Morgan Stanley: Brace For A Very Difficult Trading Environment In The Next 5 Weeks

Tyler Durden

Sun, 09/27/2020 – 15:50

Sunday Start, by Michael Wilson, Morgan Stanley chief US equity strategist

The Waiting Is the Hardest Part

Over the past month, several key risks to markets have surfaced, producing the first meaningful correction in this new bull market. More specifically, the S&P 500 dropped over 10% from its recent highs, led by the 14% plunge in the Nasdaq 100. Truth be told, I thought this correction would arrive in August, but instead US equity markets experienced a blow-off move to the upside as real 10- and 30-year yields made all-time lows and retail speculation became rampant. Timing is everything, as they say. Nevertheless, the correction in which we find ourselves is happening for the reasons I suspected back in August.

- First, the US is facing a fiscal cliff. With Congress embroiled in election-year politics and a tussle over when to fill the Supreme Court vacancy, the probability of CARES 2 getting passed before November 3 has dropped considerably – just 33% now, according to our public policy strategist Michael Zezas.

- Second is COVID-19 and the looming arrival of a second wave. So far, Europe has seen a greater impact from the second wave, but we all know it’s coming to the US and other parts the world this fall/winter. Until we know exactly what it looks like, further lockdowns here remain a real risk, particularly given the role they could play in deciding the outcome of the US elections.

- Third, real long-term interest rates appear to have bottomed as rates markets accept what the Fed has been saying all summer about yield curve control.

- Finally, we have the election itself and the uncertainty surrounding not only the outcome, but also its validity and timing of a definitive result. 2020 has been an unusual year to say the least, and this election is the cherry on top.

In short, uncertainty has rarely been higher for financial markets.

Realized and implied volatility reflect these concerns, with both up substantially in the past month. Options markets are pricing in higher risk than normal around the US election, but nothing like we experienced in 2016. This doesn’t seem right, given the uncertainty about the election process and results that is building. As a result, I expect volatility to remain high for the next 4-5 weeks, creating what is likely to be a difficult trading environment. Despite this seemingly consensus view, both gross and net exposures for our institutional clients remain decidedly elevated. When volatility and beta are adjusted, they stand at all-time highs.

What this tells me is that if volatility stays high and markets remain fairly trendless, these exposures are likely to fall over the next month. That means lower equity prices before this correction is over. We have targeted the 200-day moving averages for the S&P 500 and Nasdaq 100 as good levels to think about, which are approximately 6% and 14% lower, respectively.

Looking beyond the near term, I think three of these risks are likely to be resolved positively by the end of the year or shortly thereafter. Meaning, more fiscal stimulus is likely as both parties want to spend more but may not be able to come to terms before the election. More market pressure will likely help to get it done sooner. Meanwhile, progress on a vaccine and natural herd immunity via a second wave should become clearer, and we will have a conclusion to the election. The waiting is the hardest part.

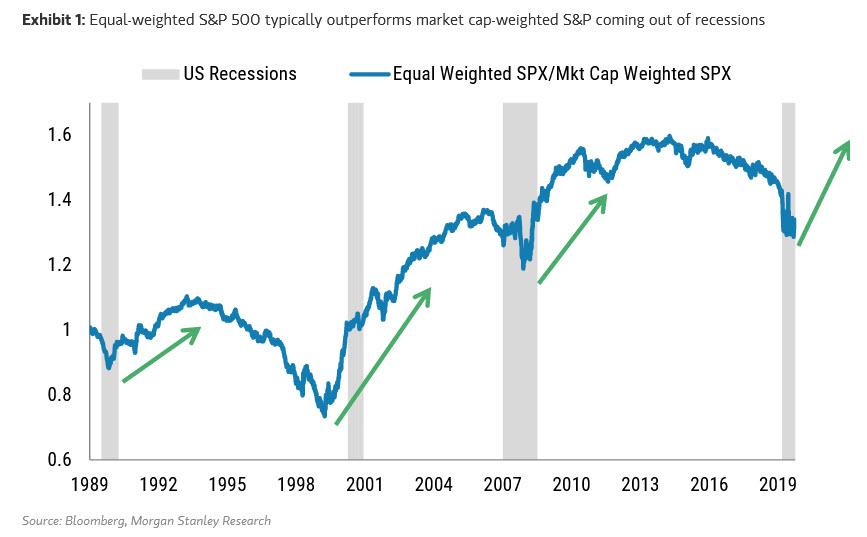

This leads me to my final point for this week’s Start. The recent correction was inevitable, in my view, as all bull markets consolidate along the way, especially when the initial rally is this powerful. Timing such corrections is difficult, and this time was no different. Now that it has begun in earnest, we need to start thinking about what to buy into this dip. If you share my view that these near-term hurdles will be cleared by year-end, this means that the recovery can continue in 2021. To me, this implies that recovery stocks should be the area of focus particularly if real rates have bottomed. This includes consumer cyclicals/services, materials, industrials and financials. Moving down the capitalization curve makes sense, too. Perhaps the best way to express such a view is to look at the equal-weighted S&P 500 versus the market cap-weighted version.

This typically works quite well coming out of a recession, and I see no reason to believe it won’t be the same this time.

Enjoy your Sunday.

via ZeroHedge News https://ift.tt/2S5WhCp Tyler Durden