General Motors shocked what has been an anemic industry with an ugly projected outlook for 2019 when it came out Friday morning and not only stated that its 2018 earnings were going to exceed expectations, but also that its guidance for 2019 is better than it had already anticipated.

Shares jumped on the company announcing it expected to report 2018 adjusted earnings of between $5.80 and $6.20 a share and adjusted automotive free cash flow of $4 billion.

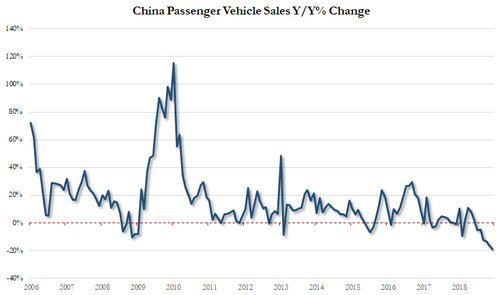

Even stranger, the company’s CEO, Mary Barra, stated that strong sales in China were acting as a catalyst for the company. On Wednesday we reported that China has been one of the key reasons that the outlook for the industry has been so gloomy, as Chinese auto sales posted their first Y/Y drop in 20 years!

The company also boosted its 2019 outlook, now expecting adj. EPS of $6.50 to $7, far higher than consensus of $5.92, and adjusted automotive free cash flow between $4.5 billion and $6 billion. Barra also said that cost controls helped earnings and that a reorganization that prompted plant closings and 14,000 job cuts in November will help save about $6 billion by the end of 2020.

The company had already announced yesterday that it planned on making Cadillac its lead electric vehicle brand, a statement the company reaffirmed again on Friday. From there, GM said it was projecting over 17 million total US vehicle sales in 2019 and 27 million in China. While these numbers are flat from 2018, Barra said they would eventually climb to 30 million in China and that the effect of cost costs should continue to act as a tailwind for the company.

As a reminder, Morgan Stanley’s auto analyst Adam Jonas – formerly one of the biggest Tesla cheerleaders – predicted that global auto sales will be down 0.3% year over year in 2019 and that many consensus estimates across the industry are far too optimistic.

In a note released last week, Jonas predicted “lower guidance” coming out of Detroit automakers at the same time that the global auto market sees its first volume drop since 2009. And despite consensus forecasts predicting revenue and margin growth across the board, Morgan Stanley generally defied the trend, reiterating its cautious view on the US auto sector.

Jonas expects global volume in 2019 to fall to 82.1 million units versus 82.4 million units in 2018. His team also expects higher input costs, combined with rising rates and rising R&D expense, to further pressure 2019 numbers. Aside from the obvious (lack of volume growth), he predicts tariff related costs will still be an overhang for automakers heading into the new year.

We’re not sure if Barra is only raising guidance now to (double) cut it later, or perhaps betting on a timely resolution to the trade war (or maybe both), but it’s tough to feel like there isn’t much more here than what meets the eye. For now, however, the bulls can breathe a sigh of relief.

via RSS http://bit.ly/2RJ8ler Tyler Durden