Key Takeaways From The UK’s Expansionary Budget

Here are the top takeaways from UK Chancellor of the Exchequer Rishi Sunak’s second budget, with the UK still stuck in its third lockdown due to the Covid-19 pandemic.

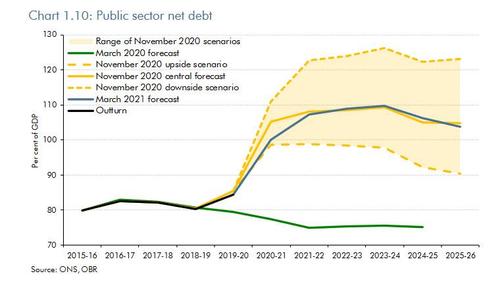

Sunak extended the pandemic “bridging” schemes through the summer and set out his plan for building the future economy, while also stressing the importance of fiscal discipline. While a bit less generous than some had expected, the Budget announced a large fiscal package totaling £65 billion split between supporting the economy through the next few months of the pandemic and encouraging firms to invest and grow. Taken together, Goldman summarizes that “the announced package was larger than widely expected (by around £40bn), with public sector net borrowing(PSNB) in the coming fiscal year of £235bn and the debt-to-GDP ratio reaching around 110% in 2023-24.“

Main points:

1. As was widely expected and, for the most part, briefed to the press in advance of today, the Budget announced an extension to the pandemic bridging measures. In particular, the furlough scheme has been extended until the end of September, with employer contributions rising from July, and the £20/week uplift to Universal Credit has been guaranteed for an additional 6 months. At the margin, the announced bridging package was slightly more generous than we had expected, as we had not predicted the additional period whereby support would be tapered beyond June for VAT, business rates and the stamp duty holiday.

2. In his budget speech, the Chancellor outlined his medium-term economic strategy, with a strong focus on business investment. The Chancellor’s vision is for the UK to be the best place in the world for high growth and innovative companies.Some of the main policies announced to achieve this are:

- The Annual Investment Allowance was extended and made more generous (with a 130% super-deduction), as we had expected, incentivizing businesses to invest in their future growth. This policy will allow firms to reduce their tax bill by up to25p for every £1 they invest, costing over £26 billion over the next 3 years.

- The government will offer a Help to Grow scheme focused on helping SMEs to up skill their management practices and update their digital software.

- The Chancellor has extended the loss carry back for businesses, helping otherwise-viable firms who have been pushed into the red.

- As well as the extension of the stamp duty holiday through June, the Chancellor also announced a new scheme tailored towards first-time buyers, which should help buoy housing demand as we enter the recovery phase.

3. In the run-up to the budget, there had been a lot of chatter about tax increases. There was skepticism that the Chancellor would implement any significant tax increases immediately, while mindful of the need to create a political dividing line with the Labour Party. The Chancellor’s tax proposals were a little more concrete than expected, with a freezing of personal tax thresholds starting next year and corporation tax moving up to 25% in 2023 (with carve-outs for small profits). Personal and corporate taxes did seem the most likely avenues for future revenue raising.

4. These fiscal stimulus policies amount to an additional £65 billion of spending. Here Goldman was expecting a slightly less generous package of pandemic bridging measures but had pencilled in a larger fiscal stimulus of £60 billion. Taken together, the announced package was larger than widely expected (by around £40 billion), but about £15 billion less generous than we had projected.

5. Today’s updated projections by the Office for Budget Responsibility (OBR) show public sector net borrowing (PSNB) at £234bn (10.3% of GDP) in 2021-22, notably larger than the £185bn average expectation across ‘City’ forecasters. While somewhat smaller than Goldman’s expectation of a £250bn PSNB in the coming year, some of this is accounted for by less borrowing this year (£355bn vs. £394bn projected in November). In outer years, the OBR projects a sizeable decline in the PSNB to around £85bn in 2023-24 (vs.£100bn projected in November).

Although Goldman continues to expect a slower pace of fiscal consolation than the OBR, the bank sees the debt-to-GDP ratio as likely to reach around 110% in 2023-24.

What is more troubling is that to fund this deficit, the UK now plans £295.9BN in bond sales in 2021-2022, up from £249.5BN expected, which prompted us to ask if more QE is coming:

*U.K. PLANS GBP295.9B OF 2021-22 BOND SALES VS GBP249.5B EST.

So more QE?

— zerohedge (@zerohedge) March 3, 2021

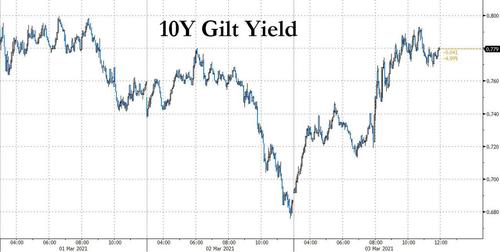

It was this surge in issuance which also prompted Mizuho’s Peter Chatwell to note that bond traders were blaming the UK government for its blowout fiscal support, having surprised the market to the upside on gilt issuance and with the creation of an infrastructure investment bank.

As Chatwell pointed out, this now leaves the UK gilt market on the backfoot, with this heavier supply expectation, and the infrastructure investment bank likely to see economists raising medium term UK growth expectations. The BoE has said they can review QE pace/size at the march MPC, but that is two weeks away.

The news sent 10Y gilts as much as 10bps higher…

… which has also flowed through to the USD rates market which has been showing worrying signs of fragility all morning, with the 5Y Treasury surging.

Finally, here are Bloomberg’s own top takeaways from the Budget Speech:

- Sunak extended support as the economy recovers from the pandemic. He’s prolonging the job-furlough program, maintaining a sales-tax cut and continuing a holiday on retail-property tax known locally as business rates

- The value of the extra support to the economy this year and next will be 65 billion pounds. But then he pivoted to his desire to be responsible with the state’s finances

- So he announced a plan to increase corporation tax to 25% in 2023. There were no increases to income tax or national insurance, but he did freeze personal-tax thresholds

- Sunak talked up the recovery, saying the economy would be back to its pre- pandemic level by mid-2022. But the Office for Budget Responsibility said the economy would see a 3% long-term hit because of the pandemic

- On markets the gilt curve steepened, with the long end climbing 10 basis points. Sterling was little changed against the dollar and the euro, and the FTSE 100 held earlier gains

Tyler Durden

Wed, 03/03/2021 – 12:56

via ZeroHedge News https://ift.tt/3bX0qSX Tyler Durden