Stocks, Yields Rise On Expectations Of “Biden’s Trillions”

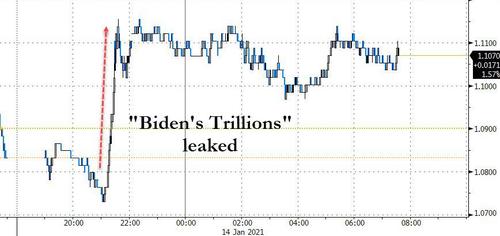

US equities futures and global markets shrugged off President Donald Trump’s second impeachment and focused instead on a report on that Joe Biden will unveil a new U.S. $2 trillion stimulus program later in the day, far bigger than even the most “optimistic” expectations. Yet despite the newfound optimism, Emini futures remained in a tight 20 points range in which they have been stuck since Friday’s payrolls report.

“This will be a great year for the economy and earnings, but just a good year for the stock market,” Bob Doll, chief equity strategist at Nuveen, said on Bloomberg TV. “In other words, I think multiples are held back a bit because of modestly rising interest rates and inflation.”

Hopes for the supersized package lifted most major stock markets even as China recorded its first Covid-19 death since April as new clusters continued to expand. Japan’s Nikkei hit a three-decade peak in Asia and Europe opened 0.4% higher as traders there ignored the prospect of another Italian government collapse.

Looking at global markets, Europe’s Stoxx 600 Index gained 0.4% with automakers and miners leading gains among sectors. Carrefour fell as much as 7.4% after the French government expressed opposition to Canada’s Alimentation Couche-Tard buying the company.

Stocks in Japan, Hong Kong, South Korea and Australia also edged higher. Asia stocks extended gains after climbing to a fresh record, with Hong Kong leading the advance on Tencent Holdings Ltd.’s rally. Tencent was the single largest contributor to the MSCI Asia Pacific Index’s gain Thursday. The Chinese internet giant’s shares jumped to a record following media reports that U.S. officials ultimately decided against banning American investment in Alibaba Group Holding Ltd. and Tencent.

“I think the market is relieved,” said Chinese equity portfolio manager at William Blair Investment Management Vivian Lin Thurston. “However, concerns over this risk and therefore volatility of these stocks may continue in the near future until perhaps the new (Biden) administration’s China strategy becomes clear.”

Japan’s Nikkei 225 Stock Average was among the lead gainers, hitting its highest level since August 1990 and taking its surge since late October to 25%. Intel supplier Nikon was among the biggest winners, rising 7.2%. The Topix benchmark rose for a sixth day, following positive data on the country’s machinery orders. Philippine stocks rebounded, reversing morning losses of as much as 0.9% after the government detected the nation’s first case of the new variant of the coronavirus that first appeared in the U.K.

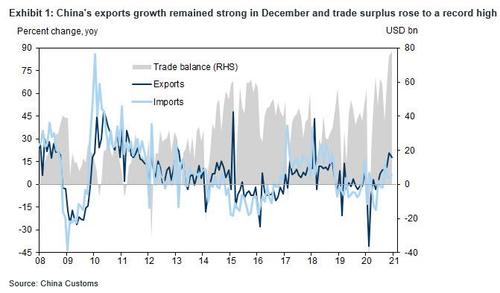

Chinese shares underperformed as investors rotated into some tech stocks that have lagged the broader market’s recent strength, with the CSI 300 Index falling the most in four months after hitting a 13 year high on Wednesday. Chinese data showed exports there grew more than expected in December – pointing to solid global demand – while machinery orders rose for a second straight month in Japan.

As Bloomberg notes, investors betting on an economic recovery this year have been tolerating record stock valuations because they expect further U.S. fiscal spending, even more “stimmy checks” and that vaccines will eventually do something to halt the pandemic. However, with Biden due to take office within days, the transfer of power promises more turbulence. Earlier, the House of Representatives voted to impeach President Donald Trump for a second time, though a Senate trial for Trump likely won’t get underway before his term ends on Jan. 20.

