“Climate War” Accelerates ESG Craze Sparking Surge In Iridium Spot Prices

While Robinhood pajama traders pump penny stocks, low-float biotechs, and, of course, GameStop and other meme stocks, they seem to be missing the ESG-driven craze in uranium stocks. It’s clear that investment flows into cleantech and ESG-related areas are hot under a Biden administration.

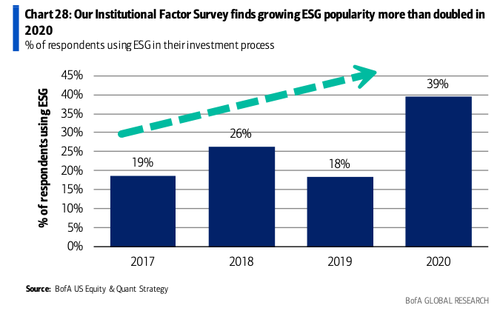

The growing interest in ESG is propelling governments to think green and adopt new technologies to power the green economy. Bank of America’s equity strategist Haim Israel shared an institutional survey of the mounting interest in ESG investing with clients.

Besides uranium, readers should also check out iridium, the latest rare-earth metal to undergo a massive speculative rally.

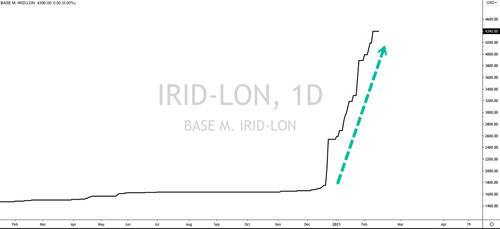

Iiridium spot prices have risen more than 160% in two months. It comes “after supply shortages and expectations it will be used to produce hydrogen to power a greener economy,” said Reuters.

In hydrogen technology, the metal is used as a catalyst in electrolysis to split water into oxygen and hydrogen, as a possible new power source that could replace fossil fuels in the coming decades.

Iridium CIF North West Europe Spot Price jumped to a record high of $4,390 an ounce last week, up from $1,685 on Dec. 12. This means iridium is worth more than double the weight of gold.

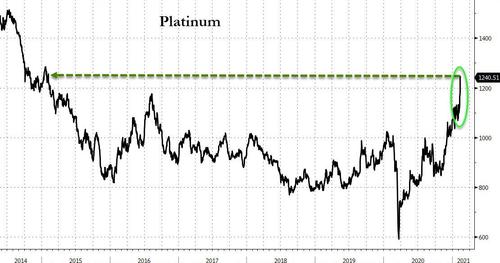

Iridium is a byproduct of platinum and palladium mining; its move higher echoes a similar rise in platinum, driven by rising emissions-control-based demand from ongoing green-energy agendas (and also supply issues).

We noted last week that platinum has been trading at a steep discount to palladium (also used in auto catalytic converters).

In a similar vein to platinum, prospects of a green economy and supply woes in South Africa are some of the main drivers in iridium’s parabolic up move.

“You’ve got increasing concerns on supply and very weak liquidity in the market,” said Emma Townshend, an executive at Impala Platinum, which mines the metal.

“Iridium supply is not growing. Iridium demand is growing,” Townshend said.

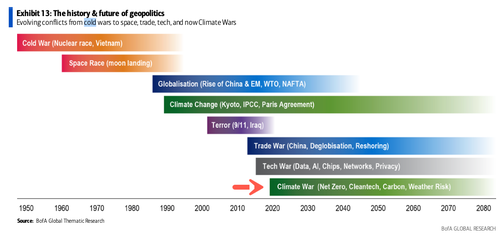

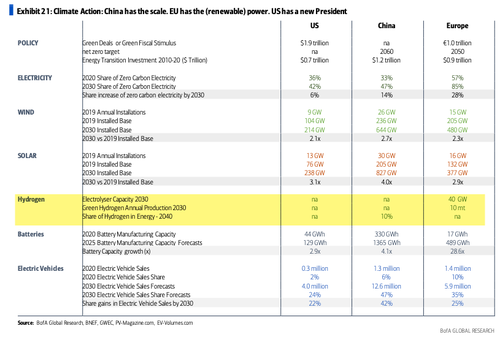

As explained by BofA’s Israel, a “climate war” between the US and China is unfolding, which means both countries are “racing to deploy renewable energy, clean molecules such as hydrogen, and batteries for electric vehicles and storage at scale will be the key benchmark in this climate war.”

BofA’s chart shows when the world’s superpowers are expected to deploy hydrogen technology to power their respective economies. Europe appears to be the leader with some capacity coming online in 2030.

However, not all is green as we have discussed previously, ESG mania has become a virtue-signaling buzzword on Wall Street that distracts from fundamental analysis and allocative efficiency. Last month, the commissioner for Texas’s powerful energy regulator slammed the “woke” ESG fraud and said the newfound popularity of ESG investing could result in record industry bankruptcies and the loss of millions of jobs while doing little to help the environment.

ESG investing is in a speculative mania wrapped in a virtue-signaling package at the moment. Booms and busts are all too familiar in today’s markets. Just don’t be caught holding the bag.

Tyler Durden

Mon, 02/15/2021 – 07:30

via ZeroHedge News https://ift.tt/3qrbkGC Tyler Durden