China CPI Tumbles To 11 Year Low After First Drop In Pork Prices Since Feb 2019

Tyler Durden

Mon, 11/09/2020 – 23:00

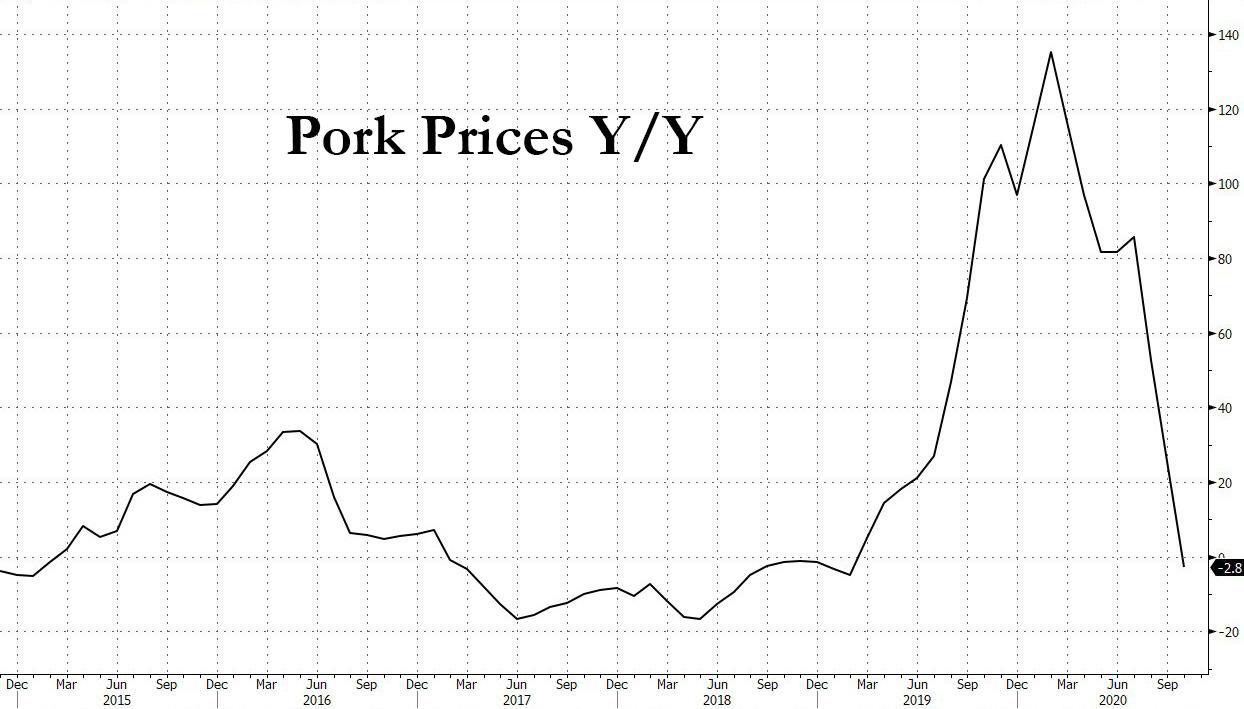

In the latest confirmation that China can not be relied upon to reflate the world out of the covid crisis the same way it succeeded to pull the global economy out of the 2009 depression, moments ago Beijing reported that in October, China’s CPI inflation rose just 0.5% Y/Y in October, below the 0.8% market expectations, and declined 0.3% sequentially failing to post the expected 0.2% increase, primarily on lower food price inflation and in particular the rapid decline of pork prices which posted their first decline since 2019.

