Futures, Global Markets Hit Record High Amid Unstoppable Trader Euphoria

Global stocks and US equity futures rose to a fresh record high on – what else – optimism that a firehose of fiscal spending will revive economic growth and bolster corporate earnings, which coupled with more pandemic relief and speedy vaccine rollouts under the new Biden administration would lead to continued risk upside. Investors also sold treasuries and the dollar while awaiting a reading on the weekly jobless claims.

The MSCI World Index touched a record high on Thursday as investors look forward to increased economic support and an expanded federal effort to get shots to more Americans under President Joe Biden. That’s even as several Republican senators expressed misgivings about his $1.9 trillion aid package.

At 7:00 am EST, Dow E-minis were up 72 points, S&P 500 E-minis were up 9.75 points, or 0.25%, hitting an overnight record of 3,859, while Nasdaq 100 E-minis were up 47.5 points, or 0.36%. S&P futures hit a record high higher after the index posted its best first-day reaction to a presidential inauguration since at least 1937. Nasdaq 100 contracts outperformed following a 2% jump on Wednesday. In Europe, tech firms led gains, with the Stoxx 600 Index touching its highest level in 11 months.

United Airlines dropped about 2% in premarket trade after posting a fourth straight quarterly loss due to the COVID-19 pandemic but said it aims to cut about $2 billion of annual costs through 2023. Ford added about 3% after Deutsche Bank raised its price target on the U.S. automaker’s stock, while GM also jumped over 2% to a new record high after Morgan Stanley analyst Adam Jonas said on CNBC the stock is likely to get interest from a wider range of investors going forward.

Solar stocks also rose in premarket trading after President Biden signed a series of executive orders in his first hours in office focused on combating climate change. Other green energy-related stocks are also catching a bid. Biden signed sweeping actions to combat climate change just hours after taking the oath of office, moving to rejoin the Paris accord and imposing a moratorium on oil leasing in the Arctic National Wildlife Refuge. Solar stocks such as NOVA, FSLR, SEDG, SPWR, CSIQ and ENPH saw premarket gains in U.S.

On the virus front, global fatalities hit a daily record, with a U.K. official comparing some hospitals there to a “war zone.”

“High valuations could find justification in the strong recovery that we expect, while inflation assets remain in the affordable zone,” according to Florian Ielpo, head of macroeconomic research and multi-asset portfolio manager at Unigestion SA. “We therefore see 2021 as a land of investment opportunities.”

In Europe, tech firms led gains, with the Stoxx 600 Index touching its highest level in 11 months as investors looked to the European Central Bank for clues on the eurozone’s economic health. The pan-European STOXX 600 index rose 0.5%, hitting new highs since February, with tech, travel & leisure and automakers gaining the most. Tech stocks jumped 1.5%, continuing their rally for a second straight session, led by software maker Sage Group which jumped 4.7% after posting higher quarterly recurring revenue.

The ECB is widely expected to keep its easy money policy unchanged, but hold the door open to further stimulus as the fast-spreading second wave of COVID-19 dims an already weak outlook. The central bank will announce its own policy decisions at 1245 GMT, followed by President Christine Lagarde’s news conference at 1330 GMT.

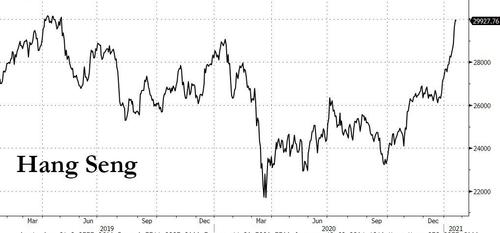

Earlier in the session, Asian stock benchmark headed for another record close amid a global rally on optimism that U.S. fiscal spending will revive economic growth and boost corporate profits. Tech giants TSMC, Samsung Electronics and SoftBank were the biggest boosts to the MSCI Asia Pacific Index, which saw broad gains among its industry groups. The regional benchmark is already up more than 7% this year. Taiwan’s key equity gauge was among the top gainers in the region after data showed the country’s export orders climbed 10.1% last year to $533.7 billion, an all-time high. India’s S&P BSE Sensex surpassed the 50,000 mark for the first time. The Hang Seng Index rose above the 30,000 level for the first time before dropping in afternoon trading.

Stocks in Tokyo maintained gains after the Bank of Japan left its main policy levers unchanged. Indonesia’s main stock index dipped after the country’s central bank maintained its key interest rate.

