Jamie Dimon Warns JP Morgan Bracing For “Potentially Catastrophic” US Default Debt-Ceiling Battle Drags On

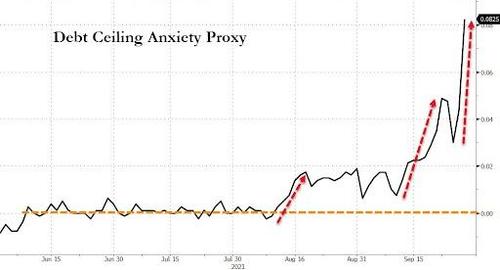

Now that Janet Yellen has confirmed Oct. 18 is the “drop dead” for Congress to lift the federal debt borrowing limit, progressives are pushing even harder against the Democratic leadership, which is stuck between appeasing the “Squad”, and moderates like Sens. Joe Manchin and Kyrsten Sinema. Markets are starting to get anxious as there’s no obvious path toward raising the debt limit and passing the Dems’ financial agenda.

So, with stocks in free-fall on Tuesday, JP Morgan CEO Jamie Dimon told Reuters that America’s biggest bank by assets has begun preparing for the possibility that the debt ceiling might not be lifted in time. Dimon said that while he ultimately expects politicians to find a solution, a “catastrophic event” like what Yellen described during her Senate testimony today could still be imminent.

Specifically, JPM has begun planning for a scenario for the US to default on its debt, and how this would impact repo and money markets, client contracts, the bank’s capital ratios while also trying to discern how ratings’ agencies might react.

“This is like the third time we’ve had to do this, it is a potentially catastrophic event,” he said. “Every single time this comes up, it gets fixed, but we should never even get this close. I just think this whole thing is mistaken and one day we should just have a bipartisan bill and get rid of the debt ceiling. It’s all politics,” Dimon added.

What Dimon is referencing are down-to-the-wire debt-ceiling battles in 2011 and 2017 under presidents Barack Obama and Donald Trump, respectively.

But while Dimon has seen this show before, many market participants are growing increasingly worried that this time, the US might actually default.

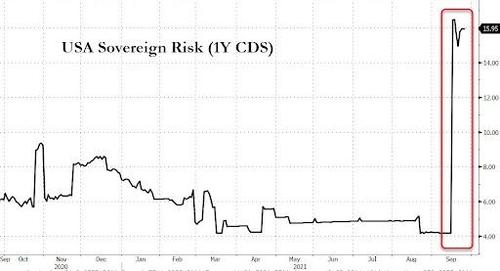

As far as the ratings agencies are concerned, markets are already pricing in higher credit risk for the US via short-term CDS, where insurance against a US default in September has skyrocketed.

A major part of this preparation involves the bank combining through its client contracts, which is a resource-intensive process that cost the bank $100 million “if I remember correctly,” Dimon said.

Dimon, who was speaking to Reuters ahead of a ribbon-cutting ceremony at a new Chase branch in southeast Washington DC, part of a promise made by Dimon in a letter to shareholders, where he outlined certain efforts to recruit more customers and employees from “under-served” communities. Per Reuters, the branch is the eleventh of its kind JPMorgan has opened since 2019 in cities including New York, Detroit, LA and Chicago. As well as providing traditional services, the branches will also work with local community groups to provide free skills training and other support for minority-owned small businesses.

“It’s not a traditional bank branch, we want it to be very welcoming, we want it to be attractive,” said Dimon.

Dimon also took a few minutes to criticize the Community Reinvestment Act, which requires regulators to “score” megabanks based on how well they accommodate “under-served” communities. Dimon said the law needs to be “modernized” to account for “technology-driven changes” to the banking business.

“It is very complicated, very slow, very late, very hard to measure,” Dimon said, adding that CRA assessments should be conducted in real time, as opposed to a retrospective review every few years. “Does it actually capture everything? No. Is it real time? No. Is it politicized? Absolutely.”

Biden’s acting Comptroller of the Currency Michael Hsu said earlier this month that’s he planning to dump changes to fair-lending laws that had been imposed by his Trump-appointed predecessor.

While Dimon used Tuesday’s interview to flex JPM’s ESG credentials, it’s too bad nobody asked him for his thoughts on other looming market risks, like the Evergrande situation. We’d also be curious to know how much JPM lost on the Didi IPO, where it served as one of the lead underwriters alongside Goldman and Morgan Stanley.

Tyler Durden

Tue, 09/28/2021 – 15:45

via ZeroHedge News https://ift.tt/3EY8dgX Tyler Durden