repayment, is at least

1.6 to 1.0.” The appraised value of the Collateral is presently significantly in excess of the 2.0 to 1.0 collateral coverage ratio necessary to access the amount under the Facility, including any contemplated increase.

Separately, the Loan Agreement prohibits American to pay dividends or buyback stock. In addition, under the Loan Agreement, AAG must maintain a minimum aggregate liquidity of $2.0 billion.

As Bloomberg notes, US airlines slammed by the coronavirus pandemic have been building cash through equity sales and loans as passenger totals remain about 70% below year-ago levels. They have also parked aircraft, cut flying schedules and asked thousands of employees retire early or take leaves to further reduce spending.

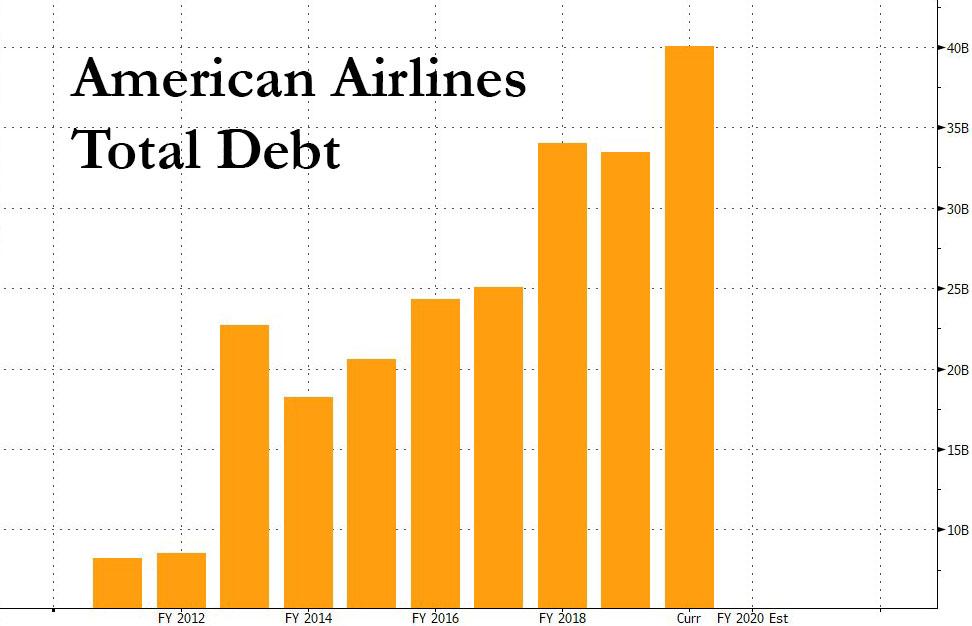

Putting the $5.5 billion number in context, American’s market cap of $6.3 billion is just above the current $5.5 billion loan size, and below what the fully expanded $7.5 billion loan will be. American currently has $42 billion in debt, a number which will soon hit $50 billion.

In late August, American said it would cut more than 40,000 jobs, including 19,000 through furloughs and layoffs, in October as it struggles with a sharp downturn in travel because of the pandemic. American executives said the furloughs can only be avoided if the federal government gives airlines another $25 billion to help them cover labor costs for six more months. American began the year with about 140,000 employees but expects fewer than 100,000 to remain in October.

It is assumed that as part of the loan conditions,

The industry got $25 billion in federal payroll support earlier this year, consisting largely of grants with a portion in loans. American received $5.8 billion as part of that package. Congress is debating whether to extend the payroll aid, which expires at the end of the month, in an effort to avoid tens of thousands of industry layoffs.

American shares initially jumped more than 3% in afterhours trading, but have since faded most gains.

via ZeroHedge News https://ift.tt/2Ey1BeI Tyler Durden