China’s CSI rose 1.6% despite the emergence of fresh tensions surfaced between U.S. companies and Beijing. China’s three biggest telecommunications firms said they requested a review of the New York Stock Exchange’s decision to delist their shares. Separately, Twitter locked the official account of the Chinese embassy to the U.S., citing a violation of its “dehumanization” policy.

In rates, Treasuries were slightly cheaper across the curve vs Wednesday’s closing levels on futures volume about half the recent average through Asia session and European morning. 10-year yield, steady around 1.085%, broadly keeps pace with slightly weaker German and U.K. cash curves ahead of ECB decision at 7:45am. Session highlights include $15b new-issue auction of 10-year TIPS at 1pm ET and an economic data slate that includes initial jobless claims.

In FX, the Bloomberg Dollar Spot Index fell as the greenback weakened against all of its Group-of-10 peers; risk-sensitive currencies, led by the Norwegian krone, advanced and Treasuries consolidated in a narrow range. The euro rose to a session high against the dollar in European trading ahead of the European Central Bank’s decision later, where policy makers are expected to refrain from any changes to their ultra-loose framework.ECB officials will confront a frustrating outlook when they hold their first policy meeting of the year on Thursday, as stricter lockdowns and a slow vaccine rollout across the region threaten to leave the economy jammed up for months on end. Norway’s krone rose to its strongest level since February versus the euro after Norges Bank said it expects to be ready to start raising interest rates as soon as next year, earlier than most of its peers. The pound rose to the highest level against the dollar in over two years, extending its longest winning streak in three weeks and adding to gains spurred by slightly stronger-than-expected inflation data Wednesday. The yen reversed an earlier loss against the dollar after the Bank of Japan held its interest rate and asset buying settings intact. The Australian and New Zealand dollars rose for a third day, buoyed by solid domestic data and gains in global stocks.

A gauge of emerging-market currencies rose for a third day as optimism about additional U.S. stimulus and accommodative monetary policy weakened the dollar. The rand and the lira advanced the most in foreign-exchange markets ahead of interest-rate decisions.

In commodities, West Texas Intermediate crude dipped 0.5% to $53.03 a barrel. Brent crude declined 0.6% to $55.77 a barrel, while gold was little changed at $1,871.64 an ounce. In crypto, Bitcoin tumbled below $33,000. The largest digital asset has trended lower ever since breaking through $40,000 amid growing speculation that the market is in a bubble.

Looking at the day ahead now, and the aforementioned ECB meeting and President Lagarde’s subsequent press conference is likely to be the highlight. Data releases from the US include the weekly initial jobless claims, December’s housing starts and building permits, and the Philadelphia Fed business outlook for January. From Europe, we’ll also get the Euro Area’s advance consumer confidence reading for January. Finally, earnings releases include Intel, Union Pacific and IBM.

Market Snapshot

- S&P 500 futures up 0.2% to 3,851.25

- STOXX Europe 600 up 0.4% to 412.55

- MXAP up 0.8% to 214.73

- MXAPJ up 0.8% to 724.85

- Nikkei up 0.8% to 28,756.86

- Topix up 0.6% to 1,860.64

- Hang Seng Index down 0.1% to 29,927.76

- Shanghai Composite up 1.1% to 3,621.26

- Sensex down 0.2% to 49,681.48

- Australia S&P/ASX 200 up 0.8% to 6,823.71

- Kospi up 1.5% to 3,160.84

- German 10Y yield unchanged at -0.529%

- Euro up 0.3% to $1.2142

- Italian 10Y yield rose 3.1 bps to 0.508%

- Spanish 10Y yield fell 0.5 bps to 0.07%

- Brent futures down 0.8% to $55.61/bbl

- Gold spot down 0.1% to $1,869.79

- U.S. Dollar Index down 0.3% to 90.20

Top Overnight News from Bloomberg

- Joe Biden began his presidency with a soaring appeal to end America’s “uncivil war” and reset the tone in Washington, delivering an inaugural address that dispensed with a laundry list of policy goals to instead confront the nation’s glaring political divides as the foremost obstacle to moving the country forward

- President Joe Biden’s proposed $1.9 trillion pandemic relief plan got a skeptical response from two Senate Republicans whose backing he would likely need for quick congressional passage

- Investors in mainland China are showing unprecedented interest in Hong Kong stocks, powering the city’s fastest rally for a new year in more than three decades

