Buyer Beware In Classic Bear Market Rally

Authored by Simon White, Bloomberg macro strategist,

The current move higher in stocks has all the hallmarks of being a bear-market rally and thus fated to end in disappointment.

Equities have bounced as much as 14% off their October lows, the third +10% bounce in this bear market. But as Wednesday’s disappointing earnings from Microsoft highlight, the market is vulnerable to abrupt reversals. A Federal Reserve still in tightening mode, elevated financial conditions and an inverted yield curve show why it will remain so. This is not an advance to buy and close your eyes.

Bear-market rallies are a microcosm of manias, from tulips to crypto. Their power comes from convincing even the most hardened skeptic. A rapid rise in prices creates its own good-news force-field, drawing in the final, few remaining non-believers. It is only then they deliver their cataclysmic finale.

There’s no reason to believe the current bear market will be any different. Stocks have discovered a renewed zeal this year, embracing a belief in an “immaculate disinflation” that will return the US to a low-inflationary regime with minimal turbulence. Traders are again chasing upside, with S&P call skew and volume rising sharply this year.

Investors should show considerable caution. Immaculate disinflation has about as much chance of transpiring as its scriptural analog. The key point remains: Rates have risen rapidly, liquidity is low and financial conditions are very tight.

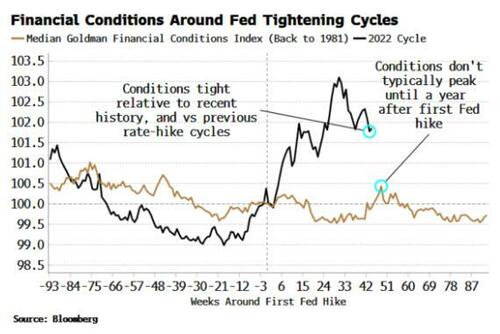

The latter have loosened in recent weeks, but they are still considerably tighter than they were earlier last year. They are also much tighter than they would typically be at this stage in a hiking cycle. Moreover, financial conditions don’t hit peak tightness on average until a year after the Fed’s first hike, i.e. another month or two away.

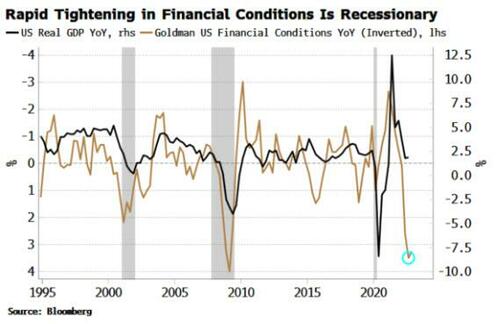

Indeed, the rapid tightening of financial conditions – at a clip not seen since the GFC – is consistent with a recession. Data show that one could be fairly deep, and that stocks are likely to make new lows.

Financial conditions should be viewed as synonymous with stock prices, as the (negative) correlation between the two is as much as 90%.

The Fed has said it wants tighter financial conditions to rein inflation in, which it cannot do unless stock prices fall. Ergo, rallies must become by definition bear-market rallies – doomed to fail – if the Fed wants to fulfill its aims.

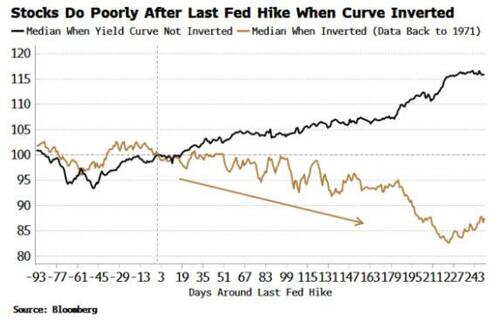

Stock boosterism also rests on the belief that the market bottoms when the Fed makes its last hike. We are certainly nearing that point. The market is implying only an 80% chance of a 25 bps hike at the March FOMC meeting, and I am leaning to the belief we’ll see the last hike in February. But either way, the view that a Fed pause will assuredly lead to rising stock prices is misplaced.

It’s true that on average stocks rise after the last Fed hike, but if we look at when the yield curve is inverted versus not inverted, we get a starkly different picture. When the curve is inverted, as it is today, stocks typically sell off by about 15-20% over the year following the last Fed rate hike.

Thus even if we do not get a recession, the ex ante picture for the stock market strongly suggests the current rally is unlikely to persist.

But that doesn’t mean it won’t go higher first. A well-watched trendline drawn from last year’s highs in the S&P has been tentatively broken. Speculative positioning in US equities is neutral and not yet net long, while CTAs and macro hedge funds, who track and can reinforce momentum trends, recently went net long, based on looking at their returns with the S&P. The conditions for follow-through moves are there.

Nevertheless, the October low remains a line in the sand. Recession or persistently elevated inflation – heads or tails – means it would likely be breached. To stay above it, immaculate disinflation – the coin landing on its side – seems the only way. Place your bets.

Tyler Durden

Thu, 01/26/2023 – 08:23

via ZeroHedge News https://ift.tt/pEAfuS7 Tyler Durden