“This Is Strange”: Goldman’s Risk Appetite Indicator Crashes Just As Stocks Explode To Record High

Something strange is going on in the market: after a brief but sharp 3.5% 3-day selloff into Monday, stocks have erupted higher on a frenzy of short covering (even if institutional buying is strangely absent). What we find more surprising is that whereas in the past, the largest US banks would be generously encouraging US retail investors to pile into sto(n)ks, this time we are seeing the opposite as both Goldman and Morgan Stanley are warning that we are months if not weeks away from (at least) a 10% correction. But what is most surprising of all, is that it’s not just a “one and done” bearish slam from the likes of Goldman – the bank has been publishing a stock market hitpiece virtually every day, similar to what JPM has been doing to bitcoin for the past six months.

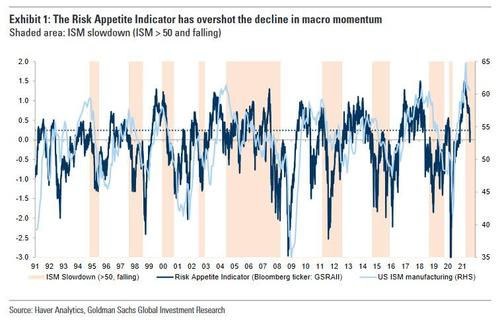

Take the latest Global Markets Daily note from Goldman’s closely followed head of global market strategy, Christian Mueller-Glissman who today writes that Goldman’s Risk Appetite Indicator (RAI) – which just a few weeks ago hit an all time high – has tumbled since mid-June as markets have moved from ‘Reflation Moderation’ to ‘Reflation Capitulation’ – and is now back below zero and at levels from before the US elections. According to the Goldman strategist, the current RAI level is consistent with an ISM manufacturing index in the low 50s – in other words, markets seem to anticipate a sharp slowdown of growth in the second half.

According to the Goldman strategist, the decline in the RAI has been “one of the sharpest on record, which is unusual from elevated, positive levels.” He goes on to note that “normally, such large declines in the RAI occur during sharp ‘risk off’ episodes, when macro momentum and the RAI are already negative – during such episodes it is quite common for investor sentiment to overshoot to the downside relative to macro fundamentals.”

Which is why even Mueller-Glissman has to concede that the current plunge is strange because until the recent correction and VIX spike, the S&P 500 and stocks in general had broadly performed well and volatility was low. They have performed even better since then.

In any case, according to Goldman, drivers behind the spectacular plunge have included “more mixed macro data, especially in China, fears on Fed tightening and a potential policy error, fading US fiscal support and rising concerns related to COVID-19, and in particular the Delta variant.”

So how does one make sense of the plunge? Goldman explains that “when the RAI declines from its peak levels it was usually a gradual process, and while procyclical rotations across and within assets were often less consistent, equities tended to deliver positive albeit lower returns (led by earnings growth rather than valuation expansion). In those instances markets became more range-bound and often volatility was relatively anchored – in fact, there were even low vol regimes in a number of instances during the last cycle, such as in 2014 and 2017.”

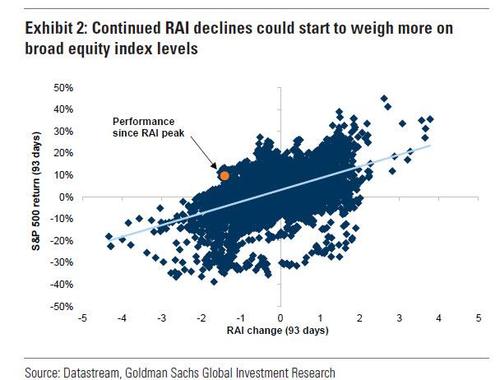

Fast forward to today when up until the recent correction, the S&P 500 had made new all-time highs with relatively low volatility despite a falling RAI. But this week the VIX had started to pick up (if only briefly), fueling concerns about rising equity drawdown risk. Considering the large decline in the RAI, Goldman notes that the S&P 500 has performed much better than expected (Exhibit 2).

This, according to the vampire squid, has been due to the boost from lower bond yields for large cap, long duration secular growth stocks, which has supported the broad index-level. In other words, without the generals, stocks woulc rash.

Goldman also picks up on what Morgan Stanley warned about yesterday, namely the market’s abysmal breadth, noting that “the breadth in US equity markets has been relatively low: the Russell 2000 was down 9% peak-to-trough.”

