Stephanie Kelton On MMT & Blurring The Lines Between Debt And Money

Tyler Durden

Sat, 10/31/2020 – 14:55

Thanks to the public fascination with MMT, Stephanie Kelton has become one of a handful of rockstar economists, known for her frequent appearances on cable news on behalf of the Bernie Sanders campaign (she served as one of the campaign’s top economic advisers), Kelton is also the author of “the Deficit Myth”, a bestselling book arguing, essentially, that the US government can run perennial deficits, then order the Fed to simply vacuum up excess debt, leaving plenty for the global dollar-based financial system. In such a system, taxation would be fine-tuned by Congress to carefully stave off inflation, preventing the dollar from devaluing like the Argentine peso, or worse, the Venezuelan bolivar.

Kelton’s ideas have been widely discussed in the financial press and we’d rather not reiterate, or relitigate, them here. Rather, Kelton’s MacroVoices interview serves as a helpful overview of her ideas, and touches on very basic concepts at the center of her thinking, like answer the question “if the government can simply print money to finance its budget, then why do taxes exist?”

Kelton and interviewer Erik Townsend delve into this pretty early in the interview.

Why Pay Taxes?

Erik: Now, let’s go a little bit deeper on those taxes and bonds because what a lot of people would say is, well, if you figured out that there’s kind of a magic source of income here and we don’t need those taxes. Let’s eliminate taxes and never have them again, because we don’t need taxes, we can print new money. But the study of MMT says actually taxes are very important, but maybe for an unobvious reason pertaining to inflation. So why do we still need taxes?

Stephanie: Okay, well, remember I just want to go take one tiny step back and just sort of reassert the point that it’s not that we can print money. It’s that there is no other way for the government to spend but to create new money as it’s been so its newly created digital dollars, and there’s no other way for it to work.

And so your question is a very good one, so once you recognize that the government spends its currency into existence, then you say, well, then why do we have to pay any taxes at all? Why not just let the government spend and forget the tax piece, which, by the way, is exactly what Congress has been doing.

Let’s just take the cares act as one example, the biggest relief package that has so far gotten through both the House and the Senate and signed into law that was $2.2 trillion. And that bill was Congress writing what we in the DC beltway circles call a clean bill, in other words, it was not offset the spending was not offset. The Congress said, listen up fed, we are ordering up $2.2 trillion, get ready, because you’re going to carry out the payments that we have authorized on behalf of the US Treasury, that’s how it works.

So, this is an example of Congress committing to spending money it did not have, it’s just what it has is the power of the purse it can commit to spending $2.2 trillion. And the Fed as the government’s fiscal agent will carry out those payments by changing the numbers in the appropriate bank account. So for people who got that $1,200 stimulus check, the way that the money got into your account is that the Federal Reserve and the bank that you bank at change the numbers upward in your account.

And so there was no pairing of higher taxes to go along with this, so why do we sometimes increase taxes? Why do we have taxes at all?

So in the book, I go into a lot of detail on this, if you wanted to start up a currency from scratch then a tax or something like it fees, fines.

Also, other obligations governments impose to get a population to put a population of people in a position where they need to earn the state’s currency in order to settle their tax or other obligation to the state.

And we could talk a lot about this, but we don’t have time, so I’ll just say that one reason for taxes is that they allow governments to start up a currency from scratch. Once that currency has been started up and now people are accustomed to having this currency around, they begin making their own payments and transacting in that currency. And the government can use the tax lever to pull some of those dollars back out of our hands.

