Surge In Chinese Industrial Profits Continues, But Is This Just More “Fake Data”

Tyler Durden

Sun, 09/27/2020 – 14:15

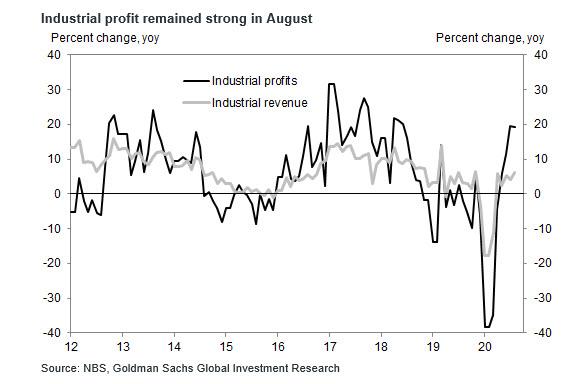

Overnight, China’s National Bureau of Statistics reported that profits at Chinese industrial enterprises remained surprisingly resilient in August, rising 19.1% from a year ago if moderating fractionally from the 19.6% y/y surge in July, as Beijing telegraphs that China’s factories maintained momentum following the pandemic shutdown. Profit margin for industrial companies increased further in August compared to one year ago. By industry, data suggest upstream industries’ profit growth outperformed downstream industries in August.

Here are the main highlights:

- China’s industrial profits grew 19.1% year-over-year in August, moderating marginally from 19.6% in July. In month-over-month non-annualized terms, profits fell 1.6% in August.

- On a year-over-year basis, upstream industries’ profit growth outperformed downstream industries in August. Downstream industries’ profit growth moderated to +16.9% yoy in August (vs. 28.7% yoy in July) while upstream industries’ profit growth accelerated to +31.0% yoy (vs. +4.6% yoy in July). By major industry, profit of general equipment manufacturing rose 37% yoy (vs. 26% yoy in July) and electrical machinery and equipment rose 13.3% yoy (vs. 8.1% yoy in July). Automobile manufacturing profits remained relatively solid and rose 55.9% yoy in August, though moderating from 102.5% yoy in July. The decline in profits of mining sectors narrowed meaningfully to -11.9% yoy in August from -40.6% yoy in July, on the back of rising commodity prices and demand recovery.

In a statement accompanying the data release, the NBS said that the increase was due to factors including the continued recovery of production and demand as well as falling costs and fees for companies. The bureau also pointed to a recovery in mining industry profitability and rapid growth in profits for equipment manufacturers.

However, as usual when it comes to Chinese ‘data’, there were several key question marks in the report – which was quite flattering for Xi Jinping in the ongoing cold war with Trump – that put the validity of the data in question:

- For one, industrial revenue growth remains stagnant, and while total industrial revenue growth accelerated to +4.9% yoy, from +3.3% yoy in July, it was nowhere near the surge in profits. In the absence of top-line growth, the continued surge in profits was entirely contingent on rising margins (total profits divided by revenues), which expanded to 6.9% in August (vs. 6.1% in the same period last year), contributing to the solid growth in total profits. How China is managing such dramatic profit margin expansion without mass layoffs, and in a time when supply chain transformations should be crushing margins remains a great unknown.

