Yes, December Is The Best Month For Stocks… But When In December

Tyler Durden

Tue, 12/08/2020 – 13:17

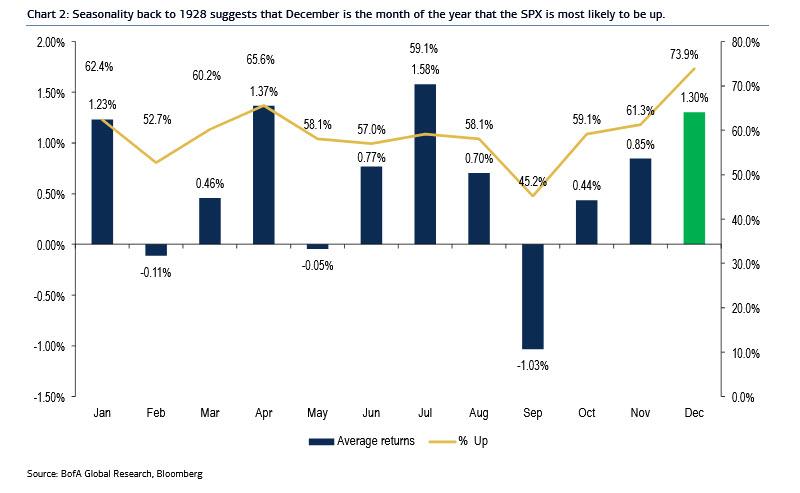

Selling in May and buying back in October may be the best calendar based strategy, but for those strapped for time, buying stocks in the month of December has been the best single-month strategy in nearly a hundred years of market data. And while December is not the best performing month on average (that would be July), December is the month when the market is up the most on average.

As BofA chief technician Stephen Suttmeier writes, seasonality back to 1928 suggests that December is the month of the year that the SPX is most likely to be up: December is up 74% of the time with an average return of 1.3% (1.5% median).

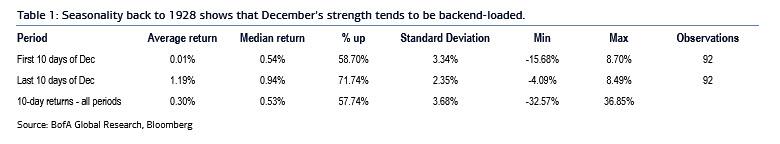

And although December has already rallied 1.8% MTD as of Dec 8, seasonality suggests that December‘s strength is back-end-loaded. The first 10 days of the month have a lackluster average return of 0.01% (0.54% median) with this period up 59% of the time. While not the case so far in December 2020, this means that December often starts with a struggle. The last 10 days of the month are much stronger with this period up 72% of the time on an average return of 1.2% (0.94% median). Based on BofA’s seasonality work, much of December’s “bullish” seasonality return occur between Christmas and New Year’s Day.

What about January

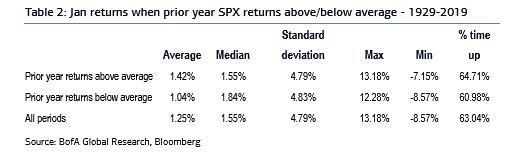

According to the BofA chartist, January tends to stay firm after an above average year. If the SPX can finish 2020 with an above average annual return – which it will absent a crash being up 14% YTD vs the average annual return back to 1928 of 7.67% – the seasonally positive month of January stays bullish. In addition, when the previous year has an above average annual return, 1Q in the following year tends to be stronger than average as well.

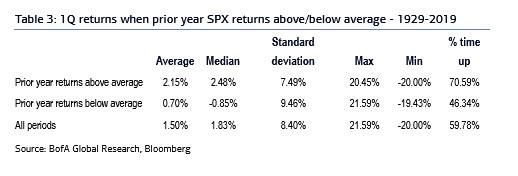

Finally, looking at Q1, the momentum will likely persist there too (absent another QE-enabling crisis). According to Suttmeier, when the SPX has an above average return for the year, the following year’s 1Q tends to be much stronger than average. This 1Q scenario shows the SPX up 71% of the time on average and median returns of 2.2% and 2.5%, respectively. This compares to the average 1Q return of 1.5% (1.8% median) with the SPX up 60% of the time.

via ZeroHedge News https://ift.tt/33RaEkf Tyler Durden