- Bank of Japan Governor Haruhiko Kuroda looked to keep all his options open for a policy review in March following two critical months that will likely determine whether the pandemic will ease or take a turn for the worse

- The front-end of major currencies’ term structures gets a boost ahead of upcoming central-bank meetings yet signs grow that volatility may resume its downtrend

- Italian Prime Minister Giuseppe Conte on Wednesday won lawmakers’ backing for 32 billion euros ($39 billion) of extra spending as he tries consolidate support for what’s now a minority government

- The Bank of Japan left its main policy unchanged after forecasting the economy will regain more lost growth than previously thought once it starts to recover from the current state of emergency. Japan nominates economics professor Noguchi for BOJ board

- Bank of England Governor Andrew Bailey said that the U.K. economy is learning to adapt to lockdowns to contain the coronavirus. Speaking in a webinar, the central bank chief said the economy seemed to weather the closure in November better than it did at the start of the pandemic in early 2020

- Japanese exports gained in December for the first time in just over two years, with China shipments climbing even as the pandemic resurged in other key markets

- Oil dipped toward $53 a barrel as pessimism over the short-term demand outlook in the world’s two largest economies was tempered by more weakness in the dollar

Quick look at global markets courtesy of newsquawk

Asia-Pac bourses took impetus from the gains on Wall Street, where stocks rallied to all-time highs on Inauguration Day and the Nasdaq outperformed as strong results from Netflix inspired the large tech names. ASX 200 (+0.8%) was lifted from the open with tech stocks inspired by their US peers and the largest-weighted financials sector also notched respectable gains, but upside was capped as participants also reflected on mixed quarterly production updates from Santos, South32 and Woodside Petroleum. Nikkei 225 (+0.7%) traded positively with exporters cheering a predominantly weaker currency and following the trade data which was mostly softer than expected although still showed the first Y/Y growth in Exports (2.0% vs exp. 2.4%) since November 2018. Hang Seng (-0.1%) and Shanghai Comp. (+1.1%) were slightly varied with the former stalling after it breached the 30k milestone to print its highest level since May 2019, while the mainland was kept afloat following another firm liquidity operation by the PBoC and on some hopes of better ties between US and China in the aftermath of the transfer power in Washington D.C. with the Chinese telecom giants even filing requests for a review of the NYSE determination to delist their American depositary shares. However, there were later comments from President Biden’s National Security Council spokeswoman who criticized China’s sanctions on former Trump administration officials and suggested that President Biden looks forward to a bipartisan effort for the US to out-compete China. Finally, 10yr JGBs were rangebound with price action restrained around the psychological 152.00 level and amid the BoJ policy announcement which provided very little in terms of surprises as the central bank maintained policy settings and downgraded current fiscal year growth estimates as expected, but raised growth forecasts for the years after and extended its deadline for loan schemes encouraging banks to boost lending by 1 year.

Top Asian News

- Ant Group’s Valuation Seen Dropping to $108 Billion on Crackdown

- Aramco Omits Carbon Data for Up to Half Its Real Emissions Toll

- Turkey Weighs End to Banks’ Dividend Freeze on Recovery Hope

- Tencent-Backed Huohua Siwei Is Said to Pick Banks for U.S. IPO

EU bourses see modest gains across the board (Euro Stoxx 50 +0.4%) after the US-induced optimism in APAC somewhat simmered down ahead of the first ECB policy decision of the year (full preview available in the Research Suite), whilst the UK’s FTSE (-0.1%) modestly lags amid unfavourable Sterling-dynamics. State-side futures meanwhile tread water ahead of the US entrance – with the tech-led NQ once again narrowly leading vs the more value-driven RTY (Unch) and YM (Unch), and with fresh catalysts light throughout the European morning thus far (Note: Intel and IBM are set to report after-market). Broader sectors in Europe do not display a particular risk bias but are mostly firmer with the exception of energy amid price action in the complex, with tech again the outperformer. The sectoral breakdown sees travel & leisure among the winners with the aid of a stabilisation in oil prices and as vaccine rollouts gain traction, albeit the flare-up of new variants could dampen the near-term outlook for the sector as travel restrictions are placed to stem cross-border contamination. The latest in UK press suggest that UK residents reportedly face a ban on entering the EU under a plan by Germany to close down borders and sever transport links with non-EU countries that have virus variants, should member states consider it necessary to protect public health. Elsewhere, financial names see modest and steady gains in the run up the ECB, whilst sources via Il Sole 24 citing rumours from Frankfurt suggested a vast majority of banks will follow the ECB’s recommendation on shareholder remuneration. In terms of individual movers, Deutsche Telekom (+0.8%) sees modest gains as the Co. is close to a deal with Cellnex (+4%) to develop European tower infrastructure, according to reports. Meanwhile, Julius Bear (+0.8%) shrugged off reports that proceedings are to be initiated by the Swiss watchdog FINMA against two employees at the firm for anti-money laundering failings.

