Oil Traders Will “Break The Fed” And “Make Jerome Powell Cry Uncle”

Submitted by QTR’s Fringe Finance

This is Part 2 of an interview with Harris Kupperman, founder of Praetorian Capital, a hedge fund focused on using macro trends to guide stock selection. Mr. Kupperman is also the chief adventurer at Adventures in Capitalism, a website that details his investments and travels.

Part 1 of this interview will be found here.

Harris is one of my favorite Twitter follows and I find his opinions – especially on macro and commodities – to be extremely resourceful. I’m certain my readers will find the same. I was excited to get the chance to ask him about anything I wanted, which I did last week.

Q; What one sector of the equities market would you dive into now if you had to pick only one – and why?

It’s not an equity, but if there was one asset to focus on, it would be long-dated OTM oil futures options. They’re the purest way to get long inflation and they’re mispriced compared to the potential upside. All sorts of right-tail assets seem mispriced, but the IV on oil futures options seem particularly mispriced as it is so cheap compared to the parabolic upside potential.

In terms of equities themselves, I think offshore oil services are about to really inflect.

With Brent at $86, demand for offshore production will come back in a major way. Especially because many Western governments are making it so painful to explore and produce oil domestically. As a result, the incremental supply will come from places that need the oil revenue—much of this will be offshore.

Meanwhile, much of this offshore equipment trades at tiny fractions of replacement cost. At the top of the cycle, these companies often trade for a few times replacement cost. I think we’re about to a surprising move in the price of oil, and these equities are the fulcrum security in the oil sector—but since most have restructured in bankruptcy, they have clean balance sheets and minimal risk if I’m wrong and the sector doesn’t inflect.

Oil is about to surprise people—offshore hasn’t moved yet. That’s where I’d be focusing my time, but buying the 2025, $100 strike oil call just seems like a more elegant way to play this with a lot less operational risk and a whole lot greater upside potential.

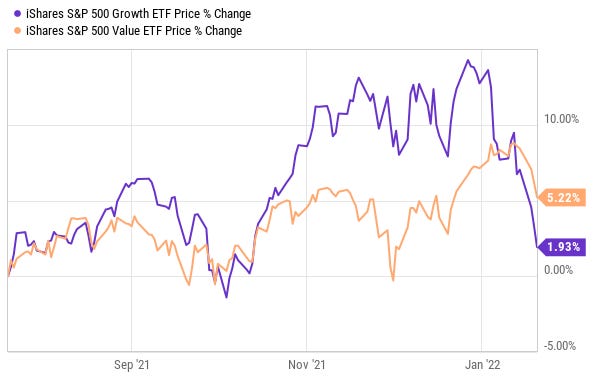

What’s your broader view on markets in 2022? Will they stabilize? Full on crash? Rotation from growth to value?

I think the market will have a lot of volatility, but sort of go nowhere. Instead, I expect a huge sector rotation from Ponzi and high-multiple growth to industrials and commodities.

A lot of these “old economy” businesses trade at low single-digit multiples on cash flow and fractions of replacement cost. They’ve been ignored for years, they’ve cut costs, consolidated and not invested much in capacity. We’re at the part of the cycle where they finally earn huge returns. That’s where you want to be.

Meanwhile, as the Fed raises rates and tightens liquidity, the high-multiple stuff will get bludgeoned. It’s amazing how many multi-billion market cap stocks are down 75% from the highs last year, yet they still seem ludicrously expensive. This will eventually get corrected and corrected with a lot more pain.

What fiat currencies do you prefer to own, assuming you have to own one? And why?

I think crypto has had its bubble. It now needs to consolidate. There’s far too much speculative interest for me. I sold out of my Bitcoin last spring for a 6x from where I bought it in 2020.

Longer term, I’m quite partial to Monero and own a few. It’s what everyone thinks Bitcoin is, while Bitcoin is actually something VERY different. The privacy aspect, along with negligible transaction costs will make Monero viable. It’s out of consensus, but adoption continues to accelerate. During the coming wash-out in risk assets, I intend to pick up some more Monero.

Is the Fed still firmly in control of the bond market. Is there any chance “bond vigilantes” take over at some point?

Oil traders are the new bond vigilantes. They’ll be the ones that break the Fed and force JPOW to cry uncle. The Fed hasn’t lost control yet, but when oil breaks $100, they’ll go into panic mode.

