Why Biden’s Tax Hikes Matter: US Households Sit On $1 Trillion In Unrealized Capital Gains

Tyler Durden

Sun, 10/25/2020 – 15:00

Two weeks ago we laid out a detailed scenario from JPMorgan explaining how Biden’s proposed hike of the capital gains tax and dividend income from 23.8% to 43.4% – under a Blue Sweep scenario – would hammer not only risk assets as investors rushed to sell before having to pay higher cap gains, some time in 2022 when the new tax law would most likely come into effect…

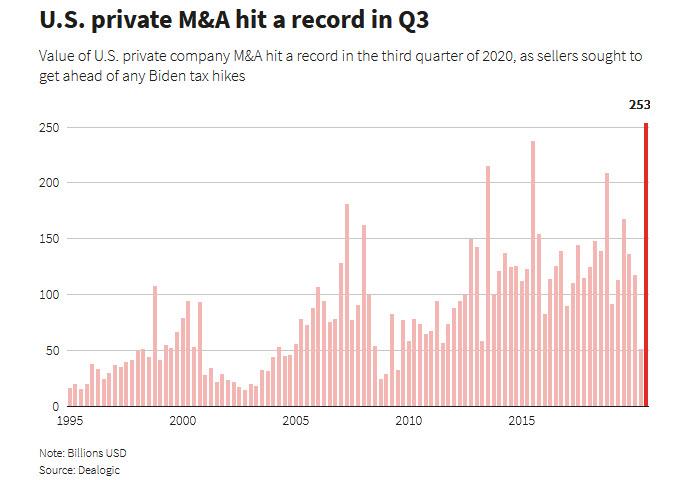

… but also small and medium private M&A activity, which would be pulled sharply forward for the same reasons, and which we have already seen in action as we reported last week in “Fears Of Biden Capital Gains Tax Hike Spark Avalanche Of Private Company Sales“.

In any case, JPM’s assessment was that while there would be some forced selling ahead of the tax rollout, as “we are likely to see some downward pressure in equity markets in Q4 2021, i.e., in a year’s time” over the longer term stocks would continue to rise simply because “equity markets have increased in value over time. Some stocks, sectors or styles do better at some times than others, depending on specific, often unpredictable factors—a fact that underlines the importance of diversification. That is why, to ensure the long-term health of one’s portfolio, we think that time in the market, rather than market timing, is key. Consequently, we advise clients to stay invested, regardless of specific events—including election results.”

Fast forward two weeks later, when in the latest coordinated effort by Wall Street banks to ease client concerns about concentrated selloffs ahead or during the Biden administration as a result of higher taxes, late on Friday Goldman’s chief equity strategist David Kostin published a piece which is almost a verbatim repeat of what JPMorgan said: namely keep calm, ignore tax policy and just keep buying.

Kostin sets the stage by explaining that Goldman clients are especially concerned about the implications that Biden’s tax hikes would mean for the market:

