“There Will Be Fear” – ARK Invest’s Cathie Wood Warns Of Stock Market Correction

ARK Invest’s Cathie Wood joined CNBC’s Scott Wapner last week. She warned of the increasing risk of a stock market correction if rates continue to “sharply” rise.

Around the 3:30 minute mark of the CNBC video, Wood told Wapner, “I do believe if rates were to take a sharp turn up, that we would see a valuation reset and our portfolios would be prime candidates for that valuation reset of course.”

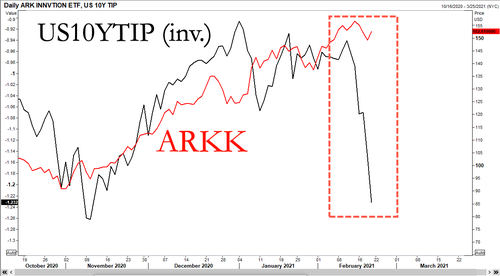

… and just last week, real yields surged, and nowhere was this more visible than 30Y real rates (i.e., TIPS), which just rose above 0%…

… for the first time since June as 10Y real yields are suddenly exploding higher.

Wood went on to say:

“Now one of the things that I found interesting over the last really 20 years is that the S&P’s P/E ratio tends to peak out in the 20 to 25 times range of forward earnings. And I think the reason for that is most portfolio managers and maybe quantitative research researchers are looking at normalized nominal GDP growth in the 4-5% range, which is where long-term interest rates should be normalized. We actually think normalized GDP growth is probably closer to 3%.”

She continued:

“Now, if you think that’s where long-term interest rates should stabilize, if you think of 20 to 25 times that’s one over four to five percent growth, so it’s the inverse of the growth rate, the nominal GDP growth. And that’s where it seems to be peaking out. We think it’s there, longer term. I agree there will be a valuation reset. There will be fear.”

Here’s the interview:

Now that real rates have moved sharply higher on the spike in commodity prices, concerns about multiple resets for high-flying growth stocks are rising.

Despite Wood’s ARK Invest ETF assets reaching a stunning $58 billion last month – the problem she has is concentration risk in rate-sensitive technology stocks.

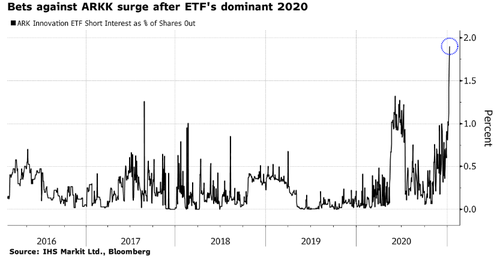

We’ve noted short interest in ARK funds had “exploded” after ARK’s banner 2020. Short interest as a percentage of shares outstanding for the firm’s flagship $21 billion ARK Innovation ETF spiked to an all-time high of 1.9% from just 0.3% two months ago, according to data from IHS Markit Ltd. and Bloomberg.

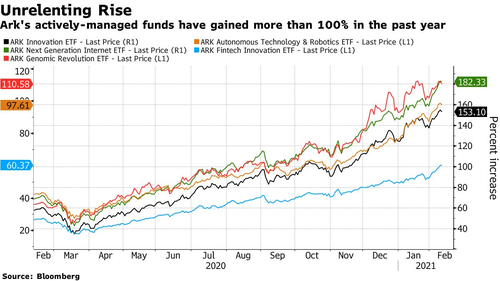

Shorts were also piling into the firm’s other ETFs, including its $9.4 billion Genomic Revolution ETF and its $5.9 billion Ark Next Generation ETF. ARKK rose almost 150% in 2020 and brought in $9.6 billion in new money. So far, they have been unsuccessful.

The Ark phenomenon could be derailed with underperformance as rates continue to surge. As Wood said herself, her ETF family of tech stocks are “prime candidates for that valuation resets” due to the rise in rates.

While the topic of record market euphoria is hardly new (with recent warnings from BofA, Goldman, Citi, JPMorgan, and others), the risk of a VaR shock is rising as rates soar.

Tyler Durden

Sun, 02/21/2021 – 13:20

via ZeroHedge News https://ift.tt/2ZDYdGi Tyler Durden