Trannies, Traps, & Trouble Ahead

Authored by Sven Henrich via NorthmanTrader.com,

Following up on The Trap which suggested recent market strength may turn into a bull trap.

Last week again we saw the tiniest dip in markets instantly reverted and markets again closed at the weekly highs on Friday, near all time highs as a matter of fact. Indeed, the historical backtest scenarios outlined in The Trap permit for marginal new highs. And in keeping with observing the set up develop we can note that during this renewed run higher last week we saw something we haven’t seen since the last major top.

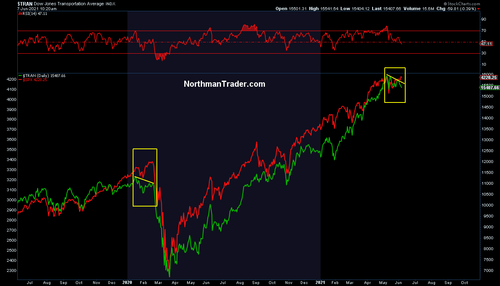

Transports diverged in a fairly pronounced fashion and we’re seeing this divergence again this morning:

As you may recall transports didn’t buy the finally rally in early 2020 either.

It’s a warning signal we’ve seen repeated throughout the years: 2007 and 2015 come to mind as transports suddenly refused to make new highs while the broader market still made new highs before getting clocked.

The context here of course being more extreme than ever on many historic measures.

Take Morgan Stanley’s market timing indicator:

It’s different this time.

It better be, or else. pic.twitter.com/zDkbRsJntt— Sven Henrich (@NorthmanTrader) June 6, 2021

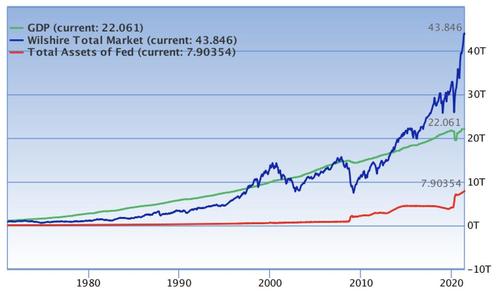

..while markets remain the most disconnected from the economy ever at 200% market cap to GDP:

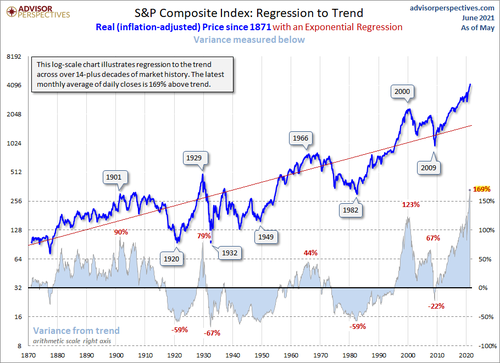

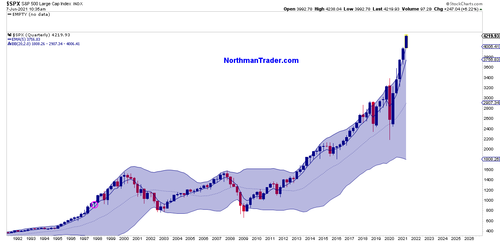

With a historic regression analysis showing markets being also the most disconnected from their long term trend ever making even the 2000 bubble look like child’s play in comparison:

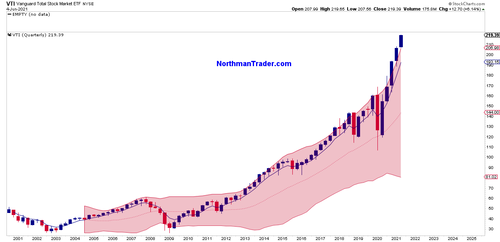

The end result: $VTI, the all market ETF, is entirely outside its upper quarterly Bollinger band, another “never seen before” market event:

Whether the sudden divergence in transports is another key warning signal will only be known in hindsight. However this market remains historically way overdue for a larger correction if only to reconnect with some of its basic moving averages. A correction back to the quarterly 5 EMA for example would just represent basic normal historic market functioning.

In this market just a reconnect with the upper quarterly Bollinger band however may be viewed as a life time buying opportunity. We shall see, but the good news for bulls may be that transports, as much as they may be giving a warning signal on the daily chart, on the monthly chart we can observe that in recent history larger tops have come on monthly divergences, and none is visible as of yet:

But even this chart does not preclude a steep correction first before the a final high yet to come months following a larger correction.

First things first. This market remains uncorrected still, and it also remains the most valued, extended and above trend and disconnected from the economy ever. And that may make it also the most dangerous market ever. At least this is what all of history suggests, including the monthly transport chart above. Radically ascending markets in steep trends with little corrective activity relying on vast technical disconnects to no longer be relevant tend to realize that things can change quickly. Watch the transports. If they can regain strength and make new highs the divergence may disappear, but if it doesn’t The Trap may still snap shut.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

Tyler Durden

Mon, 06/07/2021 – 14:05

via ZeroHedge News https://ift.tt/3g02U61 Tyler Durden