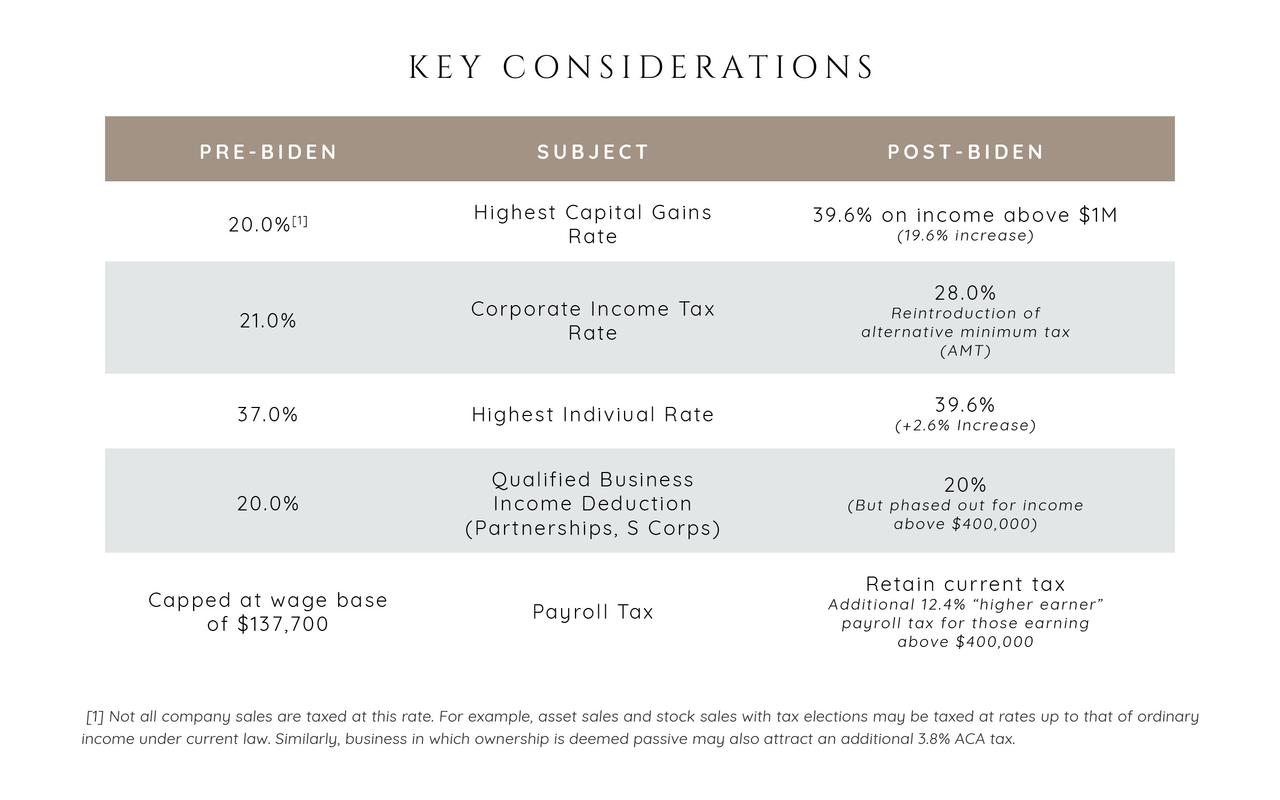

Among the tax proposals, the timing of a potential capital gains tax rate hike has been a key focus of many investors. Long-term capital gains and qualified dividends are currently taxed at a maximum rate of 20%, along with a separate 3.8% tax on investment income. Vice President Biden has proposed taxing these as ordinary income for filers with over $1 million in annual income. This would roughly double the tax rate on capital gains and dividend income from 23.8% to 43.4%.

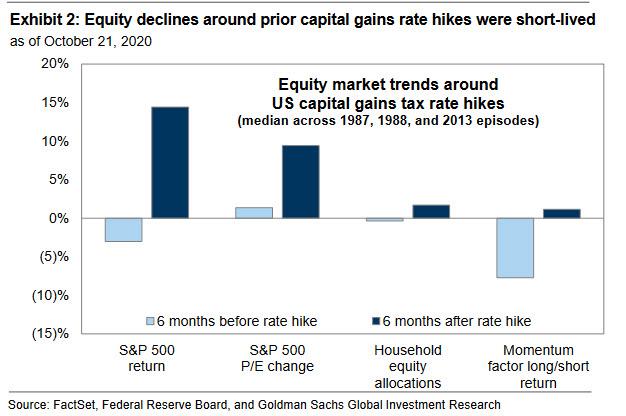

According to the Goldman strategist, while “the proposed almost doubling of the tax rate on capital gains and dividend income from 24% to 43% in the event of a “blue wave” represents a near-term downside risk”, and admits that “history shows stock prices fall, equity allocations decline, and Momentum underperforms ahead of increases in the capital gains tax rate” he then transitions into the almost lyrically bullish “However, any potential equity selling will be short-lived and reversed in subsequent quarters.” Which of course is shorthand for central banks will not allow another market crash ever again.

Some more details.

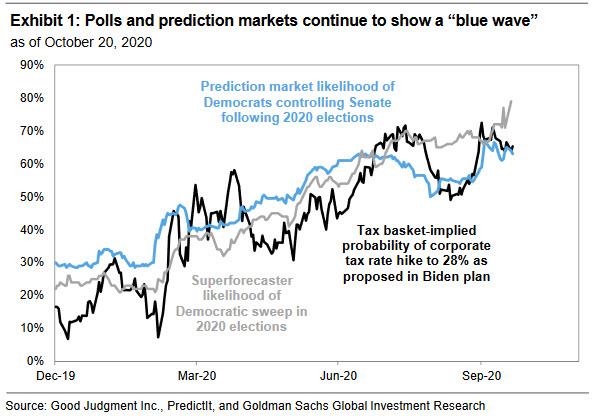

As Kostin writes, the most direct consequences of a Democratic sweep on S&P 500 profits are corporate tax reform and fiscal spending. The relative performance of high and low tax stocks appears to be pricing a probability of corporate tax reform close to the prediction market’s 61% likelihood of a Democratic sweep, as shown in the chart below…

… with potential infrastructure beneficiaries having traded closely with political sentiment in recent years also reflecting rising expectations of an increase in infrastructure spending.

The Goldman strategist then looks at past capital gains tax hikes episodes and concedes that they have been associated with declines in equity prices and in total household equity allocations.

In addition, Kostin writes that high-momentum “winners” that had delivered the largest gains to investors ahead of the rate hike have usually underperformed. The Tech and Consumer Discretionary sectors have led the market this year and have also been the largest sources of capital gains within the US equity market during the last 3, 5, and 10 years, which is why it is likely that they would also be hit the hardest.

While none of that is new, what was notable in the Kostin report was the quantification of where the selling would come from, and unsurprisingly, he found that the wealthiest 1% were the biggest net sellers of equities across US households around the last capital gains rate hike in 2013. In the three months prior to the hike, the wealthiest households sold 1% of their starting equity assets, which would equate to around $100 billion of selling in current terms.

