Futures Try To Rebound From Biggest Market Rout In Over Two Years

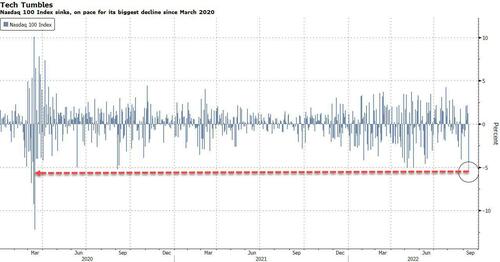

US equity futures are trying to rebound after their biggest plunge in more than two years, when the hotter than expected CPI print wiped out 4.3% or $1.5 trillion in market value from the S&P, and are up a modest 0.2% at 730am ET, erasing most of an earlier gain of 0.6%. Nasdaq 100 futures rose 0.7% after the tech-heavy gauge tumbled 5.5% in its worst day since March 2020. Ahead of today’s PPI print, the Bloomberg dollar index retreated after jumping the most in three months on Tuesday, while 10-year Treasurys ticked higher, hovering near a decade-peak. Oil was flat now that the traders consider $80 as a “Biden Bottom.”

In premarket trading, heavyweight tech stocks posted modest gains a day after the Nasdaq 100 Index saw its biggest decline since March 2020. Apple (AAPL US) +1%, Microsoft (MSFT US) +2%. Other notable movers:

- Starbucks (SBUX US) shares rise 2.3% in premarket trading after the coffee giant raised its three-year outlook for profit and sales at an annual presentation to investors. Analysts were mostly positive on the upgrades, with Jefferies finding the new three-year targets achievable.

- Oracle (ORCL US) was initiated as hold at Berenberg as the broker sees balanced opportunities and risks for the software firm, while not expecting a major re-rating over the medium term.

“The equity rally over the past week was based more on sentiment than a material change in the underlying economic drivers,” UBS Global Wealth Management strategists led by Mark Haefele wrote in a note. “Tuesday’s selloff is a reminder that a sustained rally is likely to require clear evidence that inflation is on a downward trend.”

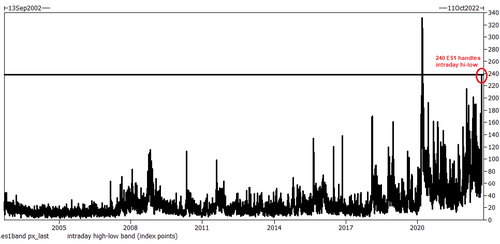

While the magnitude of Tuesday’s drop was indeed historic, and the intraday swing in spoos was one of the top 5 on record…

… the S&P 500 only reversed gains made in the previous four sessions that had been fueled by expectations of a softer reading on the US consumer price index. Investors have been waiting for any sign of peak inflation to come back to the equity market, while the previously discussed lack of a spike in the VIX shows that Tuesday’s selloff was more a recalibration of expectations than panic selling.

“Heading into the August CPI print, a number of traders thought they had information, and positioned very aggressively in the cash equity and derivatives markets,” said Christopher Harvey, head of equity strategy at Wells Fargo. “It turns out they did not have any real information on CPI (only a hunch based upon recent trends), and now they do not have as much AUM.”

The selling on Tuesday was most acute in the more speculative corners of the market that are particularly sensitive to higher interest rates. Technology falls into this category because the stock prices are based on expected future earnings, which are devalued when interest rates rise. Every single stock on the Nasdaq 100 was in the red on Tuesday, with the Index plunging the most since the world nearly ended in March 2020.

Tuesday’s hot CPI data added to concern the Federal Reserve will need to push interest rates much higher to contain price pressures, with many now expecting a 4.50%-4.75% terminal rate (and in the case of Nomura, a 100bps rate hike) raising the risk of a recession. Now all eyes will be on the Fed decision next week, with swaps traders certain the central bank will raise interest rates three-quarters of a percentage point, and odds of a 100bps hike rising as high as 47% yesterday before easing.

