Black-ish Monday: Stimulus Stumble Sparks Big-Tech’s Worst Streak In 14 Months

Tyler Durden

Mon, 10/19/2020 – 16:00

The entire market is now playing a game of deal, or no deal and today’s “no deal” headlines sent stocks reeling…

Nasdaq was down for the 5th straight day, its longest losing streak since Aug 2019…

Interesting the drop starte to accelerate around 1430ET – margin call time.

This drops Nasdaq to 10-day lows, erasing ‘Nasdaq Whale’ gains…

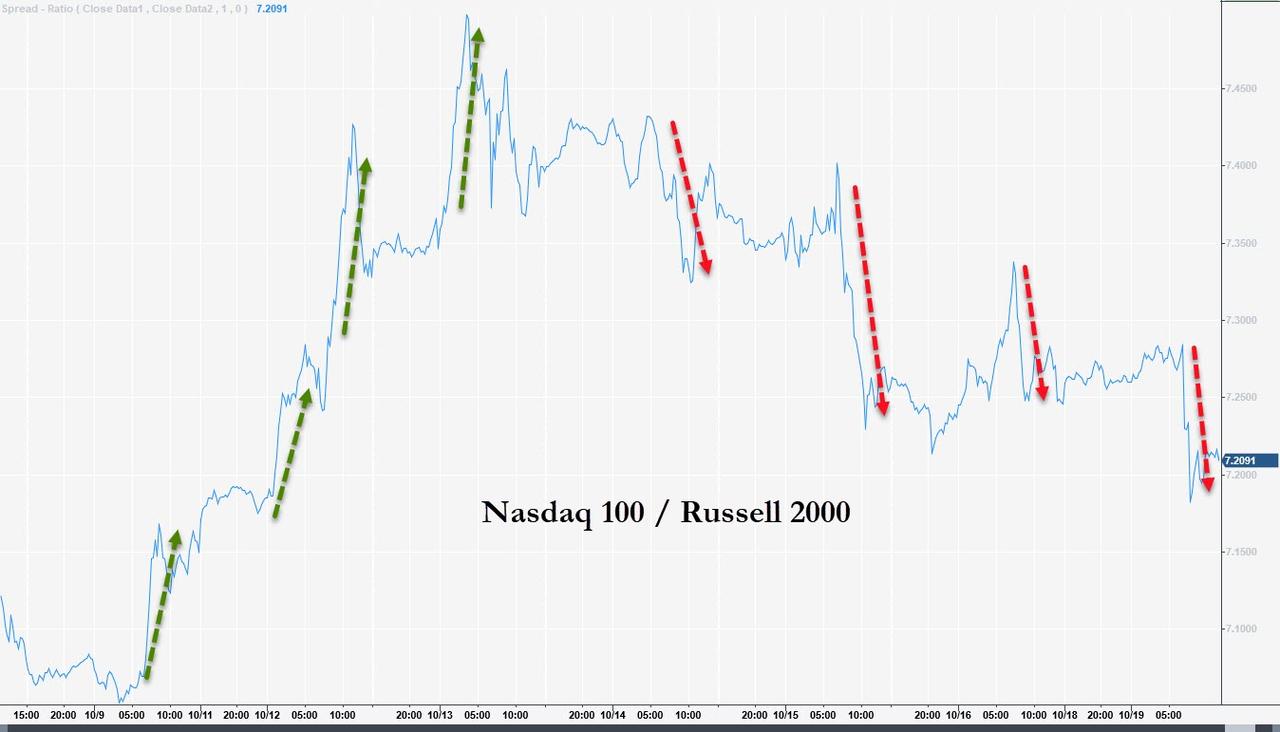

And erases most of last week’s (early) relative outperformance of Nasdaq vs Small Caps…