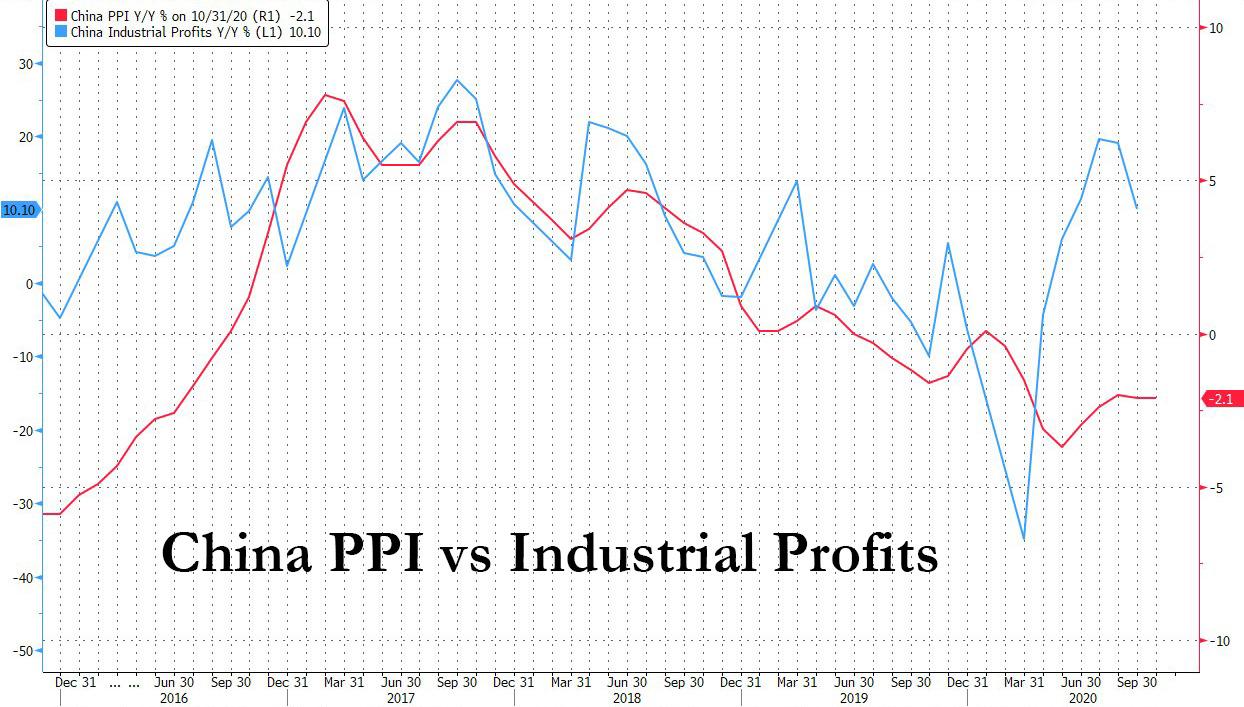

Meanwhile, PPI inflation – one of the core inputs for Chinese industrial profits – sank -2.1% Y/Y in October, also missing the -2.0% expectation, and unchanged from September. Lower price inflation in food processing related industry was offset by higher price inflation in other industries such as metal pressing and smelting and textile.

Looking at the component, in year-on-year terms, food inflation rose just +2.2% Y/Y in October from +7.9% Y/Y in September, driven by a 2.8% decline in pork prices, the first annual decline since February 2019, lowering year-over-year CPI inflation by 0.13%.

Egg prices tumbled by 16.3% Y/Y, lowering the headline CPI by 0.11%. Fresh vegetable prices rose but at a slower pace: in October, fresh vegetable CPI was +16.7% Y/Y vs 17.2% in September, adding 0.38% to headline CPI inflation. Meanwhile, non-food CPI inflation was unchanged at +0.0% yoy in October, driven by a 17.2% plunged in fuel costs vs -14.7% yoy in September.

Core inflation (headline CPI excluding food and energy) was unchanged at +0.5% yoy in October.

Looking at gate inflation, year-on-year PPI inflation was at -2.1% yoy in October, unchanged from September, and a modest improvement from the summer, but not nearly enough to explain the surging industrial profits which, at least according to the government, are trending far higher than where PPI suggests they should be.

