Dow Suffers Worst Week Since June As Dollar Surges Most In Six Months

Tyler Durden

Fri, 09/25/2020 – 16:00

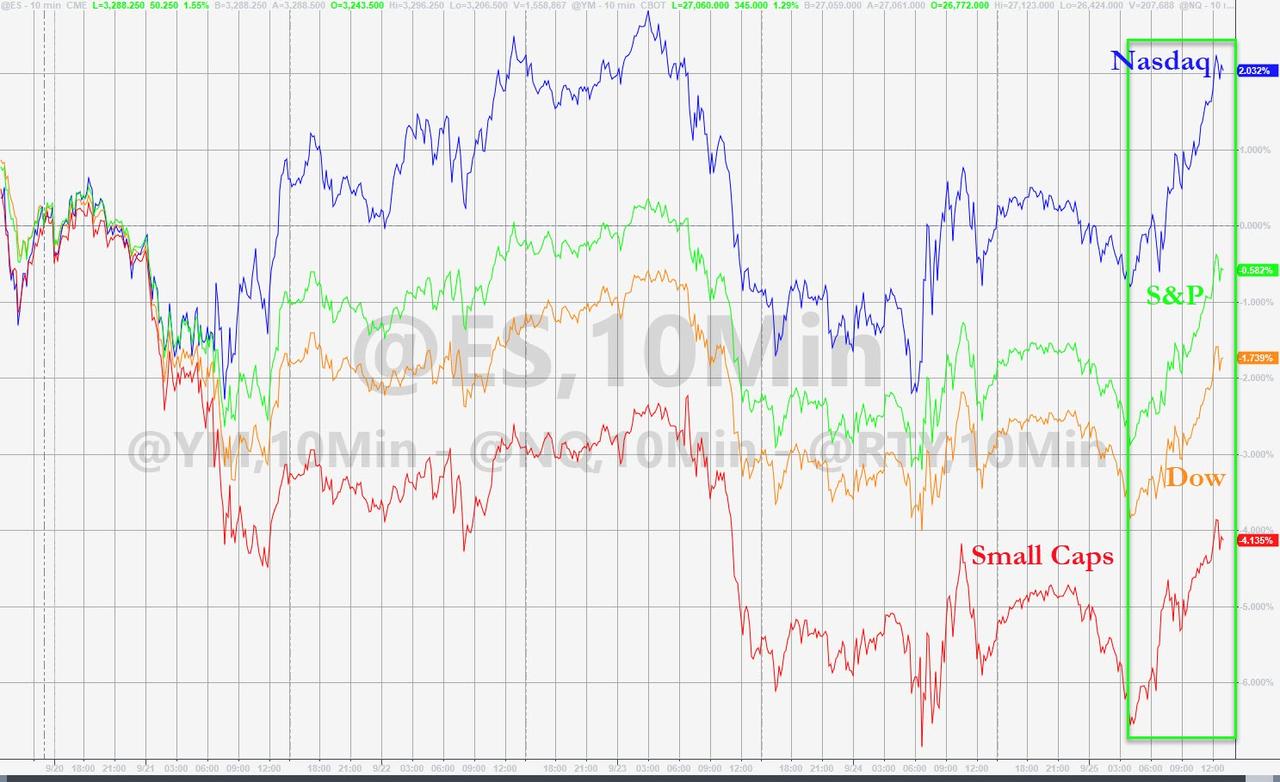

A mixed picture in the major US equity indices this week with mega-tech-heavy Nasdaq managing gains (busting a three-week losing streak) as The Dow suffered its worst week since June, S&P and Dow down for the 4th week in a row (longest losing streak since Aug 2019)…

But, away from index-land, the media US stock is in bear market, down over 20% year-to-date…

Source: Bloomberg

A much uglier week for European stocks…

Source: Bloomberg

The S&P 500 bounced off “unch” for 2020 today…

Cyclicals underperformed this week (down the 4th week in a row – longest losing streak since March collapse)