In the bond markets there was starting to be signs of selling again. 10-year Treasury yields rose two basis points to 1.11% on expectations all the new hot money will spark reflation, while the dollar faded earlier gains.

Treasury yields remained higher by about 2bp at long end of the curve after paring the surge sparked by the report Biden will propose a $2 trillion stimulus package, above virtually all estimates. Gains for bunds and gilts led Treasuries off cheapest levels of the session. Treasury 10-year yield is higher by 2.2bp at 1.11% after touching 1.116% during Asia session following CNN report on relief package; 2s10s is steeper by 2.2bp, 5s30s by 0.7bp, unwinding a portion of Wednesday’s bull-flattening move. Bunds outperform by 3.5bp, gilts by 3bp amid rout in Italian bonds.

“Finding the right balance will not be easy,” Hussein Sayed, chief market strategist at FXTM, said of the plan. “Opting for a small package will disappoint investors and lead to profit-taking in equity markets.”

“The number one question for global markets and equities will be when will the Fed start tapering,” said Frank Benzimra, head of Asia equity strategy at Societe Generale in Hong Kong. “This is where you can get some concern… but at the moment it is something that is a bit premature.”

Which is why Biden has opted for a “large” package, which however may be a problem too: Luca Paolini, Chief Strategist at Pictet Asset Management, said an ongoing rise in borrowing rates could unsettle markets if they start to accelerate. “It could be a bit difficult,” he said. “Although I would rather have the Fed (U.S. central bank) hiking rates, bond yields at 4%, growth at 5% rather than everything at zero, because it’s more sustainable.”

European yields were being held in place with the region’s stricter COVID lockdowns bolstering bets of more European Central Bank bond buying, but inflation expectation gauges were creeping higher.

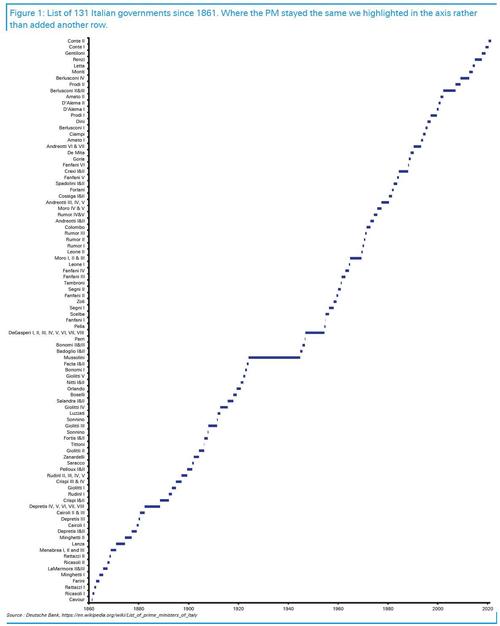

In FX, currency markets are taking a little more of a wait-and-see approach, as investors are short dollars and wondering whether the eventual tapering might limit the greenback’s decline. The Bloomberg Dollar Spot Index swung between modest gains and losses; while the yen slipped against all Group-of-10 peers. Sweden’s krona leads gains among G-10 peers, retracing about half of the losses incurred yesterday after the Riksbank announced a change to its FX reserve regime. Australian and New Zealand dollars also among the top performers on the prospect of U.S. stimulus. The pound edged up as it continued to be supported by an unwind of bets on negative rates. The euro showed modest losses at $1.2151 and 126.42 yen with the Italian government on the verge of collapse: “Fresh elections (in Italy) are still very much the outside bet but it does seem we could be on our way to our 132nd Italian government in the last 160 years.” said Deutsche Bank economist Jim Reid.

In commodity markets, oil futures dipped for the second day as fresh surges in coronavirus cases stoke worries about more lockdowns and lower energy demand. Brent crude futures were down 0.5% at $55.75 a barrel and U.S. crude futures were at $52.70. Gold, which has suffered as U.S. yields have climbed traded 0.2% lower at $1,840 an ounce – well below a two-month peak of $1,959 hit a week ago. Bitcoin surged above $38,000 as it became clear that the US is about to unleash a historic spending spree.