“A Much More Nuanced Conversation” About Inflation

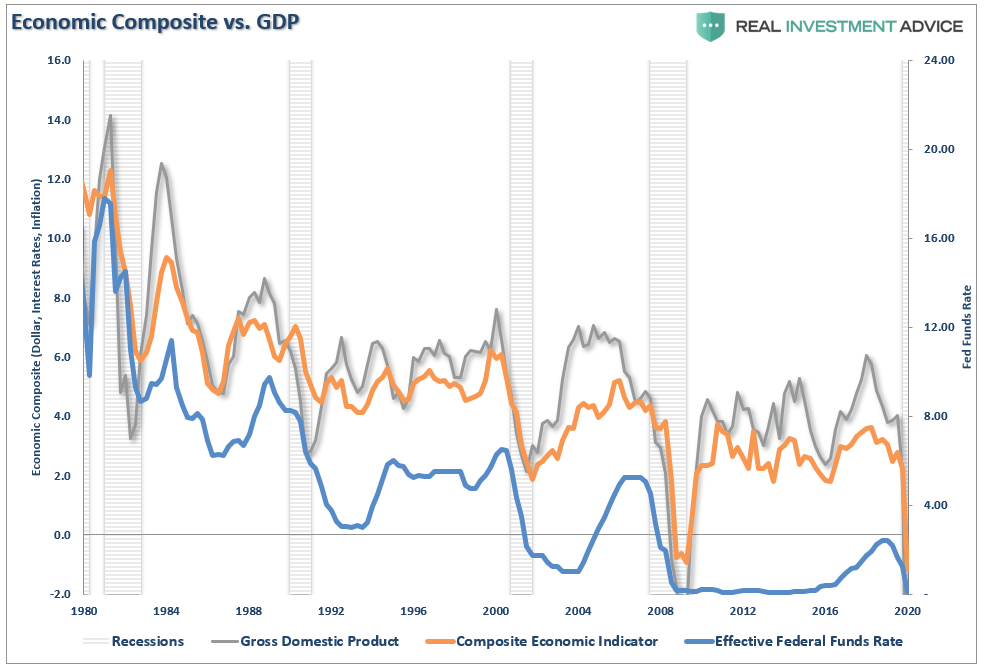

Erik: Now, I know that one of the ways that you do think about taxes in MMT is as a preventive measure to overcome the tendency of that spending to bring about inflation. What I haven’t seen addressed and maybe I just haven’t read enough about it is, wait a minute, inflation tends to be a vicious cycle with a long lead time.

That has to do with inflation leading to inflation expectations, leading to acceleration of velocity of money, and it feeds on itself and once it gets going, it’s hard to break it. So it seems to me like I worry about whether, how do you know the taxes enough to prevent that cycle from starting and how do you break out of that cycle. If some of the money that’s being created through MMT by the government financing more of its spending just by printing new money does start to lead to that widespread inflation?

The other problem that I have understanding this inflation argument is at least some people, and maybe this is the politicians as opposed to the MMT scholars are saying, well, it’s really what we have to do to prevent the inflation, we’ve got to tax the rich specifically. Tax the rich, well, wait a minute, the rich are the people whose spending habits are not really directly impacted by their tax burden and their inflation because they’ve got enough assets that they can continue spending. So how do you overcome the potential of creating a vicious cycle of inflation? Is it just taxes? Or are there other measures that MMT uses to overcome that inflation risk?

Stephanie: Okay, so let me start by saying there’s a terrific, short, accessible piece, but your audience is very smart so they can handle the higher order stuff. There’s a piece in the Financial Times that was coauthored by three MMT scholars and I think the title of the piece is something like “How MMT Thinks About Inflation” or “How MMT manages inflation” [ZH: “An MMT Response On What Causes Inflation”] Something along those lines, people can find it because I wouldn’t have time to do it all justice here.

But look, okay, let’s start by recognizing that inflation, as you say, is a dynamic process, it is a continuous increase in the price level, it’s not a one off. It’s a complex phenomenon, there isn’t economist on Earth who can write down for you a model of inflation that will apply in all times across, space and time, nobody can do it.

The Federal Reserve, Daniel Tarullo, who was a Fed Board of Governors member, he rolled off the board of governors and went out. And one of the early speeches he gave just made huge headlines, because he went out and he said, the Fed does not have a working model of inflation, we don’t know.

