Huarong Bonds Tumble Again As Fresh Debt Restructuring Rumor Surfaces

One week after the dollar bonds of China Huarong Asset Management tumbled in what some called a “fatal event” amid swirling rumors that Beijing would let its iconic bad-debt asset manager default (over, well, bad-debt) which sparked contagion across the entire Chinese USD-bond sector and was followed by urgent reassurance from official and unofficial sources that Huarong would get some financial backing, on Tuesday Huarong dollar bonds sank again after Reorg Research poked the festering wound and reported that regulators are considering options for the company that include restructuring the debt of its offshore unit.

According to the report which cited people familiar with the matter, one of several options under discussion was a debt restructuring, although a decision is far from finalized. Furthermore, it was unclear how the report said anything the market didn’t already know one week ago and which Beijing scrambled to offset in the subsequent days.

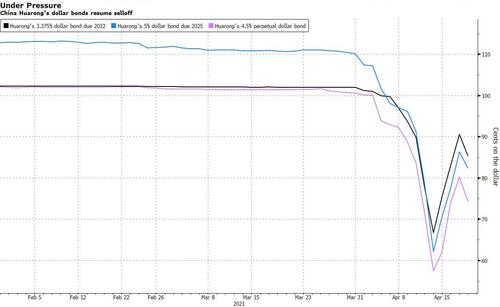

In any case, a reminder that not all is well is all the jittery market needs to send the company’s 5.5% bonds maturing in 2025 down 9.4 cents to 78 cents on the dollar while the company’s 4.5% perpetual note slumped 6.6 cents to 72.4 cents, according to Bloomberg. Almost all of Huarong’s $22 billion in dollar bonds are issued or guaranteed by China Huarong International Holdings Ltd., the offshore unit.

Today’s drop followed a 3-day rally in the firm’s dollar bonds that accelerated Friday after China’s financial regulator said that the bad-debt manager was operating normally and had ample liquidity. The statement, made after a regular briefing in Beijing, were the first official comments since the company jolted Asian credit markets by missing a deadline to report preliminary earnings on March 31.

“There’s very little clarity from China Huarong and regulators over the fate of offshore investors so the bonds are still vulnerable to big swings,” said Owen Gallimore, head of credit strategy at Australia & New Zealand Banking Group in Singapore, quoted by Bloomberg.

One week ago, Gallimore said that “Huarong is a $22 billion curve and as a distressed situation it dwarfs anything that we have seen in the Asia credit market before” adding that “this is a fatal event for a few trading desks and small funds.”

A potential restructuring or default for China Huarong which is funded by $22 billions in dollar denominated debt in addition to tens of billions in local debt, in would be the nation’s most consequential since the late 1990s. Any signs that Beijing is rethinking its support for a central, state-owned firm like China Huarong would have deep repercussions for the broader dollar bond market. The company is majority owned by China’s Ministry of Finance and is deeply intertwined with the nation’s $54 trillion financial industry.

Tyler Durden

Tue, 04/20/2021 – 12:10

via ZeroHedge News https://ift.tt/32CIPLv Tyler Durden