On today’s calendar, Fed Chair Powell and Biden are scheduled to speak. Biden is due to outline his economic plans later on Thursday and U.S. Federal Reserve Chairman Jerome Powell will also speak, either one of which could set yields rising again. Other central bank speakers include the Fed’s Rosengren, Bostic and Kaplan, and the ECB’s Hernandez de Cos. Furthermore, the ECB will be releasing the account of their December meeting. The main data release will be the weekly initial jobless claims from the US, while BlackRock will be releasing earnings.

Market Snapshot

- S&P 500 futures up 0.1% to 3,807.50

- MXAP up 0.3% to 209.77

- MXAPJ up 0.2% to 700.16

- Nikkei up 0.9% to 28,698.26

- Topix up 0.5% to 1,873.28

- Hang Seng Index up 0.9% to 28,496.86

- Shanghai Composite down 0.9% to 3,565.91

- Sensex up 0.2% to 49,599.21

- STOXX Europe 600 up 0.5% to 411.04

- German 10Y yield fell 1.5 bps to -0.537%

- Euro up 0.02% to $1.2160

- Italian 10Y yield fell 5.0 bps to 0.489%

- Spanish 10Y yield fell 1.0 bps to 0.059%

- Australia S&P/ASX 200 up 0.4% to 6,715.35

- Kospi up 0.05% to 3,149.93

- Brent futures down 0.5% to $55.80/bbl

- Gold spot down 0.2% to $1,841.48

- U.S. Dollar Index little changed at 90.30

Top Overnight News from Bloomberg

- China’s export boom continued into December, pushing the trade surplus to a record high in the month and bolstering what is already the world’s best-performing major economyGerman output shrank 5% amid recurring lockdowns and restrictions, according to a preliminary estimate by the statistics office. The government ran a budget deficit of 4.8% of gross domestic product, the biggest since 1995

- The Riksbank’s decision to revamp its foreign-reserve program has ignited bets that it may use the new set-up to cap the krona’s strength in an effort to revive inflation

- Shocks to supply chains are engulfing a wider swath of the global economy as the pandemic rages on, threatening to stifle Asia’s trade-led recovery just as soaring freight rates make it harder for businesses to weather another year like 2020

Your 3 month wrap courtesy of Amplify Trading

A quick look at global markets courtesy of Newsquawk

Asian equity markets traded mixed with cautious gains in the major regional bourses after the tech-rebound on Wall St. and better than expected Chinese trade data, although advances were restricted by tentativeness ahead of the upcoming key events stateside including the start of earnings season and President-elect Biden’s stimulus plan announcement. ASX 200 (+0.4%) was higher with outperformance in the tech sector as it drew inspiration from US peers, although Australia’s mining stocks were dragged lower in a reversal of yesterday’s fortunes due to weaker underlying commodity prices and lingering tensions with its largest trading partner China which was said to instruct owners of more than AUD 1bln of banned Australian coal to find buyers elsewhere, while Nikkei 225 (+0.8%) outperformed after Machinery Orders and PPI topped estimates. Hang Seng (+0.9%) and Shanghai Comp. (-0.9%) were varied despite the mostly better than expected Chinese trade data which showed USD-denominated exports rose by 18.1%, as the mainland suffered after US President Trump issued an executive order amendment on investments in Chinese military companies which bans Americans from holding securities of blacklisted Chinese firms from November 11th, although the large tech names in Hong Kong were boosted on relief after reports the US government is expected to let Americans continue to invest in Chinese technology giants Alibaba, Baidu and Tencent. Finally, 10yr JGBs were flat with demand sapped by the outperformance in Japanese stocks and pressure in USTs, although the downside was cushioned amid the BoJ’s presence in the market and with the 152.00 focal remaining on the horizon.