“Multiple compression will continue as long as we have sticky inflation,” said Marija Veitmane, a senior strategist at State Street Global Markets. “Profits will crater. We still see a lot of downside on equities.” She added that central banks need to slow demand and cause pain in the economy to rein in inflation. The longer recession is delayed, the harder it will be, she said, which is true but politicians simply lack to will to enact a massive recession with millions of unemployed workers and is why the Fed will be ordered – soon enough – to reverse.

In Europe, the Stoxx 600 index slipped about 0.4%, though it pared a deeper drop as retailers gained, led by Inditex SA after the owner of the Zara fashion chain reported a jump in profit. Utilities were the among the worst-performing sectors as the European Commission considers plans to contain the energy crisis, which may include revenue caps. FTSE MIB outperforms peers, adding 0.7%, FTSE 100 lags, dropping 0.7%.

Earlier in the session, Asian stocks and bonds tumbled in the wake of the broad-based selloff on Wall Street while the yen strengthened after Japan warned of possible intervention in the currency market. Equity indexes in Japan, Hong Kong and Australia slumped, led by Nikkei which closed down 2.8%. Hang Seng and Shanghai Comp were also negative amid headwinds from an approaching typhoon and with the US reportedly in early talks on sanctions against China to deter it from invading Taiwan.

Japanese equities tumbled the most in three months, following a broad selloff in the US as inflation data fueled expectations for tighter Federal Reserve policy. The Topix fell 2% to close at 1,947.46, while the Nikkei declined 2.8% to 27,818.62. Both gauges slid by the most since June 13. Keyence Corp. contributed the most to the Topix loss, decreasing 5.1%. Out of 2,169 stocks in the index, 172 rose and 1,943 fell, while 54 were unchanged. “The content of the CPI data clearly showed that inflation is quite persistent and it’s difficult to see any clear outlook,” said Hitoshi Asaoka, a strategist at Asset Management One. “Wage inflation was seen in a wide range for the service-related sector and there are no signs that it will slow down.” Inflation Surprise Puts Onus on Fed to Hit Brakes Even Harder Stocks pared losses in late morning trading before retreating again in the afternoon as the yen strengthened about 0.6% against the dollar. The Nikkei reported that the Bank of Japan conducted a so-called rate check in the currency market, a move considered a precursor for intervention.

In Australia, the S&P/ASX 200 index fell 2.6% to close at 6,828.60, the most decline since June 14, as Asian stocks and bonds tumbled in the wake of the broad-based selloff on Wall Street. All sectors declined, with banks and mining shares weighing most. In New Zealand, the S&P/NZX 50 index fell 0.9% to 11,658.04.

In FX, the yen pulled back from a slide toward the key 145 level versus the dollar after a Nikkei report that the Bank of Japan conducted a so-called rate check with traders to see the price of the currency against the greenback. The finance minister warned he wouldn’t rule out any response if curr ent trends continued. The country’s 10-year bond yield rose to 0.25%, the upper end of the central bank’s policy band. The Bloomberg dollar spot index fell 0.2%. NZD and AUD are the weakest performers in G-10 FX, JPY and GBP outperform.

- Japan’s currency rose more than 1% to around the 143 level after falling to 144.96 against the dollar early in the Asian session after reports that the Bank of Japan conducted a rate check on forex with market participants, a move that’s seen as a precursor to intervening in the currency market. Benchmark 10- year bond yields rose to the upper end of the central bank’s designated range.

- The euro briefly rose above parity against the dollar before paring gains. European bond yields were steady to a few bps higher

- Swedish bonds underperformed European peers as markets were increasingly looking for a 100bps Riksbank rate hik next week after inflation rose to a three-decade high

- The pound erased an early gain after UK headline inflation missed economist estimates, only to rebound. The UK yield curve steepened as short-dated bonds fell while longer maturities were little changed

- UK inflation eased from its highest rate in four decades after petrol declined. The CPI rose 9.9% from a year ago last month, slower than the 10.1% pace in July. Economists expected a reading of 10%

- The Australian dollar was steady amid losses in iron ore

“Many emerging markets are feeling the heat of the strong US dollar,” said Chi Lo, senior market strategist for Asia Pacific at BNP Paribas Asset Management, citing their debt burdens in greenbacks. “Only China can afford to defy this global rate-rise trend by keeping its easing policy stance.”