In month-over-month annualized terms, PPI declined by 1%, vs -5% in September. Price declines narrowed for producer goods in October (-2.7% yoy vs -2.8% yoy in September) but price decline for consumer goods widened (-0.5% yoy in October, vs -0.1% yoy in September) mainly on lower food price inflation.

By major industry, PPI inflation declined on a year-over-year basis in agricultural food manufacturing (from 3.9% yoy in September to 1.9% yoy in October); on the other hand inflation rose in ferrous metal smelting and pressing, and deflation moderated in textile and telecom industries.

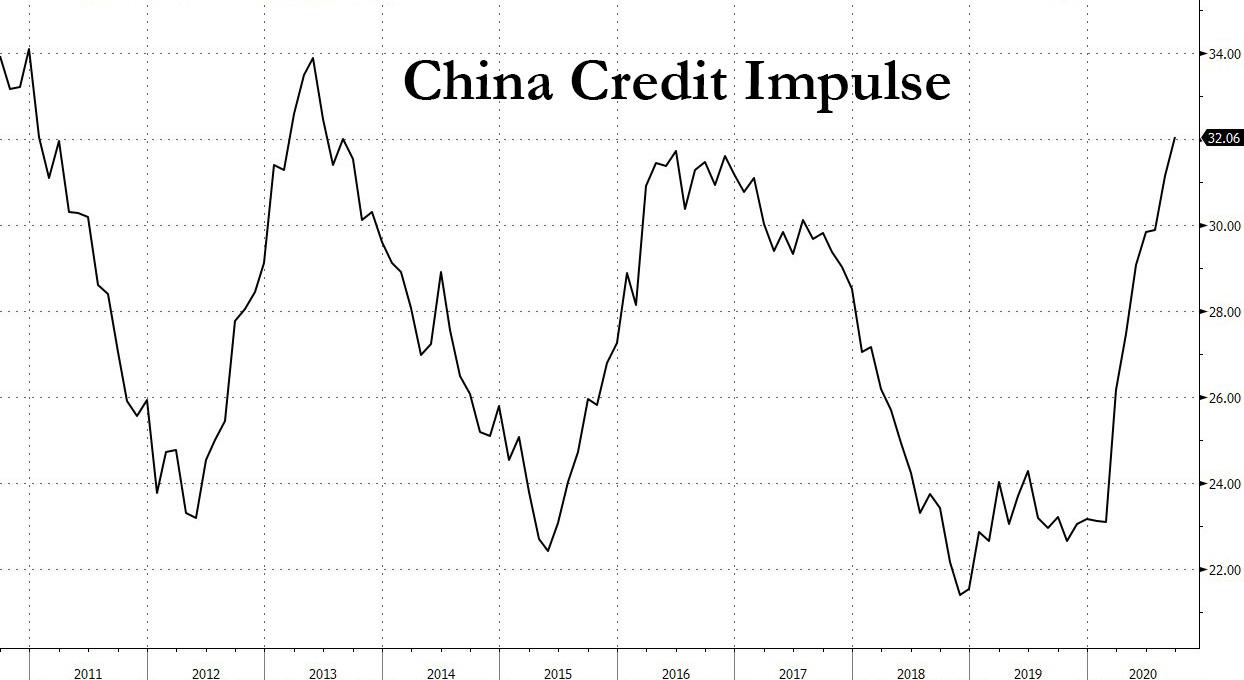

The latest numbers confirm that despite the recent surge in China’s credit impulse…

… this has to translate into a sustainable and benign increase in prices, one driven by higher wages not jumping commodity costs.

Looking ahead, Goldman predicts that headline CPI inflation will moderate further in coming months in our view, on continued decline of pork prices and a very high base in coming months.

Meanwhile, despite the continued decline in CPI and PPI, China bond yields rose to the highest level in a year just ahead of the price data and are poised to keep going according to Bloomberg. This is the result of today’s inflation scare following the Pfizer news, although judging by the sharp reversal in futures, the surge to all time highs may end up being the biggest reflationary headfake in recent history.

via ZeroHedge News https://ift.tt/3eLjq7C Tyler Durden