Deutsche Bank Whistleblower Who Gave Up $8.25 Million Award Is Going Bankrupt

Tyler Durden

Sun, 10/18/2020 – 16:35

At the height of the financial crisis, when risk assets were imploding and counterparties were in danger of overnight collapse, Deutsche Bank avoided failure and nationalization by fabricating the value of its $130 billion derivative portfolio of “leveraged super senior” trades.

Some history: back in 2005, these trades were seen as “the next big thing” in the world of credit derivatives, something which DB at the time was building a massive position in. They were designed to behave like the most senior tranche of a typical collateralized debt obligation, where assets such as mortgages or credit default swaps are pooled to give investors varying degrees of risk exposure. Deutsche became the biggest operator in this market, which involved banks buying insurance against the possibility of default by some of the safest companies.

There was just one problem: when it was building up its portfolio, Deutsche never accounted for the possibility of the financial world nearly collapsing. Which is why as the illiquid portfolio was careening, instead marking it to market – an act that would have resulted in the bank’s insolvency – DB’s risk managers misstated the value of the positions by anywhere from $1.5bn to $3.3bn.

Several years later, in 2012, the SEC found out about this, and in 2015 slapped a $55 million fine on Deutsche Bank for this criminal fabrication (of course, nobody went to jail). “At the height of the financial crisis, Deutsche Bank’s financial statements did not reflect the significant risk in these large, complex illiquid positions,” said Andrew Ceresney, then-director of the SEC’s enforcement division (who after his particular “revolving door” is currently a partner in the Litigation Department of Debevoise & Plimpton where he represents the same banks he was prosecuting during his SEC tenure); “Deutsche Bank failed to make reasonable judgments when valuing its positions and lacked robust internal controls over financial reporting”, he said.

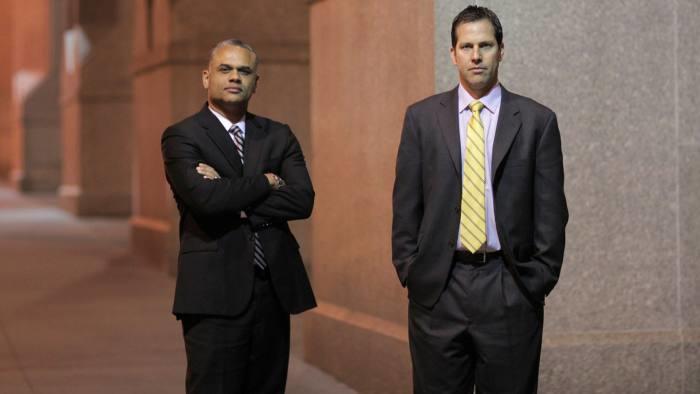

Not the reason why the SEC learned about DB’s massive mismarked derivative exposure, is because two former employee whistleblowers, Matthew Simpson and Eric Ben-Artzi, told it: the duo alleged that if Deutsche had accounted properly for its positions, its capital would have fallen to dangerous levels during the financial crisis and it might have required a government bailout to survive. The highest estimate for the unaccounted loss was $12bn. Which explains why Deutsche Bank was desperate to manipulate the numbers.

End result: DB got its wristslap with a token fine, the SEC came out looking like it knew what it was doing, and – as we learned back in August 2016 – the two whistleblowers got major awards for helping the SEC collected the $55MM fine, amounting to 15% each.

Only, something unexpected happened: one of the whistleblowers who helped expose the false accounting at Deutsche Bank turned down a multimillion-dollar award from the Securities and Exchange Commission in protest against the agency’s failure to punish executives at the bank.

In a move that sent shockwaves across the pragmatic Wall Street, Eric Ben-Artzi, the former Deutsche risk officer, told the SEC he is declining his share of a $16.5 million payout — the third largest in the whistleblower program’s history — which represents 30% of the $55 million Deutsche Bank fine.

But why turn down enough money that most people, even ex-Wall Streeters, could comfortably retire on? Ben-Artzi said that he could not take money that had been extracted from “Deutsche’s shareholders instead of the managers responsible”, claiming the fine should be paid by individual executives, not shareholders, and suggested the “revolving door” of senior personnel between the SEC and Germany’s largest bank had played a role in executives going unpunished (understandably he had no comment about the spike in Deutsche Bank suicides in 2013-2014, particularly those emanating from its legal department).

“This goes beyond the typical revolving-door story,” Ben-Artzi wrote in an opinion article for the Financial Times. “In this case, top SEC lawyers had held senior posts at the bank, moving in and out of top positions at the SEC even as the investigations into malfeasance at Deutsche Bank were ongoing.”

(Which, incidentally, reminds us of a post we wrote back in May 2010, explaining why former Deutsche Bank General Councel, and then-SEC Director of Enforcement, “Robert Khuzami Stands To Lose Up To $250,000 If He Pursues Action Against Deutsche Bank.” We were right: neither Khuzami, nor the SEC, nor anyone else, pursued any charges against Deutsche Bank in the early years after the financial crisis. In retrospect, now that the German bank has been revealed to have manipulated literally everything, such oversight on behalf of the SEC was even more criminal than what DB did over the years.)

