Huge Payrolls Beat: US Adds 379K Jobs In February… But There’s A Catch

Heading into today’s closely watched payrolls report which as we reported earlier was expected to show a sharp improvement in the labor market, it seemed that stocks were faced with a lose-lose dilemma: a strong number would boost inflation fears further, sending yields higher and crashing stocks; a bad number and the recovery narrative would be hammered as virus fears returned, hammering stocks.

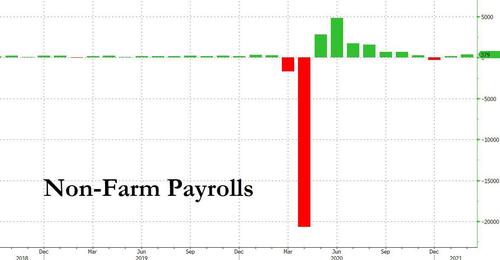

So as traders were busy navigating this tricky mind maze, moments ago the BLS reported that as expected, in February the jobs picture improved dramatically, with the US adding a whopping 379K jobs, nearly double the 198K consensus estimate. The private payrolls number was even more remarkable: coming in at 465K jobs, it was more than double the 195K expected… and also 45K more than the highest forecast of 420K from 35 estimates submitted to Bloomberg.

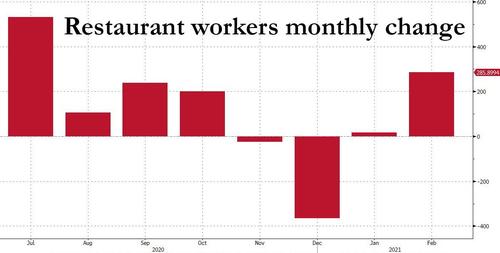

Alas there’s was a catch: About 75% of the jobs added in February were waiters and bartenders (+286,000), so any questions about the quality of the job gains can be put on the backburner. As Blackrock PM Jeff Rosenberg puts it, “This is a bit of a down-payment on a reopening report.”

Besides leisure and hospitality, some other sectors that saw increases include: manufacturing, professional and business services, retail trade, education and health services, while construction employment fell by 61,000 in February (more below).

More from Blackrock’s Rosenberg: “It’s really driving the narrative around the reopening. ‘Restart economics’ means it’s important to remember we’re not talking about ‘recession,’ we’re talking about ‘suppression.’ And that’s the Covid suppression that’s about to be lifted from this economy.”

Additionally, there are still about 9.5 million, or 6.2 percent, fewer jobs than the pre-pandemic level in February 2020. In February of this year, most of the job gains occurred in leisure and hospitality, with smaller gains in temporary help services, health care and social assistance, retail trade, and manufacturing. Employment declined in state and local government education, construction, and mining.

The change in total nonfarm payroll employment for December was revised down by 79,000, from -227,000 to -306,000, and the change for January was revised up by 117,000, from +49,000 to +166,000. With these revisions, employment in December and January combined was 38,000 higher than previously reported.

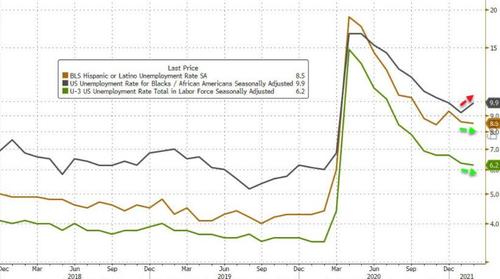

The unemployment rate dropped from 6.3% to 6.2%, also beating expectations of an unchanged print however black unemployment did rise modestly: among the major worker groups, the unemployment rate for Asians declined to 5.1% in February. The rates for adult men (6.0 percent), adult women (5.9 percent), teenagers (13.9 percent), Whites (5.6 percent), Blacks (9.9 percent), and Hispanics (8.5 percent) showed little or no change.

As the BLS notes, both the unemployment rate, at 6.2 percent, and the number of unemployed persons, at 10.0 million, changed little in February. Although both measures are much lower than their April 2020 highs, they remain well above their pre-pandemic levels in February 2020 (3.5 percent and 5.7 million, respectively).

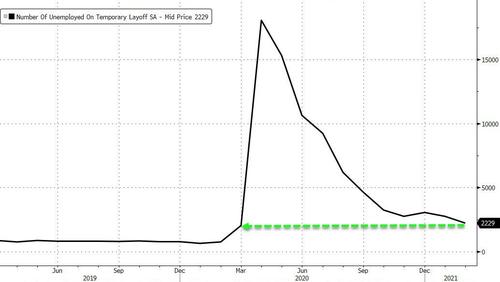

Among the unemployed, the number of persons on temporary layoff fell by 517,000 in February to 2.2 million. This measure is 1.5 million higher than the level a year earlier but is down considerably from the recent high of 18.0 million in April 2020. The number of permanent job losers, at 3.5 million, was essentially unchanged in February but is 2.2 million higher than a year earlier

The participation rate was unchanged, at 61.4% and in line with expectations.

