72% Of Millennials Have Regrets About Homes They Overpaid Or Settled For In 2021 And 2022

As new inventory is finally starting to hit the market and demand has temporarily slowed down thanks to rising rates, the housing expansion between March 2020 and now is still very likely to go down in history as blowing unprecedented amounts of air into an unprecedented bubble.

And now we have the data to show it. A new online survey commissioned by Anytime Estimate and Clever Real Estate has shed light on how much millennials paid for homes during this period, and the answer likely isn’t going to surprise you: more than any other generation, ever.

This is why it is no surprise to hear that more than 70% of millennials have regrets about their purchases.

1,001 total people who reported having bought a home in 2021 or 2022 were surveyed between July 6th and 9th this year, answering up to 21 questions about their buying experience.

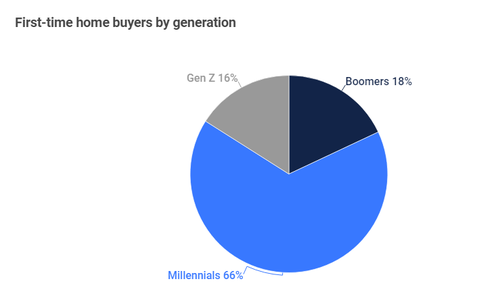

The study found that few millennials actually came away with their dream homes, especially first time buyers, who made up 70% of all buyers in 2021 and 2022. First-timers paid a median of $510,000 for a home in 2021 and 2022 — about 13% more than the $450,000 that repeat buyers paid, the report found.

Here are some of the additional statistics the study returned (emphasis ours):

- 70% of buyers in 2021–2022 bought a home for the first time. Among new buyers, one-third (33%) thought the process was more difficult than expected.

- Nearly 1 in 4 buyers (22%) were not satisfied with their home-buying experience.

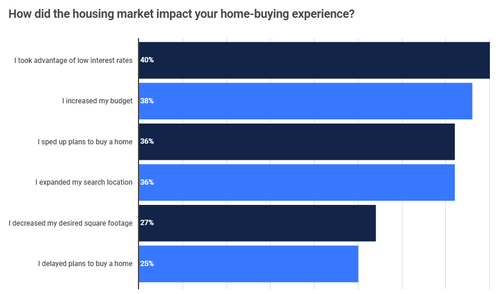

- Survey respondents paid a median amount of $495,000 for their home — about 15% more than the national median of $428,700.

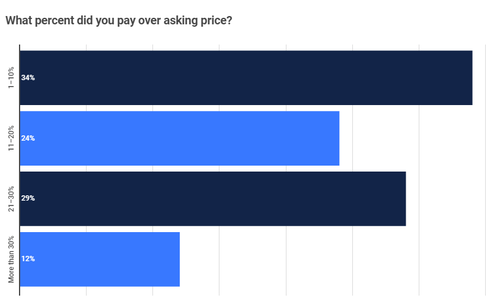

- Almost one-third of buyers (31%) paid over asking price. The median amount buyers paid over the listing price was $65,000.

- 80% of buyers made more than one offer, with 41% making five or more.

- More than 1 in 3 buyers (36%) made an offer on a home sight unseen.

- 1 in 3 buyers spent three months looking for a home, while 1 in 8 spent six months or more.

- 80% of home buyers had to compromise on their priorities.

- The No. 1 priority for half of buyers (50%) was finding a home in a good neighborhood, but 1 in 5 (20%) settled for a home in a worse location.

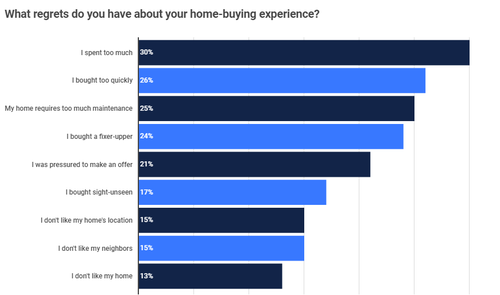

- Three-fourths of home buyers (72%) have regrets about their home purchase, with 1 in 3 (30%) saying they spent too much money.

- More than half of buyers (55%) bought a fixer-upper, but 1 in 4 (24%) regret it.

- 1 in 10 buyers paid for their home in cash, with nearly half of all-cash buyers (43%) saying they make enough money to afford it.

- But 29% of all-cash buyers had to withdraw money from savings, and 27% had to borrow funds from their investments.

- Of those who financed, 40% of buyers put down less than or equal to 20% on their home.

And perhaps most notably, 3 in 4 homebuyers (72%) have regrets about their purchase, the survey found.

When we see a statistic like that we can’t help but that 3 in 4 people will likely be eager to turn around and put their house on the market quicker than normal when the tide in the market starts to go out.

You can read Anytime Estimate’s full survey results here.

Research by Anytime Estimate’s Data Center has been cited by The New York Times, CNBC, MarketWatch, NPR, Apartment Therapy, Yahoo Finance, Black Enterprise, and more.

Tyler Durden

Tue, 08/16/2022 – 17:40

via ZeroHedge News https://ift.tt/DNPapR2 Tyler Durden