Here It Comes: Used Car Prices Soar 3% In Just The Last 2 Weeks

Submitted by Nicholas Colas of Datatrek Research

US used car/truck prices are still increasing at an amazing rate. The current semiconductor shortage at automotive assembly plants and very light dealer inventories, especially in pickup trucks, is driving marginal demand here. All this is a good reminder of just how awkwardly automotive design and assembly fits into the modern global tech ecosystem. EVs/AVs can change that relationship, but it will take time.

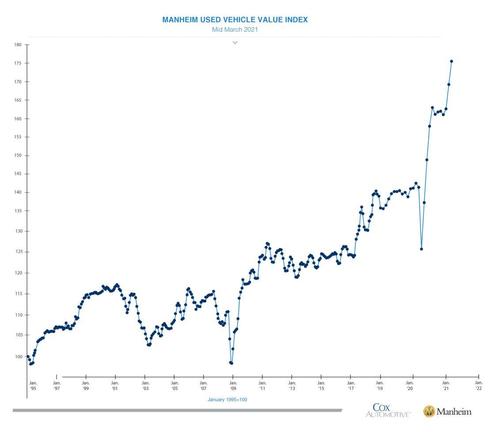

Here’s a chart to kick off the conversation.

It is the Manheim Used Vehicle Value Index through mid-March 2021. This shows US used car/truck values are up a staggering 24 percent from March 2020 and up 3 percent in just the last 2 weeks to a new all-time high. The data here comes from real-world auction transactions between dealers for late-model used cars, so it’s solid.

What’s going on? Two things.

First, US new vehicle dealer inventory is lean just now. Unlike Europeans, who customarily order their cars and wait for delivery, American vehicle buyers purchase from dealer inventory and drive off the lot literally days after they think to themselves “I need a new car/truck”. Dealers know this, so they keep as large an inventory they can afford. Most auto companies do not report dealer inventory anymore, but Ford does. As of March 1st, their dealer system was running 58 days supply. At this time of year, that number should be closer to 65 – 70 days.

Bottom line: new car dealers are aggressively buying late model used cars and trucks so they have something to show potential buyers and capitalize on the potential demand driven by stimulus/tax refund checks as well as the traditional spring buying season.

Second, Manheim’s own analysis shows used vehicle demand is especially strong in one segment: pickup trucks. Looking at the dealer inventory data, that makes sense. Ford was at 53 days supply as of March 1st for the F-Series and Toyota was at 35 days supply. Again, these should be more like 70 days going into spring selling season.

The link to “Disruption” is the shortage of computer chips that’s been much in the news. The issue here is cars and trucks now use a lot of semiconductors for everything from engine management to in car entertainment and navigation. When the pandemic hit last year the auto OEMs cut back orders, rightly fearing a decline in vehicle demand. Chip producers flipped their factories to making product for the tech industry, which was seeing excellent demand.

But light vehicle demand remained robust last year and into 2021, so OEMs have had to go hat in hand to the chipmakers. The problem is that 1) sales to car companies aren’t especially profitable and 2) changing production at a semiconductor factory takes time. You can imagine how these conversations went. The net of it is that automakers are cutting back production while they wait for chip shipments.

We’ll start to wrap this up with an observation from our days covering the auto industry: designing, producing and supplying anything for a passenger car or truck is unlike any other industry you can imagine. First, it takes at least 3 years (an eon in tech-land) to design a vehicle, and these designs are frozen a year or longer before the vehicle is available for sale. Second, OEMs are cheap because the industry is so competitive. Third, anything they put in a vehicle has to have a very low fail rate, which means they will favor older proven technology over newer products. Lastly, governments around the world regulate cars and trucks across a wide spectrum of attributes ranging from safety to fuel economy.

All this is important because there’s so much investor and tech industry enthusiasm about automotive as a growth area. Fair enough – between government mandates for electric vehicles and a lot of capital flowing to autonomous vehicle hardware and software something interesting will develop. But we’re not designing the next cool smartphone handset with a 5 year (at most) useful life. EVs/AVs will have to be as robust and safe as what’s on the market now to succeed. And the auto industry will have to integrate into the world’s tech hardware manufacturing infrastructure better – much better – than it currently is.

We’ll get there, to be sure. But it won’t be a fast move. Nothing in automotive ever is, unless it’s a fully loaded 2-year-old used pickup moving down the auction line next week.

Tyler Durden

Fri, 03/26/2021 – 15:25

via ZeroHedge News https://ift.tt/3w0n5qx Tyler Durden