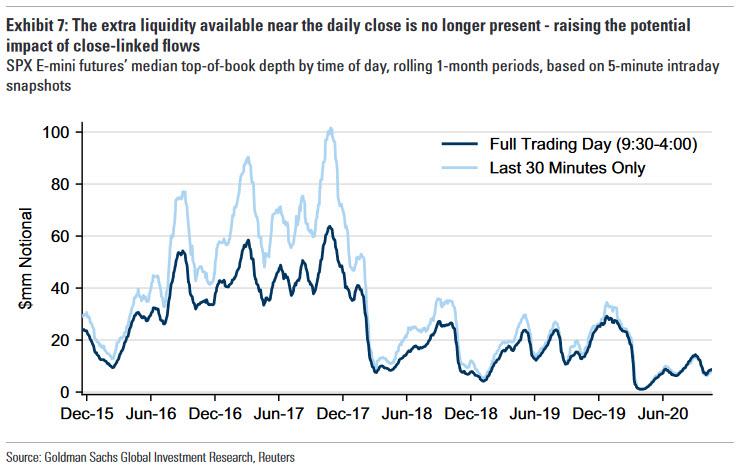

This time around, the wave of selling could be far greater: Goldman estimates that the wealthiest households now hold around $1 trillion in unrealized equity capital gains. This equates to 3% of total US equity market cap and roughly 30% of average monthly S&P 500 trading volume. Considering the continued chronic lack of liquidity of the market, while the selling in absolute terms is manageable, the fact that we may see a selling waterfall ahead of the Biden tax hikes into an extremely illiquid market suggests that there is a major risk for a market crash late in 2021, assuming a Jan 2022 rollout of the capital gains tax increase.

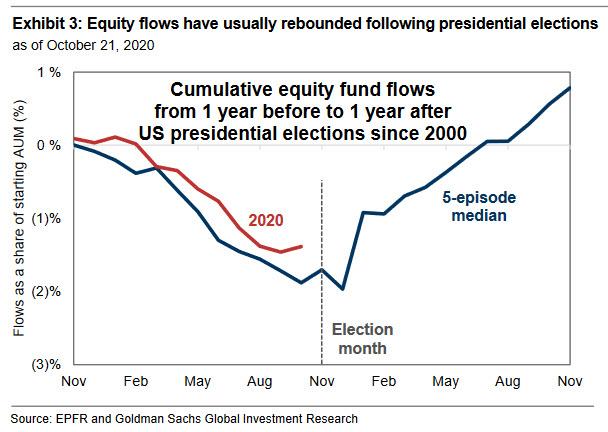

Yet while not even Goldman can deny that there will be blood selling ahead of the rollout of Biden’s tax hikes, the spin machine then goes into full blast with the bank then claiming that “the trend of net equity selling and falling stock prices around capital gain rate changes has usually been short-lived and reversed during subsequent quarters. In 2013, although the wealthiest households sold 1% of their assets prior to the rate hike, they bought 4% of starting equity assets in the quarter after the change and therefore only temporarily reduced their equity exposures in order to realize gains at the lower rate. Total household equity allocations demonstrated a similar pattern around the two preceding capital gains tax hikes.”

Where it gets even more entertaining, is Kostin’s next claim that Goldman now expects US household equity allocations to rise in 2021 “irrespective of the election outcome.” Why? Because Goldman doubles-down on its “above-consensus GDP and EPS growth forecasts” which reflect the view that the COVID-19 vaccine will be approved this year and widely distributed by mid-2021.

And just in case Goldman’s clients – who have been burned virtually every single time when they put their faith in the bank’s forecasts – aren’t convinced, Kostin trots out the tired “explanation” that while Dems may hike taxes they will flood the economy with trillions in stimulus (which will not happen if Republicans retain the Senate):

… the size and sequencing of the various policies will determine the ultimate impact on profitability. For instance, in the event of a “blue wave,” our economists expect substantial fiscal support in 2021 but expect that tax reform would only be phased in beginning in 2022. Under this scenario, the net impact on EPS would be positive in 2021 and 2022 but negative in 2023 and 2024 once the full impact of tax reform takes effect and the boost from fiscal spending diminishes.

Finally, should that emotional appeal to any bears on the fence not be sufficient to keep them from dumping, Kostin then goes full circle and makes the most honest assessment of the elections we have read in a long time, pointing out that “regardless of the election outcome, we expect roughly 10% upside to the S&P 500 by the middle of next year.“

Which incidentally, is i) what JPM said two weeks ago, when it concluded that despite the clear differences to the tax regime under a Biden administration, JPMorgan goes so far as to say ignore it all, and in fact, “don’t let the passions of this election lead you to make any key planning or investment decisions, and ii) a repeat of our own cynical conclusion when we said that “in light of all this, one wonders: does it even matter who is president as long as we have a Fed?”

via ZeroHedge News https://ift.tt/2Htxy9b Tyler Durden