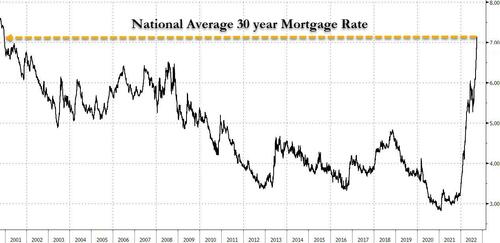

30-Year US Mortgage Rises Above 7% For The First Time Since 2000; Fastest Surge In History

Less than two weeks ago we cited Freddie Mac according to which the average 30 year US mortgage just rose above 6% for the first time since 2008, with real-estate brokerage Redfin commemorating the move by saying that “This Is The Sharpest Turn In The Housing Market Since The 2008 Crash.” Well, just a few days later, Jeff Gundlach was so kind to point out this evening…

That was quick. The National Average 30 Year Mortgage Rate posted at 7.08% today.

— Jeffrey Gundlach (@TruthGundlach) September 28, 2022

…that the national average 30 year mortgage rate just soared above 7.0%, hitting 7.08% and the highest since December 11, 2000.

This was the fastest 1% increase in mortgage rates in history; and the fact that it took place inside of a month is even more remarkable.

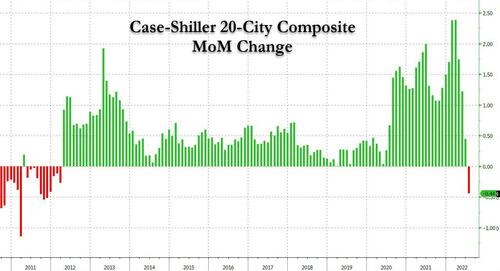

There is nothing we can add here that isn’t self-explanatory, and that we haven’t said already, like for example the fastest ever collapse in YoY Case-Shiller prices, as well as the first sequential drop in 112 years…

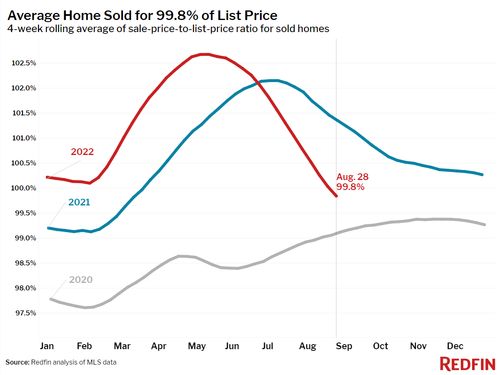

… not to mention that the typical home now sells for less than the asking price…

… but what is perhaps most remarkable is that according to the Altanta Fed, as of a few weeks ago, the median American household would needed to spend 44.5% of their income to afford payments on a median-priced home in the US, the highest percentage on record with data going back to 2006.

Well, as of today, that number is just over 50%. That’s right: more than half of the average US household’s income goes to paying housing payments, nearly double what this number was just two years ago.

That such a move can’t end in anything but tears is obvious to everyone… but the Fed, which still thinks it can somehow avoid the most destructive of hard landings.

Tyler Durden

Tue, 09/27/2022 – 21:41

via ZeroHedge News https://ift.tt/6Wkoj7b Tyler Durden