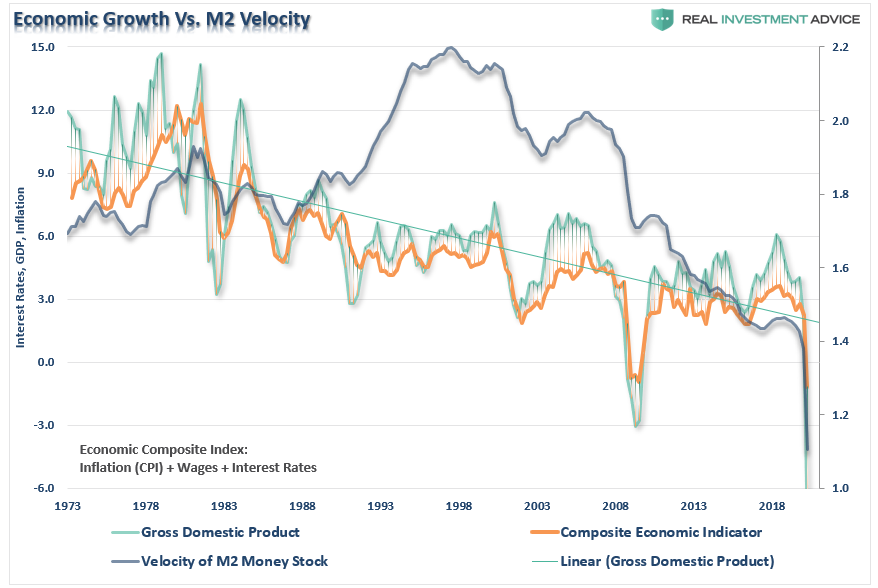

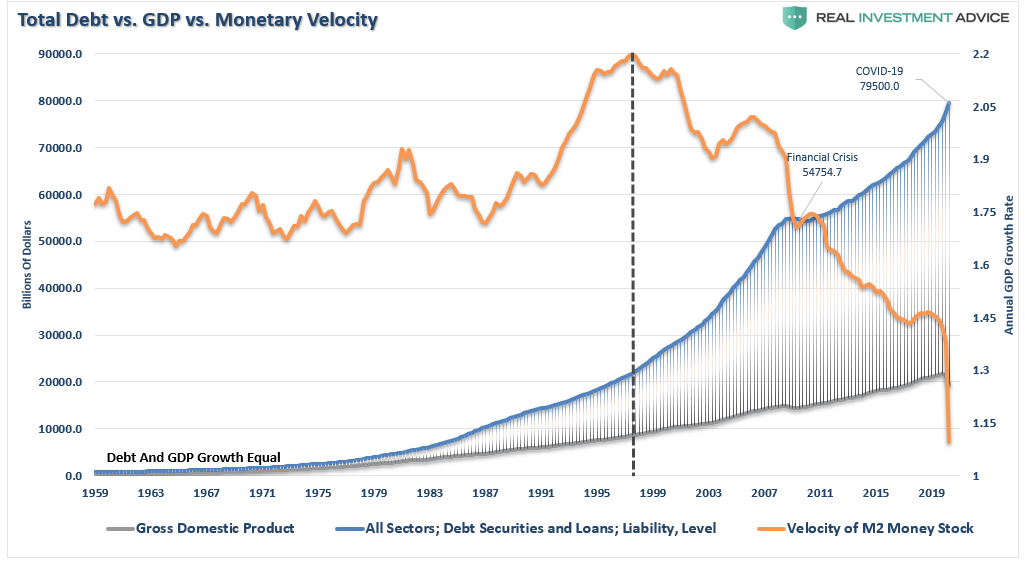

So once upon a time, there was a quantity theory of money and man, you could write that equation down, everybody could see it. And you said, inflation happens because velocity is constant, and the real economy tends to full employment.

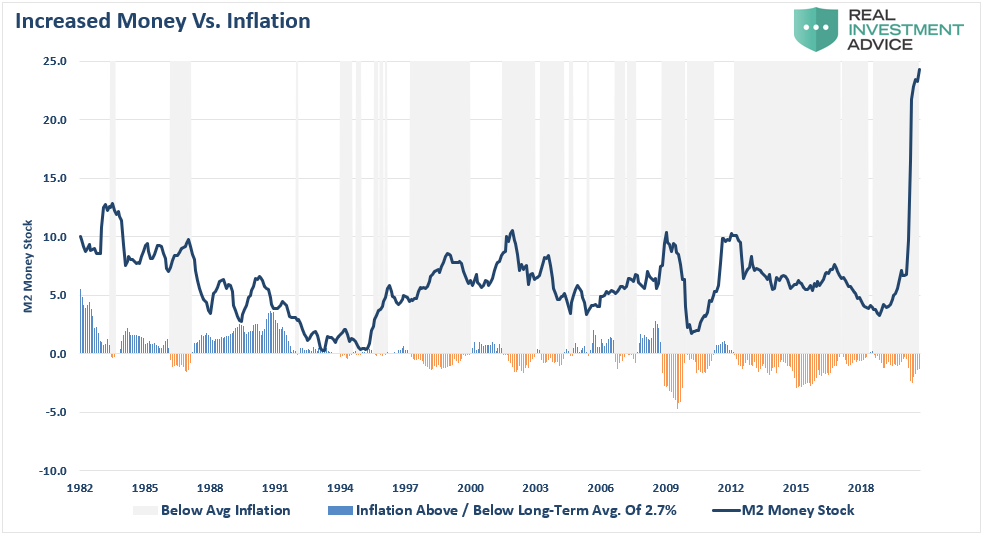

And once you apply a little calculus to the quantity theory to the equation of exchange, then you know that inflation is always in everywhere, a monetary phenomenon. Money supply growth rate accelerates, inflation will accelerate to the same degree, well, that’s clearly silly and wrong. And you know, we have decades of experience with QE where people who relied on that thinking expected quantitative easing to drive inflation or possibly hyperinflation.

