Bonds Bloodbath As Jobs Flop, Gold Pops, Dollar Drops

Tyler Durden

Wed, 12/02/2020 – 16:00

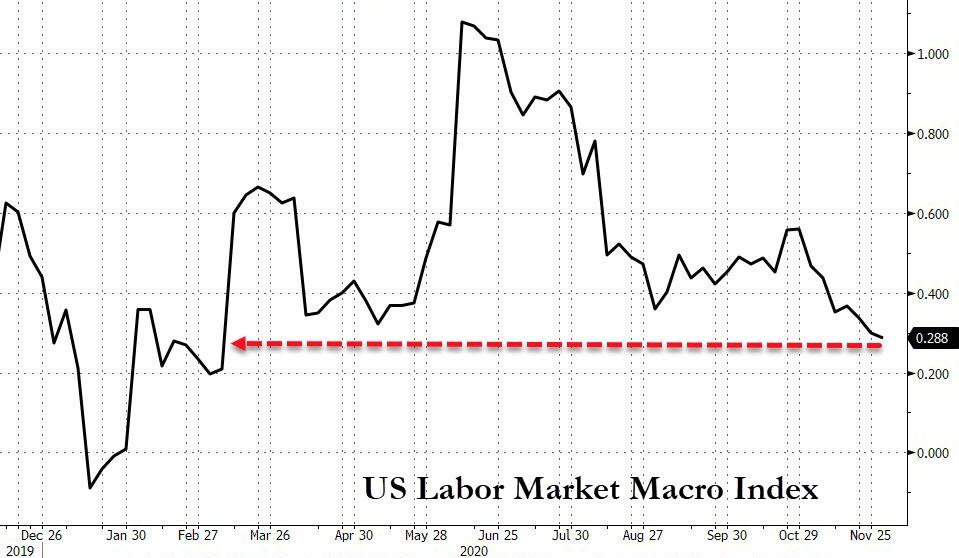

After a weak ISM manufacturing employment print, deteriorating initial claims data, and now ADP’s big disappointment, the jobs picture is deteriorating fast in America…