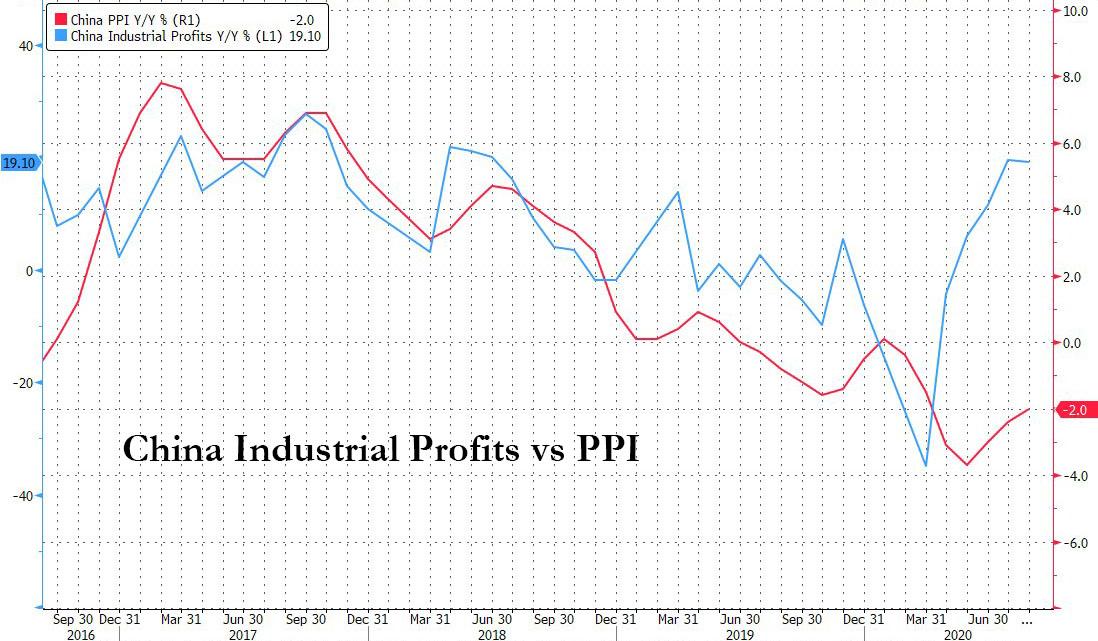

Secondly, and casting even further doubt on the data’s credibility, is that the jump in Industrial Profits comes at a time when China’s so-called gate inflation, i.e., Producer Prices, which is critical in determining pricing power for local companies and is thus a key driver for industrial profits, remains solidly negative. In fact, after tracking PPI lower for the past three years, Industrial profits magically surged starting in April, even as producer prices continued to sink. As a result, the current divergence between Industrial Profits and PPI is the widest it has ever been.

This decoupling between the two traditionally closely-correlated data sets suggests three things:

- i) Chinese PPI will jump in the coming months as rising prices are a critical component to validate the jump in both industrial margins and profits, leading to a broader reflationary wave spilling out of China and washing across the rest of the world.

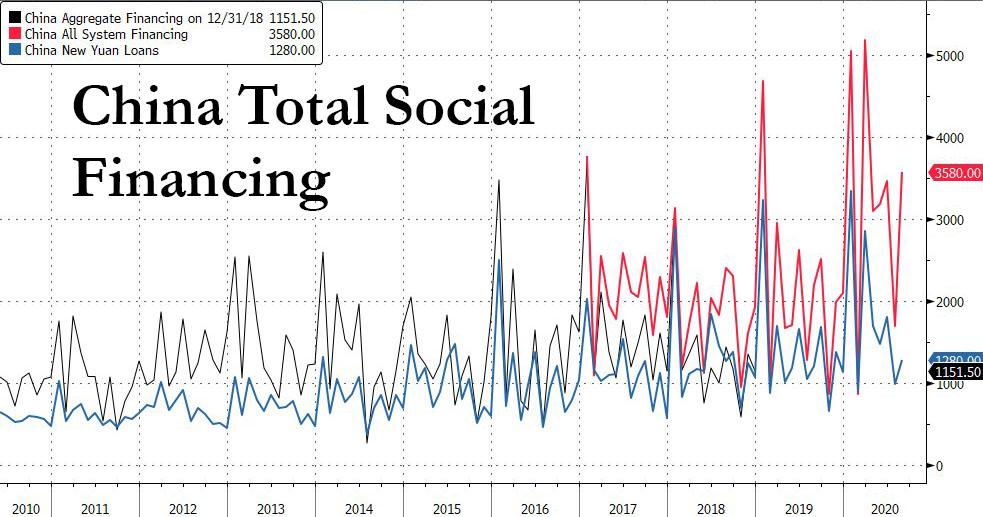

- ii) the spike in Industrial profits has been a one-off outlier, resulting from the recent surge in local credit creation which has seen trillions of dollar in new credit creation since the covid pandemic struck, and once Beijing eases back on the throttle, profits will tumble.

