CTAs Are Going “All-In” Oil

Two weeks ago when the world was still transfixed by the rolling squeezes of the most shorted stocks triggered by the WallStreetBets subreddit, we reported that JPMorgan said to ignore the spectacle du jour in the illiquid, left-for-dead smallcaps, and instead focus on what was coming: a coming massive, marketwide squeeze as quant, momentum and other systematic investors soon start covering what is a historic short across the energy sector. Importantly, JPM also gave us the timing of said squeeze: early March.

Fast forward to today when various funds have naturally frontrun what is expected to be a massive market move. Yes, the systematic short squeeze that JPM’s Kolanovic wrote about two weeks ago, has started and as Rabobank’s Ryan Fitzmaurice wrote, “the one-year rolling momentum signal for Brent flipped from bearish to bullish this week, effectively leaving systematic traders “all-in” with respect to their directional oil market bias.”

For those unfamiliar with the energy squeeze thesis, first discussed two weeks ago, here are the key points made by Fitzmaurice, whose full note is excerpted below for those who are still unconvinced about the coming surge in commodities:

-

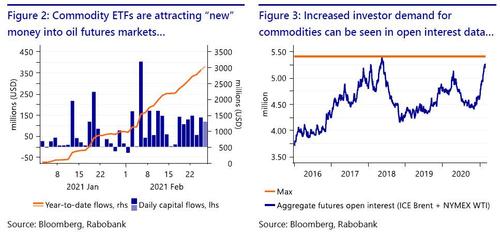

Investor dollars continued to pour into the popular broad-based commodity index ETFs this week with inflows of more than +450mm USD reported through Thursday

-

he closely followed IP week was held from Tuesday to Thursday and with that bullish oil sentiment increased markedly as tends to happen during these major industry events

-

Aggregate open interest is increasing in oil futures markets and the ICE Brent contract has even set a new record, further underpinning the oil rally

Here is Fitzmaurice’s full Oil Market Outlook:

CTAs going all-in: It was another impressive week in the oil patch with spot prices setting new multi-month highs, resulting in the one-year momentum signal for Brent turning positive for the first time in almost a year. This flip from bearish to bullish in the one-year momentum signal is quite important, to our minds, as it is a prominent trading signal used in the heavily momentum-driven CTA space.

In fact, the flip in this important signal effectively leaves systematic traders directionally “all-in” as it relates to oil market exposure with all of the trend, momentum, and carry signals we track now firmly in the bullish camp. Of course, inflows into CTA funds or a drop in market volatility or even the US Dollar could lead to more oil buying from CTAs, but directionally speaking all major signals are now “long”, as we see it. On top of the CTA buying, passive flows into the broad-based commodity ETFs continued at a brisk pace this week, a dynamic we have been highlighting all year.

In addition to this machine-driven trade, the strong oil price action has been helped along by a number of very bullish calls from prominent investment banks and trading houses in recent days and weeks. Further to that end, the much followed IP week was held this past Tuesday to Thursday and with that the bullish oil sentiment increased markedly as tends to happen during these major industry events. These events can also provide a good backdrop for discretionary “longs” at trade houses and the like to lighten up positions and especially so this week given the strong momentum bid that was in the market. As such, it would not surprise if a change of ownership took place with discretionary “longs” taking profits while the machines buy, buy, buy.

A surge in interest

As we just highlighted, CTAs were likely big buyers of oil futures on the week thereby supporting the oil rally, but to our minds, they are effectively “all-in” now. Moving forward, perhaps the more important trend to watch is the substantial pick-up in money flows into broad-based commodity index products as that has the potential to attract “new” money into oil markets, a likely precursor to sustain the strong oil and commodity index rally. This is an area that has been dormant for a number of years due to poor performance of the alternative asset class and subsequent lack of interest from the investment community. In our view, this is all set to change in a big way as both retail and institutional investors turn to commodities for purposes of inflation hedges and hedges against a falling US dollar. In fact, we have already seen nearly 3 billion USD in year-to-date flows into the popular broad-based commodity index products and that is just in the ETF space.

As we discussed in our last oil note, this is just a fraction of the true inflows as many institutional and high-net worth investors are also putting money to work in commodities but through more opaque means such as privately managed accounts. As we explained, the oil market has a substantial weighting in nearly all of the popular index products and, as such, is a big benefactor of these flows. This trend is also apparent in the aggregate futures open interest data for the benchmark crude oil contracts which is increasing back toward the 2018 high watermark.

In fact, aggregate open interest has been steadily increasing in oil futures markets this year and the ICE Brent contract has even set a new record, further underpinning the oil rally. This surge in open interest is exactly what we witnessed during the last commodity super-cycle of the mid-2000s when commodity index investing was last popular. As such, a breakout in open interest figures will be a key factor in whether or not we are in the early stages of a new commodity super-cycle as some insist or simply just a short-term bull market. At the very least, increasing open interest is likely necessary for oil prices to maintain their recent upward momentum in the near-term, not to mention reach the high levels that some are calling for. The reason being is that there are not many speculative “shorts” left to cover, so further price appreciation will likely have to come from an increase in speculative “longs” bidding up oil prices, a scenario that could indeed unfold given the extremely loose monetary and fiscal conditions at play coupled with global stimulus checks.

Looking Forward

Looking forward, we remain of the view that oil prices are likely to dislocate from oil fundamentals this year should more “new” money continue to find its way into commodity markets. As such, we are closely monitoring trends in commodity index investing and aggregate open interest data in the oil futures market for signs of a breakout. On the flip side, oil fundamentals are still mixed, as we see it, and given the now consensus bullish oil view in the market coupled with short-term overbought signals, a modest near-term correction in prices would not surprise us in the least.

Tyler Durden

Sun, 02/28/2021 – 18:00

via ZeroHedge News https://ift.tt/3bFQmxe Tyler Durden