Key Events This Very Busy Week: CPI, Retail Sales And Q1 Earnings Start

Looking at the busy week ahead, the pandemic will remain in focus as the new case count is still moving higher at the global level even if the US now appears to have left covid behind. In the week ending last Friday April 9, the numbers recorded by John Hopkins University showed a 4.45m increase in cases globally, which compares with increases of 4.11m, 3.78m and 3.29m in the 3 weeks before that, so as Deutsche Bank notes, we’ve seen an acceleration in the past month, although the rate of increase is still shy of the peaks in December and January. Some countries have been hit particularly badly by the latest wave, with India seeing another record 152,879 cases on Saturday. Japan is another that’s seen some sharp rises lately, and the governor of Osaka prefecture said over the weekend that he could request a state of emergency be declared if the latest measures weren’t enough to stem the virus.

Over in Europe, there’s been more positive news in recent days, since the latest numbers from the biggest countries (Germany, France and Italy) indicate that cases have now begun to fall from their peak, albeit still at elevated levels. Furthermore, there are signs of the market narrative turning as the pace of vaccinations are continuing to pick up in the region, with the Euro strengthening +1.19% against the US dollar last week, in its best of 2021 so far, while 5y5y forward inflation swaps for the Euro Area closed at 1.57% on Friday, a level not seen since the very start of 2019. On top of that, the UK reported fewer than 2,000 cases yesterday for the first time since early September, which comes as today marks a notable easing of restrictions in England, with the reopening of non-essential retail and outdoor hospitality venues. Finally in other vaccine news, Pfizer and BioNTech said on Friday that they’d requested their Emergency Use Authorization for their vaccine in the US be extended to 12-15 year olds, following trial results that showed the vaccine was 100% effective among this group.

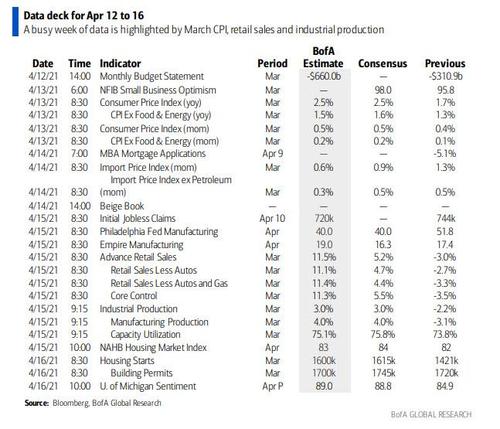

It’s a big week on the data side too, with a number of important releases out of the US set to offer more details on the strength of the recovery there. This comes against the backdrop of a very strong jobs report for March and an ISM services reading that was the highest since the series began back in 1997.

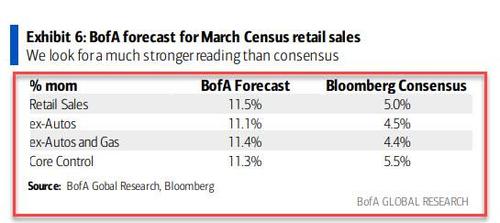

This week’s highlight will be the CPI report on Tuesday, as market participants have focused on the potential for a sharp rise in the reading over the months ahead. DB’s economists expect a blistering +0.48% month-on-month increase in the headline CPI, along with some strong releases elsewhere as well, with a projected +8.9% increase in retail sales for March thanks to the latest round of stimulus checks and payback from bad weather in February. As a reminder, BofA’s economists expect an even more blowout retail sales print, one in the 11%+ range.

The other big data release this week will come from China, where they’re releasing their Q1 GDP number on Friday. DB economists expect a surge in growth to +21.3% year-on-year, up from +6.5% in Q4, as the comparison will now be against the quarter when the pandemic first impacted the Chinese economy.

On the central bank side, we’ll have to wait until next week before the latest round of policy decisions, with the ECB announcing a week on Thursday, before the Fed and the Bank of Japan follow the week after that. Nevertheless, this week is the last chance various Fed speakers will have to offer their thoughts before their blackout period begins on Saturday, and markets will be looking out for Fed Chair Powell on Wednesday, who’s giving an interview at the Economic Club of Washington, as well as from Vice Chair Clarida later that day, who’s giving a speech on the Fed’s new framework and outcome-based forward guidance. In terms of what to expect, our US economists are expecting them to reiterate their familiar inflation mantra, in that they’ll look through the upcoming sharp rise in the year-on-year growth rate of consumer price measures, along with the “transitory” spikes caused by temporary supply-demand imbalances as the economy reopens.

It will be a busy week for US Treasury issuance, with the US auction cycle starting today with $58BN in 3-year notes auctioned off at 11:30am ET, followed by $38BN 10-year reopening at 1pm also today; It concludes with $24b 30-year reopening Tuesday.

