Fed’s Evans Says More QE Coming “If The Recovery Slows Down”

Tyler Durden

Fri, 10/09/2020 – 11:12

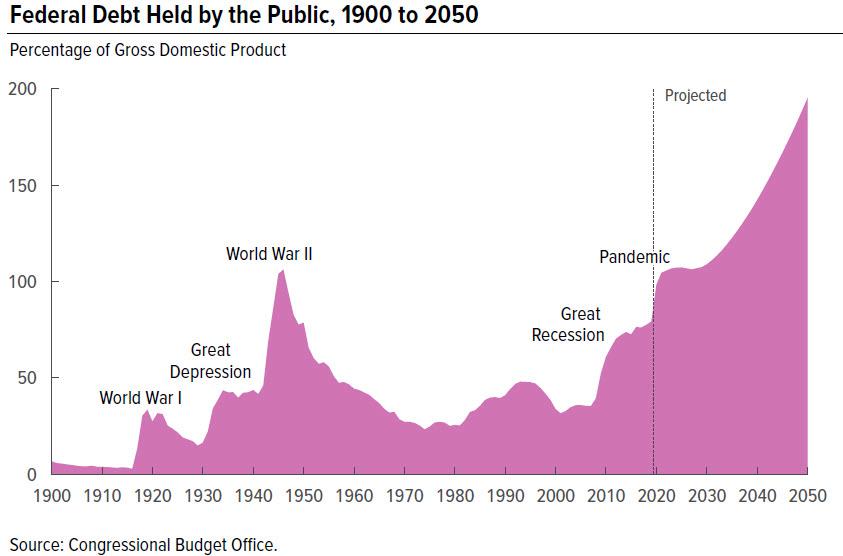

Two days ago, when we noted that according to a recent research report by a top Fed economist, the US economy would need another $3.5 trillion in QE to offset the Fed’s inability to cut rates below zero, we said that this would be the academic strawman used by Fed members to justify trial baloons of much bigger QE (which is need if for no other reason, then to monetize the trillions in new debt issuance in coming years).

We didn’t have long to wait to see this in action, and on Friday morning, Chicago Fed President Charles Evans said that the Fed would ramp up QE if the recovery were slower:

“If things were somewhat worse, if the recovery was slower, I think we’d still be having interest rates at the zero lower bound, but I think we would also be following it up with more asset purchases and hoping that there would be more fiscal support as well.”

While his lack of conviction that the Fed would not dip into negative rates was somewhat puzzling and rather ominous for US banks, the hint that more QE is coming as soon as the US economy double dips is precisely what market bulls were looking to hear.

“The discussion, I believe, is going to be: How do we characterize the asset purchases that we’re undertaking now? What might be some conditions in order to change the pace, change the way in which we’re investing?” Evans said in a Yahoo! Finance interview published Friday.

“We’re investing across the curve now. It could be more targeted if that were deemed appropriate,” he says, using the term “investing” for the first time, which was also notable because that’s precisely what the Fed is doing, and not just “across the curve” but also with corporate bond ETFs, and soon, stocks.

Going back to QE, Evans said that “there is still quite a bit of flexibility on the asset-purchase side right now, and it allows us flexibility to also provide more accommodation if that’s necessary. But there’s more conversations that need to take place.” Conversation probably discussing just how big the new QE will have to be.

Ironically, Evans also admitted that “the economy has been more resilient so far. One has to wonder if we’ve just gone through the best part of the year, when it’s been warm and you can have a lot of outdoor activities.”

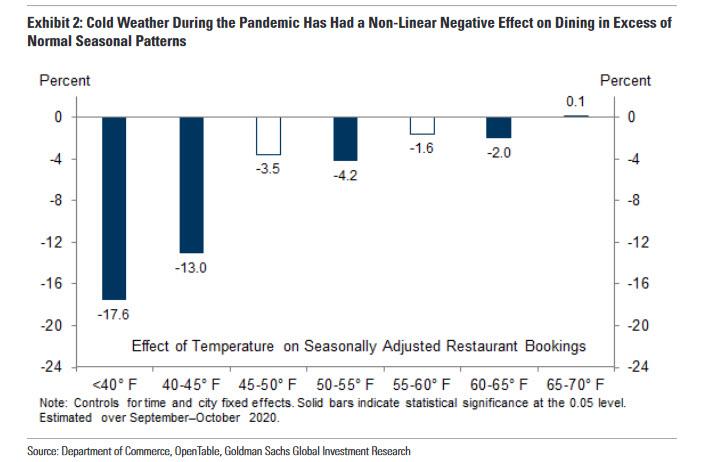

“It’s going to start getting colder, and it’s going to be indoor weather, and that’s going to be even more challenging for the spread of the virus.” Indeed, as we noted yesterday, once outside temperatures drop below 45°F, is when Goldman calculated that would be a sharp drop in outdoor dining.

Goldman then estimated that winter weather will reduce restaurant spending by 3–4% and consumption by 0.2% during the coldest months. This translates to a 0.3% hit to real GDP growth in Q4 and a 0.1% hit in 2021 Q1, followed by a rebound as temperatures rise in 2021 Q2.

In other words, this may be the first time ever when “snow in the winter” is cited by the Fed as the catalyst for another round of upsized QE.

via ZeroHedge News https://ift.tt/30MJnhm Tyler Durden