Top European News

- U.K. Suffers Deadliest Day With Some Hospitals ‘Like a War Zone’

- Germany’s Virus Deaths Surpass 50,000 Since the Pandemic Started

- Norges Bank Still Sees Scope to Start Rate Hikes in a Year

- Spain’s BBVA to Sell of $848 Million of Bad Loans to KKR

In FX, the Pound seems to have benefited from Wednesday’s pause for breath and pull-back from peaks, as Cable reclaims 1.3700+ status and surpasses prior m-t-d pinnacles to set a new high mark circa 1.3746, with ongoing tailwinds from the Eur/Gbp cross that has resumed its downward trajectory to set fresh sub-0.8850 lows. No fresh or obvious bullish catalyst for Sterling, but the Dollar remains weak overall as the index fails to sustain recovery rallies above 90.500 and the DXY looks increasingly prone to testing the 21 DMA around 90.142, if not 90.000 itself, while the Euro appears unable to take full advantage in the run up to the ECB. Elsewhere, cross flows are also having a bearing on direction and relative performance between the Kiwi and Aussie, with Aud/Nzd back below 1.0800 even though Aud/Usd is consolidating gains above 0.7750 in wake of upbeat jobs data. However, the major factor behind Nzd/Usd’s advance beyond 0.7200 is another less dovish RBNZ outlook, as Westpac revises its forecast for two 25 bp eases in 2021 and now expects the OCR to remain unchanged.

- EUR/CHF/CAD/JPY – All firmer vs the Greenback, but as alluded to above Eur/Usd has not been able to breach 1.2150 ahead of the ECB (see headline feed at 7.30GMT for our preview of the event) and the Franc has run into more resistance near recent peaks as the DXY holds just above the aforementioned technical level, at 90.176, so far. Similarly, the Loonie is still finding 1.2600 impenetrable following a more optimistic BoC assessment and before Canadian new house prices, while the Yen is pivoting 103.50 pre-Japanese CPI and post-BoJ that stuck to the script including Governor Kuroda pledging more accommodation without hesitation if warranted.

- NOK/TRY/ZAR – Only marginal and gradual erosion in Eur/Nok on the back of the Norges Bank that matched consensus for no change in the repo rate and effectively delivered a carbon copy of the previous accompanying statement, but in truth the pair was already eyeing the next psychological support or downside target at 10.2500 having cleared 10.3000, and is now edging through 10.2400. Meanwhile, Usd/Try was hovering around 7.4000 heading into the CBRT before the pair extended to the downside after the central bank matched majority expectations for no move in Turkey’s 1-week repo, but maintained until inflation is on a sustainably lower path and price are stable (please refer to the headline for the full release). Finally, Usd/Zar is straddling14.8200 amidst mixed aspirations for the SARB as opinions point to a firm and steady hand from the SA Central Bank..

In commodities, WTI and Brent front month futures are lacklustre in early European trade and remain contained within recent ranges above USD 52/bbl and USD 55/bbl as the reflationary backdrop and OPEC+ support continue to keep prices underpinned in the grander scheme. That being said, upside for the complex has been hampered by yesterday’s delayed release of the weekly Private Inventories – which printed a surprise build of 2.6mln bbl vs exp. -1.2mln bbl, with traders eyeing the weekly EIA report poised to be release tomorrow. From a more macro standpoint, the ongoing concerns about the COVID-19 variants continue to be a grey cloud over investors – with a study (not yet peer-reviewed) suggesting that vaccines could be less effective against the South African variant due to a “mutations that may be resistant to immunity from previous coronavirus infection”, according to Sky News citing the study. Elsewhere, spot gold has slipped a few Bucks from its highs near USD1875/oz, but from a chart perspective still bullish having closed above the 200 DMA and now targeting the 100 DMA (USD 1844 approx) to claim another technical scalp and spot silver is steady just under USD 26/oz in a narrow band. In terms of forecasts, ABN AMRO has reduced it 2021 average gold price forecast to USD 1,771/oz from USD 1,951/oz. The bank also lowered its average silver price forecast for this year to USD 24.6/oz from USD 27.3/oz. Turning to base metals, LME copper ekes mild gains as a softer Buck and as hopes of reflation keeps the red metal supported alongside the backdrop of a robust Chinese economy.