* * *

Long story short, instead of collecting millions of well-deserved dollars, Ben-Artzi displayed a level of idealism never before seen on Wall Street (he did get to write an FT op-ed explaining his bizarre action). Although we wonder if, in retrospect, Ben-Artzi would have reconsidered his idealism for one simple reason: four years later, the man who once worked at Deutsche Bank and then grew the world’s biggest conscience… is going broke.

Fast forward four years from August 2016, when in an update on the current financial state of the 48-year-old former risk manager (and nephew of the wife of Israeli prime minister Benjamin Netanyahu) the Financial Times reports that he is going broke.

“I would need a near miracle to avoid bankruptcy at this point,” said Ben-Artzi from Tel Aviv, where he is in quarantine after a trip to the US. Because ironically, while Ben-Artzi’s “sacrifice” attracted praise from around the world, it was also the subject of heavy fire from his (former) friends and allies.

Start with the ex-wife: after he was fired by Deutsche in 2011, Ben-Artzi went through a bitter divorce; he ended up moving from the US to his native Israel, leaving behind his children and racking up hundreds of thousands of dollars in court fines and child support debts. At one point, a court issued a warrant for his arrest.

Then, his ex-lawyers: the law firm that helped him take his whistleblower claim to the SEC, Labaton Sucharow, sued him in 2015, worried by emails from him that he might refuse the award and deprive them of an agreed 18% fee.

Then, his expert friends: he was also sued by a Canadian firm, Kilgour Williams, whose principals, Colin Kilgour and Dan Williams, had supported Mr Ben-Artzi’s claim by providing expert testimony.

The irony: while the former risk manager did not take any cash from the reward, he ended up getting stuck with all of the associated liabilities, because ironically unless everyone you are associated with is as idealistic as you are, you end up stuck with the bill.

As the FT reports, when he renounced the $8.25 million award, Ben-Artzi said his ex-wife, his lawyers and advisers should be paid what they were entitled to. But the various legal claims have eroded the whistleblower payout and now threaten to exhaust it completely! And although Mr Ben-Artzi has not personally received a penny, he is likely to be saddled with unmanageable debts.

Not everyone is a loser, of course: for one, there has been some progress in the painful seven-year divorce battle between Ben-Artzi and his ex-wife. He recently saw his two sons for the first time in six years. Not nearly as idealistic as her former husband, the former Ben-Artzi received about half the SEC award. The lawyers also got paid: Labaton Sucharow collected their fee of $1.5m.

But the experts at Kilgour Williams have yet to be paid. They had initially agreed to a 3% cut of any payout. This was later changed. In a new arrangement agreed in 2014, Kilgour Williams would receive 5 per cent of any award to Mr Ben-Artzi but would also submit an independent whistleblower claim; if that was successful, Ben-Artzi would receive 60 per cent of the second claim. Then, when Ben-Artzi’s FT article appeared in 2016, the Canadians were furious. Their own whistleblower claim had been rejected and they felt that by turning down his award and embarrassing the SEC, Mr Ben-Artzi had hurt their chances of winning an appeal.

They wrote to Mr Ben-Artzi: “We understand that you regard your share of the award as dirty money and have decided not to personally accept any portion of the award. Therefore, we request that you direct the SEC to direct $2,500,000 to us.” Under the original agreement, Kilgour Williams would have received $247,500. The amended deal would have given them $412,500.

Ben-Artzi first signed a letter agreeing to ask the SEC to send them millions of dollars, roughly equivalent to the remainder of the whistleblower payout.

And then something else happened: reality started seeping through Ben-Artzi’s idealistic facade: as the FT notes, “he then had second thoughts”:

Although Ben-Artzi believed Kilgour Williams deserved to be paid for their work and was unattached to what he did indeed see as “dirty money”, he learnt there was a chance he might have to pay tax on the award even though he had not drawn any of it himself. There was also ongoing litigation with his ex-wife.

The problem is that as a result of the mess his initial “idealistic burst” created, he is now facing financial ruin: Kilgour Williams has maintained that the signed letter was an enforceable contract, creating a $2.5 million debt for Ben-Artzi, which a judge ruled in their favor. Which means that Ben-Artzi – who personally has received nothing – is left worrying whether the remainder of the award will be enough to pay the Canadian advisers, continuing claims from his ex-wife and a potential tax bill. As the FT puts it, “he does not need his PhD in maths to know it does not add up.”

One of his former business partners has little sympathy, noting that — whatever the final outcome — he has been able to create significant wealth for his children through the payments to his ex-wife.

Ben-Artzi’s oredeal is a glaring reminder to all those who wish to wow the world with their idealism not to do it in the middle of a transaction, where many disparate parties are also eager for their pound of flesh. If he was indeed so concerned about DB shareholders, he could just have mailed out the money he received from the SEC to each and everyone one of them, an amount which would have been a laughable pittance when contrasted with the devastation in Deutsche Bank’s stock price since August 2016. In any event, for all those eager to steamroll their pragmatic realism with idealism, first wait until the money hits your bank account… then do whatever you want. Because as a whole generation of newly hatched socialists are about to learn the very hard way, idealism does not pay… in fact, as the now broke Ben-Artzi has found the very hard way, just the opposite.

via ZeroHedge News https://ift.tt/2IB4jSk Tyler Durden