Source: Bloomberg

Uncertainty around the election continued to rise this week…

Source: Bloomberg

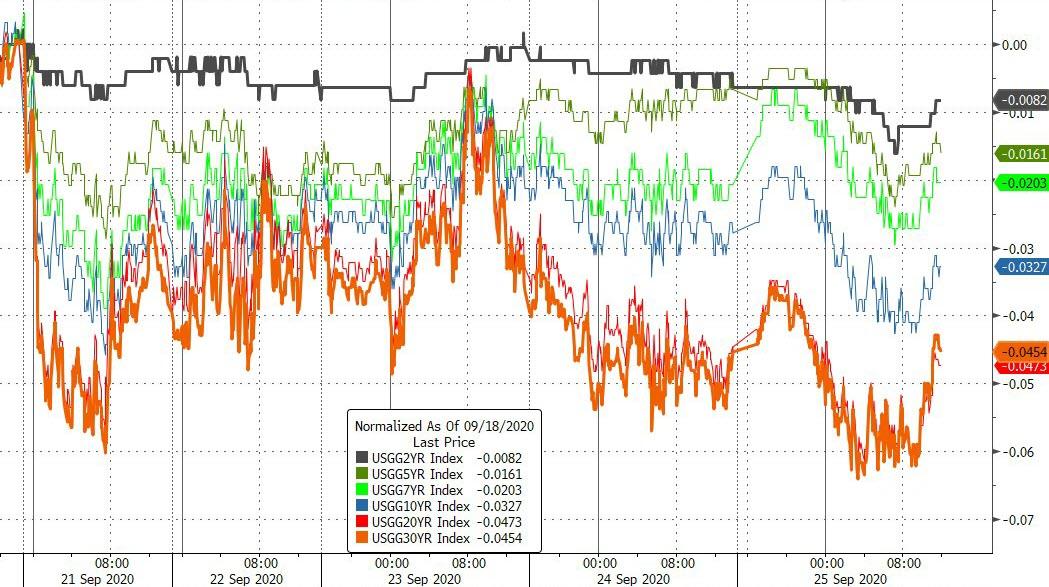

Treasury yields were all lower on the week with the long-end outperforming (30Y -5bps, 2Y -1bps)…