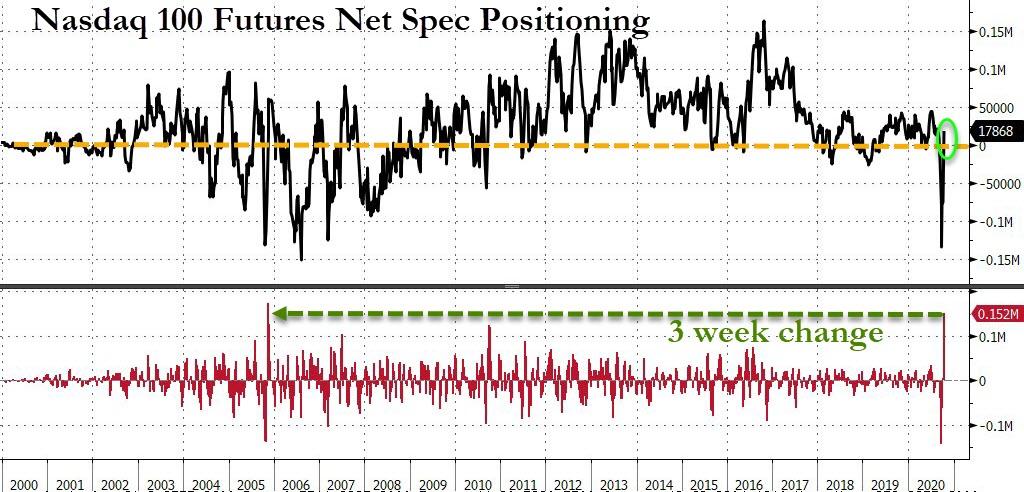

As we detailed earlier, it would seem the short-squeeze ammunition in Nasdaq futs has run out…

Source: Bloomberg

And escalated quickly today…

Source: Bloomberg

But what was remarkable was the near record surge between the Oct 6 net short of -75K and the subsequent week’s net long position of +17.8K. This was the biggest 3-week surge in NQ contracts in more than 15 years, and the second highest increase on record.