Source: Bloomberg

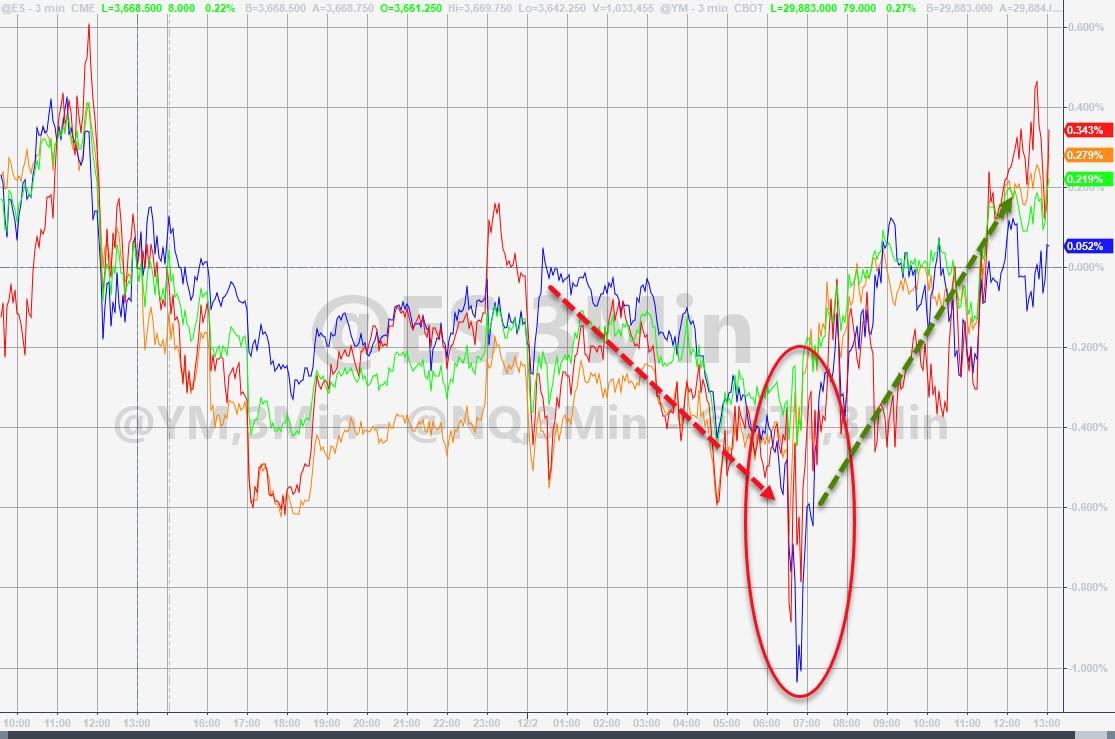

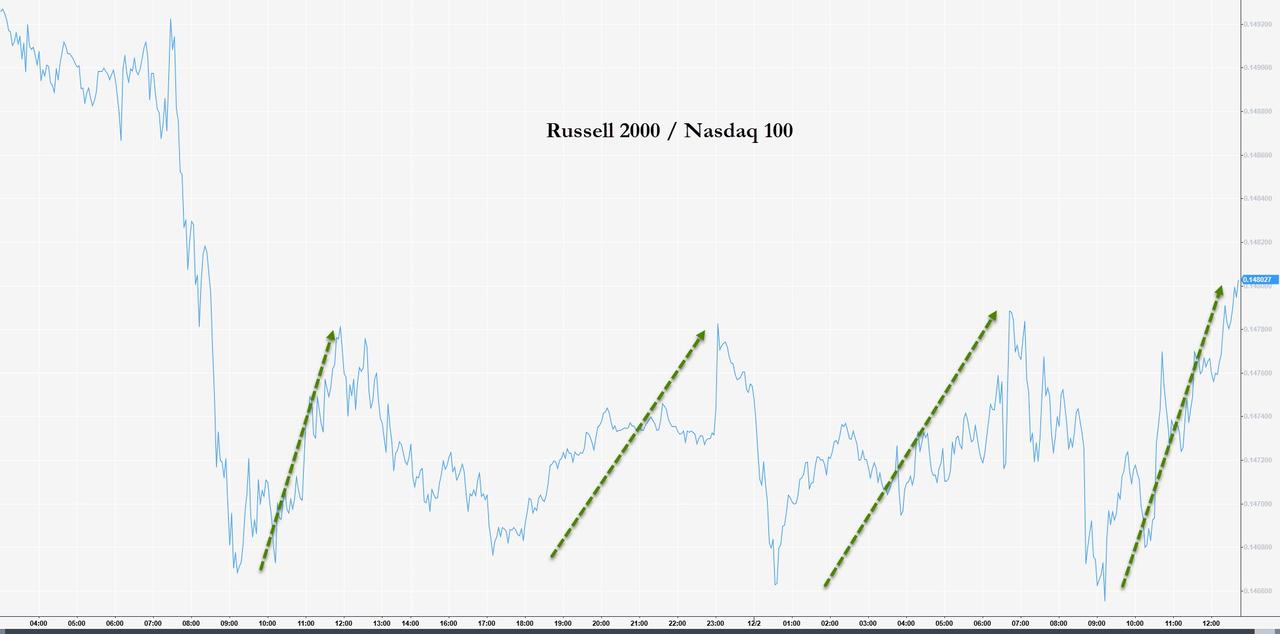

But don’t let that fool you… there’s always hope for ‘stimulus’… that lifted stocks from their ugliness intraday. But after yesterday’s exuberance, today was quiet-ish – Small Caps led the day as Nasdaq lagged but the overall moves were modest…

The Small Cap outperformance relative to mega-tech look familiar again…

One thing is for sure… it’s not the economy, stupid!