US Event Calendar

- 8:30am: Housing Starts, est. 1.56m, prior 1.55m; Housing Starts MoM, est. 0.84%, prior 1.2%

- 8:30am: Building Permits, est. 1.61m, prior 1.64m; Building Permits MoM, est. -1.68%, prior 6.2%

- 8:30am: Philadelphia Fed Business Outlook, est. 11.8, prior 11.1

- 8:30am: Initial Jobless Claims, est. 935,000, prior 965,000; Continuing Claims, est. 5.3m, prior 5.27m

DB’s Jim Reid concludes the overnight wrap

You probably want to limit how much you listen to me (assuming you haven’t already) as last night I got a homeschooling maths question that was given to my 5 year old daughter wrong. My wife casually showed it to me over dinner before admitting she got it wrong too. So on that basis there’s no genetic hope for our kids. Let’s hope the teachers can bail us out.

The main development yesterday was of course the inauguration of Joe Biden as US President. In his inaugural address, Biden attempted to reset the tone out of Washington calling for an end to the country’s “uncivil war”, saying that, “Politics doesn’t have to be a raging fire destroying everything in its path. Every disagreement doesn’t have to be a cause for total war”. While much of the appeal was aimed at cooling the temperature of national discourse there was also a message to lawmakers of the need to cooperate more as Democrats only hold a slim majority in both chambers of Congress.

However, as we previewed in yesterday’s edition, the main policy developments came through an array of executive orders to reverse various Trump policies. Among them were actions to stop the United States’ withdrawal from the World Health Organization, the re-joining of the Paris climate accord, a federal mask mandate, an end to construction on the border wall, and an end to the travel ban on a number of Muslim-majority countries. Meanwhile on the economic front, there were further support measures, including an extension of the pause on federal student loan repayments and the extension of the federal eviction moratorium.

To mark the start of Biden’s presidency, we looked at the annualised stock market performance of different presidents through time in our chart of the day yesterday (link here), using the S&P 500 on a total return basis. Notably, President Trump actually had the second-strongest annualised performance of any president since the Great Depression, second only to Bill Clinton who presided over the dot com bubble. Furthermore, no Democratic president in our sample going back to 1900 presided over a decline on a total returns basis, so if history’s any guide to the future that bodes well for stock market returns over the Biden presidency. That said, there seemed as much luck as skill as Democratic presidents have managed to avoid a number of the big shocks through history like the Wall Street Crash, the GFC, the pandemic and the 1973 oil shocks which all happened under Republican administrations.

Time will tell where Biden is on this league table, but his first day got off to a strong start as the S&P 500 (+1.39%) advanced to a fresh record high, along with both the NASDAQ (+1.97%) and the small-cap Russell 2000 (+0.44%). Meanwhile yields on 10yr Treasuries fell -0.8bps to 1.080%, having been pretty range-bound since the Georgia runoffs, though breakevens were up another +0.6bps to a fresh 2-year high of 2.12%. Looking at the equity moves in more depth, tech stocks outperformed, with Netflix (+16.85%) being the biggest winner in the S&P following its strong results the previous day, though other big tech firms including Amazon (+4.57%), Alphabet (+5.36%) and Apple (+3.29%) also made sizeable gains as well. US banks (-1.34%) were the only real laggards in a broad-based rally as 22 of the 24 S&P 500 industry groups rose on the day. And over in Europe it was a similar story with 23 of 24 STOXX 600 sectors rising as well with the STOXX 600 (+0.72%), the DAX (+0.77%) and the CAC 40 (+0.53%) all moving higher, as other risk-sensitive assets like oil gained ground.

Asian markets have taken Wall Street’s lead this morning with the Nikkei (+0.85%), Hang Seng (+0.28%), Shanghai Comp (+1.32%) and Kospi (+1.11%) all up. Futures on the S&P 500 are also up a further +0.30% overnight while the US dollar index is down -0.19%.

