Quant Who Called This Week’s Rout Turns Bullish, Says CTAs Are Now Covering TSY Shorts

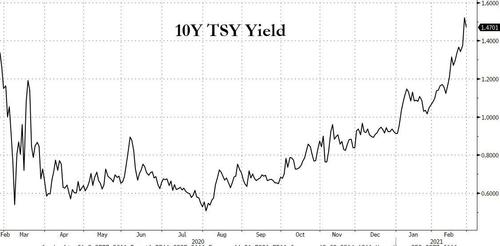

Over the past two months, when unleashed animal spirits forced Citigroup to literally get a bigger chart measuring market euphoria, one analyst was warning that pain was coming. We are talking about Nomura’s Masanari Takada, who long ago replaced a certain “gandalf” with his market predictive skills, who first warned that a burst in 10Ys above 1.20% would spark CTA liquidations and shorting, and that 1.50% on the 10Y would emerge as a critical stop out catalyst leading to an even bigger selloff in rates coupled with a puke in broader equity markets.

Well, this morning the Nomura quant takes a well-deserved victory lap, writing that while the “rise in yields was beyond what we expected, but a risk-off turn much as we expected,” and elaborates:

The upsurge in the 10yr UST yield has proved difficult to stop, with the yield even testing 1.6% yesterday (25 February). US equity markets in general and tech & growth stocks in particular fell off steeply, throwing a tantrum in response to the rise in yields. We acknowledge that the recent rise in yields has gone beyond what we expected. However, the accompanying risk-off turn in equity markets has actually been much as we had expected, as has the behavior of speculative investors.

So far so good; what is notable is that after having been quite skeptical of recent market gains, Takada views the recent flush as a positive development – a purge of excess so to speak – and says that for three reasons, his take is that “the present risk-off phase seems unlikely to amount to more than a temporary release of pressure.”

- First, the 10yr UST yield itself may be ready to fall back into the 1.20%–1.30% range in a reversion to the mean.

- Second, his measure of investor sentiment is showing no sign that investors are trying to get the jump on any anticipated downturn in economic fundamentals.

- Third and finally, there appears to be little risk of systematic funds (CTAs, risk-parity funds) deleveraging on a massive scale.

What this means practically is that if next week brings confirmation that speculators are covering short positions in USTs and that the seasonal profit-taking on long positions in Asian equities has started to abate, “we would expect the reflation trade to get another lease on life in the run-up to Easter.” For this to happen, he says that the Nikkei 225 would need to hold above 28,600, while the DJIA would need to hold above 30,500.

* * *

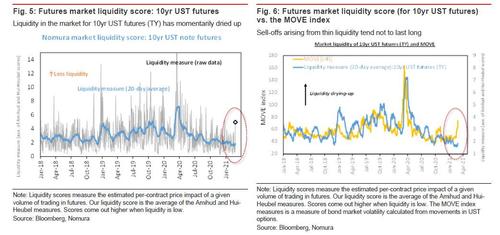

His bullish views aside, Takada then dips into the weeds of this week’s furious rates selloff, and writes that the sudden evaporation of liquidity in the 10Y “suggests that longer-term investors have capitulated”:

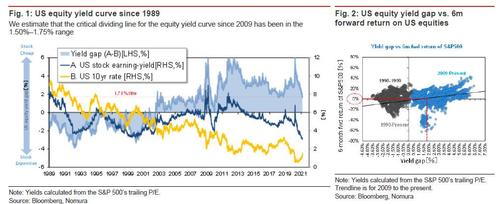

The idea of the 10yr UST yield quickly establishing itself in the 1.5%–1.6% range seems to have impressed the market as being self-contradictory, as the scenario itself is a risk-off factor. The US equity yield gap (calculated here as the difference between the S&P 500 earnings yield and the 10yr UST yield) has now moved in the 1.50%–1.75% range where the critical dividing line lies, making stocks look relatively expensive. Equity markets seem to have immediately adjusted downward so as to restore some kind of balance with bond yields. In terms of their consistency with equity markets, bond yields have gone about as high as they can reasonably go.

This is good news for all those rates bulls who got steamrolled in recent weeks when the 10Y yield exploded…

… because in terms of supply and demand, “UST short-covering signals are starting to flash, particularly among fleet-footed investors. Speculative swing traders that had been simultaneously accumulating short positions in US equities and US bonds in the lead-up to the end of February may be determining that they have accomplished their mission. A prime example of such swing traders are the investors tracked by the SG Short Term Traders Index (NEIXSTTI), which have an average investment horizon of less than 10 trading days.”

