Top Shipper Warns Commodity Freight Rates About “To Go Parabolic”

Similar to container rates, dry bulk shipping rates are poised to move higher on limited vessel capacity and robust demand, according to Genco Shipping President and CEO John Wobensmith, who spoke with Bloomberg.

“I think rates can go higher from here,” Wobensmith said. “You do get to a point, and you’ve seen this in containers, where you hit a certain utilization rate, and you start to go parabolic on rates. I think we’re getting close to that period.”

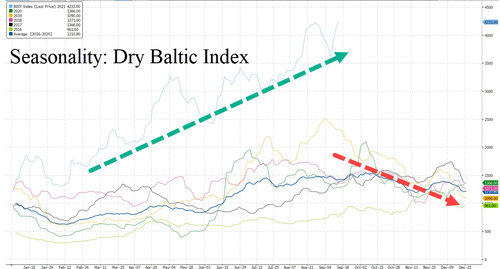

He said, “fundamentally, you’ve got demand outstripping supply growth,” adding that freight agreements are above $20,000 for 1Q, a level not seen seasonally in a decade.

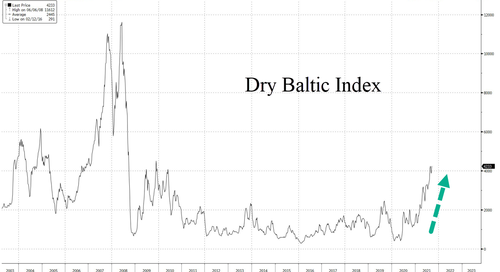

More than 5 billion tons of commodities, such as coal, steel, and grain, are shipped worldwide in bulk carriers in a given year. A move higher in the Baltic Dry Index (BDI) indicates increasing commodity demand on top shipping lanes.

Lending credit to Wobensmith’s argument is BDI on a seasonal basis that shows demand is currently outpacing vessel supply and pressuring rates higher.

He doesn’t expect bulk carrier rates to experience a significant reversal until early next year as demand troughs seasonally. “You need very little demand growth to just continue to build off what we’ve seen this year,” he said. “It’s more about higher highs and higher lows than anything else.”

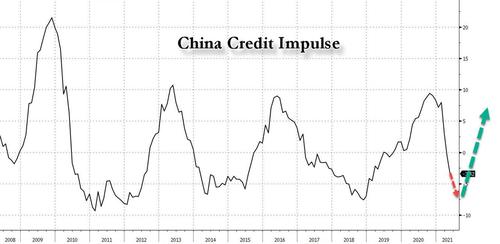

China’s credit impulse needs to turn higher for the commodity boom and bulk carrier rates to stay elevated.

Besides China, passage of a US infrastructure bill could be the fiscal injection that could also spark higher commodity prices, thus continue driving bulk carrier rates higher.

All of this is feeding into inflation that the Federal Reserve convinces everyone it’s only “transitory.”

Tyler Durden

Thu, 09/16/2021 – 16:50

via ZeroHedge News https://ift.tt/3EpD3i1 Tyler Durden