Musk To Employees: Focus On Profitability Or Stock Will “Immediately Get Crushed”

Tyler Durden

Fri, 12/04/2020 – 09:31

Despite the market never caring much about consistent profits from Tesla to begin with (the company has been anointed with a more than $500 billion market cap and is trading with a trailing P/E of more than 1000x) it appears that Elon Musk is attempting to shift his company’s focus back to profitability and cost savings.

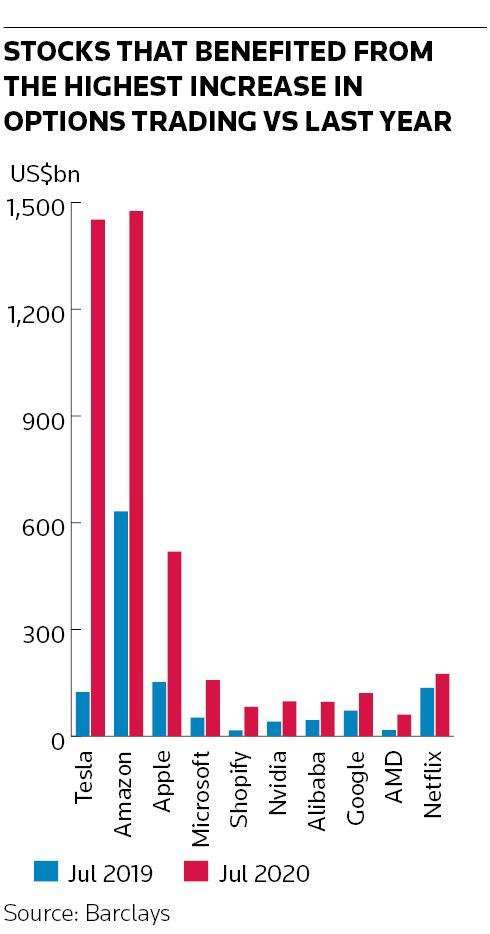

Perhaps Musk has realized that selling EV credits to turn a profit isn’t a long-term solution to profitability. The market, meanwhile, has been enamored with Tesla’s ability to turn “consistent” profits somehow, while mysterious option buyers in the name have added fuel to Tesla’s stock price over the last year.

Now, it looks like Musk understands that the rubber is going to have to hit the profitability road for real at some point.

At a time like this, when our stock is reaching new highs, it may seem as though spending carefully is not as important. This is definitely not true.

When looking at our actual profitability, it is very low at around 1% for the past year. Investors are giving us a lot of credit for future profits, but if, at any point, they conclude that’s not going to happen, our stock will immediately get crushed like a soufflé under a sledgehammer!

Imagine that – small margins in the auto industry. Who would have thought? Musk also urged spending cuts:

Much more important, in order to make our cars affordable, we have to get smarter about how we spend money. This a tough Game of Pennies — requiring thousands of good ideas to improve part cost, a factory process or simply the design, while increasing quality and capabilities. A great idea would be on that saves $5, but the vast majority are 50 cents here or 20 cents there.

It’s hilarious that Musk is begging for small cost cuts when the cars that are currently rolling off the line at Tesla are already being subjected to horrifying quality reviews. For example, Consumer Reports decided to not “recommend” the company’s Model S and panned the company’s Model Y “due to a decline in their reliability” last month.

Model S ratings dropped due to issues with its suspension – the very same issue Tesla claims China “wrongfully” made it recall vehicles for overseas last month. The Model Y suffered from “hardware and paint problems,” according to CNBC.

Previously, Consumer Reports had named the Model S its top rated vehicle ever in 2015. It’s amazing what can happen, though, when you actually drive a few of them off the lot and put some miles on them for a couple of years. Those 20 or 50 cent cost cuts that Musk is urging wind up catching up to you.

We have already documented numerous Model 3 quality control issues, including the vehicle’s bumper falling off “more than expected”. We’re not sure exactly how expected it should be that a bumper should randomly fall off of a car at any given time, but we digress.

Our friends over at InsideEVs released a scathing piece over the summer about Tesla’s Model 3, noting that the car’s bumper has a tendency to fall off at a rate that is “more widespread than expected”.

The blog shared three different horror stories of bumpers flying off that were sent to it after they posted their first article about a Model 3 bumper flying off. In all three cases, the owners were told by Tesla that the repairs would not be covered.

Regardless, it appears that nearly a half decade after Tesla has started producing cars Musk is starting to realize what a capital intensive business it is. Even more important, with all types of “tricks” to goose the stock running out, Musk may be realizing that the company’s valuation could be heading for a cold hard reality check at some point in the near future.

We can’t wait to see that first 2021 earnings report…

via ZeroHedge News https://ift.tt/2VBrlfl Tyler Durden