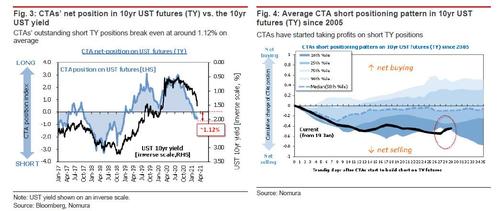

But what may be the most important observation made by Takada is that trend-following CTAs also appear to have swung to covering short positions in 10yr UST futures (TY). As we have discussed extensively, CTAs had been unobtrusively selling Treasury futures but they reversed course late in the day yesterday (25 February). “They now seem to have begun closing out short positions”, Takeda concludes.

According to Nomura, rhe swift upsurge in UST futures market volatility was the proximate trigger for CTAs’ swing to covering short TY positions and they suspect “that CTAs have organically opted to avoid taking their selling any further out of a recognition that the market for TY is behaving irregularly.”

We have our own rule of thumb which says that when CTAs suddenly call off that attack—that is, when they start taking profits not long after entering into a trade—it is usually because longer-term investors throwing their weight around have shaken up the normally orderly quantitative rules of price formation. And indeed, the TY market has recently sunk into a downward spiral of rising volatility in tandem with the evaporation of trading liquidity (which tends to amplify the price impact of a given volume of trading). Among other factors, we suspect that hedge selling on a large scale by longer-term investors has sucked liquidity out of the market in a way that has caused yields to momentarily rise by more than they would have otherwise.

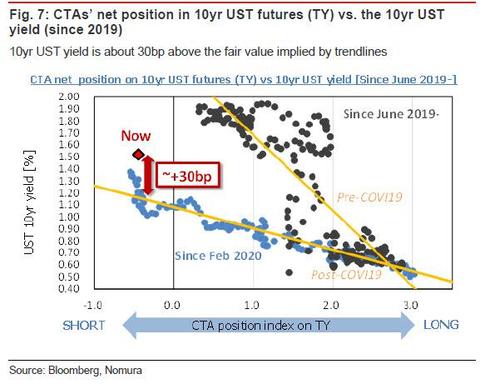

In any case, Nomura thinks the panic selling of USTs by longer-term investors “has probably passed its peak” and expects the UST futures market (among others) to regain some semblance of order next week as trading liquidity returns. This means a sharp drop in yields as the bank estimates “that the 10yr UST yield is currently about 30bp above the fair-value yield implied by trend-following strategies. Short-covering by CTAs and other speculators for the sake of locking in profits may serve the purpose of reeling the 10yr UST yield back in.”

Finally, what does all this mean for stocks?

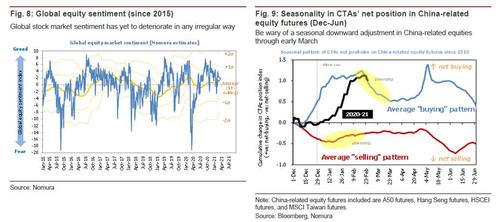

Here, Nomura is surprisingly complacent, noting that “nothing seriously irregular appears to be happening in global equity markets, either. Our measure of equity market sentiment has fallen to around the neutral line at zero, but investors do not seem to be pricing in any unexpected downturn in fundamentals. As discussed in several previous editions of this memo, there is a seasonal tendency for investors to take profits on long positions in Asian equities right about now (through early March). The steep rise in UST yields is undeniably exerting a drag on Asian equity markets, but we would advise against reading too much into what is happening.”

Perhaps responding to our observations on possible risk parity deleveraging published yesterday, Takada writes that in terms of supply and demand for equities, “some observers appear concerned about the threat of de-leveraging by systematic funds (CTAs, risk-parity funds).” However, Nomura thinks that systematic investors have thus far done no more than the minimum required trimming of their long positions: “We think we are still some distance from having to worry about a systematic, unbroken run of selling serious enough deepen and prolong this risk-off phase.”

As such, the bank sees little risk of significant de-leveraging by risk-parity funds. The parallel declines in bond markets and equity markets (representing a rise in cross-asset volatility) do tend to work against risk-parity funds and other such volatility control funds, and we are seeing some cases of funds choosing the “sell everything” option (simultaneous selling of both equities and bonds). However, Nomura estimates that the leverage ratio at risk-parity funds is still low. “In this respect, the current situation looks quite a bit different from the 2018 VIX shock and the 2020 COVID-19 shock. We see little evidence that risk-parity funds are having to hastily ratchet down their leverage.”

One final reason to be bullish on stocks is also the most obvious one: it’s only a matter of days before Biden’s $1.5 or so trillion stimulus is released with the bulk of the proceeds entering stocks, just as we have seen on previous occasions.

Tyler Durden

Fri, 02/26/2021 – 10:04

via ZeroHedge News https://ift.tt/3dVkCat Tyler Durden