In rates, Treasuries fell across the curve, sending yields 2-3bps higher, and near the bottom of Tuesday’s range, a sharp bear-flattening move following hot August CPI and strong 30-year bond auction. Curve spreads are little changed with 2s10s and 5s30s spreads inverted. US yields cheaper by 2bp-4bp across the curve with 10-year around 3.45%, underperforming bunds by ~1.5bp, gilts by ~2.5bp. The yield on short-end gilts eases about 3bps to 3.14%, while bunds 10-year yield climbs about 1bp to 1.73%.

In commodities, WTI trades within Tuesday’s range, adding 0.3% to near $87.54. Most base metals are in the red; LME nickel falls 1.7%, underperforming peers. LME lead outperforms, adding 0.6%. Spot gold is little changed at $1,704/oz. The IEA cut its 2022 demand growth view by 110k BPD to 2.1mln BPD (prev. 2.21mln BPD); faltering Chinese economy, slowdown in OECD countries undercutting demand.

Bitcoin and Ethereum trade sideways just above 20k and 1.6k respectively, after crashing again on Tuesday.

To the day ahead now, and data releases include the UK CPI reading for August, Euro Area industrial production for July and US PPI for August. From central banks, we’ll hear from the ECB’s Villeroy. And in politics, European Commission President Von der Leyen will deliver her State of the Union address.

Market Snapshot

- S&P 500 futures up 0.6% to 3,955.50

- MXAP down 1.9% to 152.39

- MXAPJ down 2.2% to 500.13

- Nikkei down 2.8% to 27,818.62

- Topix down 2.0% to 1,947.46

- Hang Seng Index down 2.5% to 18,847.10

- Shanghai Composite down 0.8% to 3,237.54

- Sensex down 0.2% to 60,447.02

- Australia S&P/ASX 200 down 2.6% to 6,828.62

- Kospi down 1.6% to 2,411.42

- STOXX Europe 600 down 0.2% to 420.19

- German 10Y yield little changed at 1.72%

- Euro up 0.3% to $1.0001

- Gold spot up 0.2% to $1,704.99

- U.S. Dollar Index down 0.33% to 109.46

Top Overnight News from Bloomberg

- Jeffrey Gundlach of DoubleLine Capital is worried the Fed will choke off economic growth by raising interest rates too fast. Former Treasury Secretary Larry Summers is among those saying the central bank needs to hike even faster to restore its credibility

- The EU’s executive arm plans to recommend cutting funding for Prime Minister Viktor Orban’s administration on concerns about widespread graft in Hungary, according to senior EU officials

- French Finance Minister Bruno Le Maire raised this year’s economic-growth forecast to 2.7% from 2.5% as consumption and corporate investment hold up, and job creation remains dynamic

- France’s power-grid operator expects to ask households, businesses and local governments to reduce energy consumption several times over the next six months, to avoid rotating power cuts as the country grapples with a regional energy crisis

A more detailed look at global markets courtesy of Newsquawk

Asian stocks declined following the bloodbath on Wall St where the S&P 500 had its worst day since June 2020, the DJIA slumped by nearly 1,300 points, while the Nasdaq 100 led the declines with all constituents in the red after hot US inflation data spurred more hawkish Fed rate pricing. ASX 200 was pressured with losses in all sectors and underperformance in real estate after ASIC moved to stop investment in two major property funds. Nikkei 225 fell below 28k amid notable losses in the tech industry and with stronger than expected Machinery Orders doing little to inspire a turnaround. Hang Seng and Shanghai Comp were also negative amid headwinds from an approaching typhoon and with the US reportedly in early talks on sanctions against China to deter it from invading Taiwan.