Of course, it didn’t do any of that, then you had the Phillips Curve and you say, well, it’s the Phillips Curve, that’s the model I’ll write down and that’s my inflation model. Well, listen, nobody believes this stuff anymore and you can expectations augment the Phillips Curve all you want, and it still isn’t workable.

So I don’t believe that we should think of inflation as something that happens because expectations become unanchored and people formulate ideas about where prices are headed, and then it becomes self fulfilling. That’s just silly stuff that we make up, I think we need to be more serious than that, price has changed, because producers raise prices, people change prices. They don’t just happen and they certainly don’t just happen across all categories of consumer goods, so let’s think a little bit harder.

If I go down stairs after this interview, and I hope this doesn’t happen, but if I go downstairs and find my basement is flooded, I don’t just run to one part of the house and say, oh, I have to stop the flooding in the basement. I don’t know what caused the flooding in the basement, I don’t know if a kid left a faucet running if a toilet overflowed, if a pipe burst, if you know the dishwasher is leaking, I got to find the source of the problem.

And I think that’s the way we in MMT think about inflationary pressures, you have to look under the hood, you have to go to what is driving that headline price inflation. I’ll give you just one quick example, the supreme court’s going to take up the case on the Affordable Care Act that’s going to happen soon. And there is a chance that the Supreme Court will say the ACA is unconstitutional, and provisions like protections against pre existing conditions that could go away some of the cost controls around medical reimbursements and prescription drug prices and so forth.

Blurring The Line Between Debt And Money

Erik: I want to move on to what you actually have identified as the next myth in the book, which would also be the feedback that you’d probably get from a lot of people who would say, look, what you’re talking about doing here amounts to stealing from future generations. You’re just scribing away without having to raise taxes, which makes it more politically viable for the government to spend more money that we don’t have and increase the national debt. That’s going to have to be paid off someday by our children and grandchildren, that’s immoral. Why is that a myth?

Stephanie: Well, it’s a myth because none of it makes any sense whatsoever. I mean, I’m sorry, I’ll just be as kind of upfront and candid as I can, I think that’s just really silly. And I know that it’s common, and I know that people repeat it and I know that sometimes serious people repeat these kinds of things.

So this falls right back into the household analogy, right back into that trap of thinking like government as a household. And when we use words, like borrowing, like paying it back, calling this thing the dead, we are falling back into that household trap. The Federal Government’s nothing like a household, it doesn’t operate its budget like a household.

So here’s just one example, okay, when the government runs a deficit, it matches up the deficit spending by selling treasuries, right. We know that and that’s something it chooses to do not something it must do. The government sovereign government doesn’t need to borrow its own currency from anyone in order to spend but the government currently matches up its deficit spending with bond sales.

So what happens? So the government spends $100 into the economy, taxes let’s say $90 back out, we say the government has run a deficit, we look at it as a shortfall. That’s not a shortfall, this government’s the scorekeeper for the dollar, right? It’s adding 100 and subtracting 90, somebody gets 10 points, that’s those $10.

Now the government comes along and says, well, because I ran a deficit I’m going to sell these treasuries, which means the government is going to subtract back out the $10 and replace them with 10 treasuries. So what the way that I look at it isn’t that the government is borrowing in any meaningful sense. If I go to a bank for a loan and I sit down with the loan officer I don’t plop the money down on the desk in front of the loan officer and then ask for the loan I came there because I don’t have the money, that’s why I’m there to borrow.

The federal government is the issuer of the currency, it doesn’t borrow because it doesn’t have the money. What it’s doing is first supplying its currency and then transforming those dollars into a different financial instruments into US Treasuries. So it’s allowing us to hold dollars that amplify themselves over time, that those are amplifying dollars. Why? Because they pay interest.

So I look at the treasuries as a form of payment, not a form of debt, there’s nothing being borrowed, there’s something being paid out. And when the Treasury matures, when the bond matures, it simply converts back into its original form, it converts back to the currency form. So paying it back quote, unquote involves nothing more than shifting funds from one account at the fed a securities account into what’s effectively a checking account, a reserve account at the Fed. That’s all the more complicated it is to quote, unquote pay it back, but I think that we have a communications problem. We don’t have a debt problem, we just have chosen very unhelpful words to narrate what’s actually taking place?

* * *

Source: MacroVoices

During the opening of the interview, Townsend noted that he and his team had reached out to Warren Mosler, an economist whom Kelton credited as one of the Godfathers of MMT thinking.

Readers can listen to the interview in full below.

via ZeroHedge News https://ift.tt/37XK8Zr Tyler Durden