Yuan Surges Most In 15 Years On Expectations Of Pro-China Pivot By “President Biden”

Tyler Durden

Fri, 10/09/2020 – 10:33

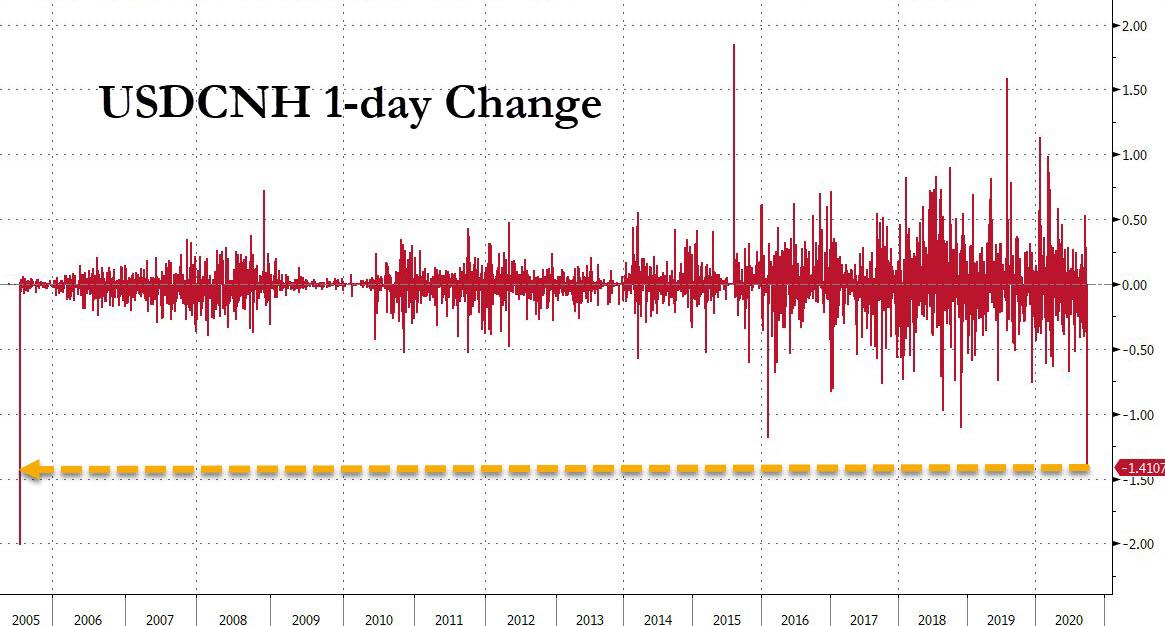

China’s onshore yuan, which was closed for trading during China’s week-long Golden Week holiday, soared 1.4% today as China returned to work and as the onshore yuan (CNY) caught up to the recent surge in the offshore yuan (CNH), driven by the recent plunge in the dollar and the rising expectations that Joe Biden will win the presidency and renormalize US-China relations by pivoting to a pro-China stance.

The onshore rate for the yuan, which had not traded since September 30 due to holiday, soared as much as 1.41% on Friday to 6.6950, the strongest since April 2019.

That was the biggest one-day change in the CNY since July 2005, when China broke the yuan-peg to the dollar and revalued its currency.

The more-loosely regulated offshore renminbi, which traded throughout the holiday, climbed 0.8% to 6.6818 against the dollar.

What prompted the surge? According to strategist cited by the FT, traders in China on Friday were emboldened by the imminent possibility of a US administration that was more friendly towards Beijing.

According to Daniel Been, head of FX strategy at ANZ, the increasing probability of a win for Democratic candidate Joe Biden in next month’s US presidential election had helped to lift the Chinese currency: “The view in the market is that the way a Biden administration approaches [US-China relations] is probably going to be less confrontational and certainly using trade less as a tool or weapon against China.”

