Clocks Ticking On Colonial Pipeline Restart: “After 72 Hours… It Gets Really Tough”

While cyber-attacks have disrupted the operations of other energy assets in the U.S. in recent years. this weekend’s theft of Colonial’s data, coupled with the detonation of ransomware on the company’s computers, is by far the largest and most impactful.

As we detailed earlier, the hackers who caused Colonial Pipeline to shut down the biggest U.S. gasoline pipeline on Friday began their blitz against the company a day earlier, stealing a large amount of data before locking computers with ransomware and demanding payment, according to people familiar with the matter.

Bloomberg reports that the intruders are part of a cybercrime gang called DarkSide, took nearly 100 gigabytes of data out of the Alpharetta, Georgia-based company’s network in just two hours on Thursday, two people involved in Colonial’s investigation said.

Aside from the inevitable sabre-rattling ‘blame Russia’ policy prescriptions that are likely imminent, the biggest concern for the ‘average joe’ American is – what will this do to gas prices?

“Restarting the pipeline is easy if no actual damage was done to it,” said McNally, who now runs Rapidan Energy Group, a consulting firm in Washington.

“The question is whether the attack was limited and contained and it didn’t cause any physical damage to it.”

But others are less sanguine.

The attack was on “the brains of the system,” according to Niyo Pearson, an oil and gas adviser for Cynalytica, a cybersecurity firm. “It controls the settings on the pipeline, what the pressure is, remote operation of valves,”

And that means, as Bloomberg reports, trying to restart the flow of gasoline without that capability would require Colonial to send people to various facilities along the length of the pipeline, and the expertise needed to operate under those conditions is limited, he said.

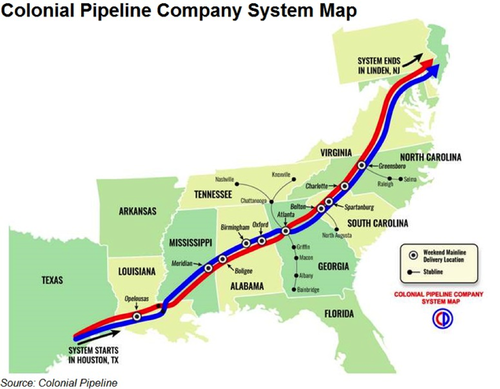

A key concern at present is meeting product demand in the U.S. Southeast, which is especially dependent on the Colonial system, people familiar with the situation said. The Northeast can secure gasoline shipments from Europe, they said, but it will come at an increasing cost the longer the pipeline stays shut.

“The longer it lasts, the more bullish it will be for refined products on the East Coast,” said Warren Patterson, head of commodities strategy at ING Groep NV.

“This will likely also drag European product prices higher, as we see more waterborne cargoes needing to go into the U.S. East Coast to meet the shortfall.”

In the meantime, Bloomberg reports that fuel producers including Marathon Petroleum Corp. are weighing alternatives for how to ship their products to the Northeast in case Colonial isn’t restored quickly. Traders and fuel shippers are seeking barges and other vessels to deliver gasoline that would have otherwise been shipped on the pipeline, according to people familiar with the matter. Others are securing tankers to temporarily store gasoline in the U.S. Gulf in the event of a prolonged shutdown, the people said.

“The Colonial outage comes at a critical juncture for the recovering U.S. economy: the start of the summer driving season,” ClearView Energy Partners said.

“We therefore think lawmakers could begin a ‘blame game’ immediately, and a sustained disruption that leads to a significant pump price spike could increase prospects of domestic policy interventions.”

The clock is ticking… “If they can restore their systems in 72 hours — or even a week — they’ll be in good shape,” Cynalytica’s Pearson said. “It gets really tough after that.”

Tyler Durden

Sun, 05/09/2021 – 13:40

via ZeroHedge News https://ift.tt/3tsrobP Tyler Durden