Source: Bloomberg

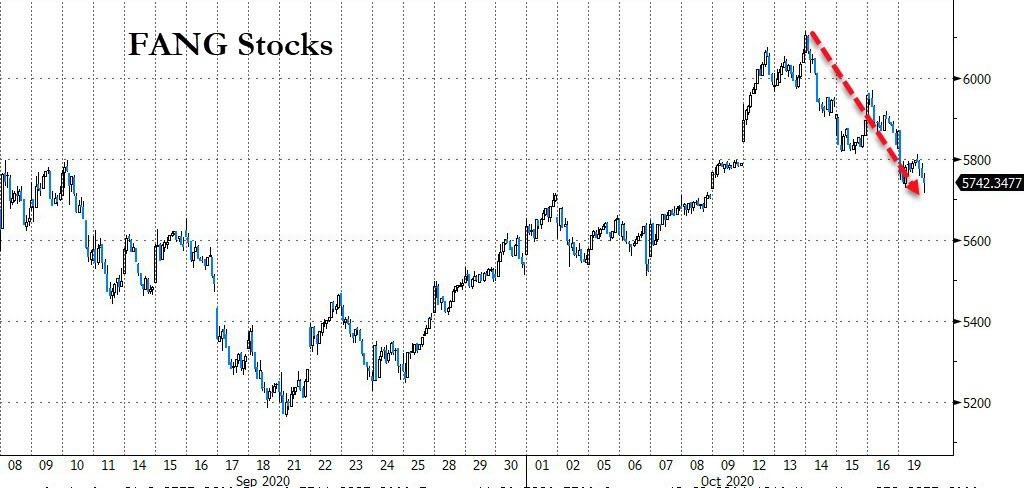

FANG Stocks sank further…

Source: Bloomberg

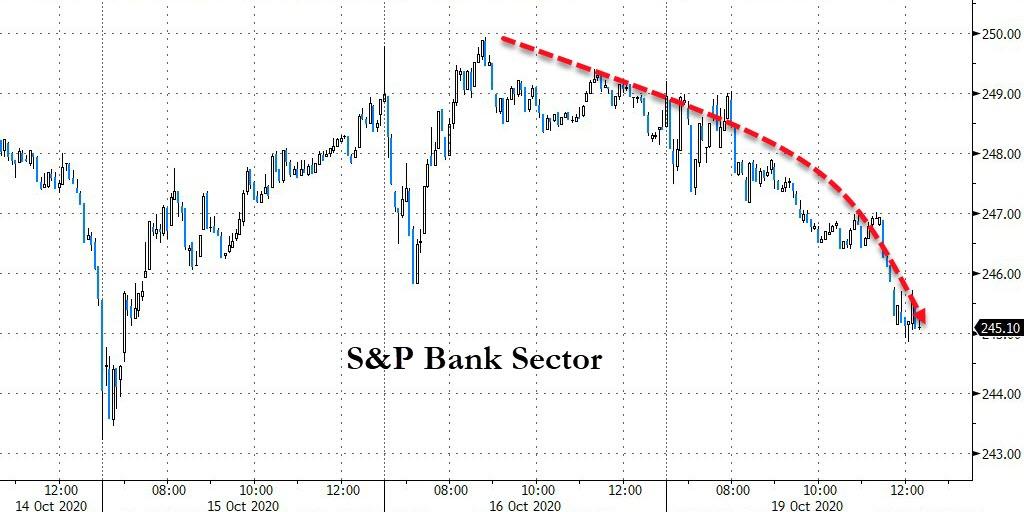

And Financials floundered…

Source: Bloomberg

VIX jumped back above 29 today…

Source: Bloomberg

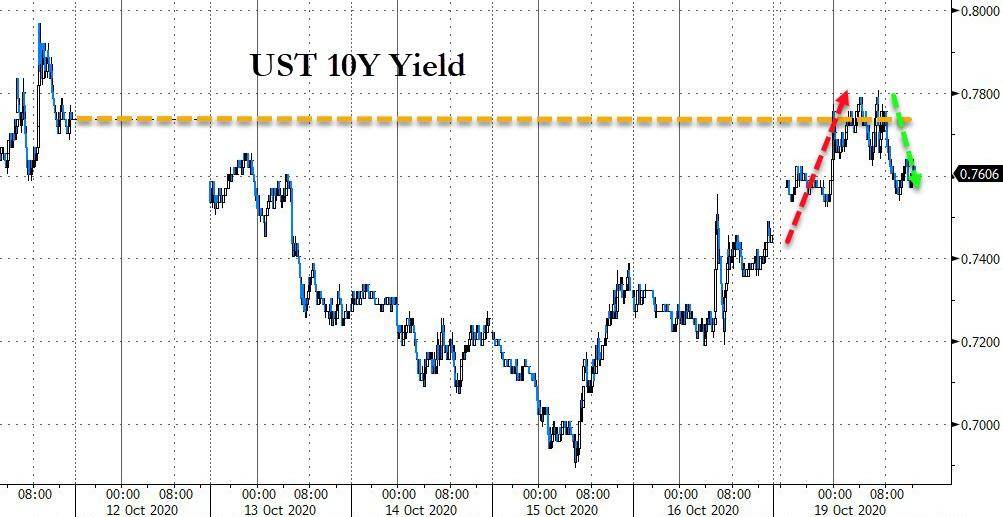

Treasury yields were marginally higher on the day, despite equity weakness (but all the TSY selling was around the European open)…

Source: Bloomberg

And note that the overnight selling in 10Y pushed yields up to unch from the previous Friday before reversing…