Elsewhere, the latest earnings season will kick into gear over the week ahead, with the highlights including a number of US financials. In their preview of the Q1 season, our asset allocation team write that they see S&P 500 earnings coming in 7.5% above consensus, which although lower than the last 3 quarters, would still be well above the historical average (+4%). Looking at the biggest names releasing this week, they include JPMorgan Chase, Wells Fargo, Goldman Sachs and Tesco on Wednesday. Then on Thursday we’ll hear from UnitedHealth Group, Bank of America, PepsiCo, Citigroup, Charles Schwab, BlackRock and Delta Air Lines. And on Friday, releases will include Morgan Stanley and BNY Mellon.

A quick recap of the key daily events in the coming week courtesy of Deutsche Bank

Monday April 12

- Data: Japan March PPI, preliminary March machine tool orders, Euro Area February retail sales, US March monthly budget statement

- Central Banks: BoE’s Tenreyro speaks

Tuesday April 13

- Data: UK February GDP, Italy February industrial production, Germany April ZEW survey, US March CPI, NFIB small business optimism index, China March trade balance

- Central Banks: Fed’s Harker, Daly, Mester, Bostic and Rosengren speak

Wednesday April 14

- Data: Japan February core machine orders, Euro Area February industrial production, US March import price index

- Central Banks: Federal Reserve releases Beige Book, remarks from Fed Chair Powell, Vice Chair Clarida and Fed’s Williams and Bostic, ECB Vice President de Guindos and ECB’s Panetta and Schnabel, and BoE’s Haskel

- Earnings: JPMorgan Chase, Wells Fargo, Goldman Sachs, Tesco

Thursday April 15

- Data: Final March CPI from Germany, France and Italy, US weekly initial jobless claims, March retail sales, industrial production, capacity utilisation, April Empire State manufacturing survey, Philadelphia Fed business outlook, NAHB housing market index

- Central Banks: Monetary policy decisions from the Bank of Korea and the Central Bank of Turkey, Fed Vice Chair Clairda, Fed’s Bostic, Daly and Mester speak

- Earnings: UnitedHealth Group, Bank of America, PepsiCo, Citigroup, Charles Schwab, BlackRock, Delta Air Lines

Friday April 16

- Data: China Q1 GDP, March industrial production, retail sales, EU27 March new car registrations, Euro Area February trade balance, final March CPI, US March housing starts, building permits, preliminary April University of Michigan consumer sentiment index

- Central Banks:BoE Deputy Governor Cunliffe speaks

* * *

Finally, as Goldman summarizes, the key economic data releases this week are the CPI report on Tuesday and the retail sales and Philadelphia Fed manufacturing reports on Thursday. There are several speaking engagements from Fed officials this week, including speeches from Powell, Clarida, and Williams on Wednesday.

Monday, April 12

- There are no major economic data releases scheduled.

Tuesday, April 13

- 06:00 AM NFIB small business optimism, March (consensus 98.0, last 95.8)

- 08:30 AM CPI (mom), March (GS +0.61%, consensus +0.5%, last +0.4%); Core CPI (mom), March (GS +0.26%, consensus +0.2%, last +0.1%); CPI (yoy), March (GS +2.63%, consensus +2.5%, last +1.7%); Core CPI (yoy), March (GS +1.57%, consensus +1.5%, last +1.3%): We estimate a 0.26% increase in March core CPI (mom sa), which would boost the year-on-year rate by three tenths to 1.6% on a rounded basis. Our monthly core inflation forecast reflects a reopening-driven rebound in airfares, hotel prices, and recreation prices. We also expect ARP Act stimulus payments and supply chain disruptions to boost core goods inflation in this week’s report, including for new and used cars, furniture, and apparel (despite negative residual seasonality in the apparel category). We estimate housing rent categories rose at a firm pace (we estimate rent and OER increases of 20-25 basis points), reflecting stabilization in our shelter tracker and the reversal of rent forgiveness effects. On the negative side, we believe college aid in the ARP Act could weigh on education CPI, and we note the possibility of normalizing alcohol prices in the wake of bars reopening. We estimate a 0.61% increase in headline CPI (mom sa), due to higher oil prices.

- 12:00 PM Philadelphia Fed President Harker (FOMC non-voter) speaks: Philadelphia Fed President Patrick Harker will discuss the economic outlook at a virtual event hosted by the Delaware State Chamber of Commerce. Prepared text and audience Q&A are expected.

- 12:00 PM San Francisco Fed President Daly (FOMC voter) speaks: San Francisco Fed President Mary Daly will participate in a Fed event on racism and the economy.

- 04:00 PM Cleveland Fed President Mester (FOMC non-voter), Atlanta Fed President Bostic (FOMC voter), and Boston Fed President Rosengren (FOMC non-voter) speak: Cleveland Fed President Loretta Mester, Atlanta Fed President Raphael Bostic, and Boston Fed President Eric Rosengren will take part in a virtual discussion on racism and the economy.