Top Asian News

- PBoC set USD/CNY mid-point at 6.9116 vs exp. 6.9003 (prev. 6.8928).

- US congressional panel was told by experts that the US ban on sales by Nvidia to Chinese clients will slow Beijing’s efforts to build a facial recognition surveillance network and further restrictions on high-tech product sales should be imposed, according to SCMP.

- Hong Kong is to tighten rules regarding issuing provisional vaccine passes to travellers, according to SCMP.

- Japanese Finance Minister Suzuki said FX intervention is among the options and FX moves are apparently rapid, while he added they are very concerned about sharp yen weakening and will take necessary steps if such moves persist.

- BoJ reportedly conducted a rate check on FX in apparent preparation for currency intervention, according to Nikkei. JiJi suggested the rate check was conducted with USD/JPY at 144.90. Note, officials have since refrained from confirming the rate check.

- Japanese Finance Minister Suzuki said recent JPY moves have been quite sharp; reiterates will not rule out any options when asked about intervention, via Reuters.

- Indian Trade Body executive said that the State Bank of India is ready for INR trade with Russia; Indian trade body executive expects exports from the country to pick up in October.

- Indian trade body executive sees a singing of India-UK Free Trade Agreement by the end of October; India-Australia trade pact likely by November.

European bourses trade mostly lower but off worst levels, but the sentiment remains dampened. European sectors are mostly lower with no overarching theme. Stateside, US equity futures consolidated overnight after yesterday’s detrimental losses, with a relatively broad-based gains performance seen across the main futures contract in the early European hours

Top European News

- Queen’s Coffin to Lie in State as Mourners Face 30-Hour Wait

- EU Aims to Boost Ukraine’s Economy With Single Market Access

- EU Starts Talks With Norway to Try to Cut the Price of Gas

- Auto Trader Downgraded by Morgan Stanley; Schibsted Raised

- Russia Earns Less Despite Higher Oil Flows in August, IEA Says

FX

- The JPY is in focus and stands as the outperformer amid overnight reports of a rate check conducted by the BoJ, whilst verbal intervention continued from Japanese officials.

- DXY is subsequently pressured but holds onto a 109.00 handle whilst EUR/USD trades on either side of parity

- The Pound bounced firmly in spite of softer than expected UK inflation data, albeit after an initial decline and following very heavy losses on Tuesday.

Fixed Income

- Bunds are regaining a firmer grasp of the 143.00 handle between 143.76-142.83 parameters following a strong 2044 auction.

- Gilts and the 10 year T-note have also bounced from deeper intraday lows in consolidative trade.

Commodities

- WTI and Brent are relatively contained after the front month futures settled lower yesterday.

- US Private Inventory Data (bbls): Crude +6.0mln (exp. +0.8mln), Cushing +0.1mln, Gasoline -3.2mln (exp. -0.9mln), Distillates +1.8mln (exp. +0.6mln).

- IEA OMR: Cut its 2022 demand growth view by 110k BPD to 2.1mln BPD (prev. 2.21mln BPD); faltering Chinese economy, slowdown in OECD countries undercutting demand

- Spot gold holds onto the USD 1,700/oz mark after dipping to a USD 1,696.10/oz low yesterday, with upside levels including the10, 21, and 50 DMAs

- Base metals are relatively flat awaiting the next catalyst.

US Event Calendar

- 07:00: Sept. MBA Mortgage Applications -1.2%, prior -0.8%

- 08:30: Aug. PPI Final Demand MoM, est. -0.1%, prior -0.5%; YoY, est. 8.8%, prior 9.8%

- 08:30: Aug. PPI Ex Food and Energy MoM, est. 0.3%, prior 0.2%; YoY, est. 7.0%, prior 7.6%

- 08:30: Aug. PPI Ex Food, Energy, Trade MoM, est. 0.2%, prior 0.2%; YoY, est. 5.5%, prior 5.8%

DB’s Jim Reid concludes the overnight wrap

After a recent run of optimism that the US economy might achieve a soft landing, and that upsides on inflation were now behind us, yesterday saw that narrative take a significant blow on the back of another stronger-than-expected CPI release. Both the monthly headline and core CPI prints surprised on the upside, which in turn led investors to ratchet up the amount of rate hikes they’re pricing in for the coming months. Indeed, futures are not only pricing in another 75bps hike from the Fed next week, but they are now pricing in a meaningful probability of a 100bp hike, while also viewing the prospect of a fourth consecutive 75bps move in November as an increasingly likely outcome.