Source: Bloomberg

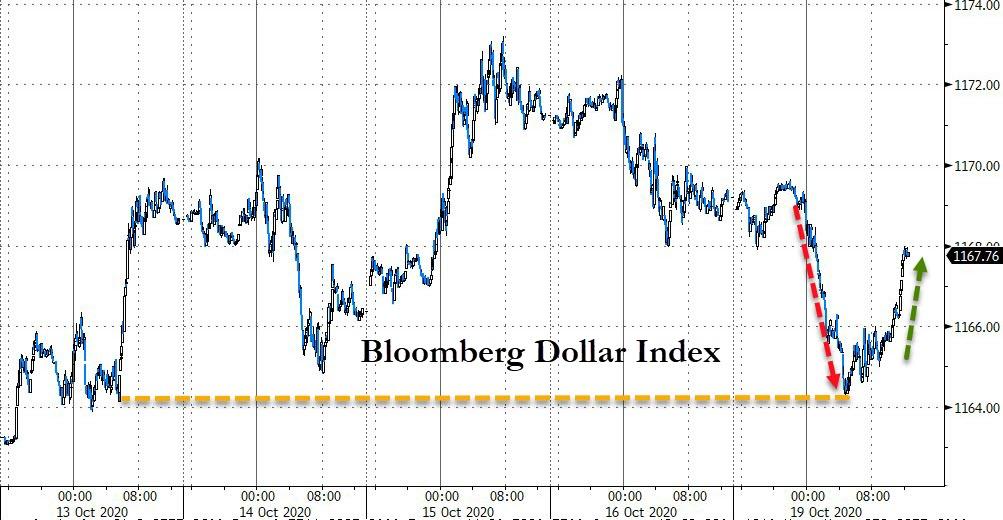

The dollar ended the day lower but erased a lot of its losses as stocks began to dump in the afternoon…

Source: Bloomberg

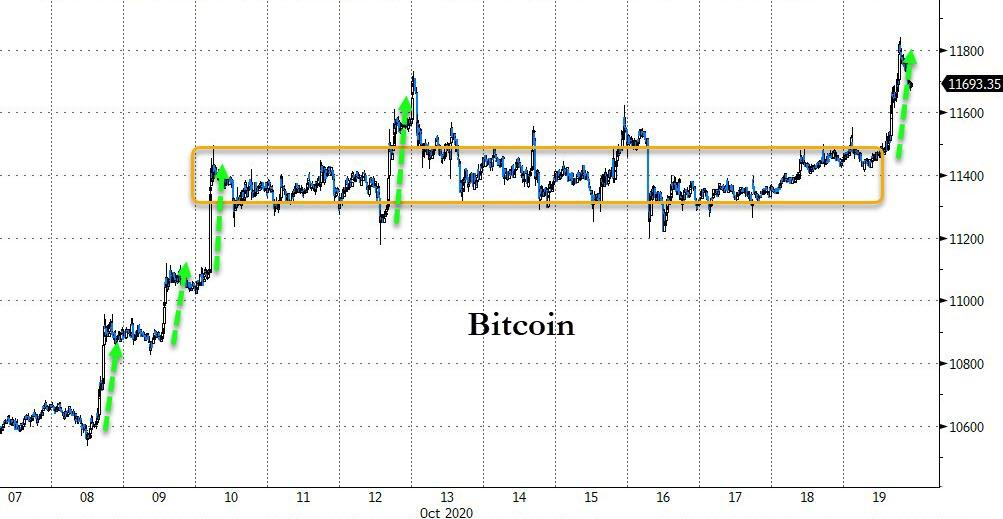

Crypto was higher today with Bitcoin spiking back above $11,800, breaking put of its recent tight range…