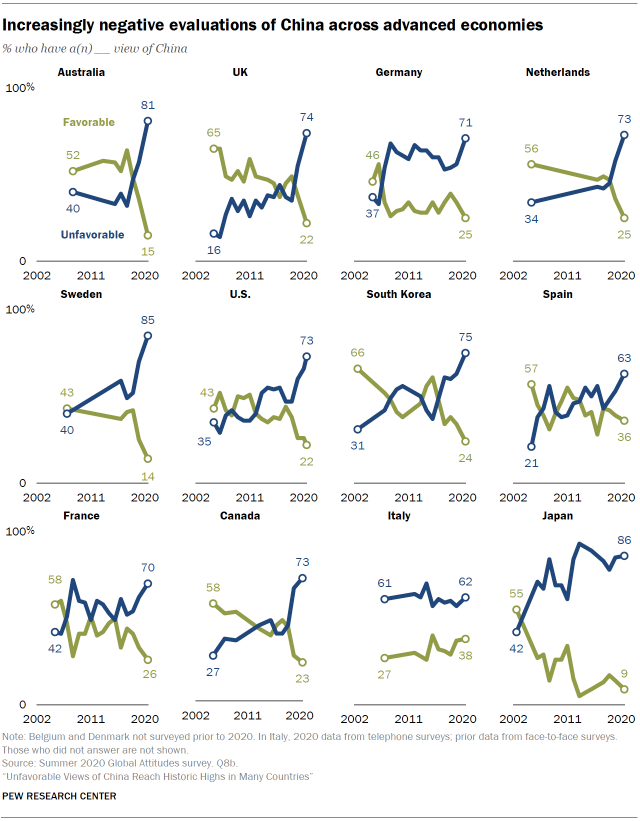

In short, China views Biden a distinctly pro-China president, which is concerning at a time when anti-China sentiment across virtually the entire world has reached record levels, as Pew found this week.

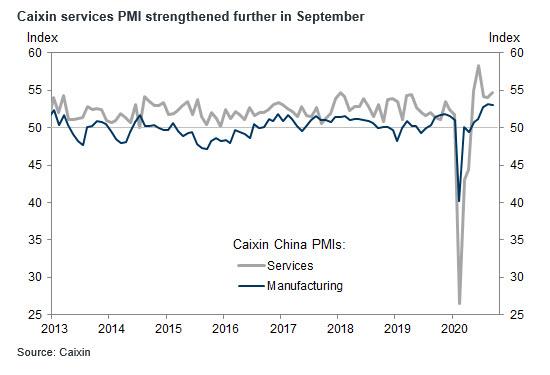

In addition to sentiment about Biden’s pro-China agenda, the Chinese currency was also boosted by fresh signs the economy is improving after authorities controlled Covid-19 in the country. Overnight, the Caixin China Service PMI showed activity climbed to its highest level in three months in September.

