Netflix Implodes After Huge Subscriber Miss, Dismal Guidance

Recent earnings reports from streaming giant Netflix have been a mixed bag: the stock tumbled three quarters ago when the company reported earnings for its first full “post Corona” quarter and warned that “growth is slowing”, before agaon plunging two quarters ago when the company reported a huge miss in both EPS and new subs, which at 2.2 million was tied for the worst quarter in the past five years, while also reporting a worse than expected outlook for the current quarter. This reversed last quarter when Netflix reported a blowout subscriber beat number and projected it would soon be cash flow positive, sending its stock soaring to an all time high – if only briefly before again reversing – which brings us to today, when investors are on edge today to find out not whether the company would beat or miss expectations, but rather if Netflix, remains a pandemic-proof company and if the slowdown Reed Hastings warned about is for real and has pulled forward even more subscribers due to covid? After all, Netflix has been warning for months that growth would slow in early 2021 compared to the phenomenal signup rate at the start of the pandemic lockdown last year. And yes, brace for a huge base effect hit: in the first quarter of 2020, the service added 15.8 million new customers, the most in its history, a number which is unlikely to be repeated ever again.

To be sure, despite a series of mediocre earnings, the company has been riding a wave of optimism, its stock soaring in early 2020, putting it in the top 20 for S&P 500 companies, similar to the gains seen by other shutdown beneficiaries Amazon.com and Ebay. Still, after surging to a record high in early July, the stock has traded rangbeound, unable to break out to a new high, for the past 10 months. And while there’s no doubt that viewership has surged during the Covid-19 lockdowns in the U.S. and much of the world, there are complications: the virus has brought TV and film production to a halt, a situation that may only get more dire for Netflix as the months wear on. But the biggest question remains how many future subs has covid brought to the present?

Indicatively, consensus expects 6.29 million new subs this quarter, higher than the company’s own guidance of 6 million, and a notable slowdown from the traditionally strong fourth quarter when NFLX added a whopping 8.51 million new subs. Revenue is expected to come in at $7.14BN, up from $6.64BN in Q4, and resulting in EPS of $2.98, up sharply from $1.19 last quarter. This is as streaming video remains on a hot streak since the pandemic struck. Something else to watch: Netflix bears will get added ammunition if Q2 guidance misses consensus for 7.39 million new users.

Previewing the quarterly result, Bloomberg analyst Doug Zehr writes that “after a blockbuster 2020, Netflix has been bracing for its toughest test yet in 1Q21, given comparisons to a record quarter a year ago when it posted nearly 16 million subscriber gains. The company should be able to deliver on 1Q guidance for 6 million additions given that most re-openings happened only in the latter half of the quarter.”

Media analyst Rich Greenfield listed several questions that he thinks investors should ask Netflix’s management, among them: why Netflix paid such a high price for the rights to future Sony movies and whether those films will come to Netflix in a shorter window than “Pay 1” films have historically.

Another thing to watch out for is how a slowdown in production last year is affecting the service. The filming of new shows and movies basically came to a standstill in early 2020, which curbed output in the following months.

* * *

So with all that in mind, was Q1 the quarter that would finally unleash another repricing higher for Netflix stock? Alas, not this time because despite a solid beat in revenue and EPS, Netflix reported absolutely dismal subscriber numbers.

First, the good news, a beat on the top and bottom line:

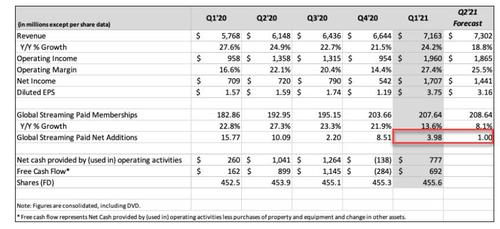

- Netflix 1Q Rev. $7.16B, Est. $7.14B

- Netflix 1Q EPS $3.75, Est. $2.98

And then the absolutely dismal news:

- Netflix 1Q Streaming Paid Net Change +3.98M, Est. +6.29M

- Netflix Sees 2Q Streaming Paid Net Change +1.00M, Est. +4.44M

Here is the full ugly breakdown:

The stock, which has a 1.4% Nasdaq weighting is crashing after hours, down as much as 10% to $480 and last trading just around $492.

Developing

Tyler Durden

Tue, 04/20/2021 – 16:07

via ZeroHedge News https://ift.tt/3vcubXX Tyler Durden