We have also seen the BoJ monetary policy decision overnight where the central bank left its main policy unchanged. The BoJ took a gloomier view of the current state of the economy but concluded that weaker growth at the end of the current fiscal year and a government stimulus package announced last month will result in a stronger rebound in the year starting April. There was no mention of the policy assessment currently underway, however we may get to hear about it at the BoJ Governor Kuroda’s presser at 6:30am London Time. Meanwhile, the Japanese government has nominated Asahi Noguchi, a Senshu University economics professor with reflationist beliefs, to become one of the Bank of Japan’s nine board members from April. He will replace Makoto Sakurai, a core member of the board who has never dissented from a BoJ decision.

Today’s highlight for markets will be the ECB’s latest monetary policy decision this afternoon, though our European economists (link here) don’t expect any changes to their message following the easing package announced in December, in which the Governing Council extended net purchases under the PEPP until Q1 2022, and the TLTRO discount until Q2 2022. Nevertheless, they also say this doesn’t mean that monetary policy is on auto-pilot, since they need to continuously assess the risks and appropriateness of the policy stance. Indeed, yesterday’s final CPI estimate for the Euro Area in December confirmed the flash reading that showed the Euro Area was in deflationary territory, with prices having fallen by -0.3% over the last year, marking the 5th consecutive month of negative annual price growth.

That said, although the Euro Area remains in deflation for now, market-based inflation expectations have actually been rising in recent weeks. Only yesterday, both the German and Spanish 10yr breakeven rose to their highest level in nearly a year, while Italy’s hit its highest in over 2 years. Furthermore, the 5y5y forward inflation swap for the Euro Area has also been hovering close to a 1-year high, and is currently at 1.33%, a far cry from the low of 0.72% it fell to at the height of pandemic fears last March even if the rise in the US expectations has been much greater. Sovereign bond yields in Europe moved higher too for the most part, with those on 10yr gilts (+1.2bps), OATs (+0.1bps) and BTPs (+3.1bps) all rising, though 10yr bunds outperformed, as yields fell -0.3bps.

On the coronavirus, Switzerland’s government announced that the job furlough program will be extended amidst renewed closures of retail shops and restaurants. The UK’s Chancellor of the Exchequer Sunak is similarly planning to extend fiscal support for jobs as the pandemic-induced lockdown continues to affect businesses. The Government’s £60bn furlough program is set to expire at the end of April, but Sunak is looking to extend the program into the summer at the very least. This comes as the UK again set a sad record for the deadliest day of the pandemic with over 1800 deaths announced yesterday. As mentioned yesterday cases in the UK have been falling since the start of January and deaths will likely follow. On the other hand, Spain saw a record number of new cases yesterday – over 18,500 – as the country has continued to eschew the national shutdowns currently seen in the UK, Germany and France. Even still, Germany announced a new record of daily deaths due to the virus as the government has now increased the measures around mask wearing in the country. Chancellor Merkel yesterday announced that Germans should be wearing surgical masks or N95/FFP-2 masks rather than simple cloth coverings, which is among the most specific face covering mandates anywhere in the world. On the topic of face coverings, the Biden administration in the US made its first move to require face masks on all federal property in the US. The president will be laying out new vaccinations plans as well as more executive actions to combat the virus in the days ahead while also starting to negotiate the $1.9 trillion stimulus bill that the administration released over the last week. Elsewhere, Amazon has offered to help the Biden administration with vaccine distribution saying “we are prepared to leverage our operations, information technology and communications capabilities and expertise to assist your administration’s vaccination efforts. Our scale allows us to make a meaningful impact immediately”. Across the other side of the world, China has imposed a lockdown on some 1.7mn residents of Daxing district. The district has reported cases infected with the virus variant found in the UK. Overall, China has reported over 1300 domestic infections so far this year, indicating that the current outbreak is continuing to swell.

There wasn’t a great deal of data yesterday, though CPI inflation in the UK rose to +0.6% in December (vs. +0.5% expected). Elsewhere, the NAHB housing market index in the US for January fell to 83 (vs. 86 expected), declining for a second successive month.

To the day ahead now, and the aforementioned ECB meeting and President Lagarde’s subsequent press conference is likely to be the highlight. Data releases from the US include the weekly initial jobless claims, December’s housing starts and building permits, and the Philadelphia Fed business outlook for January. From Europe, we’ll also get the Euro Area’s advance consumer confidence reading for January. Finally, earnings releases include Intel, Union Pacific and IBM.

Tyler Durden

Thu, 01/21/2021 – 07:46

via ZeroHedge News https://ift.tt/3906Noa Tyler Durden