Will Powell Unveil Operation Twist 3.0 Tomorrow?

There has been spreading chatter that during Jerome Powell’s upcoming appearance at a Wall Street Journal virtual event on Thursday at noon, the Fed Chair may unveil changes to Fed bond buying and potentially unveil Operation Twist 3.0. As DataTrek‘s Nicholas Colas asks, “will he preview a change in the central bank’s quantitative easing program, one that shifts purchases to the long end to bring down 10-year Treasury yields?”

In response, Colas says that the question sent him to the academic literature and historical record concerning the prior 2 times the Fed delved into implicit yield curve control:

- The San Francisco Fed published an analysis in 2011 about the 1961 “Operation Twist”. It found that the net effect was to push long term yields down by 0.15 percentage points. The paper says this was “highly statistically significant, but moderate”. (Link to the full article.)

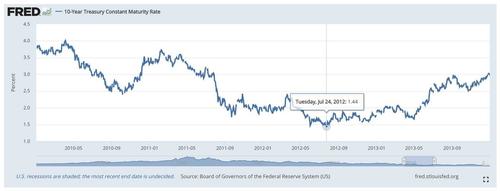

- This is what happened to 10-year yields during the September 2011 – December 2012 “Operation Twist 2” period (chart from January 2010 to December 2013):

Colas then notes that while there were other things going on at the time (European rates under pressure), 10-year Treasury yields fell from 3.75 percent in February 2011 to that low of 1.44 percent right in the middle of “Operation Twist 2” in July 2012. Then, “once Twist 2 ended at the end of 2012, they rose from 1.78 percent to 3.0 percent at the end of 2013.”

Colas’ takeaway is that “it is this more recent history – one that shows the Fed can absolutely suppress long term interest rates by 100 bp or more – that will be on investors’ minds as they tune in to hear Chair Powell this Thursday.”

* * *

But while chatter and speculation of Fed intervention emerge any time there is some market turbulence, the reason why this particular rumor appears increasingly credible, is that it originated with Bank of America rates strategist Mark Cabana, who happens to be a former NY Fed staffer, one who has “occasionally” been known to give advice to the NY Fed (Cabana correctly predicted the infamous liquidity collapse and “NOT QE” episode in late 2019 when the Fed was forced to resume QE – yes it was QE – in response to the slide in systemwide reserves).

But first, some background.

In a recent note, Cabana cautioned that the recent move higher in rates – which until recently had been “healthy” and led by breakevens and inflation expectations – could turn “unhealthy” – i.e., one “due to a hawkish policy mistake, elevated Treasury supply, or a market liquidity issue” and which would be “led by narrowing breakevens, higher real rates and tighter financial conditions.”

Case in point, Cabana pointed out to last week’s move which was led by real rates as an example of an “unhealthy” spike, where “risky assets encountered turbulence” and that a “continued sharp real rates selloff may become problematic even at lower rate levels.”

He then ominously said that “we worry that the rate move could become unhealthy as the economy, market, and Fed all approach an “inflection point” in the spring or summer. This would likely occur as macro conditions improve and the market and Fed shift their distribution of risks on the outlook from the downside toward the upside. At this time we think the Fed may start adjusting its “blindly dovish” stance of monetary policy and begin to set the stage for an eventual taper of its asset purchases, likely aiming to start in 1Q22.“

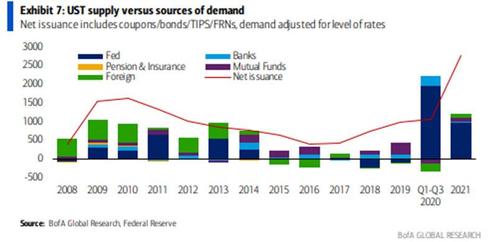

Then, echoing Deutsche Bank credit strategist Jim Reid who said that central banks simply can’t afford higher rates with global debt so high, Cabana said that “the Fed may have a willingness to taper but we question its ability to taper due to recent growth in UST market size…

“… a large UST Supply/Demand imbalance…”

“… and regulatory constraints that limit dealer ability to intermediate risk.”

Hammering the issue, Cabana then repeats he is “worried that the size of the UST market, a challenged supply/demand backdrop for rates, and limited dealer ability to intermediate may result in another round of UST illiquidity as the “inflection point” is reached and the Fed sets the stage for tapering.”

So what is the Fed to do to preempt this “inflection point” that could spark a sudden, violent and quite “unhealthy” surge in rates – one which leaves the Fed without control over the curve – at a time when markets price in even more tapering?

This is where Twist 3.0 comes into play.

In a note published over the weekend, Cabana writes that the Fed should revive the Operation Twist – a simultaneous selling of front-end Treasuries and buying of longer-dated paper – to effectively address key issues dealing with market functioning. According to Cabana, a Twist 3.0 “kills three birds with one stone: It pulls up front end rates, it stabilizes back end rates, and it does so in a reserve neutral way that lessens bank SLR pressure to hold more capital.”

There is another, more pressing reason to launch – or at least hint at launching – a new Operation Twist: “the Fed is simultaneously losing control of both the U.S. front end and back end rates curves for different reasons.”

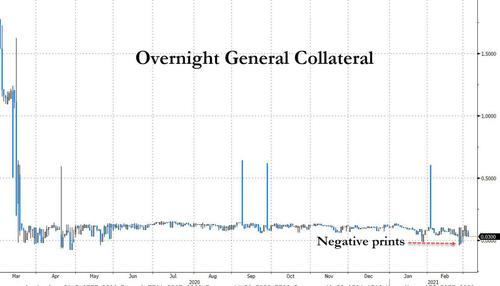

Indeed, as discussed previously, U.S. front-end rates are “dangerously close” to negative territory – and in fact overnight GC repo did dip into negative territory last week…

.. because there’s too much cash chasing too little collateral

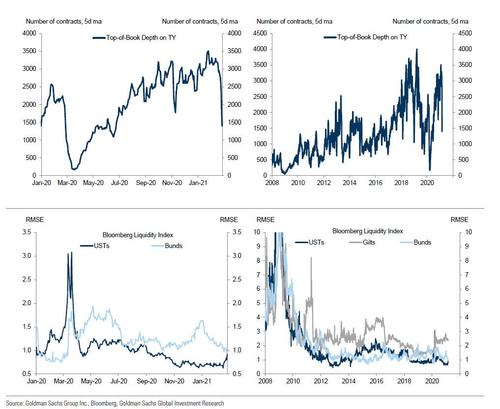

At the same time, the back end has experienced “pronounced illiquidity/volatility” over recent sessions and risk weighing on economic and financial conditions. In fact, as we noted yesterday, liquidity in the Treasury complex has collapsed to banana republic levels (to quote Nanex)

Then there is the 3rd bird: Cabana notes that the Fed also has a “burgeoning financial regulatory problem” stemming from too many reserves which could force banks to hold more capital or push away deposits (this is the infamous SLR issue which we will address again in a subsequent post).

And while Powell may be proactive and take at least some measures to advise the market that the Fed is considering such a “twist”, Cabana concedes that the central bank “may be slow to implement such a policy because it needs signs of further deterioration in liquidity and market conditions at both the front- and back-end of the curve.” Then again, in light of the continued collapse in liquidity and the latest blow out in yields which saw the 5Y breakeven hit 2008 highs…

… many will argue that that time is now.

Tyler Durden

Wed, 03/03/2021 – 11:31

via ZeroHedge News https://ift.tt/3eioQcr Tyler Durden