Source: Bloomberg

Global Central Banks are giving it all they can…

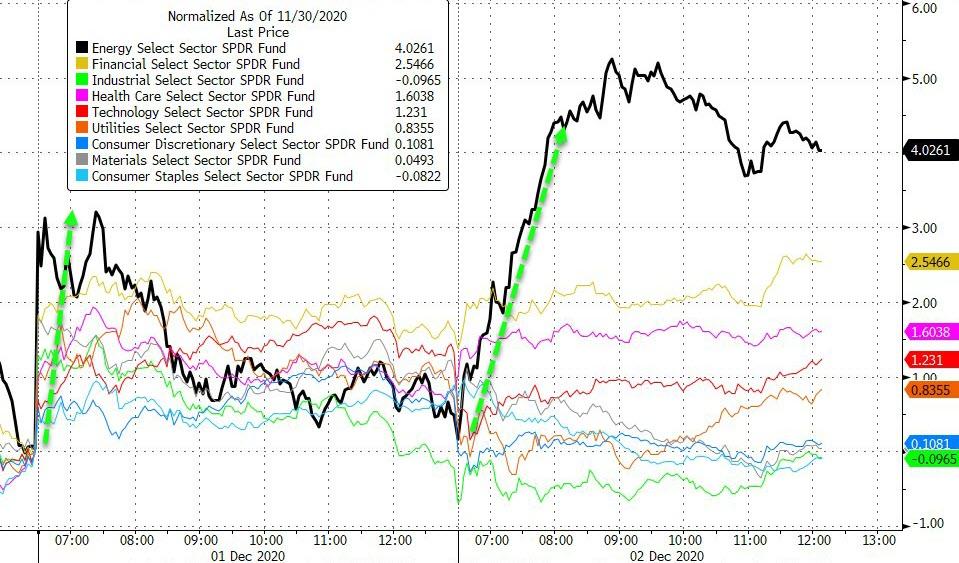

Another day, another meltup in Energy stocks…

Source: Bloomberg

Value continues to hold its gains versus momentum but, despite the recent yield spike, remains notably decoupled from its bond-regime from October…

Source: Bloomberg

CRM crashed today (and WORK was lower) after they announced their hugely expensive deal…

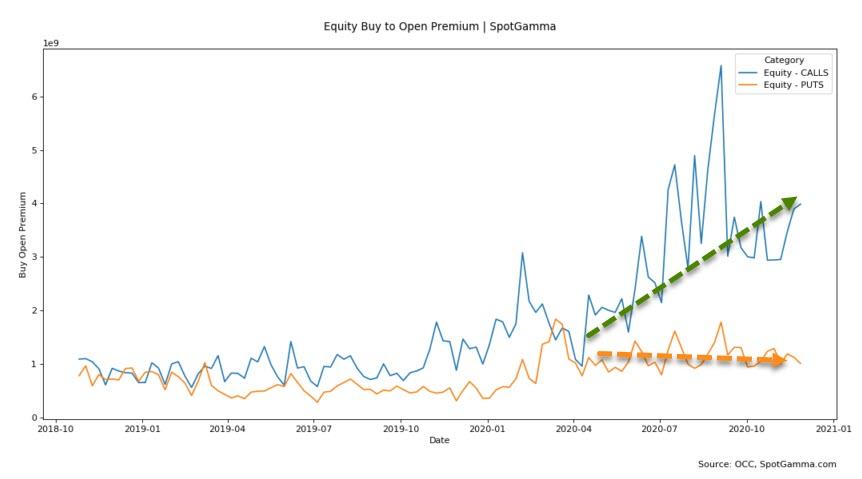

But still, no one wants any protection…

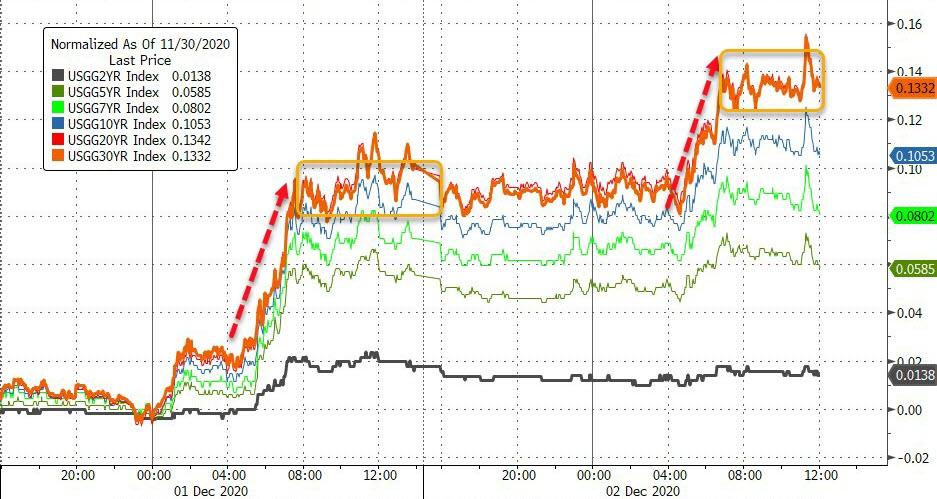

But the big headlines of the day were saved for the bloodbathery in bond-land (note the surge in yields hit around 7amET again and stalled at the EU close)…