The material tightening of policy expectations sucked the life out of equities, making it one of the worst single-day performances since the onset of the pandemic with the S&P 500 (-4.32%) and the NASDAQ (-5.16%) each having their worst day since June 2020.

In terms of the details of that CPI print, the monthly headline number was actually pretty subdued again at +0.1%. However, that was two-tenths above the -0.1% reading that had been anticipated by the consensus, and meant that the year-on-year measure only drifted down to +8.3% (vs. +8.1% expected). Furthermore, the bulk of that downward pressure came from energy once again (-5.0% on the month), and if you look at the core CPI measure that excludes the volatile food and energy components, that was still rising at +0.6% on the month (vs. +0.3% expected), which is well above rates consistent with the Fed’s target. In fact on a year-on-year basis, core CPI rose to its fastest pace since March at +6.3% (vs. +6.1% expected).

Looking at some alternative measures, the details of the report are even less flattering than the headline +0.1% number. For instance, the Cleveland Fed’s trimmed mean (which excludes the biggest price outliers in the consumer basket) saw a +0.6% gain on the month, which shows that inflation is still broad-based, and that the headline number is being dragged down by outliers. On top of that, the “stickier” components of the consumer price basket were the ones seeing the more rapid increases, with the Atlanta Fed’s Sticky CPI series gaining +0.6% on the month, which contrasts with the -0.9% decline in the Flexible CPI series. So ultimately there was a sense following the report that many market participants may have got ahead of themselves after the previous month’s downside inflation surprise, which after all was the biggest downside surprise relative to consensus in over five years. As I outlined in my CoTD yesterday (link here) that came out before the data, it’s easy to conclude that inflation has peaked due to a collapse in many supply side factors of late but the problem is that we think most of the inflation is now demand led and until the lagged effect of Fed hikes bites inflation will be sticky. The good news about demand side inflation is that the Fed have a fair amount of power over it. The bad news is that it might require notably higher interest rates still. If you’re not on the Chart of the Day (CoTD) and want to be, please email jim-reid.thematicresearch@db.com.

Given the latest inflation data, investors moved to price in a much more aggressive pace of rate hikes from the Fed over the coming months, with a number of new milestones reached. First, investors are now fully pricing in a 75bps move at next week’s meeting, with a non-negligible chance (c.34%) of 100bps as well. Second, a 75bps hike is now seen as more likely than not for the November meeting too. And third, the implied rate by the December meeting now exceeds 4% for the first time, which is a far cry from the 0.82% rate expected when 2022 began. Markets are also expecting a more hawkish Fed into 2023 as well, with the December 2023 rate moving up +18.7bps to 3.82%.

Those expectations of a more hawkish Fed led to a major selloff for Treasuries, with the 2yr yield soaring +18.5bps to a post-2007 high of 3.76%, whilst the 10yr yield rose +5.0bps to 3.41%. That was driven by higher real yields, and at one point the 10yr real yield even exceeded 1% in trading, before falling back to close at 0.96%. The entire yield curve flattened given the higher probability of a harder landing, with 2s10s ending the day at -34.8bps and 5s30s falling -15.5bps to finish inverted (-10.3bps) for the first time since the start of the month. In Asia, US 10yr USTs are another +1.2bps higher with 2yrs +0.5bps. It was a similar story on the other side of the Atlantic too, as the CPI report led investors to expect more rate hikes from the ECB as well, with 129bps of further hikes priced in for the remaining two meetings this year up from 118bps at the start of play. In turn, yields on 10yr bunds (+7.5bps), OATs (+6.4bps) and BTPs (+3.3bps) all moved higher.