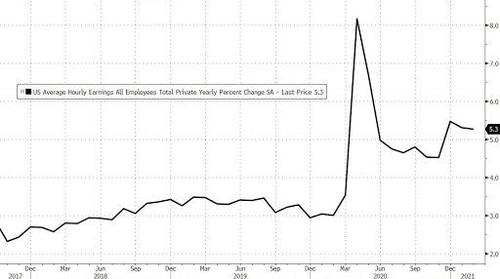

The average hourly earnings increased by 7 cents to $30.01, resulting in a 5.3% increase Y/Y, in line with expectations and down from 5.4% a month prior. Average hourly earnings for private-sector production and nonsupervisory employees, at $25.19, changed little (+4 cents). As the BLS notes, “the large employment fluctuations over the past year–especially in industries with lower-paid workers– complicate the analysis of recent trends in average hourly earnings”

One notable observation from the BLS is that among those not in the labor force in February, 4.2 million persons were prevented from looking for work due to the pandemic. This means that as vaccines become widespread, there is indeed a possibility there will be a surge in new workers in coming months.

Supplemental details of the report also indicated declining Covid-19 cases, loosening business restrictions and increasing vaccinations are having an impact. In February, 13.3 million people reported they had been “unable to work because their employer closed or lost business due to the pandemic.” While that is still an enormous number, it’s down from 14.8 million in January.

A breakdown of jobs across various industries:

- Employment in leisure and hospitality increased by 355,000, as pandemic-related restrictions eased in some parts of the country. About four-fifths of the increase was in food services and drinking places (+286,000). Employment also rose in accommodation (+36,000) and in amusements, gambling, and recreation (+33,000).

- Within professional and business services, temporary help services added 53,000 jobs in February but is down by 175,000 from a year ago.

- Employment in health care and social assistance increased by 46,000 in February. Health care employment was little changed over the month (+20,000), following a large decline in the prior month (-85,000). In February, job gains in ambulatory health care services

- (+29,000) were partially offset by losses in nursing care facilities (-12,000). Employment in social assistance rose by 26,000, mostly in individual and family services (+18,000).

- Retail trade added 41,000 jobs in February. Job growth was widespread in the industry, with the largest gains occurring in general merchandise stores (+14,000), health and personal care stores (+12,000), and food and beverage stores (+10,000). These gains were partially offset by a loss in clothing and clothing accessories stores (-20,000).

- Manufacturing employment increased by 21,000 over the month, led by a gain in transportation equipment (+10,000). Employment in manufacturing is down by 561,000 over the year.

- Employment declined in local government education (-37,000) and state government education (-32,000). For both industries, February losses partially offset gains in January. Pandemic-related employment declines in 2020 distorted the normal seasonal buildup and layoff patterns in the education sector, making it more challenging to discern the current employment trends in these industries.

- Employment in construction fell by 61,000 in February, largely reflecting declines in nonresidential specialty trade contractors (-37,000) and heavy and civil engineering construction (-21,000). Severe winter weather across much of the country may have held down employment in construction. Employment in the industry is 308,000 below its level a year earlier.

- Mining shed 8,000 jobs in February, with losses occurring in support activities for mining (-6,000) and in oil and gas extraction (-2,000). Mining has lost 153,000 jobs since an employment peak in January 2019, though nearly two-thirds of the loss has

occurred over the past year.

Also, in a month when Texas was hammered by crazy weather, Oil and Gas Extraction Payrolls Fell only 2,000, and 5,400 from a year earlier.

- Gasoline stations payrolls fell 1,000 in Feb. after falling 3,500 in Jan.

- Pipeline transport payrolls fell 400 in Feb. after falling 800 in Jan.

- Petroleum and coal payrolls fell 300 in Feb. after unchanged

Futures initially tumbled but then surged as analysts read between the lines and found that the surge in jobs has zero chance of being inflation (good luck hitting 5% core inflation on waiter tips).

What do analysts think of the numbers? Here is what BMO’s Ian Lyngen said:

“Overall, a strong report that confirms the optimism guiding markets thus far in 2021. Ahead of the data, Treasuries were effectively flat and since the release we’ve seen a return of the bearish tone with 10-year yields reaching pandemic highs of 1.624%. We’ve upped our target to 1.75% ahead of the 10-year auction next week with the only risk to higher yields at this point being the feedback from risk assets — particularly given the Fed’s hands off stance.”

Here is Bloomberg Intelligence Senior U.S. Rates Strategist Ira Jersey:

“The better payrolls report may mean continued weakness in the Treasury market, likely continue led by TIPS yields. Real yields tend to be driven by better growth expectations, and the better payrolls should maintain some forward optimism. If Treasuries continue to follow the path of other recent large selloffs, real yields could climb toward zero.”

And some thoughts from Renaissance Macro’s Neil Dutta:

“With COVID cases moderating, employment growth is picking up in high touch service industries. As the vaccination campaign goes on, we will see cases continue to drop and people going out and doing things. This will lead to a boom in the economy, service industries especially. We are going to see a seven figure jobs number at some point in the next few months. Bank on it.”

Indeed, overall this was a good number but far less exciting than the surge in 10Y yields would make it, which may explain why the 10Y is now sliding and futures are surging.

Tyler Durden

Fri, 03/05/2021 – 08:35

via ZeroHedge News https://ift.tt/3sPkiOA Tyler Durden