Source: Bloomberg

Real yields surged higher on the week, dragging gold lower…

Source: Bloomberg

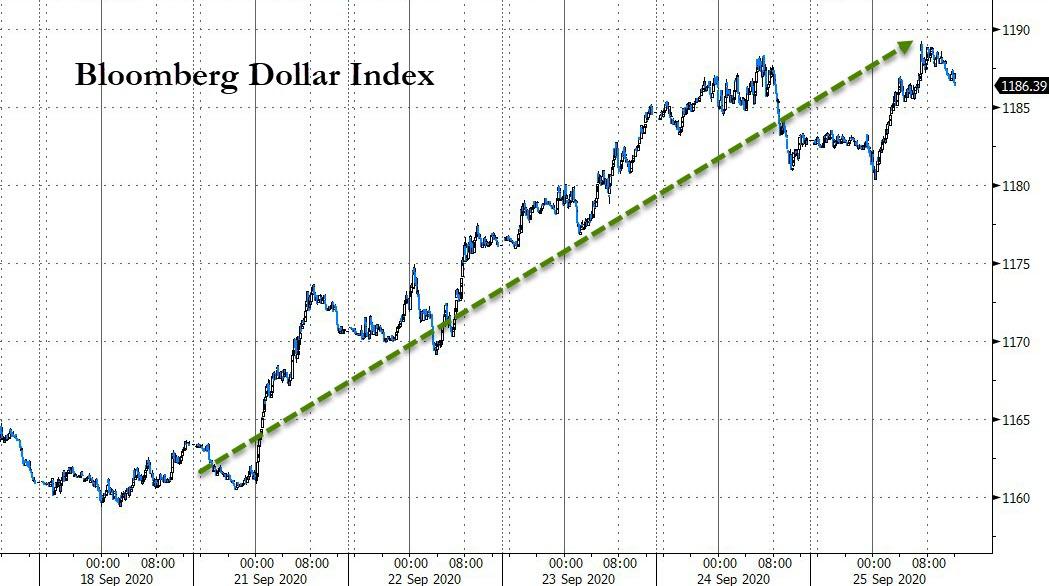

The dollar ripped higher this week (5th day higher in the last 6 higher) to its best week since March