Top Asian News

- UBS Analysts Say Evergrande May Tumble in Dramatic Sell Call

- China’s Investors Snap Up Hong Kong Shares at Record Pace: Chart

- Uniqlo Owner Benefits During Pandemic as Shoppers Seek Out Value

- Credit Raters Give Indonesia Breathing Room to Rein in Deficit

European equities trade mostly higher but off best levels (Euro Stoxx 50 +0.3%) after the APAC region posted cautious gains as earning season is about to go underway, and ahead of appearances from US President-elect Biden and Fed Chair Powell at two separate events later today. Overnight repots via CNN noted that Biden aides reportedly told allies in Congress that the President-elect’s stimulus plan could be valued about USD 2.0tln which is USD 700bln higher than what Senate Democrat Leader Schumer was calling for earlier – US equity futures show underperformance in the NQ (-0.3%) vs the RTY (+0.8%) which backs the growth to value rotation from the reflationary playbook. Meanwhile, Morgan Stanley suggested investor sentiment is “very bullish” and remarked that the current risk exposure level is the highest in ten years, although the main risks cited include a quicker-than-expected rise in inflation that would the US 10yr yield toward 2%, alongside vaccine disappointments that would reduce or delay return to normality. Back to Europe, broad-based gains are seen across the major indices with the exception of the SMI (-0.2%), dragged lower by losses in heavyweights Nestle (-0.3%) and Roche (-0.6%) as European sectors portray a pro-cyclical bias. Examining the sectors more closely, auto names drive the gains and benefit from the reflation narrative while a robust Chinese economy (indicated by trade-data overnight) underpins the sector – with PSA also noting that China sales reached the prior year’s levels, albeit Renault (Unch) underperforms after delivering an underwhelming plan but shares nursed losses after the group stated the announced targets are realistic so they can be reached even in the toughest conditions. The IT sector resides among the winners following earnings from TSMC whereby revenue increased 1.4% Q/Q and was mainly driven by strong 5nm demand for smartphone and HPC-related applications. The chip-giant added that the business will continue to be supported by 5G and advanced chips and subsequently, peers ASML (+5.2%),ASM (+5%) and Micro Focus (+2%) see tailwinds. In terms of individual movers, Carrefour (-6.3%) shares retrace a bulk of yesterday’s gains as French Finance Minister Le Maire said the Co. is key for jobs and food security in France and he is not in favour of a takeover by a foreign company and a possible bid would have to be cleared by the Finance Ministry, referring to the friendly takeover approach by Canada’s Couche-Tard for EUR 20/shr.

Top European News

- Italy’s Conte Seeks Path to Retain Power After Junior Ally Quits

- Denmark to Start First Impeachment Trial in Almost Three Decades

- Renault CEO Lays Out Plan to Slowly Improve Profitability

- German Economy Stalled in Late 2020, Probably Averting Recession

In FX, the Aussie is back above 0.7750 vs its US counterpart and eyeing 1.0800 against the Kiwi in wake of Chinese trade data surpassing expectations in headline surplus terms to offer Aud/Usd some compensation amidst the ongoing dispute over exports that has seen Beijing instruct owners of banned Australian coal to the vale of Aud 1 bn+ to find alternative buyers. Meanwhile, Nzd/Usd continues to encounter resistance beyond 0.7200 and did not get much in the way of support from a slowdown in NZ building approvals ahead of electric card sales and the food price index. Similarly, the Pound remains top heavy into 1.3700 and through 0.8900 vs the Euro following a record rise in daily COVID-19 fatalities on Wednesday, but the Loonie has extended its recent rebound from sub-1.2800 towards 1.2665 in the run up to Friday’s BoC business outlook and senior loans survey.

- USD – After inching a smidge closer to 90.500, at 90.487, the DXY is drifting back down again and it looks like Buck bulls and bears are both biding time for Biden to see whether reports of a larger than anticipated Usd 2 tn fiscal aid package prove to be accurate. In the interim, IJC metrics may provide impetus as the index hovers above 90.235 and the Dollar will also be listening intently to Fed chair Powell for his stance on tapering given more tempering of market perceptions over the timing by several officials yesterday, including Brainard and Clarida.