Source: Bloomberg

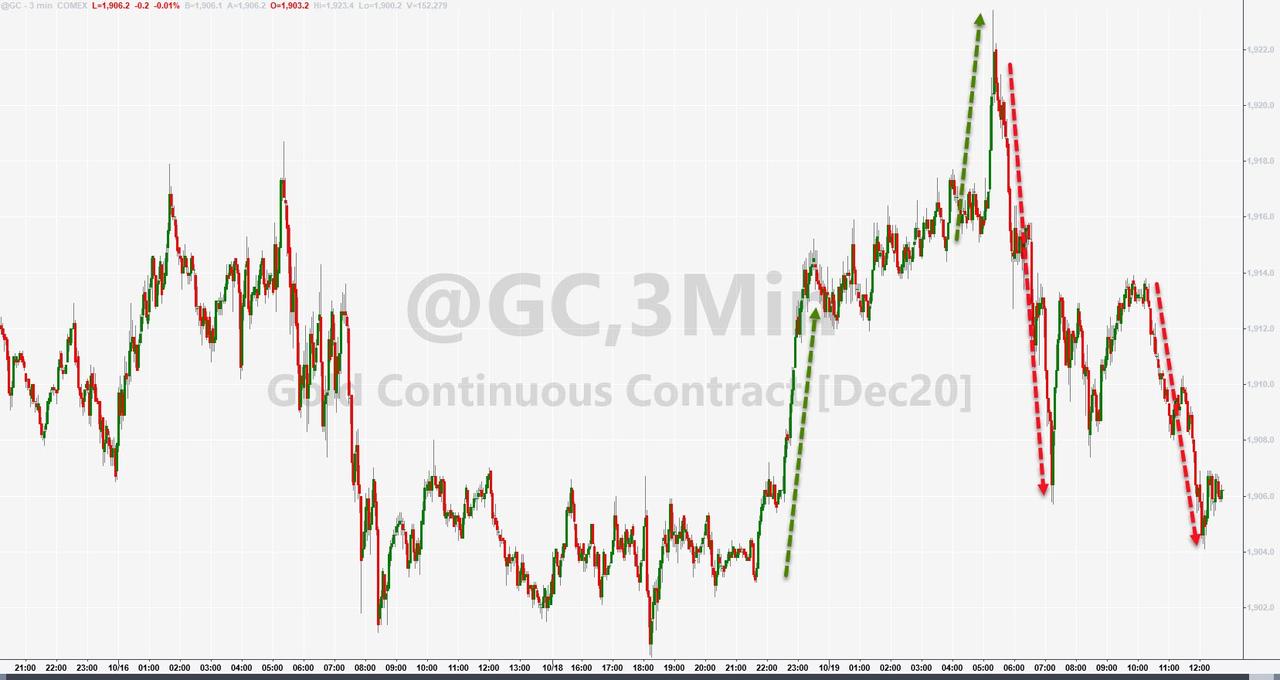

Gold had a big roundtrip on the day, ending unch…

Silver followed a similar path, with futs topping $25 briefly…

WTI slipped back below $41 as demand fears drifted back…

Finally, as we noted earlier, today is the 33rd anniversary of Black Monday (of course, it’s different this time)…

Source: Bloomberg

Now that would be an ‘October Surprise’…

Excerpted from Art Cashin’s reminisces of that day in 1987 (rings a lot of bells for 2020)…

The first two-thirds of 1987 on Wall Street was nothing short of spectacular… Fear seemed to disappear, and junior traders laughed at their cautious elders. The brash youngsters told each other to “buy strength” rather than sell it, as each buying wave was soon followed by another.

[ZH: Robinhooders?]

One thing that helped banish fear was a new process called “portfolio insurance.” It involved use of the newly expanded S&P futures. Somewhat counterintuitively, it involved selling when prices turned down.

[ZH: Nasdaq Whale buying calls, driving dealer gamma to extremes]

The rally topped out about Aug. 25, with the hitting 2,722 (less than a tenth of its current numerical value). Interest rates had begun creeping up amid concerns of early signs of inflation.

[ZH: Rally topped a week after that in 2020]

…

On Wednesday, Oct. 14, there were widely discussed rumors of a new punitive tax on takeover profits.

[ZH: Worries over Biden’s tax plan?]

Friday the 16th was an option expiration day… selling intensified into the close.

[ZH: Today is op-ex day.. and selling intensified into the close]

The weekend was a rumormonger’s delight.

[ZH: Well there is sure a lot of discussion about potentially shocking videos of Hunter Biden…]

And don’t forget that we had margin increases across most of the major retail brokerages last week.

via ZeroHedge News https://ift.tt/34d2gw5 Tyler Durden