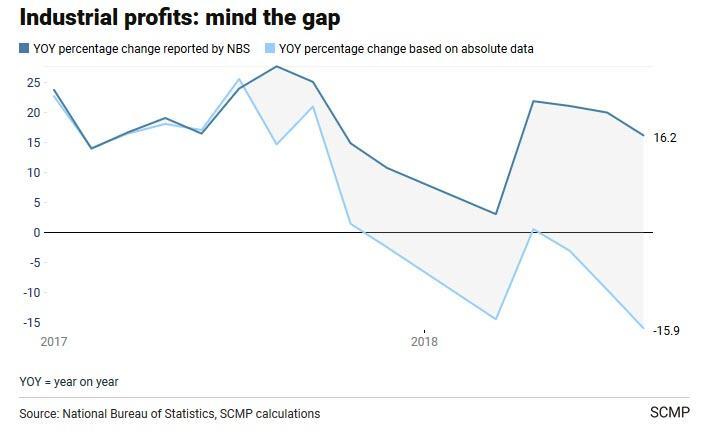

- iii) the Chinese data is (and has been) fake, and remains goalseeked for the political benefit of Xi Jinping who is eager to show that his handling of the covid pandemic has been more successful than that of Trump, resulting in a faster return to economic normalcy. Stripping away the populist veneer however sparks even more questions: as a reminder, back in 2018 we showed a staggering gap between official government industrial profits “data” and micro data in absolute terms: a divergence that could only be explained away with even more Beijing data fraud (see “More Fraud Exposed In Chinese Official Econ Data“).

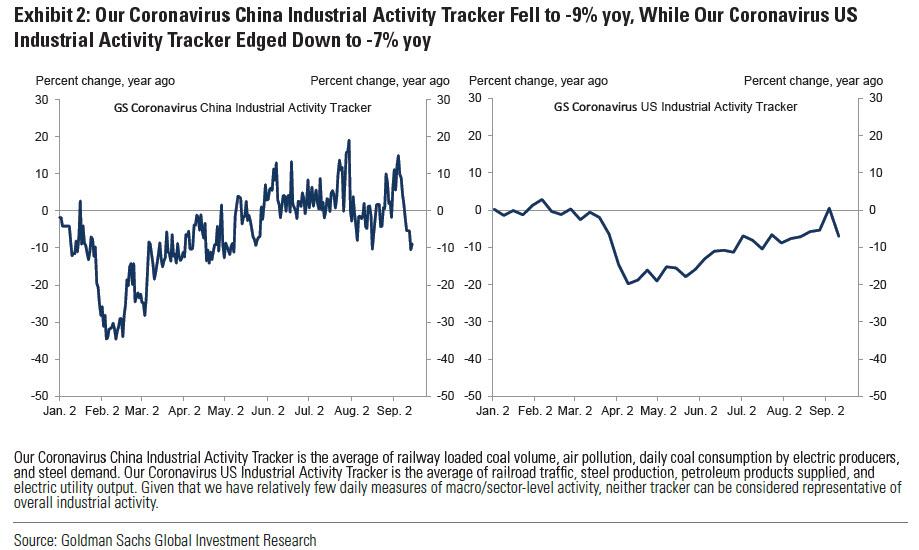

One final reason why the official Chinese “data” is especially suspect, is that Goldman’s latest China real-time activity tracker showed a sharp drop in industrial activity in the past month, just the opposite of what the official data suggests.

Of course, if China has devolved to once again simply fabricating core economic data, that makes the lives of traders and strategists especially difficult since much hope for a global reflation wave has come from the recent surge in China’s credit impulse which leads 10Y TSY yields with a 12 month lead. Unfortunately, if this impulse fails to affect China’s economy first and foremost, then it will make all bets that yields are set to jump in the next 6 months a very costly mistake.

via ZeroHedge News https://ift.tt/3ibF0lU Tyler Durden