- EUR/CHF/JPY – The Euro, Franc and Yen are still ensconced in relatively tight ranges against the Greenback, around 1.2150, between 0.8900-0.8850 and either side of 104.00 respectively, with Eur/Usd hampered by the latest Italian political fiasco in advance of ECB minutes, which also resulted in some downside pressure in the Eur/Chf cross, while Usd/Jpy has not really responded to a surprise rise in Japanese machinery orders or the BoJ’s broadly improved regional survey.

- SCANDI/EM – In contrast to the recent trend, Eur/Sek is lower and Eur/Nok higher as oil prices wane pre-OPEC’s MOMR, while Usd/Zar has reversed from around 15.2900 to 15.1400 or so even though SA’s Eskom is planning stage 2 load-shedding again and Gold has slipped back below Usd 1850/oz again. In fact, EMs are generally firmer on the latest Dollar fade after dovish Fed rhetoric and more UST yield consolidation in wake of solid auction results.

In commodities, WTI and Brent front month futures trade choppy between gains and losses in early European trade. The contracts saw a bout of selling pressure shortly after the European cash open with no immediate catalyst attributed aside from potential technical influence upon breaches of psychological levels. Both benchmarks trade in the red with WTI Feb’21 residing around USD 53/bbl (vs high USD 53.29/bbl), while Brent Mar briefly fell below USD 56/bbl (vs high 56.40/bbl). However, in the grand scheme of things, prices continue to feel underlying support from the inflationary narrative (with reports of a USD 2tln US stimulus bazooka), coupled by the OPEC+ flexibility and voluntary Saudi cuts. News flow for the supply side of the equations has remained light, but further adding to the rosier demand hopes is J&J’s COVID vaccine update whereby the one-shot vaccine is reportedly safe and generates promising immune response in early trials. Looking ahead, today sees the release of the OPEC MOMR (12:20GMT/07:20EST), the second of the trio of monthly reports. As a recap, the EIA STEO cut its forecast for 2021 world oil demand growth by 220k BPD and sees 2022 world oil demand to hit 101.08mln BPD, up by 3.31mln BPD from 2021. Further, the EIA forecasts Brent crude oil spot prices to average USD 53bbl in both 2021 and 2022 compared with an average of USD 42/bbl in 2020. Another theme to keep an eye on is the developments in the Middle East amid heightened Iranian tensions – with source reports overnight suggesting Iran appears to have sent drones to its allies in Yemen. Elsewhere, spot gold and silver trade modestly softer around recent ranges and sub-1850/oz for the yellow metal. In terms of base metals, LME copper fluctuates on either side of the USD 8,000/t mark after seeing early pressure from a firmer overnight Dollar. BoFA forecasts copper prices averaging USD 9,500/t in Q4 2021 as the bank suggest the market will likely be flipping into a deficit, with the overall 2021 copper price forecast at USD 8,725/t compared to its prior view of USD 7,588/t. Meanwhile, China’s 2020 iron ore imports hit a record high after rising almost 10% YY due to firm demand in the economy’s recovery phase. Conversely, annual rare earth exports from China fell to a five-year low amid lower pandemic-laden overseas demand .

US Event Calendar

- 8:30am: Initial Jobless Claims, est. 788,500, prior 787,000; Continuing Claims, est. 5m, prior 5.07m

- 8:30am: Import Price Index MoM, est. 0.7%, prior 0.1%; Import Price Index YoY, est. -0.8%, prior -1.0%

Central Banks

- 9am: Fed’s Rosengren to Speak About Economy in 2021

- 11am: Fed’s Bostic Moderates Panel on Inclusive Recovery

- 12:30pm: Powell Takes Part in Princeton Economics Webinar

- 1pm: Fed’s Kaplan Takes Part in Moderated Q&A

DB’s Jim Reid concludes the overnight wrap

Yesterday we launched our latest monthly survey. There is a big focus on whether you think there are bubbles in financial markets (and where) and also on whether there will be a taper tantrum in markets this year. In addition there are covid, vaccine and other market related questions. I’m grateful for the continued support we are getting for this survey. Many thanks. The link is here and it will be open until tomorrow morning.

