JPMorgan Launches Exotic ‘Whale-Watching’ Product For Wealthy Clients

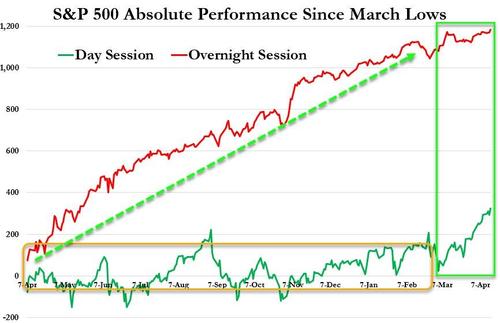

US equity markets have become increasingly driven by technicals, not fundamentals… the flow of the central bank spigots (and the concomitant flow from pension funds and asset managers), various quantitative models and levels (gamma-squeezes, short-squeezes), and traditional ‘techical analysis’ (moving averages, overbought levels). Additionally, there have been numerous ‘seasonal’ patterns that, despite being increasingly well-known, have continued to ‘work’. These include the shockingly dramatic outperformance of the US equity market when it is closed versus when it is open…

Another, shorter time frame signal can be garnered from the opening- and closing-ranges in stocks – the time when so-called ‘Smart Money’ is moving in and out of the market…

Given the rise in popularity of these – and other factors – JPMorgan Chase plans to offer its wealthy clients access to a stock strategy typically limited to institutional managers, offering them a chance to ride the wave created by a massive inflow of investors.

As Bloomberg reports, the New York-based bank has issued $15 million of structured notes that give investors a way to surf S&P 500 trading patterns caused by market whales including options dealers and pension funds (as their trading, rebalancing, and hedging activity are all giving rise to seasonal cycles and momentum trends).

The notes, which carry maturities of up to five years, track the performance of the bank’s Kronos+ index that launched in December 2020. The index reportedly captures the S&P 500’s tendency to outperform at the start and the end of each month, and to maintain its momentum going into monthly options expiry dates.

Source: Bloomberg

In fact, since its launch in December, Kronos+ has handily outperformed the S&P 500, with some notable inflections around the option-expirations and month-, quarter-ends…

Source: Bloomberg

Being among the always-skeptical-of-a-bank-selling-you-a-profitable-strategy crowd, we do wonder if, like all investing styles borne out from backtests – especially ones based on a decade of endless liquidity provisions – it may ultimately struggle for traction in the real world. While trades designed to follow systematic trading flows “can provide an attractive source of tail risk protection,” according to Matthew Yeates, head of alternative and quantitative strategy at Seven Investment Management, we can’t help but wonder if these so-called ‘smart strategies’ that look so good on paper can misfire thanks to trading costs, sudden liquidity vacuums, and market reversals.

Tyler Durden

Fri, 04/16/2021 – 12:04

via ZeroHedge News https://ift.tt/3gh4HUX Tyler Durden