I worry that they’ll eventually crush everything with a CUSIP while trying to stop oil from going parabolic. Naturally, they’ll fail at this because they have little to do with the price of oil, but that won’t stop them from trying.

What’s one lesson you’ve learned in your investing career that you want to pass on and think is important in 2022?

Leverage is dangerous. We’re entering a much more volatile period. I think the overall market will continue going much higher because they’ll keep stimulating, but there will be periods where they panic and stop stimulating.

Equities can literally trade at any price. Make sure that on these sharp and steep pullbacks, you aren’t the one forced to sell at the lows. Instead, you want to be the one who buys when others get margin calls. Play with less leverage, keep extra liquidity and expect that there will be huge opportunities coming up.

What’s your outlook on how the world thinks about Covid in the coming year?

Covid is a bad cold that has evolved into a mental disorder. You really need to separate the two. Left alone, Covid the virus will evolve to be less dangerous to humans. Unfortunately, governments like to tinker and convince voters that they’re doing something useful. Vaccinating a huge percentage of the population, with multiple boosters, is likely to change how the virus would naturally evolve. We’re already seeing this with Omicron.

The triple vax’d are more susceptible than the double vax’d, and the unvax’d are almost immune to it. This is an adjusted evolutionary path and governments should be terrified of the data. This is a warning that is getting ignored. Most scientists have always known that vaccinating against a coronavirus is a mistake—it’s the reason that they don’t vaccinate livestock against coronaviruses.

They’ve already tried that and know it doesn’t work, with the added risk that the virus can evolve to be more dangerous. What we should have done is gone for herd immunity, protected the at-risk, and gotten on with life.

Unfortunately, Covid has evolved into this mental disorder where people walk around with cloth diapers on their faces and scrub their hands with alcohol all day. There’s this whole neurosis to it, with people lecturing others on if they’re going through the motions correctly.

Governments have been quick to realize that a large portion of the population is mentally unstable and easily manipulated. They’ve prayed upon this to gain power and tell these people that their mental disorder is now normal.

Eventually, most people will get bored of role-playing “pandemic,” and they’ll push back against government-created inconveniences. We’ll return to sanity, while a lunatic fringe will continue with their new neuroses. I finally believe we’re now past peak-stupid, but I’ve thought that a few times and then governments have once again tried to flex their powers and scare people into acting insane.

Fortunately, people are starting to wake up to all of this. In another few quarters, Covid, the mental disorder, will hopefully mostly be over with—though we’ll have the residual question about long-term health risks from these experimental mRNA vaccines—which is still quite a wild-card.

You have to remember that governments are just a collection of politicians trying to guess which way the mob is trending. As the mob adjusts, the smarter politicians will follow the voters and hopefully this thing ends. Here in Florida, no one has worn a mask in 18-months, yet you have these tourists with 2 masks on at the beach.

It’s quite hilarious. But then after a few days in Florida, they attune culturally and no longer fear germs as much. This process will happen everywhere as people realize that this is all just a bad cold. They’ll see others going on with their lives without dying. People will adjust and the more astute politicians will try to stay in front of this trend. Until then, we just have to wait it out and watch this crazy psychological experiment unfold…

Part 1 of this interview can be found here.

Now read:

—

ZeroHedge readers always get 20% off a subscription to my blog using this link: GET 20% OFF FOR LIFE

DISCLAIMER:

All content is Harris Kupperman’s opinion. I own physical silver, GLD, GDX, GDXJ, PAAS, PSLV and a number of other metals/miners/gold/silver equities as well as numerous companies with exposure to oil and uranium. Readers should assume Harris also has positions in all trends/equities/etc. mentioned in this interview – as do I. We will likely stand to benefit if prices of commodities rise and/or our prognostications come true. None of this is a solicitation to buy or sell securities. It is only a look into personal opinions and personal portfolios. Positions can change immediately as soon as I publish this, with or without notice. These are not the opinions of any of my employers, partners, or associates. I get shit wrong a lot. I’m not a financial advisor, I hold no licenses or registrations and am not qualified to give advice on anything, let alone finance or medicine. Talk to your doctor, talk to your financial advisor or your therapist. You are on your own. Do not make decisions based on my blog. I exist on the fringe.

Tyler Durden

Sat, 01/22/2022 – 13:30

via ZeroHedge News https://ift.tt/3rNhq66 Tyler Durden