With the new administration taking office on Wednesday, an important event to look out for today will be the unveiling of President-elect Biden’s Covid-19 stimulus proposals. Though we await the details, we know that Biden has previously said he’s in favour of sending $2,000 cheques, and a readout of a call last week between Biden, Speaker Pelosi and Senate Minority Leader Schumer, said that Biden was in favour of “additional immediate economic relief for families and small businesses, funding for COVID-19 response, including vaccinations, testing, school reopening, and state and local frontline workers.” Meanwhile the Washington Post reported that Biden would seek to get bipartisan support for the measure, and pass it through the normal budget process, so that will be an early test of whether the Republicans are in a mood for compromise as they find themselves without the presidency and in the minority in both houses of Congress. Overnight Bloomberg is reporting that Biden will propose a $2 trillion package which is higher than most estimates. Treasuries are reversing their 36 hour rally on the news as you’ll see in the Asia para below.

Staying with US politics, President Trump was impeached for a second time yesterday, marking a first in American history. 10 House Republicans voted to impeach, including the third highest ranking member, Liz Cheaney. This means that of the four Presidential impeachment votes taken in the history of the US, yesterday’s garnered the most bipartisan support. It is unclear at this time when the articles of impeachment will be taken up by the Senate, though it remains unlikely that Trump is convicted as it would require 17 Republican Senators to join the 50 Democrats. Congressional Democrats have been conflicted between pursuing conviction right away and waiting until President Biden is able to enact more of his agenda. Senate GOP leader McConnell has said that the chamber will not hear the case before the inauguration, while also saying to his fellow lawmakers in an email yesterday that “I have not made a final decision on how I will vote.” This comes after reporting that McConnell did indeed believe that President Trump committed an impeachable offense.

Though the impeachment of President Trump dominated the news agenda, markets generally brushed this off yesterday as risk assets held steady for the most part, with US equities seeing modest advances. The S&P 500 edged up +0.23% and has now not seen a large daily move in quite some time now, with only 4 days of +1% moves in either direction since the start of December and no +2% over the same period. One big reason for the smaller top-level moves has been the degree of dispersion in the index. In fact, most of the index’s members (300) actually moved lower on the day yesterday which speaks to a good day for the bigger tech stocks as the NYFAANG (+1.02%) and NASDAQ (+0.43%) outperformed. It was a bit of an uneven day though as defensive sectors such as Utilities (+1.94%) and Real Estate (+1.39%) led the way in the S&P 500 – helped by lower yields no doubt. At the other end cyclicals – which had been leading the way in recent days – lagged, with Materials (-1.06%) and Energy (-0.81%) lower.

The bigger moves yesterday came in sovereign bond markets however, where the retrenchment in yields we saw late in Tuesday’s session continued. Similar to Tuesday, the move was aided by strong demand from investors for longer-dated US paper, this time it was an auction for 30yr debt, which helped the rate on such bonds fall to 1.82%. 10yr Treasury yields fell a further -4.6bps on the day, which believe it or not is actually their biggest daily decline in nearly two months, taking them to 1.083%. This decline has reversed a bit overnight with yields on 10y USTs up 2.4bps to 1.108% on the above news that President-elect Joe Biden is planning a stimulus package of around $2tn. The 2s10s curve is 1.8bps steeper this morning after flattening by -4.6bps yesterday, in a move lower that was the biggest in over a month. US 10yr breakevens fell for a third time in the last four session, coming down -1.3bps to 2.06%. More Fed speakers again came out against early tapering as Fed officials continue to try and assuage fears of a taper tantrum. Yesterday Brainard said it was too soon to tell how long it would take for the central bank to reach the goals of its dual mandate, and bond buying could even still increase if the economy needed it too. Today we will likely get more headlines with the Fed Chair Powell due to discuss topics including the Fed’s policy framework later in the day.