Source: Bloomberg

10Y Yields pushed up to recent resistance (election and vaccine spike highs)…

Source: Bloomberg

The yield curve soared to its steepest since Nov 2017…

Source: Bloomberg

The dollar popped and dropped on the day, ending lower once again…

Source: Bloomberg

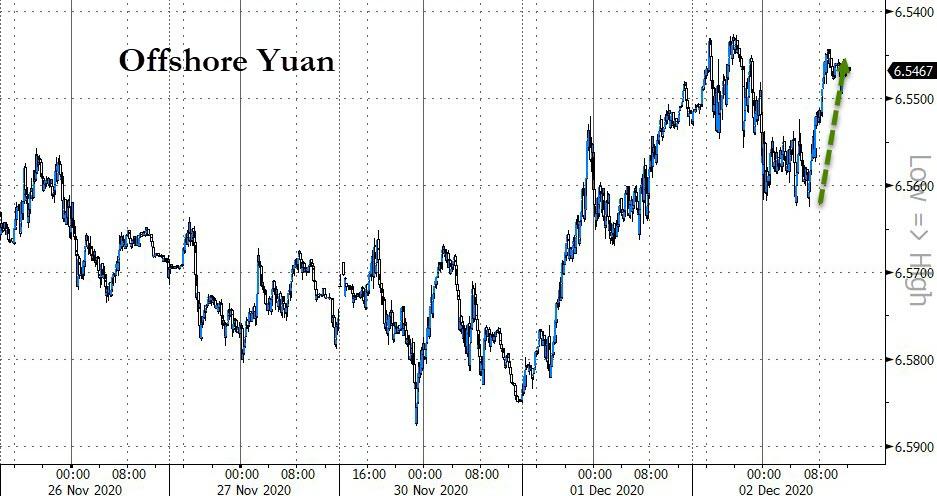

Dollar’s reversal today came on Yuan strength as headlines suggested Biden would not roll back Trump tariffs…

Source: Bloomberg

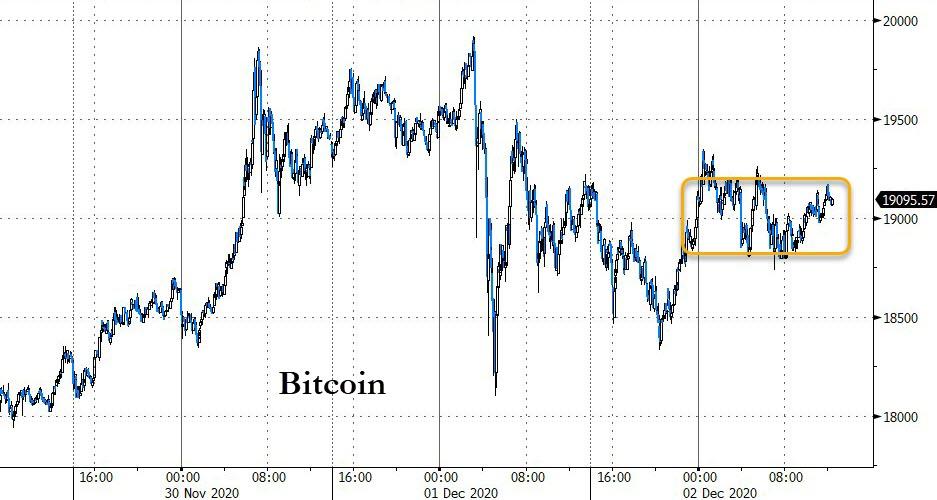

Bitcoin held steady today around the $19k mark…

Source: Bloomberg

And – for a change – gold paid attention to the dollar weakness and rallied…

…with the precious metal rising back above its 200DMA…

Source: Bloomberg

WTI ripped higher on the heels of headlines proclaiming “headway” was made among OPEC members (despite a notable surge in product stocks)…

Finally, we better hope that Copper is wrong or the world’s stock market investors are in for a hell of a surprise when rates soar…

Source: Bloomberg

Though we have seen this kinda of disconnect before… and it didn’t end well…

Source: Bloomberg

And bear in mind that bonds are now ‘cheaper’ than stocks once again…

Source: Bloomberg

via ZeroHedge News https://ift.tt/3mzGkCj Tyler Durden