Source: Bloomberg

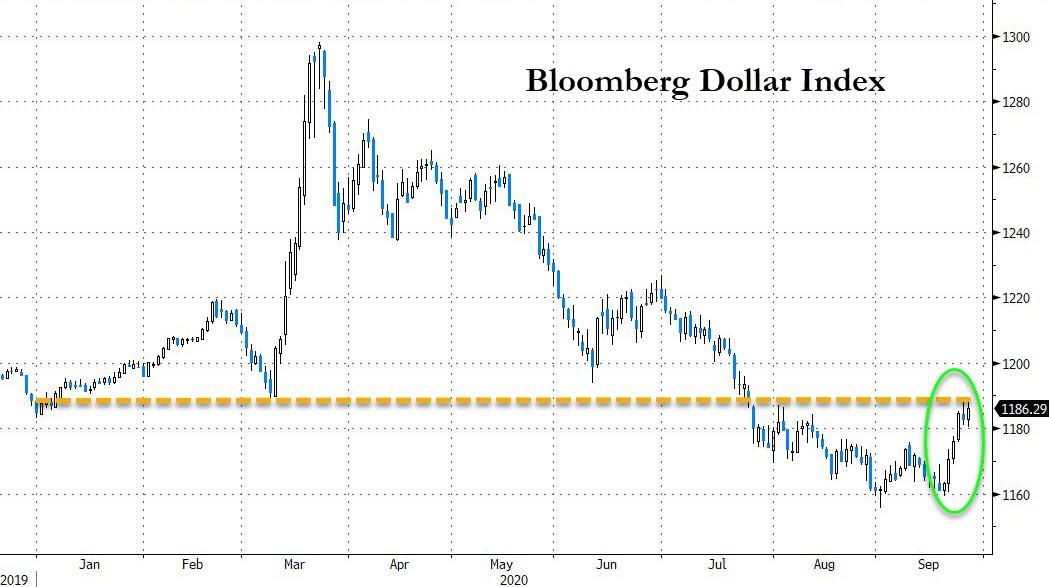

Notably the dollar rallied to the March low pivot…

Source: Bloomberg

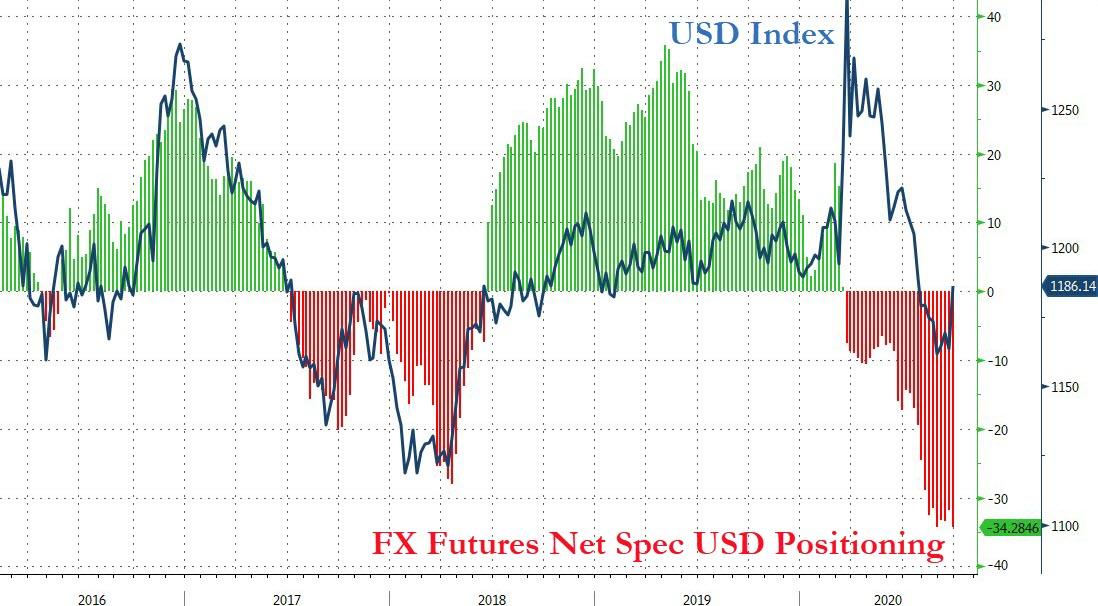

We note that the net spec positioning across FX futures was extremely short the USD which may explain the week’s squeeze…

Source: Bloomberg

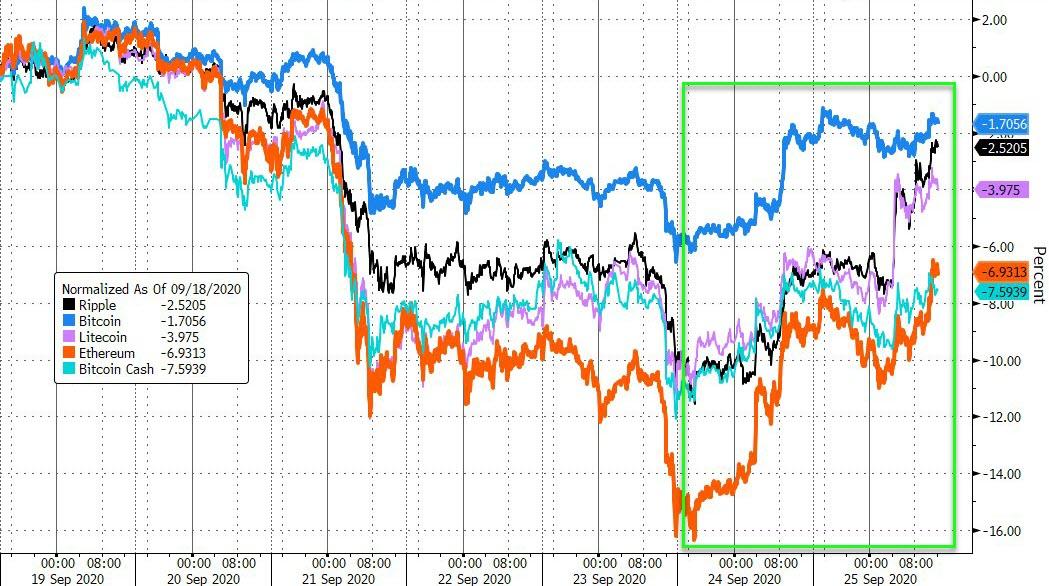

Cryptos were all lower on the week (even with the rally of the last two days) with Bitcoin the least hit and Ethereum worst…

Source: Bloomberg

Silver was on target for its worst week since Sept 2011 before today’s bounce but all the major commodities were weaker on the week amid a soaring USD…

Source: Bloomberg

The last time silver saw such a drop, it screamed higher…

Source: Bloomberg

WTI ended lower but managed to hold back above $40…

Gold has outperformed silver for 5 of the last 6 days – the biggest weekly outperformance since March…

Source: Bloomberg

Finally, there’s this…

Source: Bloomberg

And, this seemed to sum things up nicely…

via ZeroHedge News https://ift.tt/3hYgEMs Tyler Durden