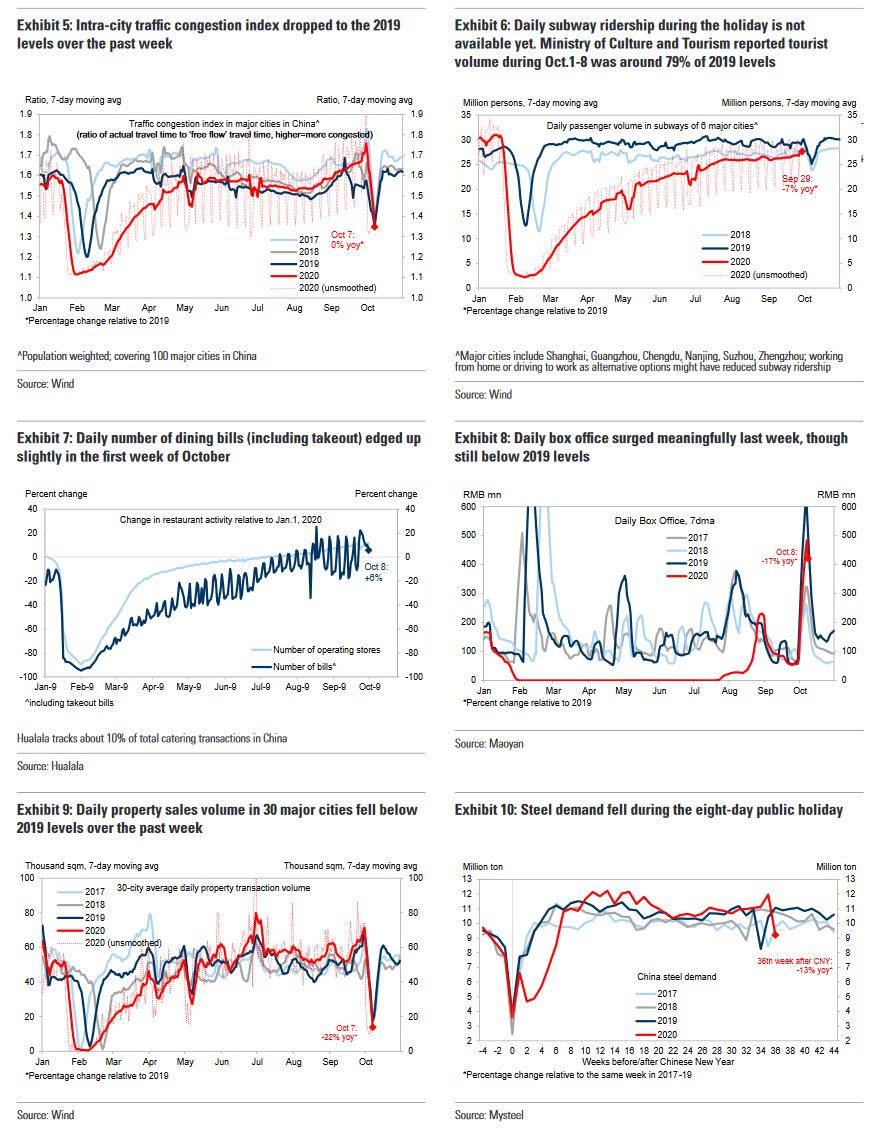

At the same time, Macquarie China economist Larry Hu, pointed to rising retail sales and a “significant” 17% year-on-year jump in domestic passenger traffic at Shanghai’s airport during the long holiday. “It’s clear that consumption, especially service consumption, is on the mend.”

Nomura analyst said that while overall passenger trips on public transportation were down about 30% y/y in the first few days of the holiday, transport ministry data showed that average highway traffic volume fell only 5.5%. A snapshot of China’s high frequency economic indicators from Goldman showed continued economic mending.

China’s improving economy stands in contrast to the US, where activity appears to be slowing, and is set to slow further amid continued Congressional gridlock over a new fiscal stimulus package.

Quoted by the FT, Christy Tan, head of Asia markets strategy and research at National Australia Bank, said there was also growing confidence that Chinese authorities would not intervene to stymie the renminbi’s rally.

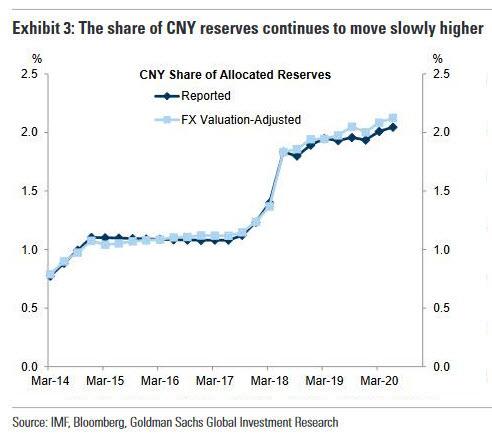

“The prospect of renminbi appreciation is getting more structural — it’s no longer just cyclical,” Ms Tan said, pointing to greater trading offshore and inflows from global investors into China’s markets. “There’s a sense of confidence that the renminbi is getting more internationalised.” To be sure, the latest IMF data confirmed a record allocation toward CNY by reserve managers.

The surge in the yuan was reflected in broad asset optimism, with China’s benchmark CSI 300 index closing 2% higher after onshore markets opened for the first time in six trading days. The tech-focused ChiNext index rose 3.8%.

As the FT notes, flows into China’s onshore equities market have topped Rmb90bn ($13.4bn) this year, taking foreign holdings to more than Rmb1tn on the back of the country’s relatively strong economic recovery. “We expect foreign capital inflows and foreign holdings in the A-share market to continue to rise,” said Bruce Pang, head of macro and strategy research at investment bank China Renaissance, referring to the country’s onshore stock market.

via ZeroHedge News https://ift.tt/33Kh9pr Tyler Durden