Back to politics, and in Italy former Premier Renzi announced last night that his party, Italy Alive, is quitting the ruling coalition. The move comes as Renzi denounced Prime Minister Conte for not doing enough to address the country’s problems. The Italy Alive party does not have many seats in the country’s parliament but they are essential to maintaining Conte’s power. After the party’s ministers resign, Conte could resign himself or call for a vote of confidence. There are likely to be new talks amongst the parties, which would then result in either another Conte government, a new premier or a technocratic administration. Fresh elections are still very much the outside bet but it does seem we could be on our way to our 132nd Italian government in the last 160 years.

Earlier in the day, Prime Minister Conte told reporters that he was working on a new coalition deal that would see the government continue until the end of its term in 2023, and Italian BTPs extended their gains after his comments with 10yr yields ending the day -5.1bps lower. This was in line with the main moves elsewhere in Europe but futures gave a bit back after the close on the new news. Elsewhere 10yr yields on bunds (-5.4bps), OATs (-5.0bps) and gilts (-4.5bps) all fell back. Comments from ECB President Lagarde were supportive here, as she said that the ECB shouldn’t tighten simply in response to a rebound that’s as a result of pent-up demand. As in the US, European bourses had made small gains by the close of trade, with the STOXX 600 and DAX both up +0.11%. The Italian FTSE MIB’s +0.43% gain does not reflect the news of Renzi resigning, as it came after trading had stopped in Europe.

Asian markets are mixed this morning with the Nikkei (+1.53%), Hang Seng (+0.35%) and Asx (+0.43%) up while the Shanghai Comp (-0.42%) and Kospi (-0.29%) are down. Meanwhile, futures on the S&P 500 are trading fairly flat.

China’s December trade data came in overnight with the trade surplus at $78.17bn (vs. $72bn expected) as exports grew by 18.1% yoy (vs. 15.0% yoy expected) while imports grew by 6.5% yoy (vs. +5.7% yoy expected). For full year 2020, the trade surplus reached $535bn (+27% yoy), the highest since 2015. Li Kuiwen, an official at China’s General Administration of Customs, said that the trade surplus may keep growing this year, supported by an expected recovery in the global economy and stable domestic growth. In terms of trade with the US, China’s exports rose +34.5% yoy in December while imports from the US rose by +47.7% yoy, the most since January 2013 and the FY 2020 trade surplus with the US was at $316.9bn (+7% yoy). In other overnight news, Bloomberg reported that the US has decided against banning American investment in Chinese tech giants like Alibaba Group and Tencent Holdings.

In terms of the latest on Covid-19, there was further worrying news yesterday over a new Brazilian variant of the virus, with UK Prime Minister Johnson expressing concern over the matter, which has already been picked up by Japan’s National Institute of Infectious Diseases. It came as Japan also announced yesterday that they were expanding their state of emergency to a further 7 prefectures. Extra restrictions were being imposed in Europe too, with Switzerland announcing the closure of non-essential shops from January 18 to the end of February, while private gatherings will be limited to five people, excluding children. Elsewhere, China recorded its first death from the virus since April as new infection clusters are continuing to expand with the country reporting 124 new local infections in the past 24 hours including 81 in Hebei province and 43 in Heilongjiang.

Wrapping up with yesterday’s data, the US CPI release for December showed prices rose by +0.4% month-on-month, while core CPI was up +0.1%, in readings that were both in line with expectations. That leaves the annual readings at +1.4% for Cpi and +1.6% for core CPI. Over in Europe, the main release was Euro Area industrial production for November, which significantly surprised to the upside, with a +2.5% month-on-month increase (vs. +0.2% expected).

To the day ahead now, and central bank speakers include Fed Chair Powell, as well as the Fed’s Rosengren, Bostic and Kaplan, and the ECB’s Hernandez de Cos. Furthermore, the ECB will be releasing the account of their December meeting. The main data release will be the weekly initial jobless claims from the US, while BlackRock will be releasing earnings.

Tyler Durden

Thu, 01/14/2021 – 08:04

via ZeroHedge News https://ift.tt/2XGWr6i Tyler Durden