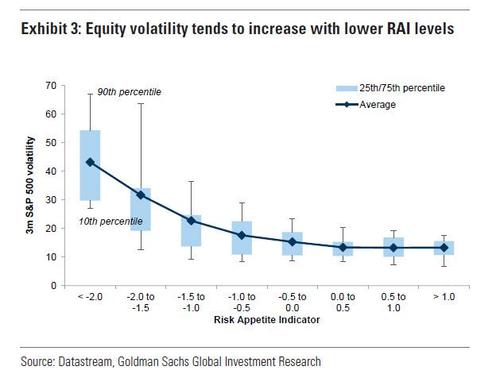

So what next? Well, with relative valuations for growth vs. value nearing all-time highs and less of a buffer from bond yields, Goldman warns that drawdown risk for equities broadly could increase in the event of a continued decline in risk appetite. And to underscore this point, Mueller-Glissman warns that “historically, equity volatility has picked up once the RAI has fallen below zero.”

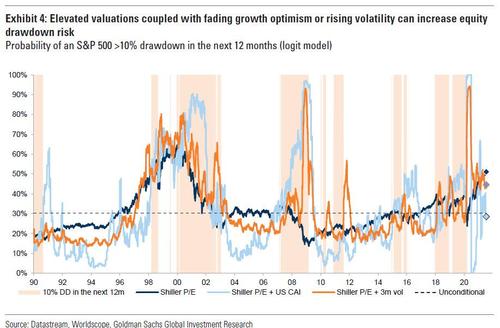

There is more to Goldman’s bearish bias, with the bank next warning that elevated equity valuations coupled with a worsening macro backdrop tend to increase equity drawdown risk, and adding that there is a “somewhat elevated” risk of a 10% drawdown. Here’s more:

While valuations alone are not a good signal for market timing, combining them with information about the macro backdrop helps assess equity drawdown risk better. One way to combine the signals is a logit model that relates the risk of a 10% S&P 500 drawdown over the next 12 months to levels of Shiller P/E and growth or realised volatility as an indicator of the macro backdrop (Exhibit 4). Currently, a purely valuation-based signal indicates somewhat elevated risk of a 10% drawdown, which is not surprising with equity valuations nearing Tech Bubble levels. However, adding the US Current Activity Indicator as a proxy for growth, which remains very strong, still suggests an average probability. Also, up until recently lower volatility helped reduce equity drawdown risk despite high equity valuations.

But as Goldman notes, markets are, of course, forward-looking, and with the RAI discounting a sharp growth slowdown there is potential for more volatility: “Not every large S&P 500 drawdown was driven by the US business cycle alone – rate shocks linked to monetary policy or global growth shocks have often led to larger corrections (e.g., the Asian Financial Crisis/Russian Default/LTCM in 1998, or the Euro area sovereign crisis in 2011).” So as markets assess risks to the cycle and the pace of the slowdown in 2H, Mueller-Glissman warns that the potential for more volatility spikes remains and elevated equity valuations increase the risk of deeper drawdowns.

The bottom line:

With several positioning and sentiment indicators still somewhat bullish and multi-asset portfolios unlikely to benefit from much of a buffer from bonds from here, the vulnerability to volatility spikes remains elevated.

If that wasn’t enough, the Goldman strategist also notes that “there are risks for the current growth pessimism to linger near term without clear catalysts for a pro-cyclical turn, especially with ongoing COVID-19 concerns.”

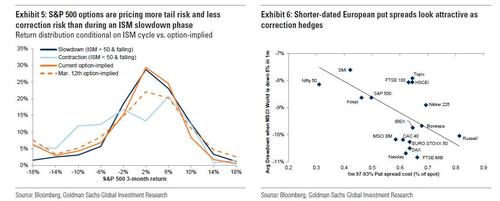

As a result, Goldman’s advice to investors is to look at equity correction hedges or ways to reduce equity risk in the near term. Option markets are already pricing higher equity drawdown risk than normal during an ISM slowdown phase, with particularly large left tails (Exhibit 5) – S&P 500 put skew and other convexity risk premia in equities are at a multi-decades highs, reflecting investor concerns about sharp and large drawdowns (although perversely, by hedging for this risk, the probability of a market crash drops substantially as it eliminates the risk of forced selling). Since the GFC,vol of vol has increased steadily with the sharp COVID-19 drawdown adding to this trend. Also, the likelihood of smaller equity corrections has been repriced lower. Back in March, when the RAI reached a peak, option markets were pricing higher right tail risks, and a higher probability of small corrections. We continue to like shorter-dated put spreads which, with elevated skew, can offer cheaper correction hedges – they look particularly attractive in Europe and EM (Exhibit 6).

Tyler Durden

Fri, 07/23/2021 – 15:15

via ZeroHedge News https://ift.tt/3kOzvyB Tyler Durden