Retail Sales Disappoint In May, April Revised Even Lower…

BofA’s practically omniscient analysts were more in line with consensus this month for their US retail sales forecast, with a return to growth expected in May’s data (after a less enthusiastic April print).

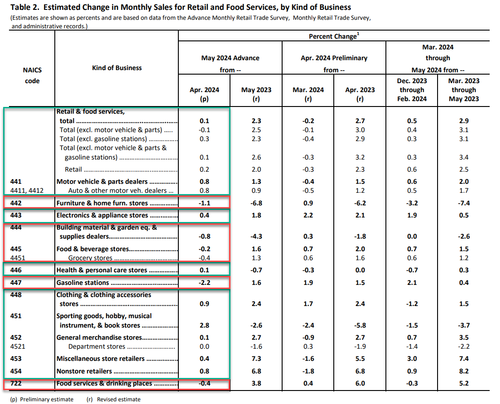

Notably, however, consensus and BofA were over optimistic as the headline retail sales rose just 0.1% MoM (vs +0.3% MoM exp). Worse still, April’s 0.0% change was revised down to a 0.2% MoM decline, leaving the headline (nominal) retail sales print up just 2.3% YoY…

Source: Bloomberg

Ex-Autos, the picture was worse with sales dropping 0.1% MoM (vs +0.2% exp) and Ex Autos and Gas Stations rose just 0.1% MoM (vs +0.4% MoM exp).

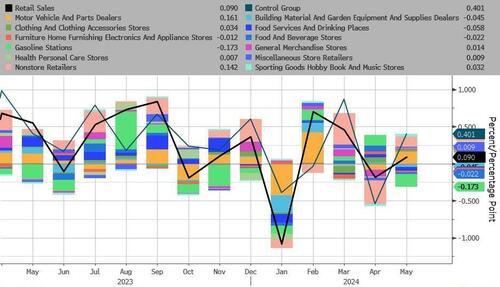

Gas Stations and Food Services spending were the biggest downside drivers, offsetting increased spending on motor vehicles and non-store (online) retailers…

Source: Bloomberg

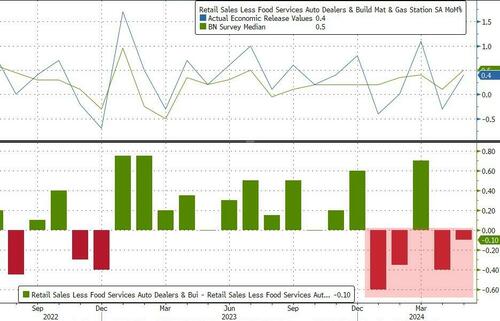

The crucial control group – which is used in the GDP calculation also disappointed in May and April was revised lower – not a great start for Q2’s GDP (April -05%, May +0.4%). That is the fourth monthly miss in a row…

Source: Bloomberg

And finally, admittedly a crude approximation, adjusting the nominal retail sales print for inflation (CPI), we see real retail sales declined in May…

Source: Bloomberg

ah, Bidenomics…

Tyler Durden

Tue, 06/18/2024 – 08:41

via ZeroHedge News https://ift.tt/zImQhoG Tyler Durden