As previewed at the top, the sharp tightening in rates led to the worst day in a while for US equities.The S&P 500 experienced a rout that saw it shed -4.33% on the day, its worst day since June 2020, where just 5 companies in the entire index moved higher on the day. Tech stocks were particularly impacted, with the NASDAQ down -5.16%, whilst the FANG+ index of megacap tech stocks fell by a massive -6.56% (worse day since September 2020) given its particular sensitivity to raising discount rates. Bear in mind that up until the CPI release, futures had actually been pointing to gains in the US, following which there was a sharp turnaround in the other direction. That was evident in Europe too, where the STOXX 600 swung from an intraday high of +0.64% just before the release before closing -1.55% lower.

In terms of yesterday’s other news, the UK unemployment rate fell to 3.6% in the three months to July (vs. 3.8% expected), marking its lowest rate since 1974. The number of payrolled employees in August was also up by +71k (vs. 60k expected), and growth in average total pay was up +5.5% in the three months to July (vs. 5.4% expected).So cumulatively the data is pointing towards further hikes from the BoE, and the hike priced in for next week’s meeting went up by +2.6bps yesterday to 68.7bps. Gilts underperformed their counterparts elsewhere in Europe, and the 10yr yield rose +9.0bps to a fresh high for the decade at 3.17%.

Elsewhere, Brent crude oil prices rebounded more than +2.5% intraday (to close down -0.88%) following reports that the United States was considering purchasing crude at $80/bbl to rebuild the Strategic Petroleum Reserve. However, that price level had been floated a few months back, and any repurchases will likely take place over the course of a few years, and wouldn’t begin in the near-term. So those headlines probably are not as incrementally important as yesterday’s intraday price action may suggest.

Elsewhere, the ever-looming geopolitical tail risks provided another nugget yesterday, with Reuters reporting the US was in early discussions of considering sanctions against China to deter an invasion of Taiwan, with Taiwan lobbying EU to take similar steps. Early days in this story, but unquestionably a potential flashpoint to keep an eye on. Regular readers will know we think a bi-polar world with sanctions and trade barriers between the two blocks is a reasonable medium-term scenario.

The strong inflation print has also shaken stocks across Asia with the Hang Seng (-2.58%) leading losses followed by the Nikkei (-2.18%), Kospi (-1.68%), the CSI (-1.24%) and the Shanghai Composite (-1.02%).

S&P 500 and NASDAQ 100 futures are trading +0.20% and +0.13% higher respectively. Stoxx futures are down c.-0.75% as the main index closed before the last leg of the US sell-off.

Elsewhere, China extended its currency defense as the People’s Bank of China (PBOC) set the daily reference rate for the yuan at the strongest bias on record at 6.9116 per US dollar, 598 pips stronger than the Bloomberg average estimate. Separately, yields on 10-yr Japanese government bonds (JGB) advanced to 0.25% for the first time since June, touching the upper end of the BOJ’s target range. This story has gone quiet in recent months so it’ll be interesting if the risk of the BoJ YCC policy going starts to bubble again. Indeed, the Japanese yen is hovering close to its 24-year low at 144.43 against the US dollar after the dollar jumped +1.4% on the surprisingly strong US inflation report.

There wasn’t much in the way of other data yesterday, but the German ZEW survey for September came in beneath expectations, with the current situation component falling to -60.5 (vs. -52.1 expected), and the expectations component down to -61.9 (vs. -59.5 expected). That’s the lowest reading for the expectations component since October 2008 at the depths of the financial crisis.

To the day ahead now, and data releases include the UK CPI reading for August, Euro Area industrial production for July and US PPI for August. From central banks, we’ll hear from the ECB’s Villeroy. And in politics, European Commission President Von der Leyen will deliver her State of the Union address.

Tyler Durden

Wed, 09/14/2022 – 07:54

via ZeroHedge News https://ift.tt/rKUF7RM Tyler Durden