Wednesday, April 14

- 08:30 AM Import price index, March (consensus +1.0%, last +1.3%)

- 12:00 PM Fed Chair Powell (FOMC voter) speaks: Fed Chair Jerome Powell will participate in a virtual discussion at the Economic Club of Washington. Moderated Q&A is expected.

- 02:00 PM Beige Book, April FOMC meeting period: The Fed’s Beige Book is a summary of regional economic anecdotes from the 12 Federal Reserve districts. In the April Beige Book, we look for anecdotes related to growth, labor markets, wages, price inflation, and the economic impacts of the ongoing coronavirus outbreak.

- 02:30 PM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will participate in a virtual discussion hosted by Rutgers Finance Society. Moderated Q&A is expected.

- 03:45 PM Fed Vice Chair Clarida (FOMC voter) speaks: Fed Vice Chair Richard Clarida will discuss the Fed’s new policy framework at the Shadow Open Market Committee meeting.

- 04:00 PM Atlanta Fed President Bostic (FOMC voter) speaks: Atlanta Fed President Raphael Bostic will participate in a virtual discussion on cities and systemic racism. Audience Q&A is expected.

Thursday, April 15

- 08:30 AM Initial jobless claims, week ended April 10 (GS 700k, consensus 700k, last 744k); Continuing jobless claims, week ended April 3 (consensus 3,700k, last 3,734k); We estimate initial jobless claims decreased to 700k in the week ended April 10.

- 08:30 AM Retail sales, March (GS +9.0%, consensus +5.5%, last -3.0%); Retail sales ex-auto, March (GS +9.0%, consensus +4.8%, last -2.7%); Retail sales ex-auto & gas, March (GS +9.0%, consensus +6.5%, last -3.3%); Core retail sales, March (GS +8.0%, consensus +7.0%, last -3.5%): We estimate that core retail sales (ex-autos, gasoline, and building materials) jumped by 8.0% in March (mom sa). High-frequency data suggest a very sharp rebound in retail goods spending from the winter storm-depressed February levels, and the intra-month spending pattern is consistent with a stimulus-driven spending surge. We believe the reopening of the economy shifted spending towards restaurants from grocers, which would create a positive wedge between the higher-level aggregates and retail control in this week’s reading. We estimate a 9.0% rise in the ex-auto ex-gas category. We also estimate a 9.0% rise in both the headline and ex-auto measures, due to large increases in gasoline prices and auto sales.

- 08:30 AM Philadelphia Fed manufacturing index, April (GS 45.0, consensus 40.0, last 51.8): We estimate that the Philadelphia Fed manufacturing index declined by 6.8pt to 45.0 in April, after rising to the highest level since 1973 in March.

- 08:30 AM Empire State manufacturing survey, April (consensus +18.0, last +17.4)

- 09:15 AM Industrial production, March (GS +2.5%, consensus +2.7%, last -2.2%); Manufacturing production, March (GS +3.7%, consensus +4.0%, last -3.1%); Capacity utilization, March (GS 75.3%, consensus 75.6%, last 73.8%): We estimate industrial production rose by 2.5% in March, reflecting a rebound following winter storm-related weakness in February. We expect mining and manufacturing production to rebound while the utilities category likely retrenched following a large increase in February.

- 10:00 AM Business inventories, February (consensus +0.5%, last +0.3%)

- 10:00 AM NAHB housing market index, April (consensus 84, last 82)

- 11:30 AM Atlanta Fed President Bostic (FOMC voter) speaks; Atlanta Fed President Raphael Bostic will participate in a virtual discussion on economic inequality.

- 02:00 PM San Francisco Fed President Daly (FOMC voter) speaks: San Francisco Fed President Mary Daly will give a speech on financial stability and monetary policy. Prepared text and audience Q&A are expected.

- 04:00 PM Cleveland Fed President Mester (FOMC non-voter) speaks: Cleveland Fed President Loretta Mester will discuss economic inclusion at an event hosted by Swarthmore College. Prepared text and audience Q&A are expected.

Friday, April 16

- 08:30 AM Housing starts, March (GS +13.5%, consensus +12.7%, last -10.3%); Building permits, March (consensus +1.7%, last -8.8%): We estimate housing starts increased by 13.5% in March. Our forecast incorporates higher permits and a sizeable rebound following delays in starts in February due to winter storms.

- 10:00 AM University of Michigan consumer sentiment, April preliminary (GS 90.0, consensus 89.0, last 84.9): We expect the University of Michigan consumer sentiment index to increase by 5.1pt to 90.0 in the preliminary April reading.

Source: BofA, DB, Goldman

Tyler Durden

Mon, 04/12/2021 – 09:44

via ZeroHedge News https://ift.tt/3s8Vn7J Tyler Durden